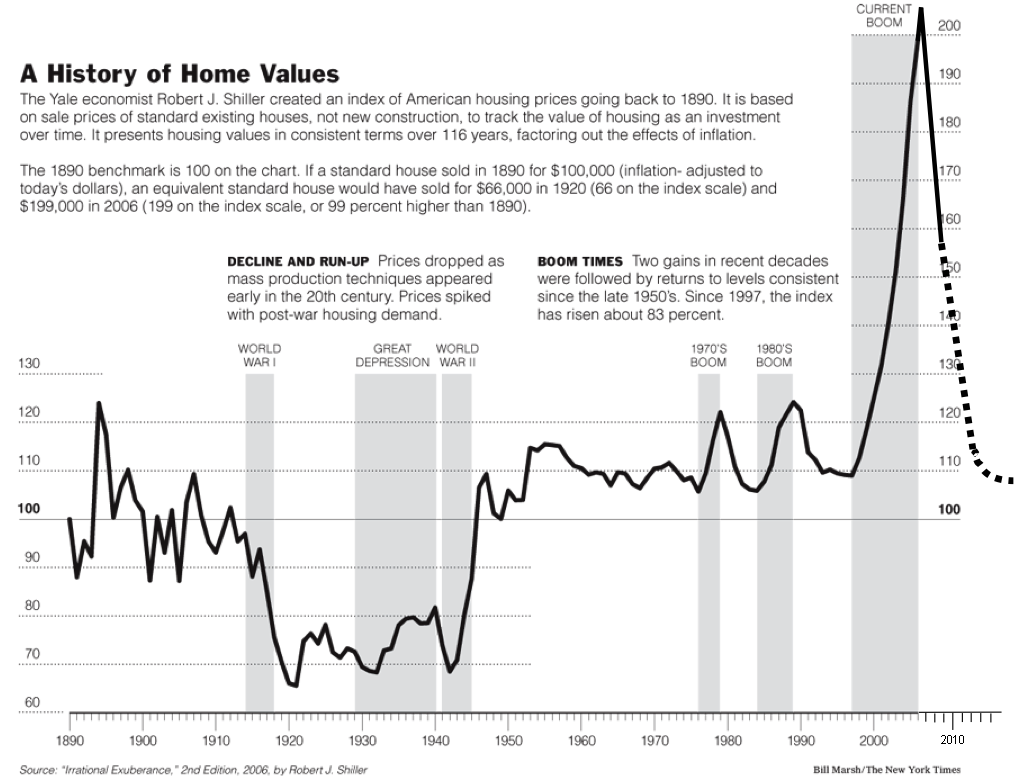

There is no doubt the home price bubble inflated by Easy Al Greenspan between 2000 and 2006 was the Mother of All Bubbles. Robert Shiller clearly showed that home prices were two standard deviations above expectations. Despite the unequivocal facts that Dr. Shiller put forth, millions of delusional unsuspecting dupes bought houses at the top of the market. These were the greater fools. They actually believed the drivel being spewed forth by the knuckleheaded anchors on CNBC. They actually believed the propaganda being preached by David Lereah from the National Association of Realtors (Always the Best Time to Buy) about home prices never dropping. They actually believed Bennie Bernanke when he said:

“We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.” – 7/1/2005

“Housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise.” – 2/15/2006

Bennie actually made these statements when the chart below showed home prices at their absolute peak. You should keep this in mind whenever this rocket scientist opens his mouth about anything. And always remember that he is a self proclaimed “expert” on the Great Depression. That should come in handy in the next few years, just like his brilliant analysis of the strong housing market.

Source: Barry Ritholtz

Easy Al Greenspan created the Mother of All Bubbles by keeping interest rates at 1% for a prolonged period of time while encouraging everyone to take out adjustable rate mortgages. His unshakeable faith in the free market policing itself allowed Wall Street criminals, knaves and dirtbags to create fraudulent mortgage products which were then marketed to willing dupes and “retired” internet day traders. Al’s easy money policies and disinterest in enforcing existing banking regulations also birthed the ugly stepsister of the Mother of All Bubbles. Her name is the Consumer Debt Bubble. The chart below is hauntingly similar to the home price chart above. The consumer will be deleveraging for the next ten years. The numbskulls on CNBC and the other mainstream media have been falsely reporting for months that consumers were deleveraging when it was really just debt being written off by banks. Baby Boomers are not prepared for retirement and will be shifting dramatically from consuming to saving. As consumer expenditures decline from 70% of GDP back to 65% of GDP, consumer debt will resemble the home price chart to the downside.

The savings rate has soared all the way to 6% of personal income. This is up dramatically from the delusional boom years of 2004 and 2005 when it bottomed out at 1%. It ain’t even close to being enough to fund the looming retirements of the Baby Boomers. The savings rate averaged 10% from 1959 through 1989. In order for the American economy to revert to a balanced state where savings leads to investment which leads to wage increases, the savings rate will need to be 10% again. With annual personal income of $12.5 trillion, Americans will need to save an additional $500 billion per year. This means $500 billion less spending at the Mall, car dealerships, Home Depot, tanning salons, and strip joints. Don’t count on a consumer led recovery for a long long time.

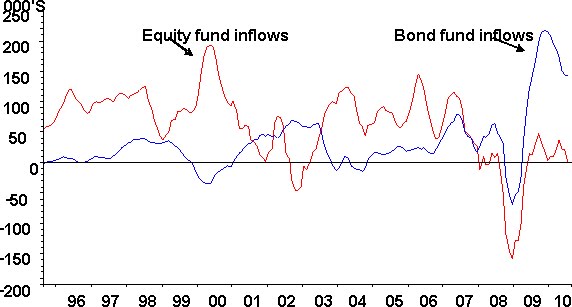

So here we stand, two years after the worldwide financial system came within a few hours of imploding, and nothing has changed. Wall Street is still calling the shots. The political hacks that supposedly run this country have kneeled down before their insolvent Masters of the Universe. Bennie Bernanke has chosen to save his Wall Street masters and throw grandma under the bus. By keeping interest rates at zero, buying up trillions in toxic mortgages, and printing money as fast as his printing presses can operate, Bennie has birthed the bastard child of the mother of all bubbles. The chart below clearly shows the birth of this bastard. It is a distant cousin of the internet bubble bastard. Despite interest rates at or near all-time lows across the yield curve, money has poured into Treasury bonds. This makes no sense, as interest rates can’t go much lower. A small increase in rates will produce large losses for investors at these rates.

Source: Barry Ritholtz

Only a fool would buy a US Ten Year Treasury bond today yielding 2.55%. Of course, only a fool would buy a 1,300 square foot rancher in Riverside, California for $800,000 with 0% down using an Option ARM in 2005 too. But that doesn’t mean there aren’t millions of fools willing to do so. Each “investment” will have the same result – huge losses. As anyone can see from the chart below, the 10 year Treasury has been in a 30 year bull market. At this point you have to ask yourself one question. Do you feel lucky? Well do you, punk? There are a number of analysts who see rates falling further as the economy sinks into Depression part 2. That may happen, but we all know that Bennie and those in power will do anything to avoid a deflationary spiral. That means looser money and more printing.

The Federal Reserve does not want a 20 year recession like Japan. They will not get it. They’ll get a hyperinflationary collapse instead. Japan entered their 20 years of stagnation with a population that saved 18% of their income and huge trade surpluses. The Japanese government could count on the Japanese population to buy every bond they issued to pay for worthless stimulus projects. The US has entered this Depression with a population that saved 2% of their income and a trade deficit of $500 billion. John Hussman describes the differences between the US and Japan in his recent newsletter:

The impact of massive deficit spending should not be disregarded simply because Japan, with an enormously high savings rate, was able to pull off huge fiscal imbalances without an inflationary event. We may be following many of the same policies that led to stagnation in Japan, but one feature of Japan that we do not share is our savings rate. It is one thing to expand fiscal deficits in an economy with a very elevated private savings rate. In that event, the economy, though weak, has the ability to absorb the new issuance. It is another to expand fiscal deficits in an economy that does not save enough. Certainly, the past couple of years have seen a surge in the U.S. saving rate, which has absorbed new issuance of government liabilities without pressuring their value. But it is wrong to think that the ability to absorb these fiscal deficits is some sort of happy structural feature of the U.S. economy. It is not. It relies on a soaring savings rate, and without it, our heavy deficits will ultimately lead to inflationary events.

The bastard child of the mother of all bubbles likes to live dangerously. The morons in Congress will surely extend all of the Bush tax cuts without restraining spending in any way. That is what they call compromise in the hallowed halls of the Capitol. By 2020 the National Debt would be $30 Trillion under this scenario. Annual interest on the debt would exceed $2 trillion per year. This is a death spiral scenario, but it is the path we are choosing. Again, I ask you, who in their right mind would buy a 10 Year Treasury bond yielding 2.55% when the US will either have a $30 trillion National Debt or will have already collapsed under the weight of that debt?

Foreigners own approximately 30% of our outstanding debt. But, we have been relying on them to purchase almost 40% of our new issuance. We will need to issue $3 trillion of new debt in the next two years. Foreigners can add. They see that we are on a course that isn’t sustainable. They know that the Fed will attempt to monetize our debt and weaken the USD over time. At 2.5% interest rates, foreigners will accumulate massive losses as the USD depreciates. They will not accept these low rates for much longer. It is a confidence game. As they lose confidence in our ability to confront our debt issues, rates will be forced higher.

The pollyannas that seem to proliferate on CNBC and the rest of the mainstream media declare that since interest rates haven’t spiked and our hyper-debt based financial system is still functioning, then there is nothing wrong. They also didn’t see the internet collapse, housing collapse or financial system collapse coming. They never do and never will. China has actually been selling Treasuries for over a year. Japan is still buying, but their far worse debt/demographic crisis will force them to curtail purchases of Treasuries in the coming years. The purchases being made from the UK are really purchases from Middle Eastern countries with their oil money. I wonder what would happen to these purchases if war with Iran breaks out? It seems we have foreign countries increasingly reluctant to buy our debt when we are about to issue trillions of new debt in the next few years and as far as the eye can see.

The only thing that could possibly keep foreigners buying our debt would be higher interest rates. Our economy is so saturated with debt from top to bottom, that an increase in interest rates of only 2% would have a devastating impact on our economy. John Hussman understates the impact of deficits on our economic future:

Continued deficits will have substantial economic consequences once the savings rate fails to increase in an adequate amount to absorb the new issuance, and particularly if foreign central banks do not pick up the slack. We’re not there for now, but it’s important not to assume that the current period of stable and even deflationary price pressures is some sort of structural feature of the economy that will allow us to run deficits indefinitely.

The Krugmans of the world are not worried about our debt. They say pile it on. We are America. We are the most powerful nation in the history of the world. We can obliterate any enemy with the push of a button. Why do we need to worry about some debt? This is the hubris that has led to the downfall of every great Empire. As Rogoff and Reinhart point out in their recent book, this time is not different:

“As for financial markets, we have come full circle to the concept of financial fragility in economies with massive indebtedness. All too often, periods of heavy borrowing can take place in a bubble and last for a surprisingly long time. But highly leveraged economies, particularly those in which continual rollover of short-term debt is sustained only by confidence in relatively illiquid underlying assets, seldom survive forever, particularly if leverage continues to grow unchecked.

“This time may seem different, but all too often a deeper look shows it is not. Encouragingly, history does point to warning signs that policy makers can look at to assess risk – if only they do not become too drunk with their credit bubble – fueled success and say, as their predecessors have for centuries, “This time is different.”

A tipping point is reached when the government debt exceeds 90% of GDP. US government debt is currently at 93% of GDP. One year from now it will exceed 100% of GDP. The bastard child of the mother of all bubbles has jumped out a window on the hundredth floor of a NYC mega bank. As he passes the 50th floor, Paul Krugman asks him how is he doing? He says great, SO FAR. We all know what happens next. SPLAT!!!!

I read and enjoyed your article however you provide no solution. What is it you would have our federal government do to stem the tide?

Jon Kessler

Cut military spending from $900 billion to $500 billion. Withdraw our troops from all foreign countries. Slash Federal spending by eliminating entire departments, scrapping the existing tax code and replacing it with a tax on consumption instead of income and savings. Get rid of the Federal Reserve and back our money with gold. Force the mega banks to account for their “assets” at their real value. This will bankrupt them. Liquidate them. The entitlement state needs to be dismantled. Means testing, extending the age for SS benefits, and introducing real competition in healthcare must be done.

Will this cause a massive Depression? Absolutely. There are no good solutions. Only painful decisions and fatal decisions. The path we are on now is fatal.

Another excellent article—-stupendous and colossal in all respects.

The only way to stem the tide is to Stop the Spending, Stop the Bailouts of Wall Street millionaires and failed Union businesses, Stop the flood of refugees from Mexico, Stop passing bills consisting of 2000+ pages of legislation that you DON’T READ and sure as hell DON’T UNDERSTAND, Stop the Spending, repeal Obama Deathcare, for the love of God I beg you Stop the Spending before we wind up like Argentina or Haiti or Zimbabwe…

Jon Kessler—-You asked.

Seems to me if we get rid of the federal reserve so would we be rid the debts they have been using as a means of control.

The we could be a creditor nation again!

Right?

Wrong?

Maybe someone can explain to me why banks should not just adjust under-water mortgages to current market values. That would erase billions of household debt and give people a chance to sell their properties instead of walking away or foreclosing. I know that would crush bank stocks, but TARP already coverered those losses. I have no pity for the banks that hold these toxic loans, no one forced them to fund or buy existing fantasy loans. I don’t consider this a reward for people that had no business borrowing over their heads, most of those people are renters now. I know good people that are in deep shit because they are too far under water to sell and most banks won’t work with them. TARP was a means to help the banks through tough times and they have done nothing to help main street. This is a complete mess and our economy is doomed until we address this issue in a big way.

Matt

If the banks did that, they would be bankrupt. The Fed is owned by the bankers. The bankers will never give up control of their power willingly.

How much does a war cost? Why do we keep this world wide military marching in Chinese boots when the cost is killing us?

Jim,

I know how insolvent the banks are but what would actually bring in more revenue: a house the bank thinks is worth $500k sitting empty or a house that the bank sells for $350k and collects payments on? Plus an occupied house generates property taxes for the county and state which may help bring unemployment down.

I am having a hard time wrapping my head around this. If a bank owns a house with a $500k note and it is empty, don’t they show a $500k liability? But if that same house was purchased at a current market value of $350k, they reduce their loss to $150k. People are waiting to buy homes, I am, but not at these overvalued prices. Am I that fuckin’ stupid, I know I am asking for it, have at it.

Matt

The bank is showing a $500k asset, not a liability. They haven’t written it down to its true value. They are extending and pretending. It is even worse on the commercial side. They show assets of $10 million for a mall that is worth $5 million. They have hundreds of thousands of these loans. If they accounted for them honestly, they would be bankrupt because they have leant out 20 times what they have in capital.

THERE IS NO SOLUTION

The article correctly states the causes and effects of Wailing Wall Street manufactured demise and collapse of USA by whiners, wimps, criminals, and underachiever Nobel prize award winners..

Everyone on the streets [masses] know what the solution to America’s created and manfactured problems are “Continued Pursuit of Broken Down Empire’.

We are doomed to a one way forced ride to oblivion and third world palookaville…However, as long as the broken down ideologues decide not to take entire humanity down with it, the world will not end and actually be more peacful place.

Thanks Admin,

I guess that is why mark to market isn’t followed anymore, am I correct there? What a disgrace this whole system has become. I get too frustrated by this nonsense, I should just ask SSS if I can borrow his medical marijuana card and just relax. Just kidding you SSS!

When the Fed was created in 1913, the bankers that created and on it were handed theckeys to the dollar printing press. Over the subsequent decades, they have conjured up an endless stream of fiat dollars and used this currency to buy our goverment, press and academic institutions at wholesale prices.

The same group of suited crooks owns the privately held Depository Trust and Clearing Corporation (DTCC), which holds the books recording ownership of all securities traded an US stock exchanges. Naked shorting of shares is rampant across all US markets. All Amercan financial markets are at their core nothing but paper frauds.

Similarly the Fed’s monetary product, the fiat dollar, is nothing but a naked short against gold and silver.

When the Fed was created in 1913, the bankers that created and on it were handed the keys to the dollar printing press. Over the subsequent decades, they have conjured up an endless stream of fiat dollars and used this currency to buy our goverment, press and academic institutions at wholesale prices.

The same group of suited crooks owns the privately held Depository Trust and Clearing Corporation (DTCC), which holds the books recording ownership of all securities traded an US stock exchanges. Naked shorting of shares is rampant across all US markets. All Amercan financial markets are at their core nothing but paper frauds.

Similarly the Fed’s monetary product, the fiat dollar, is nothing but a naked short against gold and silver.

Some amazing graphs. We teeter on the precipice of consumer spending. Once that goes, our consumer driven market goes. Then dominoes fall.

Were the Bush tax cuts included in EGTRRA? If so, would all of the EGTRRA policies be cut off (like the 401k catch up contribution for 50+)? Or can they pick and choose?

BTW Jim, I love the compromise you outline. Sounds about par for the course.

jim, you going to see wall street tonight?

imaprick

I have to convince Avalon that she wants to see this movie. Maybe dinner beforehand will work.

Admini You read any history. Bring home the troops and you will have a dictatorship. You Liberal tarians are all the same lot of great ideas and no plan. If the US ends its global presence you think someone worse won’t step in, you are dreaming and we have world war 3. And don’t give me any neocon bullshit, I ain’t one, just know history. America needs a 10 year plan to change our global position.

Jay

Step in to what Jaymeister? Are we afraid someone will jump into Afghanistan Mr. Rocket scientist?

Don’t give me any of your retarded 3rd grade level world analysis you douchebag.

Lay out your fucking 10 year plan dickhead.

Administrator—I do believe Jay would be most appreciative if you would be a little more direct in future discourse, you know, not mince words.

We’ve found out who the mother of all bubbles is, as well as the ugly stepsister of the mother of all bubbles, and the bastard child of the mother of all bubbles. The magic question is “Who is the father?” of the bastard child? Is it Bennie? hehe.

We’ve found out who the mother of all bubbles is, as well as the ugly stepsister of the mother of all bubbles, and the bastard child of the mother of all bubbles. The magic question is “Who is the father of the bastard child? Is it Bennie? hehe.

The one thing I always notice missing from every single conversation and string of comments about the future course of the US, is the one thing that ALWAYS HAPPENS. And that one thing is something that is impossible to discuss or analyze. And the existence of that one thing makes it impossible, absolutely impossible to make ANY predictions about the future course of this country or the world for that matter.

If you go back and look through history you will find that, again and again, particularly at times of social or economic upheaval, something that absolutely no one was expecting takes place and changes everything. Particularly in the United States, we have repeatedly experienced game changing events that no one saw coming. And when those events occurred all of the prognosticators had to go back and completely rewrite their predictions.

The type of event I am talking about has nothing to do with some war or tragic event. Yes, those happen as well and all to many people will predict that our global economic tensions will result in some sort of war. The type of even I am speaking of is some sort of radical technological revolution that changes everything. Good examples would be Henry Ford and the automobile assembly line, the advent of the home computer, the development of the internet.

Everyone is so freaking terrified because they are trying to look out into the future and see what tomorrow will look like but they are looking at the future through the paradigmatic lens of the reality we live in now. There is every possibility that some sort of technological revolution, some massive leap forward will take place in the coming years that will change everything. This may come from nanotechnology, new energy technology, or God knows where and what it might be.

The point is that we need to stop being so damn scared and accept that the totally unexpected can and does happen. Something nobody is expecting may be just around the corner and it may be so trans formative that it changes everything. The fact is, this process has taken place repeatedly throughout human history. Some game changing event is headed our way. It is impossible to predict what it will be but something is headed our way.

This is what makes the future impossible to predict and what makes the prognostications of fear and destruction so often end up being wrong. What if we’re right around the corner from a bright new tomorrow. I mean, We really don’t know that is not the case. It may very well be that we are on the edge of something new and fantastic. Why not expect that? Why not anticipate something positive happening that would change everything? It’s happened before. It could very well happen again.

JT

You need a lesson in reality. Get yourself a copy of The Fourth Turning. You are a linear thinker. Linear thinkers will be the first ones run over by the speeding freight train of history. Has the internet kept morons from spending more money than they have? Has it prevented ridiculous wars of choice? Your techno advances don’t change the fact that human beings are irrational creatures prone to mass delusion. You are an example.

Thanks JT. Six paragraphs of nothing.

Admin – thanks for your proposed solutions. Most I agree with, two in particular I do not.

I do not believe there is enough gold to be able convert to a gold standard. I think it is untenable, but I understand what you are trying to achieve there.

The means testing of SS also is a problem, unless you also phase out all SS contributions, and phase out SS in its entirety very quickly. Otherwise you will add even more incentive to not accumulate. Some people will make sure they have no means so as to het their rightful SS.

No matter, cause aint none of it gonna happen. Not enough spine material in DC to make even one complete backbone.

Jt – it is a nice, comfotting thought but I am afraid a bit polyanish inlight of the structural inadequacies that permeate the U.S. economy,inadequacies that are not to be out done by the political quagmire that we find ourselves in. Sure it would be great if the U.S. could fund an alternative energy ” Manhattan Project ” to eliminate our dependecy on costly foreign oil. Unfortunately, there is no political will nor can we afford what could be a massive outlay for R&D.

I have often lectured on the state of the U.S. economy and attendees have often asked,” What can turn our economy around?” A manhattan Project on Alt energy has been my canned response for a number of years. However, even now as the current administration speaks loudly about alt energy, investment performance for the sector is dismal. Over the last three or four years the returns on Alternative Energy Mutual funds have lagged the terrible performance of the S&P by a wide margin. It seems no one is willing to commit to the sector. Nano technology is surely not the answer to our structural problems. We have an aging population that isn’t going to be spending like they have in the past, our children are forgoing education in the fields of math and science, poverty is rising, income inequality is escalating, trust in our institutions is plummeting, our manufacturing capability has collapsed , and our political system is as polarized as at anytime in our history with the exception of the succesion of the south at the beginning of the civil war. We as a country are in a world of trouble and we can no longer keep our collective head in the sand.

Admin

This site is so fucked up today. I posted a long comment on this article, and it disappeared. Slow connections, too. Frustrating.

SSS

Sorry about the site. At least 50 sites picked up this article today and I think the site got overwhelmed with visitors.

The next bubble is already huge at the moment – the derivative bubble which is valued ay quadrillion US$. Are the banks allowed to leverage on bonds to any amount because they are deemed 100% safe? Are the swaps on interest and currencies like CDOs and CDSs used in financing the real estate bubble? The last recession required trillions to tens of trillions US$ to bailout the banks. Will the next recession requires hundreds of trillions of US$ for bailouts as every recession after 1987, every recession required exponential increase in bailout money.

I am finally reading Lewis’s The Big Short (though I am reading it in French which makes is slightly weird). I am kicking myself for having been too lazy, stupid, arrogant, and “intellectual” to have made the same investments as the protagonists when I saw all this mess growing back in 2003 and 2004.

Is it really possible that so many people are still drinking the Kool-Aid? Do they really believe all their crap about the crisis being over, the debt being manageable, and the future bright? Who is buying stocks and driving up prices when insiders are breaking new records every day with their sales. And how much longer can this bubble be sustained?

There are so many voices proclaiming that this time it’s different that I can’t help but wonder if many don’t believe it’s true. But GS, MS, or the Fed? Surely they are spewing out the most egregiously false propaganda in the history of finance.

A final comment, Ritholz is overly optimistic on his housing projections for a few reasons, including the use of net disposable income to price ratios projected onto gross income. Additionally, he glosses over mean reversion, record inventtory, massive unemployment, and certain to rise interest rates (can they possibly go down any more!). We have another 25 to 35% to go on house prices (to a price/income ratio of between 2.5 and 2.75). When that market finally makes it last plunge, who will be there to save us? More Fed purchases of the CDO’s Squared still hidden off balance sheet at all the banks? A direct bailout of Fannie and Freddie to the tune of three trillion dollars? Another direct handout to Wall Street of 2 to 3 trillion dollars?

My father, a man not given to such expressions, recently wrote me and told me “America is fucked.” To hear that from my own dad is shocking but revelatory.

Give JT a break, Administrator.

He’s not dillusional at all, he is looking at the whole picture.

Did you forget that there is still a material vested interest in resource security and political “stability” where those resources are(I’m thinking South America, Africa, Asia…)? Did you forget that real capital investment in agriculture and tobacco markets as well as production infrastructure in these nations means a continued US committment to the bottom line of these corporations?

The military is the street thug for the elites.

The government is, effectively, the accountant.

Even if it all goes to ruin, as predicted, corporations are, as “persons”, immortal, and the very tangible products and resources they manipulate and manufacture are not going to simply disappear. Thus, a large scale military presence is OUT OF THE QUESTION from an elitist perspective.

As to the idea that some “dictator” is going to “pop up”, I disagree. We are the dictator. And power as insidious and pervasive as that weilded by the USA does not simply shrivel up and blow away. At best, it would be a wounded animal in the corner of the room—with nukes!

Above should read “…a large scale miltary WITHDRAWAL is OUT OF THE QUESTION…”

Sorry.

Administrator—-Holy Shit!!! You reckon your response to Jon Kessler resonated with your readers? ( Or, as George W. Bush would say, RESIGNATED with them ).

Smokey

It was my diplomatic tone. I value your feedback on my new People of Wal-Mart feature. I’ll let you make the call on whether it becomes a Saturday mainstay.

Administrator—-LOL. 57 thumbs up to 1 thumbs down. That is strong. (Pay no attention to anon on gold hits $1300)

Smokey

If I get my hands on the prick who gave me a thumbs down, there’ll be hell to pay.

Yeah. That anon is a real pisser. He really knows how to stir it up.

I started to mention that thumbs down. Some mongoloid fuckwad had to sabotage an historic run. The score will still sit atop the TBP Hall of Fame regardless of the effort of a single inbred fool.

Is any else changing their short-term (3-6 month) “map” due to Fed Speak and US stock market reaction this week? I previously thought the US housing and stock market would tumble again prior to the USD tumbling. But now, due to impending QE2, it looks like the USD will begin a descent prior to the US stock market which looks like will continue upward for another 3-6 months as Bernanke continues to further f-up the US debt situation. ANy other thinkers out there want to weigh in? GOld still the long term place to be :-).

I recently discovered Quinn and TBP by reading “The Deleveraging Lie” on LRC. THE BASTARD CHILD OF THE MOTHER OF ALL BUBBLES is a great followup. As opposed to the usual anecdotal discourse and opinions Sr. Quinn supports his theses with charts, data and references.

I am a refugee of a failed new country project and am currently on the lam sailing from port to port firing my cannons at edificios gobiernos whenever possible.

I am proud to join the Mighty Quinn and his rabble of rebels. My first contribution is a proposed theme song for TBP.

The Mighty Quinn[img]C:\Documents and Settings\Gitano Reed\My Documents\Current\Ragnar.jpg[/img]

Re sufficient amount of gold:

The quantity is sufficient as long as you adjust the price to account for the vast amount of fiat printed in all currencies since 1933…

Re Treas purchases from UK:

I’m willing to bet that the UK money or a substantial part of

same is fed money in sheeps clothing…

Those gold swaps are for something, whot?

…

Good Juan

!

Grazia

!

We didn’t get into this mess overnight and we won’t get overnight either. The Republican plan to roll back discretionary spending to 2008 levels is a good start (of course I have no confidence even this baby step will be accomplished) but military spending also needs to be clawed back and of course no dare talk about the elephant in the room; entitlements. Unless and until that beast is put on a leash we have no shot at fiscal stability.

The next two years will be instructive. If discretionary spending can be restrained then there is hope.

What none here seem to understand is that, the American economy is being purposefully destroyed by those in control of the fiat money/Central Bank Franchise system. It is the only way they can implement a world currency which of course will lead to the New World Order that Huxley and others tried in vain to warn us against.

This is much more than an economic collapse. It is the total destruction of individual sovereignty along with national sovereignty. It won’t come overnight but the plan was implemented in a forceful way clear back when the US rejected the metric system. This is when the ‘gloves came off’ and the NWO boyz decided that the US would not come willingly to the party but as Kissinger & Rockefeller both said….”kicking and screaming at first….but, begging in the end.” [paraphrased but accurate]

Expat’s dad has it spot on, with the caveat….unless we get lucky or have the balls to tell all forms of gov’t to fuck off, take all money out of banks and buy staples, gold, silver and get other people to use that as money as much as possible. Stop paying all debt except for total essentials things like auto, home [unless underwater] It is through the money system that we gave up control….we can take it back the same way. Politicians, all of them will betray you…period. They can’t get on the ticket unless they are under the control of the money system…period. What I just told you will be your only option in the future anyway. Panic early…beat the rush.

Jim, great article again….keep beating the drum. Widen your perspective however….the enemy counts on being hidden. Expose the bastards….they hate America. Read Henry Carey, one of the great unsung heroes of early America who has been purposely written out of our economic history. He tells all who would listen a hundred years ago that Wall Street and the British Empire [not to be confused with Great Britain or the UK] was the mortal enemy of this and all freedom loving countries. His predictions have been spot on. This machine is who destroyed Mexico in the 80’s and again in the 90’s with Rubin as the main architect. They destroyed Argentina, Rhodesia, Russia, Germany….it is all there, plain as day if the time is taken to wade through the information. As kooky as many of you may think Lyndon LaRouche is he is totally correct in his analysis when it comes to the old British Empire, its connections to the Rothschild cabal, the Cecil Rhodes agenda, the made up Zionist agenda.

This is a bigger game than nearly all can imagine. Much more is at stake than your home, your money and possibly your life…because, if these bastards succeed they will own our posterity for hundreds of years. Those in real power…the ‘money power’ hope you all stay distracted with all the fluff…in the branches as they say; while they are busy ‘striking at the root’, totally unobserved. Act like a warrior, because you are at war! A good warrior knows when to befriend and make peace with his former enemy when he sees a much more powerful foe invading all of the territory. These bastards are and have been invading us for 40 years and we have done nothing but walk backwards…sometimes as fast as an NFL cornerback…but the time has come to say NO MORE! NO MORE on multiple fronts. It is time for MEN to come alive and act like MEN and stop being pussies. So what if you lose you material possessions and your life. Is it better to sit on your ass and watch TV, and click on a keyboard when you know in your heart of hearts the fucking government has been hijacked by the bastards I’ve described for you? Do any of you know how to hack? Do you know someone who does? I have friends who have been looking for hackers with balls enough to take the risk to at least spy on these fuckers as information will be as valuable as gold, food or ammo. If we could find out their plans we could disrupt the bastards…or die trying. Think about it. We are as close to oblivion as our founders were in 1775.

You have used 4 of my charts without asking.

They are copyrighted.

It is a compliment to have your material used, but it is not fair to paying subscribers to post materials indiscriminately. Please refrain.