“If you want to get laid, go to college. If you want an education, go to the library.” ― Frank Zappa

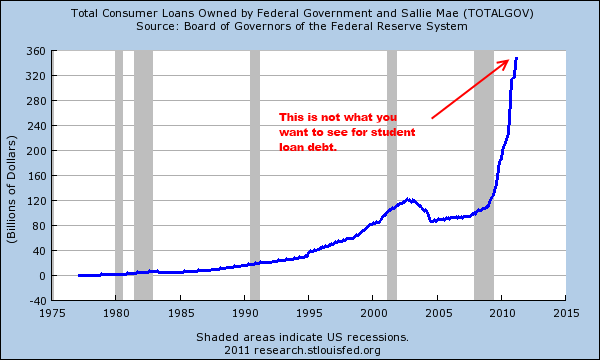

I think Frank was onto something. There is much debate going on today about whether a college degree is worth the cost. The editorial below has much truth in it. The more government has gotten involved in higher education, the more fucked up it gets. The government provides grants and low interest loans to anyone that can scratch an X on a loan document. When the crisis hit in 2008, the Federal government took complete control of the student loan program. Look what happened next.

Does that graph remind you of another graph? How about mortgage debt and home prices. It will end the same way, with you the taxpayer footing the bill for a massive write-off totaling in the hundreds of billions. Whenever the government says they are solving a problem, they are surely making it worse. Is it a good thing that anyone can get a low interest student loan? Obama and his minions wouldn’t be dishing out these loans so unemployed people will not be counted as unemployed, would he?

Student loan debt is now in the vicinity of $1 trillion. It cannot be extinguished in bankruptcy (thanks to the Boomers who hid in college during Vietnam and defaulted on their loans en masse). As the article points out, 30% of the borrowers drop out without graduating. These people will be and are defaulting in large numbers. Those who graduate have an average debt of $25,000, with many exiting college with more than $100,000 of debt. This anchor around their necks will keep them from buying houses, starting families, and buying cars. With the Boomers unable to retire, the job market is upside down. There are fewer and fewer jobs for these graduates in their fields.

When I went to college in the 1980s it cost about $8,000 per year to go to Drexel University. It was a good college, but nowhere near one of the top schools. With my accounting degree I was able to get a $20,000 per year job with an accounting firm. Today it costs $41,800 plus another $8,000 for room and board. I commuted so my room and board was $0. It costs $50,000 per year and starting accounting jobs pay $40,000 to $50,000 per year. So the cost to attend Drexel has gone up sixfold since the 1980s, but starting salaries have only doubled. The payoff is even worse for liberal arts graduates.

The government interference, manipulation and control of the student funding market has caused the prices to skyrocket. Anyone who has taken Econ 101 should understand. The proliferation of easy low interest debt to anyone who thinks they are college material has artificially boosted demand. The supply of colleges is static. Therefore, the government created high demand, based on cheap debt, leads to much higher tuition costs. If the government was out of the equation, the number of people lured into this game would drop dramatically. Colleges would be forced to compete on price and would need to offer more financial aid. Only the best colleges would have pricing power.

This would leave the for profit publicly traded diploma mills like the University of Phoenix, Corinthian Colleges, and Career Education up a creek without a government paddle. These parasites feed off the government teat. They know how to game the Federal student loan system to maximize their quarterly profits. Educating people so they can obtain good jobs is not a priority for these lowlife institutions. They lure in the 40 year olds that have been laid off with the promise of new careers with an online education. There great at marketing, great at gaming the student loan golden calf, and not so great at getting jobs for their graduates. Do you really think the 533,000 enrollees at the University of Phoenix are getting a top notch education for their borrowed money?

They have about as much chance of getting a good job as Bluto.

“Christ. Seven years of college down the drain. Might as well join the fucking Peace Corps.”

College too costly, too subsidized

Thursday, May 31,2012

WHAT PEOPLE subsidize, they get more of. Consequently, about 40 percent of Americans have college degrees, compared with 5 percent in 1940. This growth industry has been unnaturally boosted by government subsidizing higher education with direct funding and more indirectly with low-interest student loans.

This has been mistaken for progress. In reality, it is the victory of the entitlement-minded over those who foot the bill. Ironically, they often are the same young people. As with all income-redistribution schemes, it has unpleasant, unintended consequences.

Almost everyone now realizes living off borrowed money is one of the causes of today’s faltering economy. Bills come due. They don’t always buy what was intended.

Home mortgages inflated to reckless amounts and credit card debt buried consumers. They provided short-term joy rides, only to become great financial burdens. Defaults are economically damaging. Lenders lose, borrowers lose and the economy eventually self-corrects with contractions, as seen in recent years.

The more than $1 trillion in student loans is another symptom of short-sighted appetites for instant gratification, oblivious to long-term consequences. These debts, much like government-subsidized and incentivized mortgages, have ballooned to ruinous levels.

COLLEGE ENROLLMENT is up 38 percent in the past decade. More than 20 million people are enrolled. Some students amass six-figure loan debts by graduation, and too often can’t even find a paying job.

Nearly 30 percent of college students with loans drop out. Dropouts, according to the Education Sector think tank, are four times more likely to default on their loans. Many students who stay in college increase likelihood of default by working to meet expenses. That requires taking fewer courses, lengthening their stay but decreasing odds of graduating.

Much of this problem results from the misguided notion that anyone who can pick up a pencil should attend college. As columnist Robert Samuelson wrote in the Register, “We overdid it. The obsessive faith in college has backfired.” As Register editorial writer Mark Landsbaum previously noted, “Not only is a college education not necessarily all it’s cracked up to be, it’s not as necessary as you’ve been led to believe.”

Government-backed loans and subsidies encouraged colleges to accept more students because tuition is paid upfront, unlike tuition debts. The result is completely unwarranted enrollment numbers.

VOCATIONAL EDUCATION has been downplayed and bad-mouthed. Even in our high-tech culture, 69 percent of jobs don’t require post-high school degrees, the government says. To admit more students, entrance standards were lowered. “We’ve dumbed down college,” Mr. Samuelson wrote.

“Forty five percent of college students hadn’t significantly improved their critical thinking and writing skills after two years,” concluded the authors of a book, “Academically Adrift.”

Unfortunately, the herd mentality persists, urging and luring ever more young people onto campus, instead of creating new vocational and tech opportunities and private-sector apprenticeships. Living off borrowed money remains attractive, at least until the bill comes due, especially for the unemployed.

— The Orange County Register

“They have about as much chance of getting a good job as Bluto.”

If I remember my Animal House correctly, Blutarsky married the hot chick in the playboy bunny outfit and became a senator. 🙂

[img [/img]

[/img]

[img [/img]

[/img]

Admin, I believe Big Gov’s takeover of student loans is really driven by another plan – to push young college grads into Big Gov agencies to “work off” their debt.

It may be a national police force someday – but now they are “forgiving” the principal if grads “work” in low-income neighborhoods serving the “under-served”.

This scheme wreaks of indentured servitude.

We’re Irish – can spot indentured servitude a mile away too.

The government can legitimately provide low-cost programs that re-train middle-aged workers that result in re-employment. High schools and community colleges can play a role in developing programs that train people for middle-skilled jobs – that have good salaries and do not require a 4-year degree.

A number of very good paying jobs go unfilled in metro NYC market because there are not nearly enough qualified candidates. So helping people get credentialed can be a legitimate role.

But Big Gov’s role in higher ed has really distorted the market. I agree a massive tax-payer bailout is heading our way….

Unfortunately, vocational education has also been destroyed by educational subsidies, and the cost of vocational programs for such jobs as Licensed Nurse Practitioner, Licensed Practical Nurse, restaurant chef, MRI technician, and other vocations requiring some specialized training but not a 4-year degree, has inflated enormously in the past decade.

The results are disastrous for the aspirants. For-profit vocational schools for these low-to-medium pay occupations have sprung up like mushrooms after a week of rain and the tuition ranges from $20,000 to $40,000 for the two-year programs. Worse, the schools typically offer no meaningful job placement assistance, and many applicants cannot even win an interview. Needless to say, the loans are made on the same exploitative terms as loans for academic colleges, which means that lenders are allowed by law to use tactics to collect on these loans that were outlawed 50 years ago for every other type of debt.

Lenders and collectors can and do charge “collection fees” of 25% of the outstanding balance for a “default”… and a payment posted 3 days late is considered a default. Interest rates are commonly variable and forever being adjusted upward. This is how a beginning balance of, say, $15,000 balloons into $50,000, or $86,000, or more, over a few years, and it totes up really quickly if you lose your job (or fail to get hired to begin with), are ill or critically injured in an accident.

Collectors can call you at any hour of the day or night, contact your employers/friends/relatives, tell lies about you (one told a borrower’s relatives that she had forged their signatures as cosigners), and can garnish your disability or social security check. You have NO RIGHTS.

Sallie Mae and all other college lending programs should be sunset immediately, and limits should be set on collection fees and accrued interest on outstanding loans, so that the borrower has a reasonable chance of paying them off in his lifetime. As matters are at this time, these programs are designed to keep the borrower in literal debt serfdom for life. I would like to see a solution that spares us taxpayers another costly bailout, but at the same time, it is useless and destructive to squeeze people who have nothing to the point where they are homeless to collect these debts, and we need to devise a solution that makes it possible for these borrowers to pay the principal advanced by the government, and still stay alive…. and we need to the disease from doing still more damage and shut the government sponsored lending down.

And we should repeal the vicious Bankruptcy Reform Act of 2005 to permit borrowers to bankrupt out of private college debt. Bankruptcy is the Free Market method of disciplining careless lenders, and all the 2005 law did was enable lenders to safely scrape fees and interest off bad credit risks they ordinarily wouldn’t have touched.

No class of debtors should be subject to extraordinary abuse while other classes of debtors, such as over-leveraged home mortgage borrowers, walk away free, leaving behind massive deficiencies. (Sunset FHA and the GSEs while we’re at it).

As my big brother at the Beta Theta Pi house at Tulane told me “fat, drunk and stupid is the ONLY way to go through life!”

“When I went to college in the 1980s it cost about $8,000 per year to go to Drexel University.”

To provide additional perspective on just how bad prices have gone up…I graduated East Carolina University in 1977…cost per quarter for tuition and dorm room $275. That is not a typo. Books cost extra…usually about $80 (all used books) per quarter. For four years it cost about $4500.

I could work the summer (steel mill) doing double shifts and take home about $2500. I still worked a part time job in school, so I could support myself. I could pay all my costs and have money left over…granted I never participated in the school cafeteria program for food. I cooked in the room on a single burner hot plate (against the schools rules, but many folks did it) and lived off yogurt I made in a little yogurt making machine from powered milk.

My first job I was paid $13,000…about three times the cost of education.

That is how much things have deteriorated.

College….an expensive four year party.

When I asked a friend WHY he borrowed money with negative amortization in the first place, he said, “What do I know about that stuff?” Doesn’t this sort of make him a volunteer in the FSA Reserve?

Very cool posting admin, even though i am sure you heard that FZ quote before i will take credit for you including it here because i commented it a few days ago on a post. I am a huge fan of his music but also convinced he was a genius, his arguments with various senators including dipshit gore in the mid eighties about music lyrics is great and a must read.

i have similar opinions. I graduated 7 years ago, lived off campus for pennies (with roomates) compared to room and board at the school and used my money from working co-ops to pay as much of the tuition as possible. I left with 15k in debt with an engineering degree and am not sure i would do it that way again. I fixed things, strived to understand things and created solutions before i went to college, but wasnt an engineer until the moment i got that piece of paper? Thats hogwash and i am glad i recognized it early on.

It has become quite a racket, it’s becoming viewed as a right which means it will be untouchable in a few years.

Just like most things the govt gets involved in, the college education bubble will burst and everyone will be worse off because of it.

Keep up the good work jim.

The fallacy that everyone is fit for college is what started this whole mess. Sorry, but the world needs manual laborers. One of the reasons we need immigrants for those positions is because poor citizens have access to ridiculous amounts of social programs.

This means we have two sets of parasites living off of the american middle class, the upper crust and the “lower” class. In order to survive in the middle class (or even enter it) you NEED to get a college degree these days. Thanks to the ridiculous numbers of college drop outs (durr, I needed to do HOMEWORK? Nobody told me that!) the tuition costs for everyone else have sky rocketed. This means that once you’ve entered the middle class you are going to have a ridiculous amount of student loan debt. This is where things get funny, thanks to the wonders of “globalization” companies are able to charge as little as they want for positions, they know that SOMEBODY, SOMEWHERE will want the job. For example, a lot of technical workers in the US are imports from India. Why will they take the job when an American won’t? Debt. Plain and simple. In India they don’t graduate college with several years salary worth of debt. This means they can plop down in that IT job and start raking in the money without having to worry about creditors taking most of it.

=====================

Anecdotal evidence:

I’m 25 years old with my undergraduate in Biochemistry/Molecular Biology and a Masters in Chemistry. My wife, whom I’ve been married to for three years and been with for six total, also has her Chemistry degree and is currently getting her MBA – Marketing.

My job pays $60k a year and I teach chemistry as an adjunct professor, which brings my total income up to about $65-$68k. My wife is currently underemployed (has several good job prospects lined up) as a secretary, a job she took to support us while I was getting my graduate degree. She makes about $29 a year, plus an additional $11k from consulting.

A total household income of $105k annually. Thats not even including the very real possibility that she might be starting a new job this summer, which would make $12-15k more per year.

For all that money, we aren’t buying cars. We aren’t buying houses and furnishing them. We aren’t investing, and we damn sure aren’t having kids.

Why? Debt. When she graduates with her MBA we will have a combined $100k in debt. If the economy was winding up we would take the chance, apply “austerity” measures within our own household and be debt free 18 months from now. Unfortunately we are saving up for the very real possibility that we may lose our jobs and the economy’s downward spiral will only deepen.

Thank god the government has income tax, right guys? If they didn’t they wouldn’t be getting a dime of my money. All I buy these days is food and gas.

====================

Some of the issues I didn’t hit upon because I hate a wall of text as much as the next guy:

Piss poor American public school systems turning out whiny free shitters who couldn’t think their way out of a paper bag.

Social programs encouraging and supporting these attitudes.

The shitty quality of “American” goods (hint: they might be made here, but the parts are all cheap shit from china) means that nobody in their right mind buys American unless they are intimately familiar with the product.

The rising cost of healthcare is crushing families, which is more debt due to the greed of the ones on top, and laziness of the ones down below.

There are more but I’m at work and my incubator is alarming.

Mary Malone says:

“Admin, I believe Big Gov’s takeover of student loans is really driven by another plan – to push young college grads into Big Gov agencies to “work off” their debt.”

I think Mary Malone is on to something. Have you ever asked why all this college education has been pushed and yet these same grands can’t find a job or put there education to work for them in the work place, here or abroad?

When I got out of the military in 1971 I wanted to make a career in the electro-mechanical field. I had my G.I. Bill to use for my education so I decided to use it to take the training I wanted to do this. I took college courses in physics, electrical engineering technology, chemistry, mathematics, and other courses like concrete technology; but never got a degree. In other words I took the courses I thought would help me in what I wanted to do. I also went through an electrical apprenticeship and took courses on the National Electrical code. I was doing all this while holding jobs in industry. Even without having a degree I made good money because of my skills development using my college education to help me become proficient in these skills.

I am retired but would have no problem in this job market getting a job because of my skills.

We are hearing now that the baby boomers will be retiring in force next year; many are retiring now, so won’t that open up jobs for millions of young people with college degrees or vocational training ready and waiting for work? Well no, because their education won’t help them. They seem to be educated to sit behind computers operating software that tells them what to do. I learned math on a slide rule and had to figure out answers to problems. Today the computer figures out the problem as long as the programmed instructions are entered.

So what does this say about our educational system and it’s worth to the individual? As long as government jobs are available then this educational system will work. But this educational system seems to be what Mary Malone hints it is; a government creation for transforming our free enterprise system into a communist one with educated drones to manage the herd.

With all the millions of baby boomers going into retirement we really should not be experiencing a high unemployment problem. Right now their replacements should be in training. So something smells. Too many college grads without jobs? Why? Could it be that they were given an education that is now useless? The infrastructure of this country and our society still has to be maintained. The population is still increasing so more infrastructure is needed. So what is going on? Someone please make sense of it. The unemployment rate should not be going up. What is wrong with this picture?

The over threefold increase in college loans from 2005 to today is startling.

Obviously, the ease of obtaining loans has a huge impact on the price increases.

I wonder what impact grants will have on health insurance premiums if the ACA passes?

Don Levit

Every time you figure the Feddies have screwed up just one more thing – and there can’t be that much left to fuck up, they manage to find a new challenge and totally destroy it.

This time, it’s schools upon the output of which the nation will rely on within the next twenty years.

Now, those who manage to get through school are dumbed down, can’t read, write or do four way math and owe a $100K to their masters to boot.

We have simply allowed the State and Federal Governments too much latitude to screw up our world and country and we need to take it back. One way or another.

MA

Cahuita: A fellow Beta Theta Pi brethren? Thankfully I had “extra” brain cells before I got wrapped up in that racket!

@ Thudderbird Here’s more info about the Fed’s student loan forgiveness program

http://www.usnews.com/education/blogs/student-loan-ranger/2011/01/05/relieve-student-loan-burden-with-public-service-

Sorry about the typo, ThunDerbird.

Jeeze, Louise I’ve gotta get some new readers…

Can you imagine borrowing $146,000 (that is not a typo) to go to CULINARY SCHOOL?

http://finance.yahoo.com/news/this-bright-eyed-young-man-was-utterly-demolished-by-student-loans.html

Somebody, or many somebodies, fell down on the job when raising and teaching our current crop of youngsters. Critical thinking , and basic math and financial skills, like knowing that your monthly payments cannot equal your income, fell by the wayside. He never asked how much the average “chef” makes, or how many jobs paying enough to pay off this monster debt there are available in this field, or if there was any more economical way to get his training.