The talking heads predicting an ongoing housing market recovery are just blowing smoke. Critical thinking isn’t in their repertoire. You’ve got this younger generation with mountains of student loan debt and either no jobs or crap jobs. They don’t have the money to buy houses. You have the Boomers who are living in 5,000 sq ft McMansions after their kids have flown the coup. They want to trade down, but there are no suckers willing to buy their montrosities. You have the middle aged people with little or no equity in their houses, so they can’t do jack shit.

And you have the unintended consequences of Ben Bernanke’s zero interest rate policy. Millions of people have refinanced their homes at below 5% interest rates. Just the slightest rise in mortgage rates and the entire market will come to standstill. Who will sell their existing house with a 4% mortgage rate and have to pay 5% for a newer higher priced house? Ben has created a long term problem with his short term solution. What a surprise.

The recession generation is also the screwed generation. By the way, here’s the $16 trillion current bill and the $100 trillion future bill. Credit cards are accepted.

Recession Generation Opts to Rent Not Buy Houses to Cars

The day Michael Anselmo signed a lease on his first apartment in New York City, he lost his job at Buck Consultants LLC. He spent about 10 months struggling to pay rent with unemployment benefits. Two years later he’s still hesitant to buy a home or even a road bike.

“Every decision that I have made since I lost my job has been colored by that insecurity I feel about the future,” said Anselmo, 28, who now rents an apartment in Austin, Texas, and works as a consultant for UnitedHealth Group Inc. “Buying a house is just further out on the timeline for me than it used to be.”

Anselmo and many of his peers are wary about making large purchases after entering adulthood in the deepest recession and weakest recovery since World War II. Confronting a jobless rate above 8 percent since 2009 and student-loan debt hitting about $1 trillion, 20-to-34-year-olds are renting apartments, cars and even clothing to save money and stay flexible.

As the Great Depression shaped the attitudes of a generation from 1929 until the early years of World War II, so have the financial crisis and its aftermath affected the outlook of young consumers like Anselmo, said Cliff Zukin, a professor of public policy and political science at the Edward J. Bloustein School of Planning and Public Policy at Rutgers, the state university of New Jersey.

Recession Effects

“This is a generation that is scared of commitment, wants to be light on their feet and needs to adjust to whatever happens,” said Zukin, who’s researched the effects of the recession on recent college graduates. “What once was seen as a solid investment, like a house or a car, is now seen as a ball and chain with a lot of risk to it.”

One key difference is that technology now allows companies to provide younger consumers access to what they want, when they want it and at a reduced cost, said Paco Underhill, founder of New York-based consumer-behavior research and consulting firm Envirosell.

“Renting is something that is in play that wasn’t in play during the Great Depression,” he said. “To a modern generation, ownership isn’t about having it forever, it is about having it when you need to have it,” said Underhill, who has studied shopper behavior.

Hourly Rental

Enterprise Holdings Inc. and Hertz Global Holdings Inc. (HTZ) are expanding in what the Santa Monica, California-based research firm IBISWorld estimates to be the $1.8 billion hourly car- rental business, a segment dominated by younger drivers and made popular by Zipcar Inc. (ZIP) Startups such as Rent the Runway Inc. are supplying high-fashion apparel to satisfy those who want to wear, not own. CORT, a unit of Warren Buffett’s Berkshire Hathaway Inc. (BRK/A), is increasing its furniture-rental marketing efforts to college students and fledgling households, said Mark Koepsell, CORT’s senior vice president.

“Renting makes a lot of sense,” said David Blanchflower, professor of economics at Dartmouth College in New Hampshire and a Bloomberg Television contributing editor. “They have no money and they are not buying fridges and they are not buying the things they normally buy when they set up homes. Their incomes are a lot lower.”

College Graduates

College graduates earned less coming out of the recession, according to a May study by the John J. Heldrich Center for Workforce Development at Rutgers. Those graduating during 2009 to 2011 earned a median salary in their starting job $3,000 less than the $30,000 seen in 2007. The majority of students owed $20,000 to pay off their education, and 40 percent of the 444 college graduates surveyed said their loan debt is causing them to delay major purchases such as a house or a car. The U.S. Consumer Financial Protection Bureau said in March it appeared student loans had reached $1 trillion “several months” earlier.

The U.S. economy shrank 4.7 percent from December 2007 to June 2009, making it the deepest and longest slump in the post- war era. In the three years since the recession ended, the economy has expanded 6.7 percent, the weakest recovery since World War II.

Even as the housing market shows some signs of revival, the slow pace of recovery is keeping the younger generation fearful of investments rather than confident about building wealth for the future, said Jeffrey Lubell, executive director for the Center for Housing Policy, based in Washington. First-time home buyers in 2011 accounted for the smallest percentage of the total since 2006, according to the National Association of Realtors. The vacancy rate of U.S. rental properties is at its lowest level since 2002.

Shifting Attitudes

The shifting attitudes also pose a threat to retail sales, said Candace Corlett, president of New York-based retail- strategy firm WSL Strategic Retail. Younger consumers are already comfortable buying used items and borrowing from friends. Renting will only reinforce their tendency not to buy new.

“In a post-recession economy where retailers are trying to make every shopper count, it’s the wrong direction,” she said. Retail sales fell in June for a third consecutive month, the longest period of declines since 2008.

The by-the-hour segment accounts for about 6 percent of the $30.5 billion U.S. car-rental market, a share that is forecast to rise to about 10 percent in five years, according to IBISWorld.

Enterprise’s Customers

St. Louis-based Enterprise, the largest U.S. car-rental company, expanded in the segment in May by acquiring Mint Cars On-Demand, an hourly car-rental firm with locations in New York and Boston. Half of Enterprise’s customers in this segment are under 35, according to company spokeswoman Laura Bryant.

Hertz, which began renting cars by the hour in 2008, plans to equip its entire 375,000-vehicle U.S. fleet with the technology for hourly rental within about a year, said Richard Broome, senior vice president of corporate affairs and communications for the Park Ridge, New Jersey-based company.

“It made sense to reach the younger demographic to get involved in car sharing,” Broome said. Those 34 and younger make up 84 percent of Hertz’s by-the-hour customer base, he said. “The higher costs of insurance, the higher costs of fuel, the economics would lead someone to conclude that it’s a better decision to rent the car or do car sharing than it is to own a car.”

Zipcar, the Cambridge, Massachusetts-based company that joined the market segment in 2000, says it now has about 731,000 members and more than 11,000 vehicles worldwide. More than half of Zipcar’s customers are under 35, said Mark Norman, the company’s president and chief operating officer.

Formal Wear

“Whether it’s movies by the month, music by the song or formal wear by the occasion, all of those are a smarter way to think about consumption, and Zipcar fits into that really well,” he said. Zipcar’s shares have dropped 43 percent this year under the threat of the new competition.

While sales of new cars are rebounding, 18-to-34-year-olds accounted for 11.8 percent of vehicle registrations for new cars in the five months through May, compared with 16.5 percent in May 2007, according to data from R.L. Polk & Co., an auto- industry research company based in Southfield, Michigan.

Jared Fruchtman, 25, said using Zipcar gives him about $600 more a month to spend on dinners out, cab rides and trips on the weekends.

“It wasn’t financially worthwhile to buy or lease a car right now,” said Fruchtman, who is studying to be a certified public accountant and lives with his girlfriend in a rented apartment in San Francisco.

“I never considered buying,” he said. “It didn’t make sense to tie ourselves down right now.”

High Fashion

That attitude extends to clothes. Rent the Runway, a website that offers high-fashion gowns and other couture for around 10 percent of the purchase price, is also targeting younger consumers. President Jennifer Fleiss, 28, said its business model is “almost recession proof.” Since its start in 2009, the company has grown to about 3 million online members and is adding approximately 100,000 per month. In May 2011, the New York-based company raised $15 million in venture capital from outside investors, said Fleiss. Rent the Runway members typically range from 15 to 35 years old, she said.

Lindsay Abrams, 22, started working in 2009 as an on-campus representative at Vanderbilt University in Nashville, Tennessee, one of 175 colleges with company-sponsored teams to drive brand awareness.

Important Part

“The recession has been an important part of Rent the Runway’s popularity,” said Abrams, who has rented about 15 dresses and is now a customer communications associate for the company. “For people my age, the new thing is renting versus buying. It is a great way to save money.”

Furniture companies are also getting in on the act. Chantilly, Virginia-based CORT, the world’s largest provider of rental furniture, boosted its efforts in 2009 to reach college students and younger customers.

Koepsell, the senior vice president, said the company was “foolish” not to aim for the market earlier. Last year, CORT provided furniture to about 15,000 students and predicts that number will grow to 25,000 this year.

Among CORT’s customers is Michael Ferraiolo, a 20-year-old senior at Virginia Tech, who pays $198 monthly for everything from beds to a coffee table to furnish the rented townhouse he shares with two roommates in Blacksburg, Virginia.

“With the job market such an uncertainty, none of us know where they are going to end up,” Ferraiolo said. “Now, more than ever, you see people moving around in different job markets all throughout their career. We just don’t know what to expect.”

Shifting attitudes about larger purchases aren’t the only reason preventing young consumers from buying. Stricter lending practices and higher requirements for down payments on houses and cars are crowding out buyers, Blanchflower, the Dartmouth economist, said.

Build Wealth

For those who choose to rent not buy, there’s a price to pay, said Lubell of the Center for Housing Policy. By foregoing purchases of assets like homes, young people are giving up on a chance to build wealth, he said.

“What you are seeing is a delay in all the kinds of decisions that require a long-term financially stable future,” Lubell said. “That’s home purchases, that’s marriage and that’s having kids.”

Anselmo, the health consultant who rents an apartment in Austin, Texas, says he understands such arguments. Even so, he can’t bring himself to buy a house.

“The logical person in me gets pissed off when I write a check every month and it just goes down the drain,” he said. “But we are very hesitant.”

To contact the reporter on this story: Caroline Fairchild in Washington at [email protected]

The American fertility rate has dropped 12% since 2007, down to its lowest point in 25 years. So at least there is a silver lining.

This kind of sticks out: “What you are seeing is a delay in all the kinds of decisions that require a long-term financially stable future.”

It is interesting that he uses the term “delay.” I don’t think that during the rest of my lifetime anyone will have a long-term financially stable future. So perhaps “delay” is not the proper nomenclature.

You forgot to mention the 20 million people underwater on their mortgages, who can’t sell either.

I’d call it “purposeful forgetting”, a “mental block” or some other psychological reason.

“Build Wealth”

Oh my lawds…. I contend that the BEST thing that could happen to the economy is for house prices to drop to affordable levels….

The entire mortgage model is based on a 30+ year carreer and pension.

New home buyers spend like crazy on their new castle. People buying foreclosures and shorts have provided my shop with a hefty amount of work.

Low housing payments free up money for toys.

An entire generation is being deprived of property for the sake of banks and consumers trying to purchase a bigger penis.

Administrator: You are dead right on the prospects for the hopefull fools in wait of a housing price regeneration. Just who in the fuck will they sell their house to? Oh… that’s right…. they won’t.

This whole article is crap.

Nothing but “Poor me!”, “Oh woe is I!”, “The world’s not fair!”, “Why do I have to w-a-i-t for anything,especially a McMansion?”………….

Pardon me while I throw up.

I’ll give those wanna house nowabees a message. If you can ‘t afford to buy a house and for some reason renting is anathema to do, then get off your ass and BUILD ONE…..

Can’t be done? Horsepucky. Back in 1979, after a multi-year contract working for Johns Hopkins Univ. in Scotland, I told my sweetie that it was now or never to build a house — which is something I’ve always wanted to do (especially after owning three of them in the past, doing no better than breaking even on any one of them).

We had 10 acres up in the panhandle of Idaho that we had bought 10 years before “just because” and we were then going overseas to Kwajalein for a tour overseas.

So off we went. Got back to the states, bought a used F150 and a 28’ travel trailer and pulled it up to Bath, Maine. There I went through a nifty three month school called “The Shelter Institute”.

I didn’t learn much in the class work, but the most fantastic part was that we students got to go out and work on other peoples owner-built homes. Hands on.. Amazing, did not describe it as we got to see what could be done with sweat equity.

After that fun time, we went towing to Idaho, getting there just after Mt. St. Helens had blown her stack and covered everything in sight with grey ash.. Fun start.

And my sweetie and I built a little old cabin in the woods just North of Spirit Lake in the Hoodoo Valley of N. Idaho.. It started out to be a little cabin in the woods and ended up being a 2400 sq. ft. two story passive solar home with a 10 x 40 foot rock bed green house on the South side of it so we had fresh produce right through the winter.

We took a year to build it – working full time – I hired two hammer swingers to help when the beams got too big for me to lift.

After the house was finished, I too two more years off (our fixed expenses at the time were $50.00 a month for telephone and electricity. I shot the meat and my sweetie grew the veggies.) and went back to school, getting an extra degree just for the hell of it.

After finishing that, I told my love that now that we had done what I wanted to do, we’d go where she wanted next.. She said, “Take me back to the Pacific.” and we packed up a container, sold the house for 2 1/2 times what it cost and shipped a car and container to Maui.

My sweetie had, while building the first house, had vehemently said on more than one occasion that she never wanted to build another house in her life. Sure love, I said, sure……

We got to Maui and found, not to our surprise, that even with the proceeds of the Idaho house, there was no way we could afford to buy a house. We rented for two years, finally buying a gorgeous 2 1/2 acre lot on the West side of Mt. Haleakla at 2500 ft. elevation in the little village of Kula, HI. We had money to build a house ourselves or buy the land, not enough for both.

So BUY THE LAND FIRST…. Then the old man went to work atop Mt. Haleakala managing observatories at 10,000 feet from dusk to dawn and began work building a house from dawn to dusk. My sweetie had, by then relented about building another house ourselves and really got into this time.

A year later, we moved into a empty wooden post and beam tent with one working bathroom (closed off by a sheet), two saw horses, a hot plate and a microwave for a kitchen and one bedroom (also closed off with a blanket nailed to studs). We washed dishes in a tub.

The house was 4000 sq. ft. under the roof with 1500 sq. ft. of decking on three sides. I designed and engineered it and again hired hammer swingers to do the heavy lifting. My late son-in-law was in the Navy at Pearl Harbor at the time and I’d fly him and our daughter and grandkids over on long weekends and paid him to help too.

Here’s the cool part. We didn’t borrow money to buy a single nail. I’d get a pay check from the Univ. of Hawaii, we cash it and write checks to a lumber broker in Oregon to ship a container load of treated lumber to us. I’d work another two months and contract the kitchen cabinets (Koa) out to a local craftsman and paid him in cash when he was done.

We ended up 6 years later with three dwellings on the property; main house, a “farm dwelling” of 1400 sq. feet and a “Mother in law” cottage attached to the main house by a covered bridge with flowers growing on it.

My love turned the two extra dwellings into a high end Bed and Breakfast and every square foot of the property not covered by house was raising protea (flowers native to S. Africa and beautiful) and we also had a lime grove (Bearrs limes) and a field of pineapple. Our taxes were penny-anti because we were a working farm while the B&B was a great success.

We kept at it, me on the mountain, working two jobs, my sweetie running the B&B and managing the farm for twelve wonderful years when it occurred to us that we’d both probably have to keep working at 4 jobs until we died in order to cover the costs of living out there and so we made a change.

We sold the farm and I took another contract overseas at which I worked at until I retired in 1996.

So if you just want to own a house, build one yourself.

There is, in any market, no way to loose money doing it yourself (even with some hired help) because every hour you work on that home is just like putting $400 in your pocket (I worked out the figures one time after we had sold the property in Idaho). Every dollar you spend on material is worth four times what you paid for it when cut and used in the home. Talk about “value added”!

Build it out of cash flow, not from borrowed money. If things have to sit for a week until payday, so be it. Building a home yourself is the best instant gratification you’ll ever have because at the end of the day (or evening), you can see and touch what you’ve done – and it’s yours, not some banks.

Buy the land first, then, if you have to, live in a tent with a slit trench latrine and hauled water until you can improve the situation through bloody hard work and persistence.

It can be done.

MA

What Muck was really saying

Muck, that was an awfully long story, just to illustrate that things were better in 1979.

Not that I disagree. I was nine years old then, so I remember.

The Muck hath spoken.

PJ:

I was willfully defying my potty training in 1979….

“And my sweetie and I built a little old cabin in the woods just North of Spirit Lake in the Hoodoo Valley of N. Idaho.”

I bet Muck’s sweetie was really something before electricity came along.

Muck, I’ll just add that these kids were told that they could get a good job, if only they got a good education and worked hard. They’ve been told since they were kids that the “American Dream” meant owning a home (which we all know isn’t true, but if you were 10 when Greenspan / Bush pushed that idea, you’d think that’s what it meant, too).

For the most part, these kids are reacting the same way the GI generation did; they’re delaying settling down, they’re settling on minimalist lifestyles and doing shared-owning/renting to afford things like cars. The worst part of all of this is that everyone (companies, government, society) lied to them that a good education in any field would net a decent job and a wage they could thrive on, all while seeing to it that good jobs were shipped overseas. And, at the same time, the educational system in the U.S. was decimated to the point our kids can’t begin to compete with graduates from other countries. Frankly, I’m surprised these kids aren’t rioting.

Thinker: I’m surprised that at the very least these kids aren’t in the streets with cardboard signs.

Colma

They were until they were beaten, maced, clubbed and thrown in jail.

They are retarded!!!

Every kid you see nowadays has tattoos everywhere, especially on there arms. And piercings.

Who the fuck is going hire somebody covered in tattoos? Nothing says LOSER faster than having a tattoo. It immediately excludes them from sales jobs, or any job dealing with customers. There are only so many jobs at auto repair shops and janitors. Cheezeus.

[img [/img]

[/img]

Oh god, AWD just turned Boomer on us.

Muck wrote:

“So if you just want to own a house, build one yourself.”

Not gonna happen.

My parents built their first little house in the mid-1950s. It most certainly can be done.

But there are very few people like you and Mrs. Muck, and my parents anymore.

The younger ones want what they want and they want it now and they much prefer that someone else do the hard work. They think if they can get a loan for the max amount (the biggest house they can (not really) afford) and sign on to be a debt slave for the next 3 decades of their lives, they’ll be livin’ large.

We have relatives who are building a new home and they hired part of it done and they are finishing it. But they were only able to do this because Grandma gave them the land (no sacrifice while they saved their own money to buy some land) and they are living with her parent while the house is being completed (they ain’t gonna live in no tent!!!).

With this project being so financially “tight” for them, I am concerned for their future. They will have a $200K+ mortgage hanging over their head when it’s done.

No matter though, at least they’ll finally have their “dream home”. 😉

Colma:

There is no greater insult than the one you just hurled at me. I shall take my Katana and slice and dice you into sushi-sized pieces and feed you to the snapping turtles!

Boomers wrote the book on tattoos, losers one and all

[img [/img]

[/img]

“I’m surprised these kids aren’t rioting.”

Nah.

That might require they put down their iphone.

Regarding tattoos and piercings amongst the young, I blame Jim Morrison. It took a lot of ingenuity to surpass masturbating onstage.

Maddie’s Mom: “That might require they put down their iphone.”

Funny, they said the same thing about the GI generation and that generation’s new technology — radio.

….You wouldn’t think M’s Mom would notice glued to that PC.

[img [/img]

[/img]

[img [/img]

[/img]

Government employees, Colmes, couldn’t get a job anyplace else.

Round here anything goes.[img [/img]

[/img]

My wife and I realized long ago that if we want a house that we actually desire, we will have to have it built.

No, I’m not fucking building that myself. I’d rather pick up a contract gig on the side in my chosen profession that also helps build my portfolio. I can’t put “built my very own house” on my CV ya know?

PC: Actually that might show initiative and the ability to deal with regulations of all sorts…

But you have a gig so whadevuh.

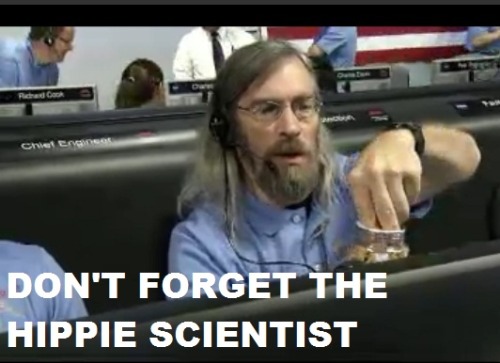

On the subject of “Mohawk Propulsion Guy”…. I guaranfuckintee he can work anywhere in the private sector, even if he got a tattoo on his forehead after accomplishing that for NASA which is still a dream-job for extremely competent engineers.

“Hey cut that hair”, “What’s with the tat?”, “piss in this cup we screen dopers”….

THE SOUNDS OF SECOND-RATE COMPANIES

At least in tech. Doesn’t fly.

Now, for some unskilled lunk without experience interviewing for a sales job? Yeah…. visible tats/piercings/ thumb-rings and such isn’t a hot idea.

Unless you’re me. Then it’s a done-deal, even with my “Sheitan” Arabic neck tat, hammer-head brand on the wrist, nose stud, hands clad with bling and such. Everyone knows women handle HR now, I’m a fucking shoe-in.

Colma sayz

“gimme the mutha fuckin job beotch”

[img [/img]

[/img]

Yea, a shoe in

No way, fuck that.

The shirt doesn’t come off for a job.

It only comes off for the signing bonus.

That guy looks British.

Nipple rings and gauges….

Not good in a fight. Not good at all. Worse than long hair….

Actual picture of Colma Rising:

[img [/img]

[/img]

Would ya like to buy some software?

[img [/img]

[/img]

You’re hired, how soon can you start?

[img [/img]

[/img] [/img]

[/img]

[img

I always wanted to see a chicken coup. Oh, wait … didn’t Nick Park do one?

Maybe some nostalgia is in order …

http://www.youtube.com/watch?v=n-KPGh3wysw&feature=player_detailpage#t=49s

Colma – ear rings are not good in a fight. I have seen more than one earring wearer come to significant grief. Another no no is long hair. I am sure there is a smart ass that had a pony tail that well remembers me – a pony tail is a really bad idea in a fight, as it can be used as a handle. I expect he either cut it off or learned to keep his mouth shut.

This is a recent photo of Colma:

[img [/img]

[/img]

WTF? You can’t fire me old man….

[img [/img]

[/img]

[img [/img]

[/img]

“PC: Actually that might show initiative and the ability to deal with regulations of all sorts…

But you have a gig so whadevuh.” – Colma

That it would, but its quite as direct as what I have right now. My company has had an R&D department for a long time, but the PhD who ran it treated the place like his own private playground.

This means that I need to make the lab compliant under the guidelines of a veritable alphabet soup of government and international regulatory agencies.

If I had to learn all of the regs for housing as well I’d probably scream.

PS: Is the percentage of tatt’d up, mohawk wearing, gauged out millenials really THAT high? Or is it just the fields you guys work in? Almost every millenial I interact with on a regular basis looks like any other professional.

PissyC:

No, the percentage isn’t that high at all. Maybe tattoos but rarely in a spot that can’t be covered…

You all would be very surprised though….

LLPOH: One of the most make-me-wince sights was at a show where some moron had his shirt off with fucking nipple rings in a pit…. Somebody, I hope for good reason for the sake of humanity, ran up and ripped them out. I shudder even recalling it.

Colma,

I’ve been away for a few hours, but I see that shit on my screen.

In fact, it would be GenX who took the sleeves and tackle-box face thing to the levels we know and love.

I stopped bar hopping in the Mission years ago due to the over-pierced fat hipster chicks you had to wade through to get a cocktail. They looked like bulletin boards covered in thumbtacks waddling around in pointy shoes barfing in the planter boxes.

Colma – how about this for an image: two hands grip a pony tail and then make believe you are an Olympic hammer thrower. I repeat – long hair in a fight is a serious no no, and a pony tail is just plain stupid.

llpoh: Ouch.

Maddie’s Mom: Wasn’t me.

My apologies to the real Colma.

MM:

It was me, I confess. Just a retort from my smart phone to your monitor.

A monkey will fling poo.

llpoh says:

Colma – ear rings are not good in a fight. I have seen more than one earring wearer come to significant grief. Another no no is long hair. I am sure there is a smart ass that had a pony tail that well remembers me – a pony tail is a really bad idea in a fight, as it can be used as a handle. I expect he either cut it off or learned to keep his mouth shut.

I’ve had long hair most my life. You can tear it out by the handfuls if I’m mad enough and I won’t feel it.

Though, it does serve as a trap if I’m trying to run away. It makes my pursuers arm two foot longer. As long as the fall doesn’t hurt me, I’m ok though..lol

See, I knew growing up in a neighborhood full of boys was good for me.

The couple people that pulled my hair found out the hard way, it doesn’t hurt me, but when I pull yours back you’re going to bleed.

Agreeing with llpoh here, long hair is a definite no no in a fight. Honestly, anything you can dig your fingers into is a no no.

Once you have your fingers buried in someone’s hair its pretty easy to control their movements.

Illustration from Max Brooks’ “Zombie Survival Guide”:

[img [/img]

[/img]

“And my sweetie and I built a little old cabin in the woods just North of Spirit Lake in the Hoodoo Valley of N. Idaho.

My current pup (in my avatar) was born in the Hoodoo Valley. Magnificent country too. Practically in my backyard.

I_S

“Once you have your fingers buried in someone’s hair its pretty easy to control their movements.”

My hair is medium long but while you have your fingers buried in my hair, you’ll have to contemplate how to get your nuts out of my left hand while simultaneously dodging the hollow points coming from the handgun in my right hand. I hope somebody gets it on video!

I_S

I sell piercing supplies, and do quite well…

[img [/img]

[/img]

One got a job at McDonald’s

One got a job at NASA,

Which one would you take?

(This picture is not Photoshopped)

[img [/img]

[/img]