For the first time in a long time (since 12/2010 for gold: March 2011 for the general stock market) we have a simultaneous “Buy It ALL” situation on our hands. (Actually I call it “The Big Hedge”)

Remember, usually, the general stock market and the precious metals move in opposite directions. The DOW goes up and XAU goes down and vice versa.

Precious metals and the general stock market march to different drummers most of the time and while it is very true that should the general stock market take a nose dive, it will also drag down precious metals stocks, miners and metal alike – although that set of circumstances doesn’t last long. If the general markets continue to show weakness, very shortly, general market positions will start to be liquidated and funds moved into “safe haven” areas such as gold, silver, miners, foreign currency, etc..

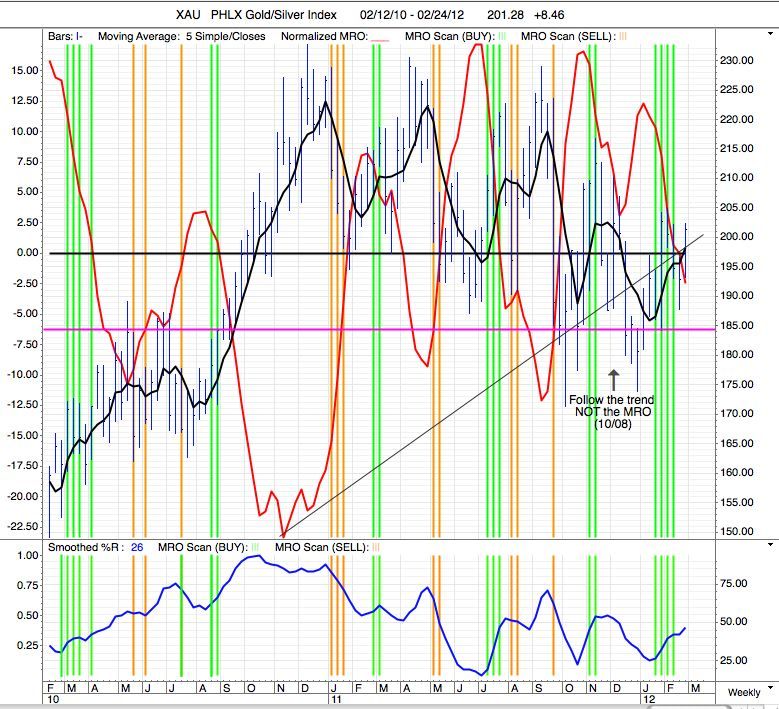

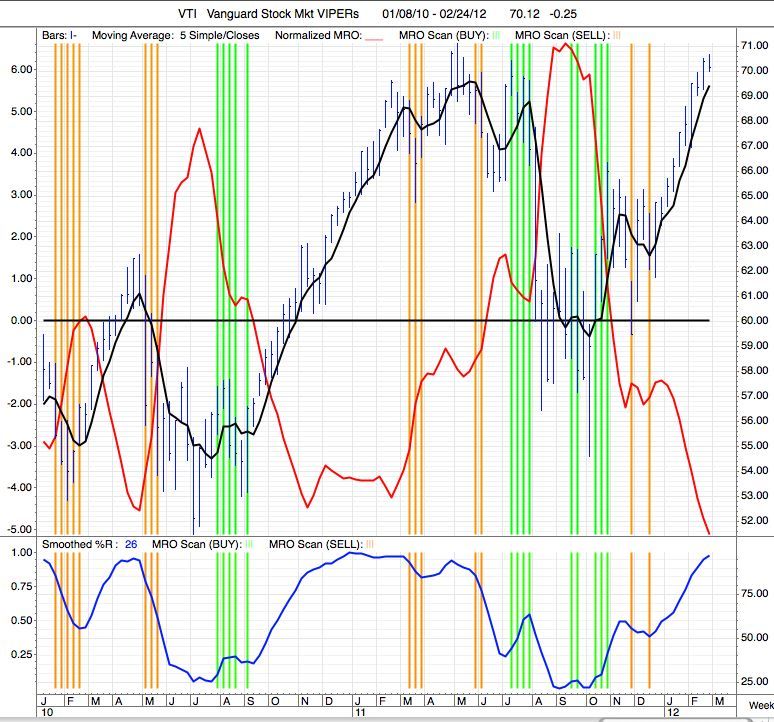

As you can see from the VTI chart (VIPER – represents the entire general market), the general market gave a sale back in August of 2010 and had a good run through March of 2011 where it entered a corrective phase, eventually falling back to a low of 60 in September/October of 2011. Since October, 2011, it has been on a tear and one never “fights the tape” or argues with Mr. Market when he’s on a rip! Just quietly take a long position and add to it as things keep going up.

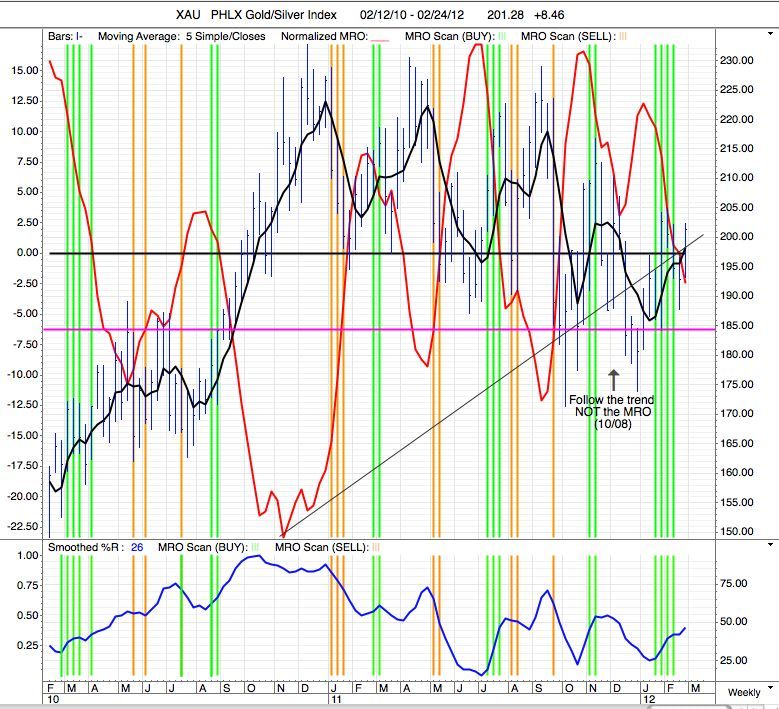

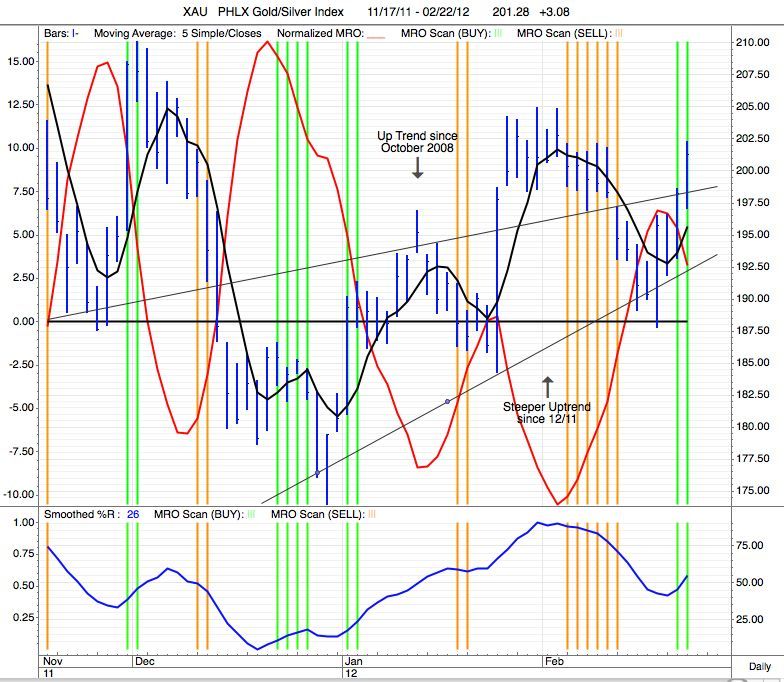

XAU (precious metals index proxy) has been doing just fine from October, 2008 to December, 2010 when it entered a correction. Note that this correction was not a big downer for the index but a correction that has worked it way out by moving sideways with ever lower highs and ever lower lows. This is a perfectly valid technical correction and tends to show great underlying strength with very few sellers.

You will please note that XAU has now penetrated the UP trend running back to 10/08 and promptly climbed right back to its’ current position above the trend line in quite a bullish show of strength.

XAU gave a short term BUY in late December and has generated a steeper uptrend in addition to piercing the long term uptrend going back to 2008. It has just given a further “strength” signal in both of the last two days.

So we are in a most interesting situation where both the VTI and the XAU (plus all of the other precious metals, miners, most commodities) are also on a BUY.

So what does one do in this rather odd situation?

You hedge, that’s what.. “Hedge” in this case means buy the broad PM ETFs or mutuals (GDX, PHYS, PRPFX and so on) while at the same time taking a position in those stocks considered general market (VTI, QQQ, some stronger specialized ETFs like XLE, XLK).

Just for your information, the list below is part of my current open positions. I run charts daily on each one and several positions are based on other market forces than just “hedge” possibilities.

VTI

QQQ

FCX

GDX

PRPFX

PHYS

PSLV

TBF

UDN

USO

TBF is a short against long term US Treasuries and will be expanded when 20 year Treasuries climb above 3.22%

UDN is a VERY SPECULATIVE bet against the dollar. This one has made me a pile of money trading in and out between UDN and UUP but is subject to instant sale if the default of Greece/et al causes a run out of the Euro. A run out of the Euro can’t help but be mostly in the direction of the Dollar and when that happens, the dollar will strengthen significantly until things calm down and buyers realize the Dollar is in worse shape than the Euro. Then it will be rush to the door from more and more currencies until there’s no other door except those labeled “Gold” and “Silver” or other assets such as farmland (which – if you didn’t know, has risen 30% in Nebraska over the past year!)

USO is self explanatory and with what’s going on in the ME, everyone should have a position in Oil.. It has nowhere to go but up and benefits from every rumor, car bomb, and hijacked tanker.

We don’t get many chances to be long PMs and long hedges in the general market that are also in full BUY modes but when we get the chance, it would be dumb to ignore the chance.

Just remember, these are (with the exceptions of my core PM positions) short term positions and subject to dumping on any signs of extended weakness of the general market.

There are a LOT of market bears out there right now who expect a general market crash and are preaching even more gloom and doom than usual. Please remember that bull action “climbs a wall of worry” with everyone preaching a fall and yet the markets just keep moving up. When everyone turns bullish, then take some of your profits and watch out!

USO stock comes with lots of hidden strings attached, buyer beware. John

Jeez! The quality of the charts suck bigtime! Sorry about that.

MA

Here are the charts from the article, I don’t know why they didn’t show up right. I will try to fix it in the post tomorrow.

[img ?t=1330045086[/img]

?t=1330045086[/img]

[img ?t=1330045085[/img]

?t=1330045085[/img] ?t=1330045083[/img]

?t=1330045083[/img]

[img