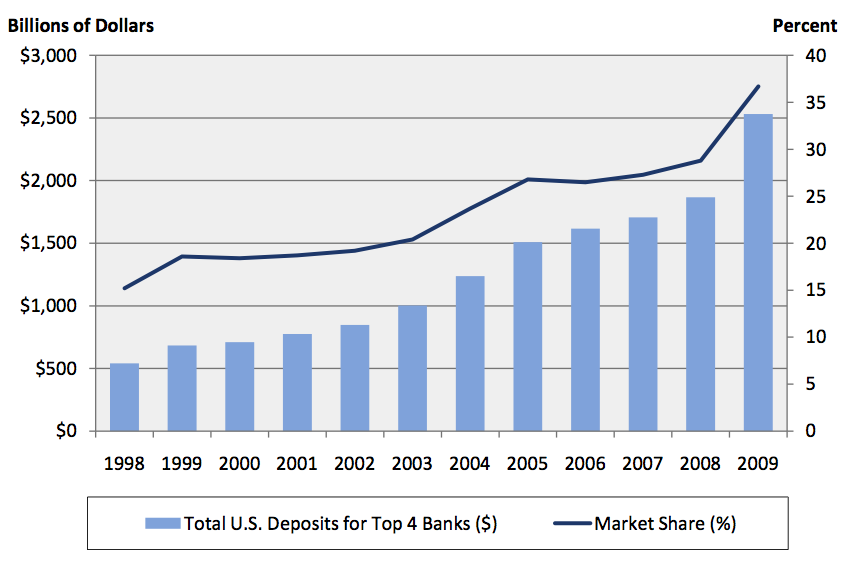

“We now have an economy in which five banks control over 50 percent of the entire banking industry, four or five corporations own most of the mainstream media, and the top one percent of families hold a greater share of the nation’s wealth than any time since 1930. This sort of concentration of wealth and power is a classic setup for the failure of a democratic republic and the stifling of organic economic growth.” – Jesse – http://jessescrossroadscafe.blogspot.com/

Source: Barry Ritholtz

“All of the old-timers knew that subprime mortgages were what we called neutron loans — they killed the people and left the houses.” – Louis S. Barnes, 58, a partner at Boulder West, a mortgage banking firm in Lafayette, Colo

The storyline that has been sold to the public by the Federal government, Wall Street, and the corporate mainstream media over the last two years is the economy is recovering and the banking system has recovered from its near death experience in 2008. Wall Street profits in 2009 & 2010 totaled approximately $80 billion. The stock market has risen almost 100% since the March 2009 lows. Wall Street CEOs were so impressed by this fantastic performance they dished out $43 billion in bonuses over the two year period to their thousands of Harvard MBA paper pushers. It is amazing that an industry that was effectively insolvent in October 2008 has made such a spectacular miraculous recovery. The truth is recovery is simple when you control the politicians and regulators, and own the organization that prints the money.

A systematic plan to create the illusion of stability and provide no-risk profits to the mega-Wall Street banks was implemented in early 2009 and continues today. The plan was developed by Ben Bernanke, Hank Paulson, Tim Geithner and the CEOs of the criminal Wall Street banking syndicate. The plan has been enabled by the FASB, SEC, IRS, FDIC and corrupt politicians in Washington D.C. This master plan has funneled hundreds of billions from taxpayers to the banks that created the greatest financial collapse in world history. The authorities had a choice. This country has bankruptcy laws. The criminally negligent Wall Street banks could have been liquidated in an orderly bankruptcy. Their good assets could have been sold off to banks that did not take their extreme greed based risks. Bond holders and stockholders would have been wiped out. Today, we would have a balanced banking system, with no Too Big To Fail institutions. Instead, the years of placing their cronies within governmental agencies and buying off politicians paid big dividends for Wall Street. Their return on investment has been fantastic.

The plan has been as follows:

- In April 2009 the FASB caved in to pressure from the Federal Reserve, Treasury, and Wall Street to suspend mark to market rules, allowing the Wall Street banks to value their loans and derivatives as if they were worth 100% of their book value.

- The Federal Reserve balance sheet consistently totaled about $900 billion until September 2008. By December 2008, the balance sheet had swollen to $2.2 trillion as the Federal Reserve bought $1.3 trillion of toxic assets from the Wall Street banks, paying 100 cents on the dollar for assets worth 50% of that value.

- In November 2009 the Federal Reserve and IRS loosened the rules for restructuring commercial loans without triggering tax consequences. Banks were urged to extend loans on properties that had fallen 40% in value as if they were still worth 100% of the loan value.

- By December 2008 the Federal Reserve had moved their discount rate to 0%. For the last two years, the Wall Street banks have been able to borrow from the Federal Reserve for free and earn a risk free return of 2%. The Federal Reserve has essentially handed billions of dollars to Wall Street.

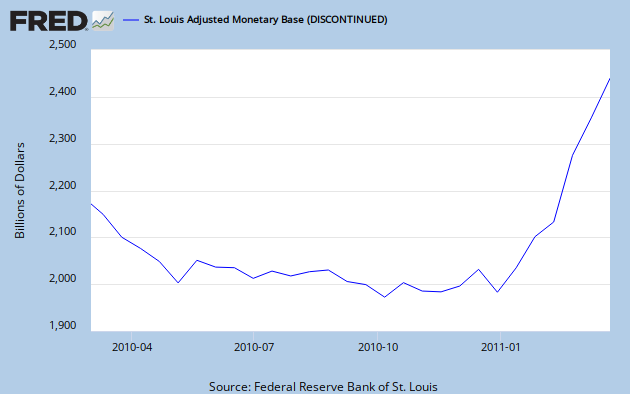

- When it became clear in October 2010 that after almost two years of unlimited liquidity being injected into the veins of zombie banks was failing, Ben Bernanke announced QE2. He has expanded the Fed balance sheet to $2.6 trillion by injecting $3.5 billion per day into the stock market by buying US Treasury bonds. Bernanke’s stated goal has been to pump up the stock market. While taking credit for driving stock prices higher, he denies any responsibility for the energy and food inflation that is spurring unrest around the world.

- The Federal Reserve has increased the monetary base by $500 billion in the last three months in a desperate attempt to give the appearance of recovery to a floundering economy.

- Beginning on December 31, 2010, through December 31, 2012, all noninterest-bearing transaction accounts are fully insured, regardless of the balance of the account, at all FDIC-insured institutions. The unlimited insurance coverage is available to all depositors, including consumers, businesses, and government entities. This unlimited insurance coverage is separate from, and in addition to, the insurance coverage provided to a depositor’s other deposit accounts held at an FDIC-insured institution.

When You’re Losing – Change the Rules

Wall Street banks had absolutely no problem with mark to market rules from 2000 through 2007, as the value of all their investments soared. These banks created products (subprime, no-doc, Alt-A mortgages) whose sole purpose was to encourage fraud. Their MBA geniuses created models that showed that if you packaged enough fraudulent loans together and paid Moody’s or S&P a big enough bribe, they magically became AAA products that could be sold to pension plans, municipalities, and insurance companies. These magnets of high finance were so consumed with greed they believed their own lies and loaded their balance sheets with the very toxic derivatives they were peddling to the clueless Europeans. They didn’t follow a basic rule. Don’t crap where you sleep. When the world came to its senses and realized that home prices weren’t really worth twice as much as they were in 2000, investment houses began to collapse like a house of cards. The AAA paper behind the plunging real estate wasn’t worth spit. After Lehman Brothers collapsed and AIG’s bets came up craps for the American people, the financial system rightly froze up.

After using fear and misinformation to ram through a $700 billion payoff to Goldman Sachs and their fellow Wall Street co-conspirators through Congress, it was time begin the game of extend and pretend. Market prices for the “assets” on the Wall Street banks’ books were only worth 30% of their original value. Obscuring the truth was now an absolute necessity for Wall Street. The Financial Accounting Standards Board already allowed banks to use models to value assets which did not have market data to base a valuation upon. The Federal Reserve and Treasury “convinced” the limp wristed accountants at the FASB to fold like a cheap suit. The FASB changed the rules so that when the market prices were not orderly, or where the bank was forced to sell the asset for regulatory purposes, or where the seller was close to bankruptcy, the bank could ignore the market price and make up one of its own. Essentially the banking syndicate got to have it both ways. It drew all the benefits of mark to market pricing when the markets were heading higher, and it was able to abandon mark to market pricing when markets went in the toilet.

“Suspending mark-to-market accounting, in essence, suspends reality.” – Beth Brooke, global vice chair, at Ernst & Young

Wall Street desired all the billions of upside from creating new markets for new products. Their creativity knew no bounds as they crafted MBOs, MBSs, CDOs, CDSs, and then chopped them into tranches, selling them around the world with AAA stamps of approval from the soulless whore rating agencies. When the net result of a flawed system of toxic garbage paper was revealed, there was no room at the exits for the stampede of investment bankers. The toxic paper was on the banks’ books and no one wanted to admit the greed induced decision to purchase these highly risky, volatile “assets”. The trade had not gone bad, the ponzi scheme had unraveled. Suspending FASB 157 has been an attempt to hide this fraudulent business model from investors, regulators and the public. By hiding the true value of these assets, the financial system has never cleared. The banks remain in a zombie vegetative state, with the Federal Reserve providing the IV and the life support system.

Let’s Play Hide the Losses

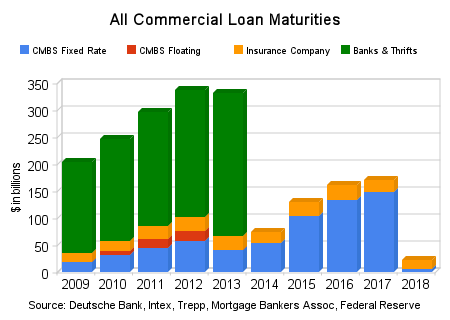

Part two of the master cover-up plan has been the extending of commercial real estate loans and pretending that they will eventually be repaid. In late 2009 it was clear to the Federal Reserve and the Treasury that the $1.2 trillion in commercial loans maturing between 2010 and 2013 would cause thousands of bank failures if the existing regulations were enforced. The Treasury stepped to the plate first. New rules at the IRS weren’t directly related to banking, but allowed commercial loans that were part of investment pools known as Real Estate Mortgage Investment Conduits, or REMICs, to be refinanced without triggering tax penalties for investors.

The Federal Reserve, which is tasked with making sure banks loans are properly valued, instructed banks throughout the country to “extend and pretend” or “amend and pretend,” in which the bank gives a borrower more time to repay a loan. Banks were “encouraged” to modify loans to help cash strapped borrowers. The hope was that by amending the terms to enable the borrower to avoid a refinancing that would have been impossible, the lender would ultimately be able to collect the balance due on the loan. Ben and his boys also pushed banks to do “troubled debt restructurings.” Such restructurings involved modifying an existing loan by changing the terms or breaking the loan into pieces. Bank, thrift and credit-union regulators very quietly gave lenders flexibility in how they classified distressed commercial mortgages. Banks were able to slice distressed loans into performing and non-performing loans, and institutions were able to magically reduce the total reserves set aside for non-performing loans.

If a mall developer has 40% of their mall vacant and the cash flow from the mall is insufficient to service the loan, the bank would normally need to set aside reserves for the entire loan. Under the new guidelines they could carve the loan into two pieces, with 60% that is covered by cash flow as a good loan and the 40% without sufficient cash flow would be classified as non-performing. The truth is that billions in commercial loans are in distress right now because tenants are dropping like flies. Rather than writing down the loans, banks are extending the terms of the debt with more interest reserves included so they can continue to classify the loans as “performing.” The reality is that the values of the property behind these loans have fallen 43%. Banks are extending loans that they would never make now, because borrowers are already grossly upside-down.

Extending the length of a loan, changing the terms, and pretending that it will be repaid won’t generate real cash flow or keep the value of the property from declining. U.S. banks hold an estimated $156 billion of souring commercial real-estate loans, according to research firm Trepp LLC. About two-thirds of commercial real-estate loans maturing at banks from now through 2015 are underwater. Media shills proclaiming that the market is improving, doesn’t make it so. The chart below details the delinquency rates from 2007 through 2010 as reported by the Federal Reserve:

| Real estate loans | Consumer loans | |||||

| All | Booked in domestic offices | All | Credit cards | Other | ||

| Residential | Commercial | |||||

| 2010 4th Qtr | 9.01 | 9.94 | 7.97 | 3.71 | 4.17 | 3.10 |

| 2010 3rd Qtr | 9.77 | 10.90 | 8.69 | 4.03 | 4.60 | 3.39 |

| 2010 2nd Qtr | 10.02 | 11.32 | 8.74 | 4.25 | 5.07 | 3.37 |

| 2010 1st Qtr | 9.78 | 10.97 | 8.66 | 4.63 | 5.76 | 3.48 |

| 2009 4th Qtr | 9.48 | 10.29 | 8.74 | 4.64 | 6.36 | 3.48 |

| 2009 3d Qtr | 9.00 | 9.67 | 8.57 | 4.72 | 6.51 | 3.61 |

| 2009 2nd Qtr | 8.19 | 8.69 | 7.84 | 4.85 | 6.75 | 3.69 |

| 2009 1st Qtr | 7.19 | 7.89 | 6.55 | 4.62 | 6.50 | 3.52 |

| 2008 4th Qtr | 5.99 | 6.57 | 5.49 | 4.29 | 5.65 | 3.37 |

| 2008 3rd Qtr | 4.88 | 5.26 | 4.66 | 3.73 | 4.80 | 3.05 |

| 2008 2nd Qtr | 4.21 | 4.39 | 4.15 | 3.55 | 4.89 | 2.80 |

| 2008 1st Qtr | 3.56 | 3.70 | 3.50 | 3.48 | 4.76 | 2.76 |

| 2007 4th Qtr | 2.89 | 3.06 | 2.75 | 3.41 | 4.60 | 2.66 |

| 2007 3rd Qtr | 2.40 | 2.78 | 1.98 | 3.20 | 4.41 | 2.48 |

| 2007 2nd Qtr | 2.01 | 2.30 | 1.63 | 2.99 | 4.02 | 2.37 |

| 2007 1st Qtr | 1.77 | 2.03 | 1.43 | 2.93 | 3.97 | 2.29 |

Delinquency rates on residential and commercial loans in early 2007 were in the range of 1.5% to 2.0%. Now the MSM pundits get excited over a decline from 8.7% to 8.0%. These figures show that even after trillions of Federal Reserve and Federal Government intervention, delinquencies remain four times higher than normal. In the real world, cash flow matters. Payment of interest and principal on a loan matters. Actual market values matter. According to Trepp, LLC, a data firm specializing in commercial data, non-performing commercial real estate loans makes up 72% of the $320 million in non-performing loans reported by banks in February. These figures are after the “extremely” relaxed definition of non-performing allowed by the Federal Reserve. The game is ongoing. Misinformation abounds. The SEC now issues press releases saying they are worried that banks are covering up losses, when they were involved in encouraging the banks to cover-up their losses. Last week the SEC announced they have become concerned that extend and pretend, along with another practice known as “troubled debt restructuring” that allows banks to break loans into pieces, may have been abused in order to diminish the volume of reserves banks are holding. What a shocking revelation. Who could have known?

Are You Smarter than a Wall Street CEO?

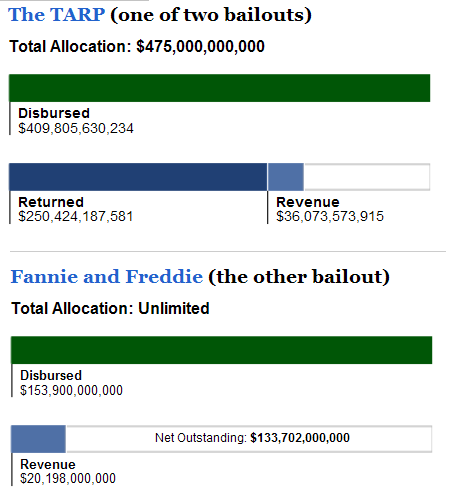

The Federal Reserve paid shills and Wall Street front men are out in droves declaring that TARP was a success and the banking system is recovering strongly. Columnists like Robert Samuelson declare TARP was a great investment and will profit the taxpayer. Samuelson says that the Treasury has recouped $244 billion of the $245 billion it invested in banks and that, when it winds down its last investments, it likely will show a $20 billion profit from the banks. This type of propaganda is ludicrous, as Barry Ritholtz succinctly points out:

“No, we are not profitable on the bailouts. TARP has $123B to go before breakeven, and the GSEs are $133B in the hole. All told, the Taxpayers have a long way to go before we are breakeven. That’s before we count lost income from savings, bonds, etc., the increased costs of food stuff and energy due to inflation (the Fed’s has done this on purpose as part of their rescue plan), the higher fees the reduced competition of megabanks has created, and the future costs our Moral Hazard will have wrought in increased risks and disasters.” – Barry Ritholtz

Source: Barry Ritholtz

Fannie Mae and Freddie Mac have hundreds of billions in bad loans sitting on their balance sheets. Their total cost to taxpayers will reach $400 billion, and never be repaid. The Federal Reserve has over $1 trillion in toxic assets on its balance sheet, off loaded by the TARP recipient banks in 2009. The taxpayer will never be repaid for this toxic waste. The government is implementing the Big Lie theory. If you tell a big lie often and loud enough, the non-thinking masses will believe it. That leaves us with today’s fantasy world.

The reality on the ground does not match the rhetoric coming from the government, Wall Street and the corporate mainstream media. The truth is as follows:

- The vacancy rate for office space in the U.S. is currently 16.5%.

- The vacancy rate for industrial space in the U.S. is currently 14.2%.

- The vacancy rate for retail space in the U.S. is currently 13%.

- Delinquencies within collateralized debt obligations in commercial real estate loans rose to 14.6% in February. The increase signals a trend of higher delinquencies in the segment. Signs of pressure surfaced as early as January when the delinquency rate on CDOs within commercial real estate loans hovered well above 13%.

- According to Moody’s, CRE prices are down 4.3% from a year ago and down about 43% from the peak in 2007.

- The delinquency rate on loans packaged and sold in commercial mortgage-backed securities rose to a record 9.2% in February, according to a March 15 report by Moody’s.

- Regional and local community banks have as much as 80% of their balance sheets tied up in commercial real estate, and very few other sources of significant fee income to offset CRE losses.

- CRE once had an estimated national value of $6.5 trillion. Today it stands at an optimistic $3.5 trillion.

- There are 1.8 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

- There are about 2 million current negative equity loans that are more than 50% “upside down”.

- Home prices are off 31.3% from the peak. The Composite 20 is only 0.7% above the May 2009 post-bubble bottom and will probably be at a new post-bubble low soon.

In the face of this data, mouthpieces for the Federal Reserve go before Congress and try to paint an optimistic picture. “While we expect significant ongoing CRE-related problems, it appears that worst-case scenarios are becoming increasingly unlikely,” Patrick Parkinson, the Federal Reserve’s director of banking supervision and regulation, told Congress. Parkinson said that since the beginning of 2008 through the third quarter of 2010, commercial banks had incurred almost $80 billion of losses from commercial real estate exposures. Banks are estimated to have taken roughly 40% to 50% of losses they will incur over this business cycle, he said.

The Federal Reserve will be forced by the Federal Courts to reveal the banks they have saved from failure since 2008 by funneling billions of practically interest free tax payer dollars into their hands. The Fed is expected to release this week documents related to discount window lending from August 2007 to March 2010, including the peak month of October 2008, when loans hit $111 billion. It will be revealed they kept alive hundreds of banks that should have died. Shockingly, the supposedly taxpayer protecting Dodd-Frank law exempts past discount window lending from an audit by the Government Accountability Office, that’s examining much of the central bank’s other crisis-era programs. That champion of the little people, Barney Frank, said such disclosures might have “a negative market effect. If people saw the data the next day, they come to the conclusion that the bank must be in trouble.” Openness and transparency are evidently grey areas for Mr. Frank. Despite the non-disclosures, free Fed bucks, accounting fraud and uninterested regulators, over 300 banks managed to go out of business in the last two years, essentially bankrupting the FDIC. Have no fear. The Treasury gave the FDIC an unlimited line of credit with your money.

It is fascinating that every Friday afternoon the FDIC announces approximately three bank failures. Steady as she goes. No panic. Just a slow trickle of failure. But the reality is much worse than the show. Despite the gimmicks of extending and pretending, there are 900 banks essentially insolvent sitting on the FDIC “Problem” list. This is after closing the 300 banks. There are at least a couple hundred billion of losses in the pipeline, to be funded by the American people/Chinese lenders. A critical thinking American might ask, if things are getting better, why does the number of troubled banks continue to rise week after week, month after month?

One year ago the website www.businessinsider.com listed the 10 major regional banks with the highest risk from commercial real estate loans. These 10 banks had $133 billion of commercial real estate loans on their books. Most, if not all, are still in business today. The fact is those real estate loans are worth 30% to 50% less than they are being carried on the books. A true valuation of these loans would put all 10 of these banks out of business. They are dead banks walking. In a world where transparency, honesty, and true free markets reigned supreme, these banks would pay for their poor risk taking choices. They would be liquidated and their assets would be sold off to banks that did not make horrific lending decisions. Failures would fail.

| Bank | CRE Loans (bil.) | % of Tier 1 Capital |

| NY Community Bank | $22.0 | 915% |

| Wintrust Financial Corp. | $3.4 | 419% |

| M&T Bank | $20.8 | 378% |

| Synovus | $11.2 | 376% |

| Wilmington Trust | $4.0 | 369% |

| Marshall & Iisley | $13.8 | 283% |

| Zions Bancorporation | $13.4 | 253% |

| Regions Financial | $28.3 | 218% |

| UMB Bank | $1.3 | 156% |

| Comerica | $14.3 | 97% |

How could anyone deny the world is back on track after examining the following chart?

It should warm your heart to know that Financial Profits have amazingly reached their pre-crash highs. All it took was the Federal Reserve taking $1.3 trillion of bad loans off their books, overstating the value of their remaining loans by 40%, borrowing money from the Fed at 0%, relying on the Bernanke Put so their trading operations could gamble without fear of losses, and lastly by pretending their future losses will be lower and relieving their loan loss reserves. The banking industry didn’t need to do any of that stodgy old school stuff like make loans to small businesses. Extending and pretending is much more profitable.

The big four of JP Morgan, Citigroup, Bank of America, and Wells Fargo should have undergone orderly bankruptcy liquidation in 2008. They took on a vast amount of leverage and a vast amount of risk. Their greedy bets went bad. In a true capitalist system, they would have failed. Instead, in our crony capitalist system, they were bailed out by taxpayers and continue to function as zombie banks pretending to be healthy. They reported profits of $34.4 billion in 2010. Every dime of these profits was generated through accounting entries that relieved their provisions for loan losses. These “brilliant” CEOs who virtually destroyed the worldwide financial system in 2008, looked into their crystal balls and decided their loan losses in the future would be dramatically lower. I’ll take the other side of that bet. I dug into their SEC filings to get the information in the chart below. Just the fact that Citicorp and Bank of America have still not filed their 10K reports after 3 months tells a story.

| Bank | Source | CRE | Mortgages | Credit Card | Total Loans | Loss Reserve | % of Loans |

| JP Morgan | 12/31 10K | $53,635 | $174,211 | $137,676 | $692,927 | $32,266 | 4.7% |

| Citicorp | 9/30 10Q | $79,281 | $209,678 | $216,759 | $654,311 | $43,674 | 6.7% |

| Bank of America | 9/30 10Q | $77,062 | $394,007 | $142,298 | $933,910 | $43,581 | 4.7% |

| Wells Fargo | 12/31 10K | $129,783 | $337,105 | $22,375 | $757,267 | $23,022 | 3.0% |

These four “Too Big To Fail” bastions of crony capitalism have $340 billion of commercial real estate loans on their books. That’s a lot of extending and pretending. Just properly valuing those loans at their true market value would wipe out most of their loan loss reserves. I wonder if Vikrim and his buddies have noticed that home prices have begun to plunge again. Deciding to not foreclose on home occupiers that haven’t made a mortgage payment in two years is not a long term strategy. These four banks have $1.1 billion of outstanding mortgage debt on their books. I wonder what a 20% further decline in home prices will do to these loans. Throw in another half a billion of credit card loans to Americans being hammered by soaring energy and food prices and you have a toxic mix of future losses. These banks are gonna need a bigger boat.

The game of extend and pretend at the expense of the American working middle class is growing old. When this game is over, Wall Street will be looking for another bailout. The American people will not fall for the lies again. Wall Street’s oppression reeks of greed and disgrace. They are liars and thieves. They have pillaged and stolen all that was left to steal. I will be surprised if they get out alive.

Well you are my accuser, now look in my face

Your opression reeks of your greed and disgrace

So one man has and another has not

How can you love what it is you have got

When you took it all from the weak hands of the poor?

Liars and thieves you know not what is in store

There will come a time I will look in your eye

You will pray to the God that you always denied

The I’ll go out back and I’ll get my gun

I’ll say, “You haven’t met me, I am the only son”

Dust Bowl Dance – Mumford & Sons

I nominate BAILOUTS and ZIRP as more important drivers of Wall Streets ongoing corruption and looting of the American people. ZIRP makes “financial innovation = systemic LOOTING” possible, real world interest rates ~ 5% or above render 90% of these schemes unviable/impossible.

BAILOUTS are more insidious, they reward looting and broken risk management, as such they GUARANTEE endless FINANCIAL CRISIS (every 5-7 years according to JP Morgan).

TBTF cannot be sustained forever, sooner or later the can WILL slam up against the wall.

And yet there’s word that the banks may be getting only bigger…

More bank mergers are likely on the horizon

Fabulous work, Admin…

Back when this crap was materializing, Bill Bonner said something to the effect of “It seems central planning is good for the markets”. You have done the best job of explaining how and why that I’ve seen yet.

In this day and age, what would be slam-dunk decision making is distorted beyond belief. The markets are not free… and the information we use to try and navigate our personal wealth (or lack of) is fabricated for the sole purpose of our confidence.

A “Con” game is short for a Confidence Game. What a sham, a fraud, and what a way to hold the head of the American Dream under the murky waters of fraud so as to drown it DEAD.

Sadly, analytical Jim Quinn seems right again. Can’t you get us some numbers that lie, Jim, so we can sleep better at night? I don’t know what the solution is except to cut one’s expenses and save more. Jim and his sources favor gold and those commodities which are likely to become more scarce. For some of us who like to think about things other than money most of the time, and don’t have the inclination to be the mutual fund manager of our own stash, history suggests that the stock market does well in inflationary times.Anyway, whatever’s the solution, keep up the good work Jim. You’re often the bearer of bad news, but bad news is better than no news or the government’s good news, when the bad news is truthful news not tripe.

Wow Jim. Great info.

A couple things I want to point out:

You state, “…Beginning on December 31, 2010, through December 31, 2012, all noninterest-bearing transaction accounts are fully insured, regardless of the balance of the account, at all FDIC-insured institutions. The unlimited insurance coverage is available to all depositors, including consumers, businesses, and government entities. This unlimited insurance coverage is separate from, and in addition to, the insurance coverage provided to a depositor’s other deposit accounts held at an FDIC-insured institution…”

Now most of us look at that and think, “we will get a bailout,” but here is what you didn’t state (and that I was notified by the bank last month), this extra “protection” comes at a cost. We, the money holder, in exchange for this insurance (which, if things were really better, why would we need this now?) agree that the bank can require a seven day hold to withdraw ANY funds. Whenever they want.

As this only applies to non-interest bearing accounts are primarily held by the non-wealthy. The wealthy carry big enough balances that they have their cash in interest bearing accounts. Something to keep in mind.

As for the banks revaluing commercial loans. Well, maybe for the bigger guys. But, for us little guys at the same time they were forgiving Taubman and Trump debt, they were yanking our loans because our assets crashed. They forced many of us to cash in our personal assets AT MARKET BOTTOM to pay them off. Even when NO payments were ever missed. And they are sniffing around again right now.

The only thing I truly disagree with is the “why” the crash came. The crash came because CONGRESS fucked everything up in 2005. The “double mandatory minimums” and quadrupled interest rates on existing debt hit the over-extended middle class at the same exact moment $150 barrel crude, rising prices and the effect of the offshoring/gutting of manufacturing. We need to make NO fucking mistake about this. CONGRESS has created this disaster and CONGRESS continues to steal from us to gift to everyone else.

Wall Street or not. Fix CONgress, fix Wall Street. NOT the other way around.

I for one sure as hell hope they don’t get out alive.

damn this is a depressing read first thing in the morning.

But this article is dead on. this spells it all out in terms i can understand ( i’ll go to ZH and read some stuff , but sometimes it gets so esoteric it’s impossible for me the understand)

we are caught in a spider’s web of lies. The only think the powers that be can do spin more lies. Until everything collapses. Then of course it won’t be the faults of the media or big banking. No their will be more new “madoff”s to scapegoat.

The bankers and their ilk (I love that expression…”and their ilk”) live in a different world from us. They honestly believe they deserve their money even if they know that what they do is occasionally illegal and generally immoral. They really feel bad because they can’t afford a bigger yacht and don’t own three ski chalets (Vermont, Rockies, and Alps just in case the snow sucks). They really believe that people who don’t send their kids to $50k a year pre-schools or eat in four star restaurants have only themselves to blame.

But most of all, they really, really feel victimized and persecuted. They feel threatened by regulators, Congress, the poor and the press. They even think CNBC is too bearish and the NAR too pessimistic about real estate. They need more money and more power to protect their hard-earned billions from the commies, Al Qaeda, and bleeding heart liberals who are too lazy and stupid to earn their own money.

I don’t think there is a cure for this disease. I think it is a voracious cancer which won’t respond to chemo or radiation therapies. I think it needs to be excised. And I think we need to sacrifice a few limbs (banks, sectors) to excise it.

Unfortunately, most Americans really do watch and believe Fox and CNBC. They really believe they could be America’s Next Millionaire. They believe Uncle Warren cares about them.

Egypt. Tunisia. Bahrain. Yemen…..USA? Fuggedaboudit!

What really amazes me in this age of information is how easy it is to the goods on a system so corrupt. What is so sad about it is that fat dumb Americans do not care to hear the message. You just posted in an easy to read, complete outline how we are being anally raped on an epic scale but if I forwarded this to my family and friends there would be a collective yawn. TPTB know this and could care less about this and other blogs.

These guys make Chicago 1920’s look like a Baptist convention.

So, if I understand correctly, everyone is dipping into the taxpayers pockets, except since the end of WWII, federal spending has been increasingly financed by borrowed dollars, to the extent we’re witnessing the end game. Extend and pretend is too polite a term.

The next several months should be interesting as potentially bankrupt states have to balance their budgets and the federal debt ceiling breaches as tax season approaches.

If the plunge protection teams are successful in sweeping the carcasses under rug, the power elite will have another year to plunder.

I’m not sure what TeresaE means by “CONgress fucked everything up in 2005,” but apparently she has an ax to grind about how unfairly small businesses are treated in this country. No, duh!

It isn’t anybody’s fault federal deficit spending is out of control except the fed’s. I read an interesting article about the founding of this nation at a friend’s blog, http://tcallenco.blogspot.com/2011/03/secret-societies-and-conspiracies-in.html in which the premise is the founders were to a large extent one worlders, but that Christian principles overrode the one world agenda.

As the reserve currency of the world is rendered useless, let’s hope and pray that Christian principles again win the day.

YOU WRITE The American people will not fall for the lies again….. I ask “What are the American people going to do about it?”

Nada. Zilch. Zero.

and the truly pathetic thing is that the japanese tried since 1989 what is now the u.s. (and euro zone) technique with similar, impotent results, while the nordic nations, (sweden, etc.) in the late ’90’s did the orderly reorganization (with appropriate haircuts for stock and bondholders) with brilliant recovery results. its the corruption stupid.

The wheels are coming off you say? GEEZ, how can you tell?

Thanks Jim…there goes my breakfast…

http://www.nytimes.com/2011/03/30/opinion/30barofsky.html?_r=1&src=me&ref=homepage

..the country was assured that regulatory reform would address the threat to our financial system posed by large banks that have become effectively guaranteed by the government no matter how reckless their behavior. This promise also appears likely to go unfulfilled. The biggest banks are 20 percent larger than they were before the crisis and control a larger part of our economy than ever. They reasonably assume that the government will rescue them again, if necessary. Indeed, credit rating agencies incorporate future government bailouts into their assessments of the largest banks, exaggerating market distortions that provide them with an unfair advantage over smaller institutions, which continue to struggle.

Worse, Treasury apparently has chosen to ignore rather than support real efforts at reform, such as those advocated by Sheila Bair, the chairwoman of the Federal Deposit Insurance Corporation, to simplify or shrink the most complex financial institutions.

In the final analysis, it has been Treasury’s broken promises that have turned TARP — which was instrumental in saving the financial system at a relatively modest cost to taxpayers — into a program commonly viewed as little more than a giveaway to Wall Street executives.

It wasn’t meant to be that. Indeed, Treasury’s mismanagement of TARP and its disregard for TARP’s Main Street goals — whether born of incompetence, timidity in the face of a crisis or a mindset too closely aligned with the banks it was supposed to rein in — may have so damaged the credibility of the government as a whole that future policy makers may be politically unable to take the necessary steps to save the system the next time a crisis arises. This avoidable political reality might just be TARP’s most lasting, and unfortunate, legacy.

Neil M. Barofsky was the special inspector general for the Troubled Asset Relief Program from 2008 until today.

The Federal Reserve released thousands of pages of secret loan documents under court order, almost three years after Bloomberg LP first requested details of the central bank’s unprecedented support to banks during the financial crisis.

The records reveal for the first time the names of financial institutions that borrowed directly from the central bank through the so-called discount window. The Fed provided the documents after the U.S. Supreme Court this month rejected a banking industry group’s attempt to shield them from public view.

“This is an enormous breakthrough in the public interest,” said Walker Todd, a former Cleveland Fed attorney who has written research on the Fed lending facility. “They have long wanted to keep the discount window confidential. They have always felt strongly about this. They don’t want to tell the public who they are lending to.”

The central bank has never revealed identities of borrowers since the discount window began lending in 1914. The Dodd-Frank law exempted the facility last year when it required the Fed to release details of emergency programs that extended $3.3 trillion to financial institutions to stem the credit crisis. While Congress mandated disclosure of discount-window loans made after July 21, 2010 with a two-year delay, the records released today represent the only public source of details on discount- window lending during the crisis.

Protecting Its Reputation

“It is in the interest of a central bank to put a premium on protecting its reputation, and, in the modern world, that means it should do everything to be as transparent as possible,” said Marvin Goodfriend, an economist at Carnegie Mellon University in Pittsburgh who has been researching central bank disclosure since the 1980s.

“I see no reason why a central bank should not be willing to release with a lag most of what it is doing,” said Goodfriend, who is a former policy adviser at the Richmond Fed.

The discount window was the first tool Fed Chairman Ben S. Bernanke reached for when panic over subprime mortgage defaults caused banks to tighten lending in money markets in 2007. The Fed cut the discount rate it charged banks for direct loans to 5.75 percent on Aug. 17, 2007, and it continued to reduce the rate to 0.5 percent by the end of 2008. The rate stands at 0.75 percent today.

Lending through the discount window soared to a peak of $111 billion on Oct. 29, 2008, as credit markets nearly froze in the wake of the bankruptcy on Sept. 15, 2008, of Lehman Brothers Holdings Inc. While the loans provided banks with backstop cash, the public has never known which banks borrowed or why. Fed officials say all the loans made through the program during the crisis have been repaid with interest.

Appeal Rejected

The Fed was forced to make the disclosures after the U.S. Supreme Court rejected an appeal by the Clearing House Association LLC, a group of the nation’s largest commercial banks.

The justices left intact lower court orders that said the Fed must reveal documents requested by Bloomberg related to borrowers in April and May 2008, along with loan amounts. The late Bloomberg News reporter Mark Pittman asked for the records under the Freedom of Information Act, which allows citizens access to government papers. News Corp.’s Fox News Network LLC filed FOIA requests for similar information on loans made from August 2007 to March 2010.

Former Fed officials, lawyers representing the central bank, and even some Fed watchers have expressed concern that revealing the names of discount-window borrowers could keep banks away from the facility in the future.

Next Crisis

“I am concerned that in the next crisis it will be more difficult for the Federal Reserve to play the traditional role of lender of last resort,” said Donald Kohn, former Fed vice chairman and senior fellow at the Brookings Institution in Washington. “Having these names made public, or the threat of having them made public, could well impair the efficacy of a key central bank function in a crisis — to provide liquidity to avoid fire sales of assets — because banks will be reluctant to borrow.”

“I think it will make it harder for people to use the discount window in the future,” Jamie Dimon, chairman and chief executive of New York-based JPMorgan Chase & Co. (JPM), the second- biggest U.S. bank by assets, told reporters yesterday after a speech in Washington. “We never intend to use the discount window.”

With little more than a phone call to one of 12 Federal Reserve banks, a bank anywhere in the country can ask for cash from the discount window. Banks typically have already given the Fed a list of unencumbered collateral that they use to pledge against the loans. The Fed gives the banks less than 100 cents on each dollar of collateral to protect itself from credit risk.

Discount-window lending was not the largest source of the Fed’s backstop aid during the crisis. Bernanke also devised programs to loan to U.S. government bond dealers, and to support the short-term debt financing of U.S. corporations.

To contact the reporter on this story: Craig Torres in Washington at [email protected].

Damn, Dustbowl Dance is a badass song.

Jim – There must be some good information/outlook in those reports somewhere.

The Founding Fathers made a mistake when implementing our Constitution. They should have implemented a “balanced Budget amendment” and since we all know the “root of all evil” is MONEY they should have required a NATIONAL public referendum if any MAJOR changes were made to our monetary system…..If the referendum for major monetary changes had been implemented we would NOT have experienced “Jeckyl Island” and the 1913 takeover of the US Monetary system/IRS implementation by the Banksters….does anyone here think “The People” would have approved the Banksters changes…I think NOT.

Everything I see wrong with our country has everything to do with FIAT money………We have lost OVER 30% of the dollars purchasing power since 2000……THe Banksters secret tax…INFLATION

Thomas Jefferson wrote that if we ever allowed the BANKSTERS to CONTROL our monetary system, first through inflation then through deflation Americans would one day wake up homeless in the country their fathers conquered….God help us!

POSTED: March 30, 2:13 PM ET | By Matt Taibbi

The S.E.C.’s Revolving Door: From Wall Street Lawyers to Wall Street Watchdogs

Got a quick note from a friend today, sending some happy news from the corporate non-enforcement arena. It seems that the white-shoe corporate defense firm Wilmer Cutler Pickering Hale is expecting yet another regulatory baby!

The SEC last week announced that Anne Small will serve as the SEC’s new deputy general counsel. Small worked in Wilmer Hale’s litigation department before snagging this post. She’ll be replacing Mark Cahn, who worked at – wait for it – Wilmer Hale for 20 years, until joining the SEC last March, when he stepped in to work for a fellow named Andrew Vollmer, who had served as the SEC’s Deputy General Counsel since 2006. Cahn will now be kicked upstairs into the General Counsel spot.

But guess who his predecessor Vollmer worked for? That’s right, Wilmer Hale. So a Wilmer lawyer comes in to replace a Wilmer lawyer, who replaced a Wilmer lawyer. Hence the firm’s nickname – “SEC West.”

Besides Cahn and Small, there are other ex-Wilmerites at the Commission. There’s Joseph Brenner, the chief counsel of the Enforcement Division, and Meredith Cross, who heads the Division of Corporate Finance. Both were Wilmer partners.

Of course it’s not like the traffic doesn’t go in both directions. Last year the SEC’s head of trading and markets, Daniel Gallagher, left to become a Wilmer partner. And the SEC’s former Director of Enforcement William McLucas is now the head of Wilmer’s securities department. The firm hired the head of the SEC’s Los Angeles office, Randall Lee, in 2007. And so on and so on.

Exactly how tough do you think all these ex-Wilmer lawyers will be on current Wilmer clients like Goldman, Citigroup, Morgan Stanley, General Electric, Credit Suisse, and practically every other major financial services company? The shamelessness factor is growing by the minute.

Fiatmoney, the founding fathers neglected to include a “balanced Budget amendment” for our Constitution because they knew that our country was covertly to be run by the Crown anyway. The same City of London banksters that ran shit in 1770’s England are still running it here (and there), today. In their little secret society get-togethers they talked about a Constitution Republic being the cover for imperial British worldwide rule.

Jim, just had a chance to really read the whole piece. Great work!

In fact, it’s so well-reasoned and backed up with numbers, I’d give anything to have Ben Bernanke or Tim Geithner or Paul Krugman (or their ilk) actually respond to it. If they’re not corrupt, if they’re not acting in the best interest of Wall Street instead of all Americans, then respond to this and tell us where Jim’s got it wrong.

Go ahead, Bennie. Make my day.

Thinker

Bennie is busy posting the indecipherable info about who borrowed from the discount window in 2008.

Good information, Jim. Unfortunately, this “extend and pretend” behavior makes it difficult to operate in the real world. If I want to buy investment real estate, I have to wait — or it is prudent to wait — until all of the funny business ceases. Meanwhile the assets deteriorate…

Great article. The problem with this anti free market philosophy is that it makes it nearly impossible to value companies as an investor. On top of that, it makes it incredibly hard for entrepreneurs to forecast properly. If the numbers are fudged, how can one make a reasonable business decision for the future? This trickles down to the consumer and in the end the consumer gets fucked along with entrepreneurs. We have created a moral hazard for these banks. They basically carry no risk on any of their decision making. This system is so fucked up. The best regulation for Wall Street is free market regulation. Fuck the SEC. If banks make bad investments, let them fail as they should. The SEC is a joke. Investors need to do their own diligence. The free market will eventually complete the best form of regulation for wreckless businesses if our government would stop intervening.

Excellent writing in this article!

However, our problem is that we are trying to fix the SYMPTOMS of the problem, rather than getting to the ROOT CAUSE.

Until we get the money out of politics, our bought puppet politicians will continue to do the bidding of their wealthy and corporate overlords. We keep electing Republicans and then Democrats and then back to Republicans and wonder why nothing changes. How can things change when we keep doing the same thing and expecting different results. It is time for new political parties and candidates that renounce campaign “donations” and are willing to do what is right.

The “extend & pretend” title reminds me of a joke I heard about Soviet Communism;

“In Russia we pretend to work, they pretend to pay us.”

Seems to now be more applicable to Amerika.

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.”

Lord Acton

You know, I have another question… why would the FDIC suddenly, fully insure all noninterest-bearing transaction accounts regardless of the balance of the account? Let’s think about this… unless there is only one bank to deposit your money in, why not spread it around to fall under the $250K/account insured limit that already exists? Do they expect hyperinflation, in which case the $$ limit needs to be eliminated, because what was $250,000 will now become $1,500,000? Or are they hoping the rich will repatriate money from offshore accounts if they have greater security here?

What are the implications of this? What do they know that we don’t?

Thinker

They know that our banking system is still a shambles. Bernanke, Geithner, Bair and the rest of the gov’t drones are afraid their master plan is failing. I think you are right about the hyperinflation preparation idea.

Fantastic work and a rare find. We need more of this type of analysis for those that are really trying to understand what happened and what is happening right now. Again thanks for putting in the time.

Dude, you know that cartoon is you at “you know where”.

“I can’t see this! ……….”

Mandan writes, “What are the American people going to do about it?”

Nothing because we’re feckless. Whether it’s you, I, or the selectively outspoken Jim Quinn, we’re all just peeps who don’t disrupt the government, the military, AIPAC, and the banksters who run this country.

The United States is a tightly regimented state where influential people both have been trained to believe in the government and, after the realization that they’ve been duped, realize that they’re too invested and have too much to lose by bucking the system.

Ask yourself if you’d be willing to stand up, in a public meeting, and ask your U.S. Senator or Representative probing questions about the Constitution, 9/11 cover-ups and inconsistencies, or the three Mid-east wars. Of course not. You’d either find yourself in jail or you’d be quietly crushed.

pack animals layin down for the alpha dog(s). Somebody has to be strong enuff to lead us

Wall Street skates because Wall Street has been financing the deficits that Washington has used to buy votes for decades, Wall Street is the bagman. Washington has been successful buying votes because the majority of Americans, as all human beings, like selling their votes, the ultimate “something for nothing”.

The majority of people also do not care much for freedom, what they want is security and, hopefully, prosperity and they will give up freedom tomorrow to get whatever crumbs they can get today.

The situation will continue to deteriorate until a war comes along to wipe the slate clean. With the bioweapons to come, it will be quite a war.

So it goes.

Foreign Banks Tapped Fed’s Lifeline Most as Bernanke Kept Borrowers Secret

U.S. Federal Reserve Chairman Ben S. Bernanke’s two-year fight to shield crisis-squeezed banks from the stigma of revealing their public loans protected a lender to local governments in Belgium, a Japanese fishing-cooperative financier and a company part-owned by the Central Bank of Libya.

The biggest borrowers from the 97-year-old discount window as the program reached its crisis-era peak were foreign banks, accounting for at least 70 percent of the $110.7 billion borrowed during the week in October 2008 when use of the program surged to a record. The disclosures may stoke a reexamination of the risks posed to U.S. taxpayers by the central bank’s role in global financial markets.

Please put me on your e-mail list. [email protected]

Thank, Barbara Conrad

You seem to know what you are talking about and agree with my German Website “Kopp Verlag”. Please include me in your e-mailers.

Barbara

@Nonanonymous

No, 2005 had nothing to do with small business (other than the fact that many small businesses use personal credit to finance).

Along with “bankruptcy reform,” they also added reams and reams of other financial laws, rules and regulations. (yet most Americans scream for “regulation” to fix the mess regulation has wrought).

Anyway, one of the bills slipped through was the doubling of minimum mandatory payments in order to “help” (force) the average American idiot to pay off their debt “faster.” This clause did not kick in until (guess it) November 2007. Amazingly we, a country living on – and drowning in – debt, hiccuped when our minimums went from less to 1% to 2% OR 2% plus monthly interest.

Which would not have been that bad had CONGRESS reinforced usury AND made the banks keep their interest rates at the same, or close, to pre-law change.

But the banks cried foul (just think of all the interest they would lose if idiots paid more off every month) and banks did what they always do. With Congress’s blessing they fucked us hard.

My credit entering 2007 was STELLAR. I was carrying some debt (in large part due to our business tanking thanks to foreign “competition” and customer bankruptcies/mergers), but I always made double, or more, my minimums and was NEVER a second late with payments. I also had a great debt to available credit ratio.

Starting in January of 2007, I started getting credit lines slashed and interest rates – in some cases – quadrupled and more. Which not only trashed my credit – through no fault of my own – it trashed my finances as the debt I had acquired and was paying off went from an average of 3.5% interest to an average of 23% OVERNIGHT.

THIS is what Congress did, and they did it to the entire country.

Yet we continue to scratch our heads, look at the real devastation cause by regulation, foreign “competition,” mega-national competition and Congress and NOT SEE it.

Anyone that truly thinks CONgress will ever right a regulation fixing the millions of regulations that fucked us over is completely delusion.

The banks will not stop taking a larger piece of the pie as long as we the people allow Congress to continue on as usual. The only end result is eventual, and complete, devastation of all of us too little to matter.

Good article Jim,

Many fresh faces commented on this article. Those who have the power and wealth make the rules, and change the rules for their benefit.

I guess this article went semi-viral as TBP got 23,800 visitors yesterday. I think that is a new one day record.

The 23,800 visitors were treated to plenty of boobs. Am I referring to the TBP shit throwing monkeys, or to actual boobs? You decide.