Another great article on Peak Oil from Gail the Actuary on http://www.theoildrum.com/. If her assessment of oil production between now and 2021 is even close to accurate, we’re in a world of hurt. Impartial articles like this one should convince the most delusional peak oil denier that their drill,drill, drill mantra is nothing but hot air. I hadn’t seen the figure she stated as being the current cost for a barrel of oil to be produced in the Middle East as $95. That would appear to put a floor on the price of oil at a level above $95.

The good news is that our oil consumption will decline as soon as the price gets high enough to push our country back into recession. We are just about there. So, oil prices will decline again, but the low price this time will be much higher than the last low. This is the bumpy plateau. Supply and demand sure is a bitch. Expect some more humanitarian invasions of Middle East countries sitting on top of our oil.

My little peak oil widget just passed the 10 billion barrels consumed level for the year so far. I wonder if we discovered 10 billion new barrels during this same time frame.

Peak Oil – April 2011 Update

Posted by Gail the Actuary on May 2, 2011 – 1:27pm

The US Energy Information Administration’s January oil production figures are out, and they show record oil production. Where are we headed from here?

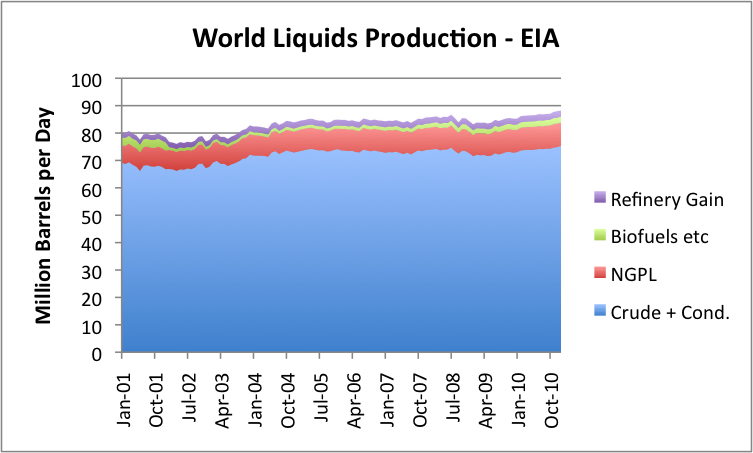

Figure 1. World “Liquids” Production through January 2011, based on Energy Information Administration data.

While production for January is up a bit (219,000 barrels compared to December), the monthly numbers bounce around a fair amount because of planned maintenance. They are also subject to revision. Figure 2 seems to indicate that the production amounts are trending upward a bit, probably in response to the recent higher prices.

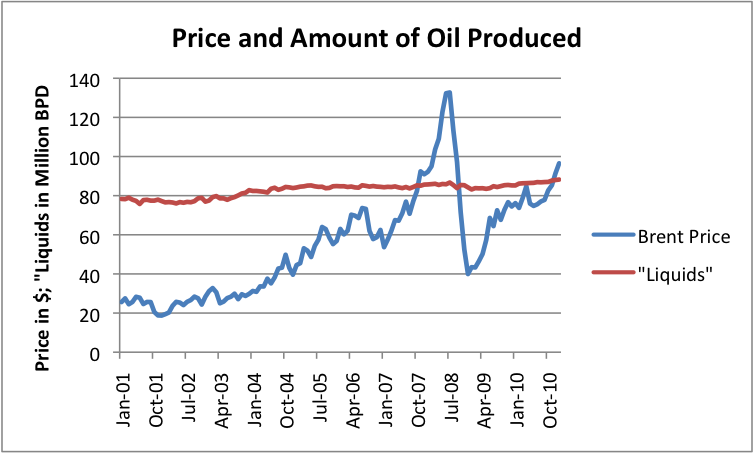

Figure 2. Monthly average Brent Oil price and total “liquids” produced, both from US Energy Information Administration.

The amounts in Figures 1 and 2 are not entirely up to date, since they are only through January 31, 2011. All of the disruption in the Middle East started at the very end of January, and the disruption in Libya’s supplies did not start until February. The earthquake in Japan took place March 11. OPEC estimates that OPEC and world oil supply fell in both February and March, with Libya’s production falling by 1.2 million barrels a day between January and March, with only small supply increases elsewhere offsetting this. World oil prices continue to be high. At this writing, West Texas Intermediate is about $111.50 a barrel; Brent is about $122.

So what do we expect going forward?

Eventual Decline, but not Following a Hubbert Curve

It seems to me that the story about what happens in the future with oil supply is much more complex than what depletion and new supply alone would suggest. As I explained in a previous post (Our Finite World version and Oil Drum version), the actual downslope is likely to be steeper than what a Hubbert Curve would suggest, because economies of many importing countries are likely to be adversely affected by rising oil prices, and because demand (and tax collections) are likely to be low in countries that lose jobs to countries that use oil more sparingly.

Hubbert assumed that nuclear or some other cheap alternative form of energy would allow business to go on pretty much as usual without oil. We know now that we are close to the downslope, but no inexpensive alternative has been developed in quantity. Because of this, actual production is likely to be less than the amount that is theoretically possible. This happens because of indirect impacts of inadequate oil supply, such as recession when prices oil prices rise; riots when food is in short supply; and inadequate demand for oil because of jobs move overseas to countries using less oil, leaving many unemployed.

In some sense, if oil prices could rise indefinitely, we would never have a peak oil problem. The high prices would either stimulate production of alternative types of energy or would enable oil production in areas where oil is very costly to extract. The indirect impacts mentioned above prevent oil prices from rising indefinitely. These indirect impacts seem to be related to inadequate net energy for society as a whole. Theoretically, if oil prices could rise indefinitely, we could even end up using more energy to extract a barrel of oil than really is in the barrel of oil in the first place–something that is hardly possible. The fact that rising oil prices lead to impacts that tend to cut back demand seems to be a way of keeping prices in line with the energy the oil actually provides.

Which countries are able to buy the oil that is produced?

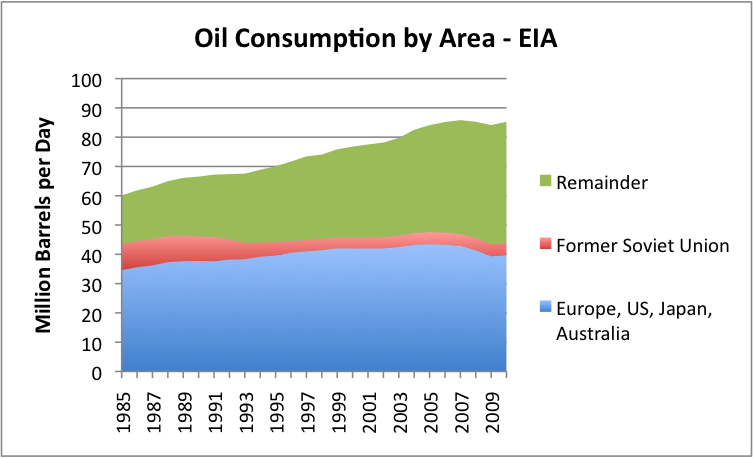

If we look at oil consumption by area, we find the following:

Figure 3. Oil consumption by area, based on EIA data.

It is clear from Figure 3 that consumption of my grouping called “Europe, US, Japan, and Australia) is much flatter (and recently declining) than that of the “Remainder.” The Remainder includes oil exporting nations, plus China and India and other “lesser developed” countries, many of which are growing more rapidly than countries like Europe, US, Japan, and Australia.

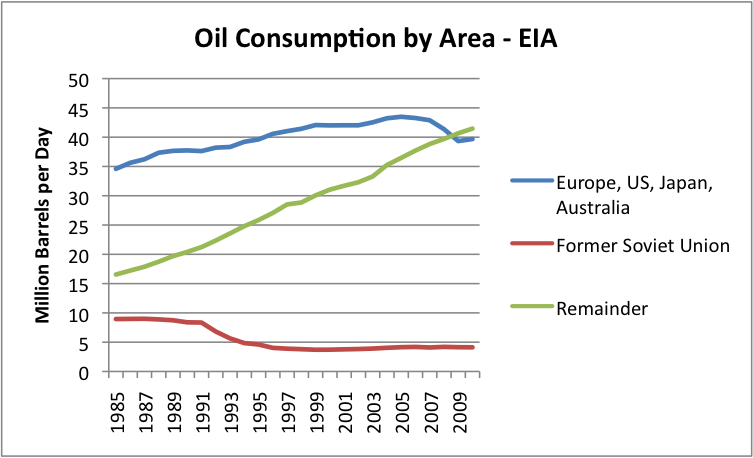

I have plotted the same data shown in Figure 3 as a line graph in Figure 4. The latter figure shows even more clearly how different the oil use growth rates have been.

Figure 4. Data from Figure 3, graphed as a line graph, instead of a stacked area chart.

If world oil supply is close to flat (shown in Figures 1, 2, and 3), Figure 4 shows that we have a potential for a real conflict going forward. The “Remainder” countries in Figure 4 will want to continue to increase their oil usage in future years, even if oil supply remains flat. This is likely to lead to considerable competition for available oil and high prices, such as we are seeing now. About the only way the “Remainder” countries can increase their oil usage is if oil usage by the “Europe, US, Japan, and Australia” group declines.

Many people believe that the only alternative to adequate oil supply is for the amount of oil produced by oil companies to fall and because of this, for shortages to result. While this scenario is possible, especially in the presence of price controls, in this post we show another way that oil consumption can be limited.

A very common way that oil usage (consumption) can be expected to decline is if high oil prices induce a recession. The countries that seem to be most susceptible to recession are countries that are (1) oil importers and (2) are heavy users of oil, since an increase in oil price has the most adverse impact on the financial health of these countries. When recession is induced, there are layoffs. These layoffs reduce oil usage in two ways: (1) less oil is used for making and transporting products that these workers would have made, and (2) the laid off workers are less able to afford products using oil, so reduce their purchase of oil products.

Because of this relationship, competition for oil is likely to be very closely related to competition for jobs in the future. The countries that get the jobs can be expected to get a disproportionate share of oil that is available.

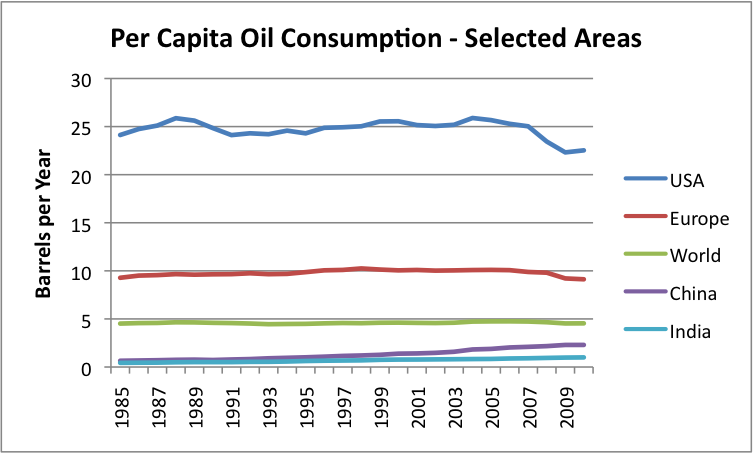

Figure 5. Per Capita Energy Consumption, based on EIA data.

If we look at per capita oil consumption (Figure 5) on a world basis, it has been close to flat since 1985, because oil production until very recently rose enough that oil growth more or less corresponded to population growth. China and India’s per capita oil consumption rose, meaning that the oil consumption of someone somewhere, such as the Former Soviet Union, needed to decline.

Future Oil Supply

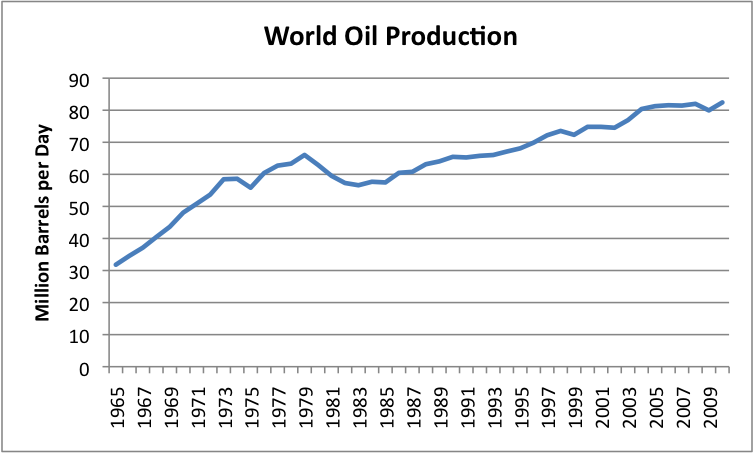

If we look at historical oil production (Figure 6), it has been fairly “bumpy”:

Figure 6. World oil production for crude, condensate and natural gas liquids. 1965-2009 from BP; 2010 from EIA.

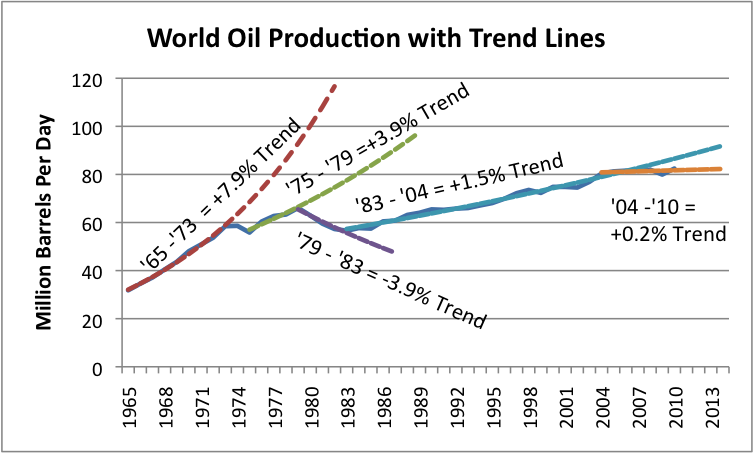

By fitting trend lines, we can see where oil production seems to be headed:

Figure 7. World oil production from Figure 6, with fitted exponential growth trend lines.

What we can see from Figure 7 is that the growth rate of world oil supply has gradually been slowing. The growth rate was highest in the 1965 to 1973 period, at 7.9% per year. Then we hit the “oops” period of 1973 to 1975, when we ran into conflict with OPEC regarding oil supplies. The trend rate dropped to 3.9% in the 1975 to 1979 period. Between 1979 and 1983, oil consumption dropped to a -3.9% per year, when we picked some of the low hanging fruit regarding oil usage (mostly by eliminating petroleum from electricity generation and downsizing automobiles). The trend between 1983 and 2004 shifted to +1.5% per year, and since 2004, seems to be about +0.2%.

There are so many countries involved, that it is not easy to identify one country or area that is rising, but one country of note is Iraq. Its production in January, 2011, seems to be up by 300,000 barrels per day, relative to mid-2010, based on the latest data. Thus Iraq seems, for now, to be helping to keep world oil production flat, or even growing by a bit, despite increasing depletion elsewhere.

Looking at Figure 7, it looks like the “trend” in trend rates over time is down. In the absence of other information, we would expect production to remain at its recent trend rate of 0.2%, or alternatively, the trend rate could take another step downward, probably to an absolute decline in oil production. A recent announcement from Saudi Arabia suggests that its ability to offset declines elsewhere in the future is likely to be virtually nil, so a continued decline in production from the North Sea and elsewhere will need to be made up with new production elsewhere, or will lead to a worldwide decline in oil production.

World population has been growing. If oil production remains flat or declines, and world population grows, this means that someone has to be a loser, in terms of per capita consumption. I am not certain how this will turn out, but I see at least three forces that may come into play:

1. Countries may figure out that permitting jobs to move to less developed countries is not in their best interests, and start increasing protectionism. This will tend to keep demand more level (higher for importers, and lower for growing economies). The overall impact on oil demand is less clear–less oil will be needed for long-distance transport, but more oil will be needed to maintain current lifestyles of workers.

2. Countries that are in financial difficulty may find themselves increasingly shunned, as they seek to “restructure” their debt, and may find themselves increasingly cut off from buying oil products and the goods that that are made using oil products. This will tend to reduce aggregate world demand for oil, by reducing consumption in specific countries that have financial difficulty.

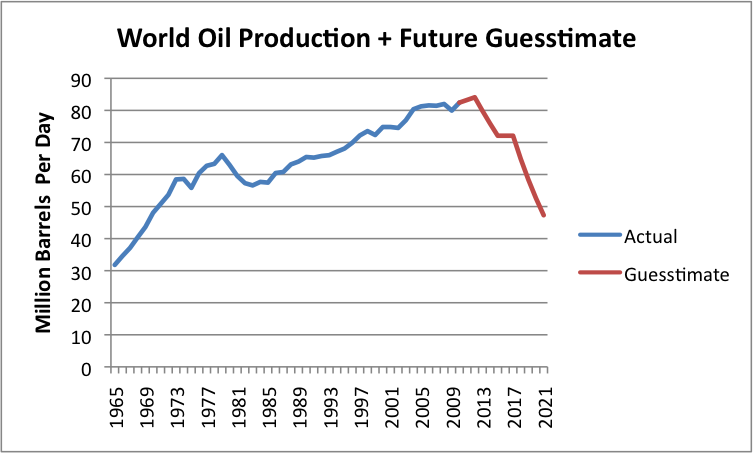

3. There may be recession affecting a number of countries, reducing their demand for oil. We don’t know how exactly that this will change the shape of the world oil production curve, but Figure 8 shows my very rough guess as to how supply might be affected. (Your view may differ.)

Figure 8. Historical crude, condensate, and NGL production based on BP and EIA data, plus a Guesstimate of Future Oil Supply.

It seems to me that as we go forward, we are likely to see a jagged pattern in oil production decline, reflecting a combination of less demand for high-priced oil as oil supplies continue to be very tight, except at high prices. In addition, some countries can be expected to increasingly drop out of competition for oil, as their financial situations deteriorate. Thus, the pattern for decline in oil consumption can be expected to vary significantly from country to country, depending on their policies and their financial conditions.

Clues as to Which Countries May Drop Out First

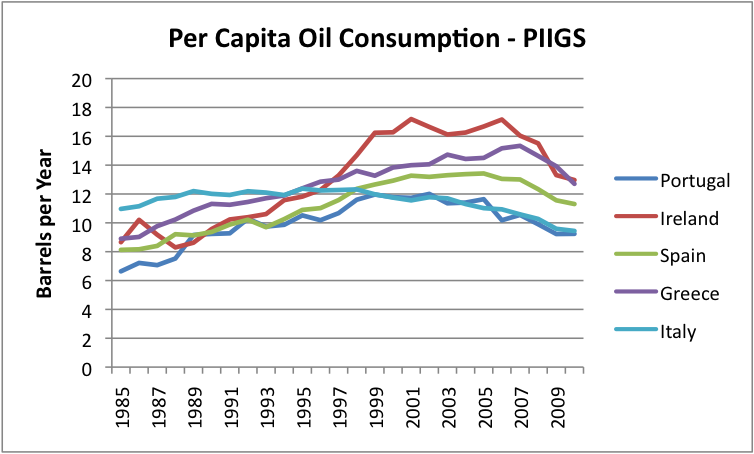

If we look at the per-capita consumption of the PIIGS countries, we see that for the most part, these were countries that increased their consumption of oil, and then were not able to maintain the increase.

Figure 9. Per capita oil consumption of PIIGS countries, based on EIA data.

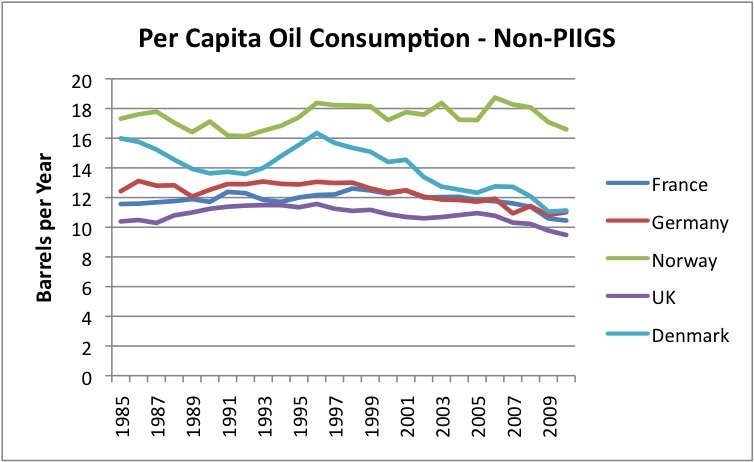

The difference is quite striking when we compare per-capita oil consumption to a few of the non-PIIGS European countries.

Figure 10. Per capita oil consumption of selected European “non-PIIGS,” based on EIA data.

Why is there such a different pattern between the PIIGS and the non-PIIGS? I haven’t researched the situation extensively, but it would seem as though the PIIGS countries tended to be agricultural countries that tried to develop more diversified (oil intensive) economies. They expanded and incurred a lot of debt, and now this debt is becoming difficult to pay back. As far as I can see, this economic growth was not based on the growth of stable, fairly cheap supply of electricity, such as hydro-electric or coal. Instead, growth depended fairly heavily on oil use, and the cost of oil rose. It may be that part of this growth in oil use occurred because of an improvement in standard of living–more cars, more vacations, bigger homes.

My working hypothesis is that when oil prices went up, the economies of the PIIGS countries had too much debt for the new industries to provide enough revenue to service both the higher costs of oil and the debt costs. Countries which didn’t try to grow in this way didn’t have as much difficulty, although high oil prices are still a burden for them. They may eventually run into debt problems, just a little later.

What are China and India and some of the other countries that are growing rapidly doing differently, that their economies haven’t collapsed? One thing they have going for them is the fact that their oil usage is at a vastly lower level, even after rapid growth. Another thing that they often have going for them is growing electricity production, using an energy source that is relatively cheap. In the case of China and India, this is mostly coal; in the case of some of the other lesser developed countries, it is hydro-electric.

It seems as though at some price, each country will hit recessionary pressures and drop back in its demand for oil. This price will vary by country, depending on the country’s current debt situation, the extent to which the country can continue to “grow” its economy based on a growing source of cheap electricity, and how well international trade holds up with increased protectionism and higher oil prices. Countries depending on growing hydroelectric and coal-fired electricity are likely to hit limits, too, as these supplies reach natural limits.

One situation which may affect how long oil prices can stay high for the United States is the existence of QE2, or “Quantitative Easing 2.” This seems to keep the dollar low relative to other currencies, thus allowing commodities prices to remain high. QE2 is scheduled to end June 30, or earlier. If it is allowed to expire, it would seem as though interest rates could rise materially (because QE2 also keeps interest rates low), and could lead to a rapid deterioration in the financial condition of the United States. If this should happen, it would seem as though the United States could be one of the countries that enters recession and significantly decreases its demand for oil. Of course, high oil price by itself may lead to this outcome quite soon, also.

We cannot know how all of these forces will play out. Generally, I would expect that there will continue to be an upward push on the price for oil because of rising extraction costs, and because unrest in the Middle East is causing countries to provide additional benefits for their citizens, further raising their costs (estimated to be $95 barrel by the Wall Street Journal). As long as the world economy is expanding, rising demand will also tend to pull oil prices upward, because many countries are trying to compete for a supply of oil that is barely growing.

The various countries around the world can be expected to be in differing positions with respect to their ability to pay high oil prices. Gradually (or not so gradually), the weakest ones will be pushed away from buying oil, either because of debt defaults and shunning by exporters (unless they have goods to trade in return), or because of recession, or both. World oil production seems likely to decline as the number of countries that can afford to continue to purchase high-priced oil declines. Ultimately, oil consumption can be expected to drop to close to 0, because no country will be able to afford to buy very much oil at a high price, and because oil companies will not be able to maintain necessary infrastructure for a very limited supply of oil.

I don’t think that we can expect an analysis of the theoretical capacity of future world oil production to tell very much of the peak oil story. We really don’t know how much of the oil which seems to be available will actually be produced. A lot of the story will depend on the ability of individual countries to keep their economies in good enough shape that they can afford to buy high-priced oil. Many residents of countries that are shut out from oil supply are likely to find that oil products are not available at any price.

Originally published on Our Finite World.

God help us if global oil production were to crash in the sudden cliff drop that is depletion in modern oil wells with their ultra-vacu-suck extraction systems. Not to mention the various gas wells, especially the fracked ones, that produce massively for 1-1.5 years and then cliff dive. We would really see Mad Max in all its leather-clad glory.

Anyone notice the odd coincidence that Gail, one of TOD’s biggest contributors, is an actuary, and RE, TBP’s resident LPN Know-It-All is a former underwriter with an actuarial bent? See, if we just off’d the actuaries we would all be fine!

Yemen light crude output, exports slashed

Reuters May 4, 2011 – 2:20 PM ET

DUBAI/ADEN –Yemen’s production and export of light crude oil from its offshore terminal in the Red Sea have come to a standstill after a mid-March blast on its main oil pipeline, shipping sources said on Wednesday.

The poorest Arab country’s output of 110,000 barrels per day of Marib Light crude from its offshore Ras Isa terminal closed three weeks ago after an explosion on the main pipeline carrying oil.

“There have been no exports of crude from Ras Isa for the past three and a half weeks,” one shipping source said. “There has been no production of Marib Light crude since then.”

Yemen produces a total of around 280,000 barrels per day of crude oil. Around 110,000 barrels of that is light crude, which is in short supply globally after the loss of Libyan output in February.

The pipeline blast occurred in the central Marib province, where several oil and gas fields operated by international companies are located.

“It is thought that tribesmen, angry with the government, were responsible, and it is linked to the current unrest,” a second shipping source based in Yemen said.

The impoverished Arabian Peninsula state has been rocked by weeks of demonstrations, with both pro- and anti-government supporters appearing to resort increasingly to violence in the struggle.

Meanwhile, workers an another Yemeni field operated by Canadian company Nexen returned to work late on Wednesday after a brief strike during the day, a union spokesman said.

An Oil Ministry official and the union spokesman said earlier in the day that production was halted at the Hadramout oilfield due to the strike.

But a spokesman for Nexen in Canada said, “Production activities and export shipments continue to be unaffected as we continue with the mediation process with the union.”

The workers agreed to remain at their jobs for five days while talks continue toward a more permanent accord, the union spokesman said.

The field produces about 150,000 barrels per day of oil, most of which is exported, trade sources said.

The oil terminal at Ras Issa is operated by the SAFER Exploration and Production Operations Company, based in Hodeidah and under the Ministry of Oil and Minerals.

Oil extracted from the Marib oilfield, east of the capital Sanaa, is pumped to the coast to a shore terminal and then carried by sub-sea pipeline to SAFER and then discharged to ships that take it either to Aden refinery or to other countries as exports from Yemen.

Around 65 percent of the 110,000 bpd Marib crude is normally sent to Aden refinery, but the lack of crude from the field has also forced a shutdown of the 130,000 barrel per day refinery for at least a week, shipping sources said.

“There have been serious shortages of petrol in Sanaa recently, with massive price hikes,” a second shipping source said.

He estimated the price of 20 litres of fuel from non-government suppliers, who still had stocks, had jumped to 6,000 Yemeni rials from 1,500 rials a few weeks ago.

“There’s no petrol, there’s no diesel,” the first source said. “What Yemen is doing at the moment is importing petrol and diesel from Saudi Arabia,” the source said.

One vessel carrying 15,000 tonnes of diesel from Saudi Arabia has already arrived at the Hodeida port, he said, adding the imports would continue.

“There will be another two vessels coming from Saturday onwards, carrying gasoline,” the source said, adding that each vessel would carry about 15,000 tonnes of the fuel.

The coastal terminal of Hodeida handles small tankers.

Separately, a spokesman for Yemen LNG, a Total-led liquefied natural gas plant, said on Wednesday operations were running normally.

Saudi Oil Production Doesn’t Add Up

Recent oil production figures from Saudi Arabia, the world’s largest oil exporter, simply don’t add up.

There are competing explanations for this inconsistency. Some analysts claim that the increase in oil production Saudi officials promised in late February to compensate for lost Libyan supplies was fictitious. Statements from the Saudis themselves imply that the kingdom cut its production several weeks later much more sharply than reported. But either scenario contradicts previous statements from Saudi officials.

This muddy picture of what the OPEC kingpin is up to is troubling in an oil market already suffering from high prices and extreme uncertainty.

Saudi Arabia’s Oil Minister Ali Al-Naimi told reporters in Kuwait last week:

“The market is overbalanced … Our production in February was 9.125 million barrels per day, in March it was 8.292 million barrels per day.”

Assuming Mr. Al-Naimi was following OPEC norms and quoting average production figures for those months, his numbers are odd to say the least.

Shortly after the civil war in Libya erupted in February and halted much of the country’s 1.3 million barrels a day of oil production, Saudi Arabia promised to quickly fill the gap. On February 28 Saudi officials said they would raise production to 9 million barrels a day–swift action that reassured oil consumers that unrest in the region wouldn’t result in supply shortages.

However, Mr. Al-Naimi’s statement contradicts this version of events. According to him, Saudi Arabia was already producing an average of 9.125 million barrels a day in February, before the output hike in response to the situation in Libya.

So did the Saudis really pump more oil to make up for the loss of Libyan crude?

Analysts at Goldman Sachs and Barclays Capital say no. “They were producing at nine million barrels a day since November in response to the strength of demand,” said Barclays analyst Amrita Sen.

Goldman analysts said in a note: “While Saudi Arabia announced a boost to production to offset the [Libya] shortfalls, the production increase had likely already happened some time ago.”

One Saudi official who did not wish to be named said the kingdom did indeed increase its production in February. The official explained that production averaged 9 million barrels a day that month because, “our output does change from one day to another.”

Other Saudi officials said prior to Mr. Al-Naimi’s comments that production increased by between 500,000 and 600,000 barrels a day at the end of February in response to the Libyan crisis. The kingdom subsequently reduced output by 500,000 barrels a day in mid-March, officials said, but only because of lack of demand for their oil, which is unsuitable for regular refiners of Libyan crude.

If you take these statements at face value, major inconsistencies remain. By crunching the numbers above, Saudi Arabia’s March production should have averaged around 9.4 million barrels a day. But Mr. Al-Naimi said it produced 8.3 million barrels a day in March. The only way you can get to Mr. Al-Naimi’s figure is to assume that in the second half of March the Saudis slashed production to just 7.0 million barrels a day. This is a level not seen since the 1990s and it is scarcely credible that Saudi Arabia would cut so deep at a time when oil demand is still growing and prices have been hitting two-and-a-half year highs. Independent estimates from the International Energy Agency and OPEC put Saudi Arabia’s production at 8.9 million barrels a day in March.

So what is going on?

The honest answer is that nobody knows right now. A clearer picture will probably emerge in time that explains the confusing Saudi figures, although maybe not soon enough to ease the tremendous uncertainty that has pushed up oil prices since the beginning of the year. What is certain is that the largest oil exporter can’t seem to get its story straight, and that is a big worry for all oil consumers.

Libya unrest dampens OPEC oil output

By Alex Lawler May 3, 2011

LONDON – OPEC output fell to a 23-month low in April as extra oil from Saudi Arabia and Nigeria did not make up for supplies lost due to fighting in Libya and oilfield maintenance in Angola, a Reuters survey found May 3.

Supply from all 12 members of the Organization of the Petroleum Exporting Countries averaged 28.42 million barrels per day (bpd), down from a revised 28.48 million bpd in March, the survey of oil companies, OPEC officials and analysts found.

The Libyan crisis has almost shut down output in what used to be Africa’s third-largest producer. Analysts say the loss of its crude is likely to keep the heat under prices trading at $124 a barrel and near the highest since 2008.

“It looks like Libya’s going to stay shut for the long term and I think there will be a geopolitical risk premium for the rest of the year, supporting the price,” said Paul Tossetti, senior energy adviser at PFC Energy.

Top world exporter Saudi Arabia raised supply in April from a much lower figure in March than initially estimated. The kingdom cut production in March due to oversupply, Saudi Oil Minister Ali al-Naimi said on April 17.

OPEC output in April was the lowest monthly total since May 2009, soon after the organization had implemented a record output cut to prop up prices, according to Reuters surveys.

Supply has fallen for three months since reaching 29.63 million bpd in January, the highest since December 2008.

Angolan supply declined by the most in OPEC because of field maintenance and, according to industry sources, declining output at some of the country’s older fields. Export schedules suggest little change in output for May.

Libya’s production posted a further decline of 70,000 bpd in April to average 250,000 bpd. Until violence broke out earlier this year, output had been running near 1.6 million bpd.

Of the countries with higher output, Saudi Arabia boosted supply by 200,000 bpd from 8.3 million bpd in March — much lower than the 9 million bpd initially estimated by Reuters for March.

“Production was around 8.5 (million bpd) in April and the reason we raised output is because there was higher demand,” a Saudi-based industry source said on Sunday.

Initial estimates suggest a decline of 100,000 bpd in the United Arab Emirates and stable output in Kuwait.

Nigeria shipped more barrels in April because of a reduced impact of field maintenance on output. Iraqi output, excluded from OPEC output agreements, was slightly higher.

OPEC has so far decided against taking any formal action on raising its output in response to the Libyan crisis and it is not scheduled to meet until June.

The group has not officially changed its policy for more than two years since cutting output by a record 4.2 million bpd in December 2008 as prices fell and recession destroyed demand.

OPEC does not provide timely official production figures, so the oil industry relies on supply estimates from news agencies, consulting firms and organizations such as the International Energy Agency.

You’ve got it all wrong, Jim. Our current high oil prices just CAN’T be a result of production cuts and shortfalls. It’s all because of evil speculators. HRH Obama told me so, and he ain’t never told a lie.

You need to get with the program. I think your wild conspiracy theories are un-patriotic. And you know what we do to un-patriots.

“Two days ago, I saw a vehicle that’ll haul that tanka. So if you want to get out of here….you talk to me.”

And hence:

Figuratively speaking we’re already there. It’s not literal yet. Heading rapidly for littoral though.

When they remake The Road Warrior, I’m going to propose these actors:

Lord Humongous – George Soros (alternate: CEO of BP)

Wes – GW Bush

The gyro pilot – Reverse Engineer

The feral kid – me

Let’s hear your suggestions.

Persnickety, you forgot one…

Mad Max- Colma Rising

“The gyro pilot – Reverse Engineer”-Persnickety

I’ll consider the role for my next Avatar 🙂

[img [/img]

[/img]

RE

One more thing, Persnickety, regarding your first post…

If my girlfriend passes the P1 exam this month I rescind my thumbs up… nobody touches my sugar-mama.

I don’t know where she gets the cost of $95 per barrel of oil. Obviously we have another oil and gas wizard who has never drilled or operated oil and gas wells. The cost here in the USA lower 48 is much lower than that overall. Cost to produce is the costs to drill and complete, operating expenses vs the total cumulative recoverable oil per well. At 50 or 60 dollars we can still find a few prospects that have a chance to earn some profit. The US is a much higher cost producer than the middle east because of the massive reserves per well they have. Also most of the ME wells were drilled many years ago and payed for themselves with their first few days of production, and don’t cost jack to operate. We find nothing like that here in the US. yet our cost per BO are still much lower than $95.

Not to say we have not reached or will soon reach Peak oil. We have or will. Every well ever drilled that produced oil or gas eventually depleted. Every well ever drilled today or in the future will eventually become depleted. Same goes for every field and every region on earth. If the value of the dollar stays about where it is and oil is at 70 dollars or higher there are thousands of guys just like me that will be very motivated to go out and find some. Right now though the FED is driving up oil prices not supply. When a supply problem develops and it always does sooner or later and you combine that with FED printing………….watch out the sky’s the limit. Oil is a boom and bust business and always has been but its possible we may be in a long boom that can only bust by drastically reduced demand. Oil, gold silver that’s all you need and maybe a good rifle.

Bwftx:

I believe Gail comes up with that cost per barrel as a result of state-owned operations and the cost of social benefits these countries have. When it’s considered as their SOLE export, every machination of the state… infrastructure, security and cost becomes a factor in the per barrel price.

I believe that Venezuela has an even higher production price as they are outright red.

Maybe I can pull some info when I get to a real computer, but that’s probably how that variable in her calculations developed.

[img [/img]

[/img]

Here is a picture of me with my sugar momma. I sure hope she passes that test. Please God, let her pass that test.

[img [/img]

[/img]

Tis is a photo of her sister, who is also going to be rich, if any of you are looking for a sugar momma. I can put you in touch.

[img [/img]

[/img]

Son of a son of a bitch.

Dirty tleilaxu, horrid doppelgangers a comin’ for Colma.

I have a feeling this isn’t just llpoh, either…

The doppelgangers gather and hose Colma while he’s walking for a burrito…

[img [/img]

[/img]

When you admit to being a male whore, youse gets what youse gets.

Colma takes his whooping like a man…

Colma -I really like the little matching nechlace thingy you and your momma are wearing in the photo. She would look better in a leash, tho.

That is, like a man:

[img [/img]

[/img]

necklace thingy.

I gather the drill drill drill mantra is about deregulating and not about production. What oil company would want to lower prices by increasing production? Thats like all the bakeries in town saying bake bake bake because high cake prices are bad for business.

Oil demand is already dropping. Refineries arent running at 100%

Oil demand didnt drop by nearly 75% when the price of oil went from 140 a barrel back to 40 or so. Nor did global demand. If you think speculators dont speculate on and set thru futures contracts the price of oil on delivery you must not understand what prophecy means and we all know prophets are usually wrong.

[img ?t=1304556904[/img]

?t=1304556904[/img]

But Colma’s resolve is only strengthened… and revenge will be his.

Just so long as they do not run out of oil for my ride before I pass on, I will be happy. This is my ride:

[img [/img]

[/img]

Don’t fret, llpoh… your real ride can plug into a solar charger…

[img]http://t2.gstatic.com/images?q=tbn:ANd9GcTFKxGo1pbs_aw-Mygguq0UfA7HfxKzVh30WftV4P97_00wKDr2[/img]

Just wait until dec 21 2012 when a meteor hits the ginormous caldera in Yellowstone causing a huge inferno reducing the oxygen level to 10% and cars wont run and and and they wont be able to sell that shit oil because nothing will burn not even firewood and and the earths magnetic field flips and a coronal mass ejection knocks out the power grid and big brother cries because his tracking devices stop working and and then where will the social justice be when inequality and three hundred thirty million blocks of squalor rise up!!!

/doomgloom

At least I don’t have to ride your sugar momma, if you get my drift. How much a week do you spend on paper bags?

KB:

That’s supposed to be on the other thread.

SUV driver after the global apocalypse [/img]

[/img]

[img

KB – lmao! Can you imagine the smile on RE’s face when that day comes. His last words will be “I told you all so!”

That’s supposed to be on the other thread. -CR

Sorry. I thought those pics were of people that survived a radioactive apocalyptic scenario.

My Bad

KB: They’re from some strike in S. Korea a few years back…

the old officer in the refinery compound–me

(dude on the right, with the medals and the helmet)

[img [/img]

[/img]

“I’ll talk to this Humongous. He seems like a reasonable fellow!”

KB – lmao! Can you imagine the smile on RE’s face when that day comes. His last words will be “I told you all so!” -llpoh

I would drive my Two Wheeled SUV-OXmobile into his yard and let it crap there.

Since Jim leads our ragtag band of doomer blog commenters, I was going to nominate him for the role of Pappagallo.

Don’t tell him how that winds up in the “run for freedom” scene.

Admin – you must pull out what remains of your hair when you see this shit happen. You put up a serious and important topic for discussion, and the feral monkeys quickly come along and cover it in shit. I am truly sorry to have been a part of this. It will never happen again.

[img [/img]

[/img]

[img.jpg) [/img]

[/img]

[img [/img]

[/img]

All starts with a harmless sugar-mama comment… all in a day’s work.

KB: Genius

Kill Bill: a pic of the Bernank and TT Timmy?