“There will be, in the next generation or so, a pharmacological method of making people love their servitude, and producing dictatorship without tears, so to speak, producing a kind of painless concentration camp for entire societies, so that people will in fact have their liberties taken away from them, but will rather enjoy it, because they will be distracted from any desire to rebel by propaganda or brainwashing, or brainwashing enhanced by pharmacological methods. And this seems to be the final revolution.” – Aldous Huxley

Researchers at the University of Texas recently published a study about why men buy or lease flashy, extravagant, expensive cars like a gold plated Porsche Carrera GT. There conclusion was:

“Although showy spending is often perceived as wasteful, frivolous and even narcissistic, an evolutionary perspective suggests that blatant displays of resources may serve an important function, namely as a communication strategy designed to gain reproductive rewards.”

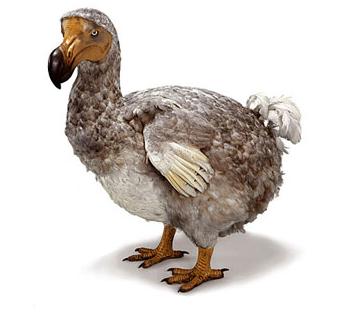

To put that in laymen’s terms, guys drive flashy expensive cars so they can get laid. Researcher Dr Vladas Griskevicius said: “The studies show that some men are like peacocks. They’re the ones driving the bright colored sports car.”

Lead author Dr Jill Sundie said: “This research suggests that conspicuous products, such as Porsches, can serve the same function for some men that large and brilliant feathers serve for peacocks.” The male urge to merge with hot women led them to make fiscally irresponsible short term focused decisions. I think the researchers needed to broaden the scope of their study. Millions of Americans, men and women inclusive, have been infected with Peacock Syndrome. Millions of delusional Americans thought owning flashy things, living in the biggest McMansion, and driving a higher series BMW made them more attractive, more successful, and the most dazzling peacock in the zoo.

This is not an attribute specific to Americans, but a failing of all humans throughout history. Charles Mackay captured this human impulse in his 1841 book Extraordinary Popular Delusions and the Madness of Crowds:

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

The herd has been mad since 1970 and with the post economic collapse of 2008, some people are recovering their senses slowly, and one by one. The country was overrun by flocks of ostentatious peacocks displaying their plumage in an effort to impress their friends, families and work colleagues. What set the flaunting American peacocks apart was the fact they financed their splendid display of plumage with $0 down and 0% interest for seven years. The lifestyles of the rich and famous miraculously became available to the poor and middle class through the availability of easy abundant credit provided by the friendly kind hearted Wall Street banks and their heroin dealers at the Federal Reserve.

The United States has experienced a four decade long “expenditure cascade”. An expenditure cascade occurs when the rapid income growth of top earners fuels additional spending by the lower earner wannabes. The cascade begins among top earners, which encourages the middle class to spend more which, in turn, encourages the lower class to spend more. Ultimately, these expenditure cascades reduce the amount that each family saves, as there is less money available to save due to extra spending on frivolous discretionary items. Expenditure cascades are triggered by consumption. The consumption of the wealthy triggers increased spending in the class directly below them and the chain continues down to the bottom. This is a dangerous reaction for those at the bottom who have little disposable income originally and even less after they attempt to keep up with others spending habits.

This cascade of expenditures could not have occurred without cheap easy credit, supplied by Wall Street shysters and abetted by their puppets at the Federal Reserve through their inflationary policies. Real wages are lower today than they were in 1970. Coincidentally, the credit card began its ascendance as the peacock payment of choice in 1970. There are now over 600 million credit cards in circulation in the U.S. in the hands of 177 million fully plumed peacocks and peacock wannabes.

Monthly Payment Nation

“Consumerism requires the services of expert salesmen versed in all the arts (including the more insidious arts) of persuasion. Under a free enterprise system commercial propaganda by any and every means is absolutely indispensable. But the indispensable is not necessarily the desirable. What is demonstrably good in the sphere of economics may be far from good for men and women as voters or even as human beings.” – Aldous Huxley

The country seemed to do just fine from 1945 through 1970 with no credit card debt and moderate levels of auto loan debt. In fact, this period in U.S. history was marked by strong economic growth created by capital investment, savings, and the American middle class realizing the American dream of a better life based upon their work ethic. Around about 1970, the intersection of Baby Boomers coming of age, the belief that social justice for all was a noble goal, and Nixon’s closing the gold window, opened Pandora’s Box and the evil released has brought the country to the precipice of ruin. Today, consumer credit outstanding totals $2.43 trillion, or $22,000 per household. It peaked at $2.6 trillion in 2008 and the storyline fed to the masses was that Americans had seen the light and embraced frugality by paying off their debts. As with most storylines spouted by the mainstream media, it was completely false. The Wall Street banks wrote off over $200 billion since 2008, while delusional peacocks continued to finance and lease gas guzzling luxury automobiles, while charging their purchase of an iPad2 and Lady Gaga concert tickets on one of their 13 credit cards.

It seems a vast swath of America refuse to shed their peacock feathers. This explains why you see BMWs, Mercedes, Escalades, and Porsches parked in the driveways of $100,000 houses. Automobiles are the truest representation of American peacock syndrome. Very few people look at a car purchase in a rational long term financial sense. It’s about impressing the neighbors, your peers and your family. Driving a brand new luxury car gives you the appearance of success. The neighbors don’t know you are in debt up to your eyeballs. This explains why 30% to 40% of all luxury cars are leased. A man could buy a $20,000 Honda hybrid with 10% down and finance the rest at 0.9% for three years. His monthly payment would be $500. After three years he would own the car outright, with the added benefit of getting 45 mpg. He could then invest the $500 per month for the next seven years in gold and silver or something else that benefits from Federal Reserve created inflation. In today’s society this would be the act of a doo doo bird.

Why drive a putt putt car when you can drive the ultimate peacock machine – a BMW 528i with 24-valve inline 240-horsepower 6-cylinder engine with composite magnesium/aluminum engine block, Valvetronic, and Double-VANOS steplessly variable valve timing, 10-way power-adjustable driver’s and front passenger’s seat with 4-way lumbar support, and memory system for driver’s seat, steering wheel and outside mirrors, along with high-fidelity 12-speaker sound system, including 2 subwoofers under the front seats, and digital 7-channel amplifier with 205 watts of power. Plus it looks really cool. This materialism machine can be leased for the same $500 per month that the doo doo bird pays for his Honda hybrid. Of course, after three years of renting luxury wheels the peacock has to turn in the 528i and lease an equally luxurious auto because driving an economy car would now harm his reputation. Colorful plumage is everything to a peacock.

Sometime over the years Americans lost their bearings and began to ignore a basic truth. The only way to accumulate wealth is to spend less than you make and save the difference. Over a ten year time frame the peacock will have dished out $60,000 renting luxury cars, while the doo doo bird will have expended $21,000 during the first three years and then invested $500 per month for 84 months, leaving him with a net $25,000 asset, based on a modest investment return of 5%. The doo doo bird ends up $85,000 wealthier than the peacock at the end of ten years. If you peruse the car dealer advertisements in your local paper, the price of the car is rarely even printed, only the monthly lease payment or 0% financing offer. There is a reason why the average American lives paycheck to paycheck, has no emergency fund for a rainy day, and has virtually no retirement savings socked away. Status, reputation and the appearance of success became more important to millions of Americans than living within their means and actually sacrificing and doing the hard work required to succeed. Delayed gratification is an unknown concept in America.

In 1970, 37% of households consisted of 4 or more people and we somehow managed to get by with one four door car per household. Today, only 24% of households consist of 4 or more people. There are 113 million households and over 250 million passenger vehicles, or 2.2 per household. So, even though the number of people in our households has shrunk dramatically, we needed 120% more vehicles to transport our vast quantities of stuff. Not only do we have more vehicles, but the size of these symbols of gluttony has doubled and tripled, with fitting names like: Tundra, Navigator, Titan, Yukon, Suburban and Hummer. Every soccer mom with two kids needed a 20 foot long, 6 foot high Yukon with an 8 cylinder engine, getting 12 mpg to shuttle around little Aiden and Chloe to their ten scheduled weekly activities. It wasn’t only automobiles that Americans went gaga over. The average home size in 1970 was 1,400 square feet (we drive cars bigger than that today). By 2009, the average home size reached 2,700 square feet. God knows we need 12 rooms for our 2.4 person households. The expenditure cascade started as a trickle in 1970 but became a raging uncontrollable waterfall by 2008.

Delusional Americans have been slowly lured into the web of debt and living their lives based upon whether they can make the monthly payment on their debt. I can anticipate the outrage from those who declare it wasn’t them, it was the other guy. Everyone has an excuse for why they aren’t to blame, but the facts speak otherwise:

- Non-revolving (auto & education) debt outstanding is at an all-time high of $1.64 trillion.

- The average auto loan is now $27,000 with a loan to value ratio of 80% to 90%, down from 95% in 2007.

- Auto dealers are now offering $0 down and 0% interest for 72 months on many models. Ask yourself how a finance company can make a profit with those terms.

- There are 54 million households with a revolving credit card balance, proving that approximately 50% of Americans are attempting to live above their means.

- The average credit card debt per household with credit card debt is $14,687.

- The average APR on a new credit card is 15%, even though the banks can borrow from the Federal Reserve for 0.25%.

- In 2009, the United States Census Bureau determined there were nearly 1.5 billion credit cards in use in the U.S. A stack of all those credit cards would reach more than 70 miles into space — and be almost as tall as 13 Mount Everests.

- 76% of undergraduates have credit cards, and the average undergrad has $2,200 in credit card debt. Additionally, they will amass almost $20,000 in student debt.

- On average, today’s consumer has a total of 13 credit obligations on record at a credit bureau. These include credit cards (such as department store charge cards, gas cards, and bank cards) and installment loans (auto loans, mortgage loans, student loans, etc.).

- Over 90 percent of African-American families earning between $10,000 and $24,999 had credit card debt. What bank in their right mind would issue a credit card to someone making $15,000 per year?

- Discussing credit card debt is highly taboo. The topics at the top of the list of things that people say they are very or somewhat unlikely to talk openly about with someone they just met were: The amount of credit card debt (81%); details of your love life (81%); your salary (77%); the amount you pay for your monthly mortgage or rent (72%); your health problems (62%); your weight (50%). I wonder why?

- Penalty fees from credit cards added up to about $20.5 billion in 2009, according to R. K. Hammer, a consultant to the credit card industry. Don’t be one day late with that credit card payment. It’s good to be a bank.

- The average late fee was found to have risen to $28.19, way up from $25.90 in 2008. Consumer Action reported that late fees reached up to $39 per incident.

- The volume of gasoline purchases placed on credit cards jumped 39% last month from a year earlier, compared with a 21% increase in June 2010. Food shopping increased 5% after falling 7% last year. The value of an average transaction on credit cards outpaced the gain for debit cards, showing consumers are increasingly relying on borrowing to pay for gasoline and other necessities.

After decades of a debt financed contest to display the gaudiest plumage, is the average American happier? Considering more than 10% of all Americans are on anti-depressant drugs, I’d say not. The rat race for status, the appearance of wealth and visible faux displays of success do not increase well-being. If most of our earnings are spent on an empty game of status, we should not expect much improvement in our quality of life. There is something perverse about having more than enough. When we have more, it is never enough. It is always somewhere out there, just out of reach. This is the attitude that drives the criminals on Wall Street and politicians in Washington DC to constantly seek more power and wealth. The more we acquire, the more elusive enough becomes. Much of the debt financed purchases of consumer trinkets, baubles and gadgets is nothing more than an expensive anesthetic to deaden the pain of empty lives.

Based upon the facts, the average American has not benefitted from the decades long materialistic frenzy. They have sacrificed their futures for the fleeting glory of ephemeral riches. In fact, the average American could not have participated in the expenditure cascade had they not been enabled by the financial industry and cheap plentiful money provided by the financial industries’ drug dealer – the Federal Reserve. The financial industry complex used their power and wealth to utilize all means of propaganda and mass media outlets to convince Americans that debt was good and more debt was even better. I’ll address the insidious aspects of the unholy union of debt and propaganda in Part Two – Propaganda Nation Built Upon Delusions of Debt.

Meanwhile, millions of Americans cling to their borrowed peacock feathers as the butcher of reality bears down upon them. The end won’t be pretty. The brave conquerors of strip malls across the land can enjoy their toys, gadgets, and treasures for awhile longer, but they need to remember one thing – Glory is fleeting and death can come suddenly.

“For over a thousand years Roman conquerors returning from the wars enjoyed the honor of triumph, a tumultuous parade. In the procession came trumpeteers, musicians and strange animals from conquered territories, together with carts laden with treasure and captured armaments. The conquerors rode in a triumphal chariot, the dazed prisoners walking in chains before him. Sometimes his children robed in white stood with him in the chariot or rode the trace horses. A slave stood behind the conqueror holding a golden crown and whispering in his ear a warning: that all glory is fleeting.”

Well, I’m glad to see TEOTWAWKI didn’t happen with the market open today. The Repubs are still trying to inch a short term deal along so it will be BIG deal next November to squabble over and give the bought and paid for propaganda machines of the MSM more absolutely meaningless bull shit to write about.

But we’re not talking about Ireland defaulting on its debt Friday – paying debtors a mere $0.10 on the dollar or the fact that gold now has no ceiling and a clear shot at $2K. Oh no……..

Here we’re covering the importance of driving a hot car to get laid. Hmmmm.. Fun article to read but doesn’t apply to many people here on TBP.

Oh, me? We are a single car family of two, driving a 2010 FIRE ENGINE RED Mustang with a blown 6 cylinder that’ll make the blood drain out of your head if you get too carried away with it. Not to mention that getting carried away too much makes your tires last 12k miles instead of 30k and does nasty things to an otherwise reasonable mile/gal ratio.

My wife picked it out, it had 10k on it and someone else paid the first years depreciation for me and it was a cream puff inside and out. I tried to talk her into another Corvette (of which we once owned an ’82 – last beautiful ‘Vette made without a right angle on it) but she told me I’d have to add a lift to the passenger side to assist her getting in and out (and my sweetie is slim and trim too – just getting creaky joints like I am!)

So to stay on subject, I drive a new red race car because it turns Momma on. That is the best reason I knew of to have gotten it too! I have been known to give pretty young girls rides when they beg me to. But Momma keeps a stop watch on me and I have never been a fast draw kind of guy.

All you fellows can be poop-in-the-muds if you want to, but for me, I’ll go out in something red and fast and sounds great with glass packs that gets thumbs up from all the other old fuds driving their wee Jap boxes out there.

Each your Honda hearts out!

MA

Oh, yeah.. I paid cash for it too.

MA

Muck

Paying cash is the point of the story. Buy whatever you want, as long as you can actually afford it.

German cars are over rated junk,unless you enjoy hanging out at the dealership while they fix it.and its human nature to want to own nice stuff,and be lazy.On a more normal level i see so many people with big pickup trucks,must be trying to make up for a lack of something.So many people dont beleave in god so livin like a king while theyre alive is what theyre tryin to do,death is being worm dirt to most.I beleave in God and drive a mini van because i have kids and the mini van has lots of room and can haul a lot of gear.All these empty suits well be our downfall.

golden tool, how the hell do those four numbers add up to 18? i see you’re probably a liberal arts major

Ron — Good call on German junk

From Consumer Reports 2011 …..

==========

The major Asian brands are still doing well overall. All models from Acura, Honda, Hyundai, Infiniti, Scion, and Toyota have at least average predicted reliability.

Ford continues to be the most reliable American automaker. Ninety percent of Fords, including Lincoln models, have at least average reliability.

Chrysler remains the lowest-ranked manufacturer in our survey. We can recommend only one of its vehicles, the four wheel-drive Dodge Ram 1500.

While European reliability had been improving, momentum seems to have stalled. All Porsche and Volvo models are rated average or better.

BUT AUDI, BMW, and MERCEDES ARE AMONG THE WORST AUTOMAKERS OVERALL.

The Porsche Boxster has the best predicted reliability in our survey, while the Audi A6 3.0T and Jaguar XF have the worst.

Great writing, great thread. A bleeding heart liberal by any other name is still a bleeding heart liberal.

“Since President Lyndon Johnson declared a War on Poverty in 1964, Americans have spent around $16 trillion on means-tested welfare. We will spend another $10 trillion over the next decade based on recent projections. Even with all these resources devoted to assistance for the poor, poverty is higher today than it was in the 1970s.”

What could we have done with $16 trillion? Whose going to come up with $10 trillion more?

A breakdown: [/img]

[/img]

[img

AwholeDr

That chart is revolting.

And the left wingers think we need to do more. It’s never enough. Just like Keynesian economics. Never enough.

This is where I should say something witty like “That’s how the government does it’s accounting” or “I hit the one key rather then the two key” but I just didn’t check before I clicked.

Do unto others.

i don’t see medicare in there. or regular ss.

Admin:

Obama raised spending by 30% just since 2008, to almost $1 trillion per year. If one year’s Welfare spending was instead spent on student loan debt, it would wipe our ALL student loan debt in this country.

As far as food-stamps/SNAP are concerned, more than 2/3 kids are obese or overweight. Sometimes when I go to a store, I’m the only one paying cash, the other 6 people have snap cards, and more than 2/3 of them are obese. Losing weight would benefit most of the kids nowadays. But let’s use a more scary word, like starvation. Starvation is no food for an extended period of time. Nobody in this country is in danger of starving. Most people could live off their blubber for at least 6 months.

[img [/img]

[/img]

Being a fat kid isn’t funny anymore.

@ Suspicious – “My big problem with the post that we are supposedly commenting on is that it serves to divide the people against each other rather than for us to recognize who our real enemy is.”

I have seen the enemy. And it is us. We have caused this to ourselves. We have flocked to the cliff for deeper values. We have bought the lie that 2 incomes = greater value in life. We have turned our backs on deeper things. Insert any rant from any Old Testament prophet here. Middle America has bought the lie of the intellegensia… We no longer instill great value in our children (insert 4th Turning principles here).

The group I feel for are those who make $40-$60k as a family on one income. This is a family that’s doing everything right in raising their children, staying out of debt, live in a ‘sub-standard’ house (per today’s norms), drives 5-8 year old cars bought used with cash, and is having their home equity chewed up, their 401k pillaged, their future purchasing power destroyed, and no possible way to ‘get ahead’ (per today’s measures), paying into a system with nothing to so for it… All because borrowers/lenders destroyed the credit system and the gov’t is destroying the fiat system, the school system was destroyed long ago, and the culture/civilization mores are all relative (and equally worthless)…

Actually, what the slave whispered at the Roman parade was “Cave ne cadas” – literally, be careful not to fall.

BTW – it’s do do bird. The [deep] doo doo bird is the one whose cry is given by Rodney Copperbottom in the animated movie, “Robots.”

I’m a “po'” person, so ignore me if you’re an Oprah fan.

Welfare has always had a place in all societies. The problem is not the fact that we have welfare – that’s a good thing. The problem is that we take everything else away from the individual to get it, no protection from it and then we have ABSOLUTELY no way out of it.

I’m looking for one of those armchair financial advisors who has a suggestion. Any help is very welcome and it won’t cost you dime (maybe a brain cell or two).

For the article: I could pick it apart, but it’s not worth it. Without any deep thinking, it’s very amusing.

indeed

Please, please, pick it apart. We are honored to be in your presence. We seek your wisdom. Please amuse us with your vast knowledge.

@indeed: WTF do you want advise on? Charity has always had a place in society – not fucking WELFARE.

Clarify please…

MA

Nice article. Some of those numbers are staggering. $15K in credit card debt per household? That is unreal.

About the BMW’s, i was talking to my wife the other day about how many new BMW’s and Audi’s are on the road. If you were an alien from another planet you would never think we were in a economic crisis judging by the cars you see on the road these days. Every 25 year old college grad is driving around in a BMW 330 or Audi A4 and making 40K a year, if they’re lucky!

Admin – you are going soft. Suspicious is still standing, although a bit wobbly, and Indeed is barely bloodied.

Indeed – it is much more difficult today for young people to rise through the social stratus. However, as Muck pointed out, and as I for one am living proof, that almost any boomer, or near boomer, worth his salt has had ample opportunity to achieve financial independence. Hard work, education and thrift would have seen it done.

For today’s young, hard work, education and thrift are no cast iron guarantees of success, for a wide range of reasons. However, any young person has the opportunity to work hard and get educated, and to implement a thrifty lifestyle . Any of them. Which will assuredly be of help to them in the future.

Indee- btw, you have made TBP list of fuckwits. I would like to say you are in illustrious company, but you are not.

llpoh

I’m getting soft in my old age.

the peacock syndrome is here on tbp –its called the like or dislike button—the more action the bigger the…………….

Any college sophomore can write a vapid little essay about conspicuous consumption. Has it occurred to you that some us can actually afford our Porsches? One works to live not lives to work. Life is for enjoying.

Marcus

I thought you had the vapid market cornered with your moronic comments. Has it occurred to you that you’re a douchebag? I guess the world needs pricks and dickheads so the rest of us know who we don’t want to become. Thanks for providing us all an example to not follow.

Marcellus – welcome! We are always happy to welcome newbie fucktards to the site! Welcome! Welcome!

Marcus heading out to take hisorsche for a spin:

[img [/img]

[/img]

Those glasses are awesome. I’d be the life of the party, as long as they are gold rimmed.

Sold my Bmw M Roadster and paid cash for my ” new ” 1994 Ford Bronco! 🙂

Suspicious stated that we here at TBP need “to start thinking for ourselves.” Umm, the opinions that are expressed on here are well outside the mainstream. Also, the regulars on here either had/have their own business or work halfway decent jobs. You know they looked in the mirror and thought: “The reason I’m at where I’m at and where I’m going is totally up to me.” They didn’t go into sheeple rants about “the powers that be” and other illuminati pigman bullshit.

Also, unions set themselves up for destruction as soon as, well, as soon as they unionize.

All that welfare has accomplished is keeping a certain demographic down.

Marcus – yes Porsche’s are for those who can afford it. Not for some wannabe who has to borrow, end up defaulting, causing bank problems, etc. Read past the first sentence.

I’m a recent college grad too. So all you dailykos, democractic underground ideologues: tough shit! Look in the fucking mirror for a change

Hey Petey – way cool!

Hey SSS and NoVista! Good to see you again.

Public transportation is a boondoggle, and has been since its inception. If public transportation’s customers had to actually pay the real costs of using it instead of stealing gasoline tax revenues meant for highway construction to subsidize its construction and operation, a Manhattanite could rent a limo more cheaply than riding the subway.

High speed rail is another wet dream of the left. There is no such thing as high speed passenger rail. It does not exist anywhere on the planet. Sure, there are several pricey little trains that hit 200-300 mph on their routes, but it must accelerate from a dead stop leaving the station and it must slow to zero speed at the next station, and sit at zero speed while all the passenger embark/disembark. Do not try informing me of regenerative braking, etc. Trying to sell this in America to link “major” cities fifty to one hundred miles apart is asinine, and it is promoted by people who stand to gain from skimming government funds and idiots “edjumicated” at public expense.

Over my life, I certainly have not been as frugal in many areas as I should have been. Racecars slapping their $400 tire and wheel assemblies into concrete walls does not build wealth. I started straightening up a bit when I married 15 years ago. The fairly recent purchase of a small farm has not really impacted my net worth (or lack thereof) due to improvements made on it over the last few years and lack of desire to use it as a cash cow. I’m just raising a few cows! One more tractor payment (annual) and it’s done. We bought a used SUV last year instead of new. The little turbo roadster has a 0% loan and we have some equity in it and a short time left. We need some more hay equipment, fence and fruit trees but things are coming along. It takes time, dedication and hard work to start a farm from scratch, sort of like what is required to get off the dole.

As for Suspicious and others with similar attitudes, you folk are why I have become a customer of Trijicon. Go with God, or cross this property line and meet him. Warning shots will NOT be fired.

If you buy an inexpensive but reliable car, pay cash and drive it for at least 10 years you will, within 20 years save enough money to buy the third car for essentially free.

I must confess guilt here. We have 5 in our family and a car for each, but one is sitting idle. college Kids cars are beaters buying 1 for $1900 and the other two were picked up for free (one 03 Ford Escape, with 190,000 miles picked up in Piperville PA)

Article is on point though I really don’t think most Americans have changed their ways despite the recent economic trials. Restaurants are still full in the strip malls, luxury cars are still the hot ticket and credit cards offers are still plentiful.

ed

Good to see you posting again, I like the finish!

In the end, we’re all put in the same sized casket. Yours may be bronze and mine pine, but neither of us will be remembered very long except by close family members, no matter how big our homes were or how many cars we owned. I hope to die with a zero balance, having paid all my bills and, if anything’s left, to gift it to a worthy charity. And if there’s an after-life, I hope we both reach our intended destination.

All these insecure spendthrift cunts have done, in purchasing crappy but expensive homes and cars, is set themselves up to be targets when law and order breaks down – when blacks and Mexicans are ‘encouraged’ by the elite to pillage those neighborhoods.

I believe the quality was intentionally removed from these late-model and trendy homes and cars, so as to keep virtuous and intelligent people from falling into this trap. It provides justification for the pillage to come, “because they were dumbfucks.”