The deficit only went up by $125 billion in May. No wonder the stock market is soaring. Everyone knows, the bigger the deficit, the better the economy gets. Borrowing always leads to prosperity and growth. Just ask the 3 million people who’ve been kicked out of their houses in the last few years. The deficit through 8 months according to the CBO is $845 billion. We’re right on track for another $1.3 trillion deficit. That Obama is sure serious about deficits. Of course, if you go to the Treasury Dept site and see how much the National debt has risen over the first 8 months it shows a $902 billion deficit. That’s only a $57 billion discrepancy. Close enough for government work.

http://www.treasurydirect.gov/NP/NPGateway

I know math is hard for 98% of willfully ignorant Americans, but I’ll try to put this $902 billion deficit in perspective so that even a CNBC Bimbo might understand:

- We are spending $3.8 billion more per day than we are bringing in.

- We are spending $157 million more per hour than we are bringing in.

- We are spending $2.6 million more per minute than we are bringing in.

- We are spending $43,500 more per second than we are bringing in.

To make it understandable to my readers in West Philly, this means that the government is buying a Cadillac Escalade on credit, every second of every day, forever.

But don’t worry. The national debt as a percentage of GDP is only 102%. Rogoff & Reinhart said we only have to start worrying when it reaches 90%. See. Nothing to worry about. The stock market is up 100 points and Bernanke has promised to save the world. Back to America’s Got Talent.

U.S. posts deficit of $125 billion in May

By Jeffry Bartash

This will be the fourth consecutive year that the federal government has had an annual budget deficit greater than $1 trillion. I don’t see how the federal government will ever again have a balanced budget.

Admin, have you ever thought of trying to do a “Real news” webcast once a week?

TPC

I barely have time to take a shit as it is.

Hey! That works out to ONLY 0.86 cents per American per minute!!

Not to worry, let’s just round that up to a penny per American per minute.

See! If you look at these debt/deficit things in the right way you can make them out to be, well, POCKET CHANGE!!!

Included for your viewing pleasure, some coins from Rome, an empire we are fast emulating:

[img [/img]

[/img]

…..I guess you COULD do it from the shitter.

I guarantee your views would skyrocket anyways.

Wat. Stupid computer. The above wasn’t Wordman, it was me.

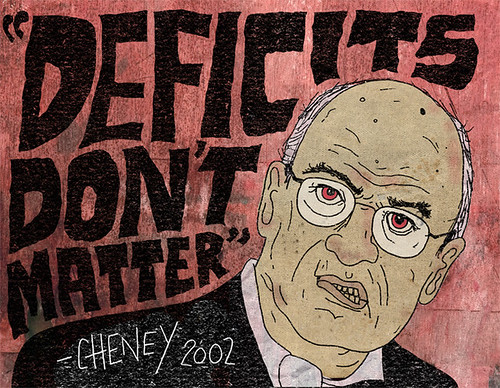

Debt doesnt matter -Darth

If that were true we would not have need for federal income taxes.

Assets, of course, are not risk-based capital. According to the Comptroller of the Currency report, as of December 31, 2011, JPMorganChase held $70.2 trillion in derivatives and only $136 billion in risk-based capital. In other words, the bank’s derivative bets are 516 times larger than the capital that covers the bets.

It is difficult to imagine a more reckless and unstable position for a bank to place itself in, but Goldman Sachs takes the cake. That bank’s $44 trillion in derivative bets is covered by only $19 billion in risk-based capital, resulting in bets 2,295 times larger than the capital that covers them. -DPCRoberts

~~~~

Well, maybe they dont matter…IF your one of these peoples

Admin doesn’t have time to take a crap.

Our money is soon going to be worth crap. Admin is constipated, so he is full of money. Fat people are full of crap, so they are full of money. Old people can’t crap, so they are full of money. It’s okay, the Japanese make crap, and they are in debt over 200% of GDP, so they can use their crap to pay off the auctioneer that sells their country to China. But China has 1.5 billion people, and that makes for a lot of crap, imagine 1..5 billion people crapping every day., that’s a lot of money. They’ve made trillions selling crap, and now are stuck with USD crap, soon to be worth less than crap. Where does it all end? Our money in the toilet, because it’s worth crap. Everybody else’s money worth even less crap. All that debt, who’s going to pay it off? How can the politicians and Obama get away with that crap? Is it just me, or does Obama look like a pile of crap?

[img [/img]

[/img]

[img [/img]

[/img]

[img [/img]

[/img]

How long can we spend what we don’t have?

“How long can we spend what we don’t have?”

As long as politicians can draw a breath.