Have you heard the news? Auto sales are booming. Total sales for the month of August were 1,285,202 vehicles, according to Autodata Corp, the highest monthly sales figure for any August since 2007, when 1.47 million autos were sold in the United States. Year to date auto sales have totaled 9.7 million and are on track to reach 14.5 million. Between 2006 and 2007, auto sales ranged between 16 million and 18 million. They crashed below 10 million in 2009. The Keynesians running our government have pulled out all the stops to restart this engine of consumer spending. First they wasted $3 billion of taxpayer funds on the Cash for Clunkers debacle. Almost 700,000 perfectly good cars were destroyed in order to keep union workers happy. This Keynesian brain fart distorted the used car market for two years, raising prices for cars needed by the working poor. After that miserable failure, they realized the true secret to selling vehicles is to give them away to anyone that can scratch an X on a loan document, with 0% interest for 60 months, financed by Federal government controlled banking interests. Add in some massive channel stuffing and presto!!! – You’ve got an auto sales boom.

General Motors sales are up 3.7% over 2011. Ford Motors sales are up 6% over 2011. The Obama administration continues to tout their saving of the U.S. auto industry with their bailout in 2009 that saved unions and screwed bondholders. If this strong auto recovery is not an illusion, how do you explain the two charts below? General Motors stock is down 42% since 2011. The highly proclaimed success story called Ford Motors has seen their stock collapse by 50% since 2011. This is surely a sign of tremendous success and anticipation of soaring profits for these bastions of American manufacturing dominance.

This is America, land of the delusional and home of the vain. The appearance of success is more important than actual success. The corporate mainstream media dutifully reports the surge in auto sales is surely a sign the economy is recovering and the consumer has finished deleveraging and is ready to spend again. The government propaganda machine proclaims the surging auto sales are due to their wise and forward thinking policies (like the Chevy Volt). Luckily for them, there are millions of gullible Americans who believe the storyline and are easily convinced that driving a $30,000 new car, financed over seven years, makes them a success. The decades of Bernaysian marketing propaganda has worked its magic on the government educated, math challenged citizenry. There are only two things that matter to the non-thinking auto buyer (renter) – the monthly payment and what the next door neighbor and his coworkers will think. Buying a fuel efficient car they can afford, paying it off in three or four years, and driving it for ten years, while saving the monthly car payment, is what a practical, rational thinking person would do. The fact that only 20% of the 9.7 million vehicles sold this year have been small cars and the average sales price of new cars sold is now $31,000 proves Americans are still living in a delusional fantasyland of cheap gas and monthly payments for eternity.

As gas prices surpass $4 per gallon across the country, somehow 4.7 million of the 9.7 million vehicles sold in 2012 have been pickups, vans, crossovers or SUVs. Three of the top eight selling vehicles are pickups. Luxury vehicle sales are booming, with Mercedes, BMW, Porsche, Land Rover and Audi showing double digit percentage sales gains over 2011. We’ve entered a recession, gas prices are approaching all-time highs, job growth is pitiful, and Americans continue to buy luxury gas guzzlers on credit. This will surely end well.

The average payment on a new car in 2012 is $461. For used cars, the average monthly payment is $346. Today, 77% of new car purchases are financed. About half of all used vehicles involve financing. Of those cars financed, 89% are through a loan vs. 11% with a lease. A critical thinking person might wonder how a country with 4 million less employed people than we had in 2007, median household net worth down 35%, and real wages lower than they were in 2007, could be experiencing an auto boom. The answer is a government/corporate/banker/media effort to funnel taxpayer funds to deadbeats across the land in a fruitless attempt to create a facade of recovery. Our governing elite are convinced that more debt peddled to the masses is the path to recovery for an economy that imploded due to excessive debt peddled to the masses in the first place. Essentially, it comes down to who benefits from the peddling of debt. It isn’t the masses, as they become enslaved in the chains of debt and monthly payments in perpetuity. Debt peddling benefits Wall Street bankers, politicians, and mega-corporations selling crap to the masses.

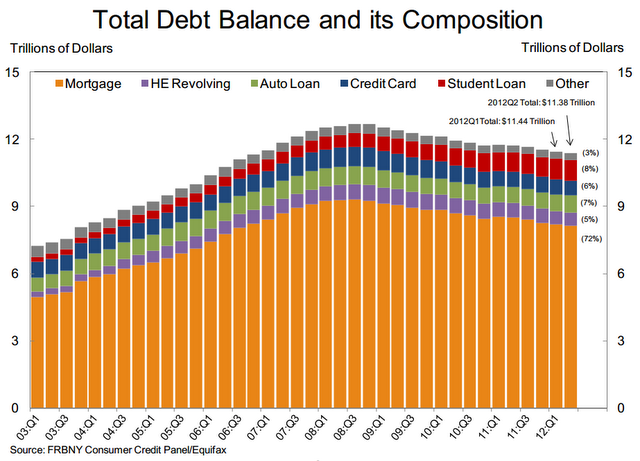

The storyline being sold to the vegetative dupes (watching Honey Boo Boo) that occupy space in this delusional paradise we call America, by the corporate media, is that consumers have deleveraged and are ready to resume their “normal” pattern of spending money they don’t have on stuff they don’t need. Of course, the facts always seem to get in the way of a good yarn. Consumers have never deleveraged. Consumer credit outstanding is at an all-time high of $2.58 trillion. The decline from $2.55 trillion in 2008 to $2.4 trillion in 2010 was NOT deleveraging. It was the Wall Street Too Big To Fail banks taking a big dump on the American taxpayers. They passed their bad debts to you through TARP, the Federal Reserve buying their toxic “assets”, and ZIRP.

Revolving credit (credit card) debt peaked at just above $1 trillion in 2008 and “declined” to $850 billion during 2010. The media storyline is that you buckled down and paid off your credit cards, therefore depressing consumer spending and creating a recession. Sounds convincing except for the fact that it’s a load of bullshit. The Federal Reserve’s own data proves it to be false. Your friendly Wall Street banks have written off $213 billion of credit card debt since 2008 and passed the bill to the few remaining taxpayers in this country. For the math challenged, this means that consumers have actually INCREASED their credit card debt by $68 billion since 2008. The bad news for our Chinese crap peddling mega-retailers is that the significantly poorer average middle class American household is using their credit cards to pay their property tax bills, IRS bills, and utility bills in order to survive.

Credit Card Charge-off in Dollars 2005 – 2011 — Not Seasonally Adjusted:

| Year | Dollar Amount |

| 2011 | $46,017,459,671 |

| 2010 | $75,090,106,350 |

| 2009 | $83,179,901,000 |

| 2008 | $53,506,353,600 |

| 2007 | $38,149,440,000 |

| 2006 | $32,111,934,400 |

| 2005 | $40,634,994,400 |

| Year & Quarter | Dollar Amount |

| 2012Q1 | $8,772,385,443 |

The category of debt that barely budged in the 2009 collapse was non-revolving credit. It stayed in the $1.5 trillion range in 2009 and has since surged to over $1.7 trillion in 2012. What could possibly have made this debt skyrocket by $200 billion when the GDP has only grown by 12% over the same time frame? You guessed it – your corporate fascist friends in Washington DC and on Wall Street. Non-revolving debt consists of auto loan debt of $663 billion and student loan debt of approximately $1 trillion. Student loan debt has shot up by $300 billion since 2008. This student loan debt is being distributed, like candy by a pedophile, from the Federal government in an effort to artificially hold down the unemployment rate.

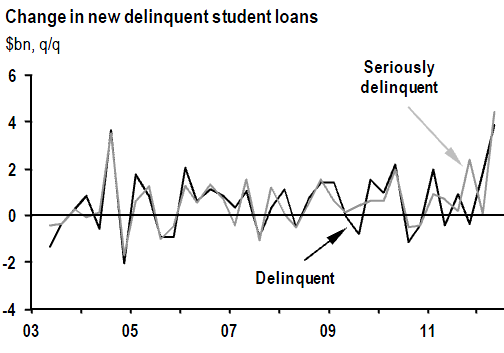

Approximately $500 billion of the student loan debt is held directly by the Federal government, up from $100 billion in 2008. The Feds guarantee the majority of the remaining student loan debt. Can you think of a more subprime borrower than a 40 year old former construction worker getting a liberal arts degree from the University of Phoenix, sitting at his computer in his underwear scratching his balls, and paying with a $10,000 Federal student loan from you? This fraudulent attempt to obscure the true employment situation will end in tears for the borrowers and the American taxpayer. It’s tough to make a loan payment without a job. The student loan bailout is just over the horizon and will cost you at least $300 billion. Delinquencies are already off the charts.

When has offering low interest debt in ample portions to people without jobs, income or assets ever backfired before? The bankers and politicians that control this country seem to be a one-trick pony. They will never admit that debt is the problem and reducing it the solution. The real solution would make them poorer, so their solution is to pour gasoline on the fire with more debt at lower interest rates to more people. The addict will keep injecting more poison into their system until sudden death. The bankers and politicians know we are a car-centric society and appeal to our vanity and poor math skills to keep the game going.

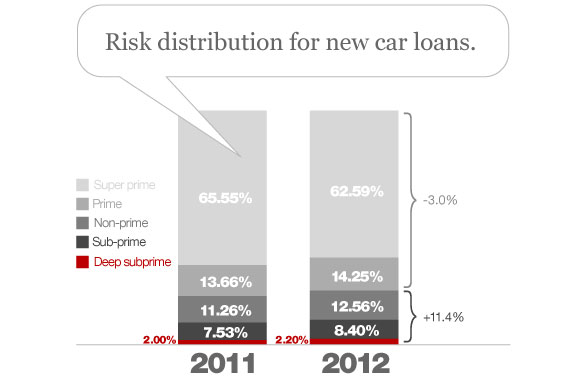

During the first quarter of this year, total U.S. car loans totaled $52.5 billion. That’s 49% higher than the same period in 2009. Also during the first quarter, the average amount financed on new vehicles rose by $589, to $25,995, and for used cars by $411, to $17,050. Furthermore, buyers are stretching out payments for longer terms: The average length of new- and used-vehicle loans jumped a full month during the first three months of this year, to 64 and 59 months, respectively. The surge in auto sales is being completely driven by doling out more loans for a longer time frame to deadbeat borrowers. Subprime auto loans now make up 45% of all car loans and the vast majority of all used car loans. They have even created a category called Deep Subprime. Borrowers classified as “deep subprime” (i.e. those with Vantage scores below 600) account for 10.7% of auto loans. You can also classify them as loans that will never be repaid.

Two thirds of all car sales are for used cars, so the fact that 37% of all new cars are being sold to subprime borrowers is exacerbated by the ridiculous lending practices for used cars. The fine folks at Zero Hedge have provided the outrageous data and a chart that proves beyond a shadow of a doubt what awaits the American taxpayer – another bailout. Zero Hedge has already revealed the GM fake recovery by detailing their channel stuffing over the last two years. Now they’ve dug up more dirt on why car sales are surging. What could possibly go wrong providing loans for more than the value of the asset to people with a history of not paying their debts?

- Subprime borrowers received 56.46% of loans on used cars in the quarter, up from 52.70% a year earlier.

- The average loan-to-value on new cars was 109.55%

- The average used car loan-to-value ratio rose to 126.62%

- 77% of Subprime Auto Loans are for a period greater than five years

It’s amazing how many cars you can sell when you aren’t worried about getting paid. This is the beauty of a fiat currency, a printing press, and a taxpayer available to pick up the tab after the drunken party gets out of hand. The chart below provides the details of our superhighway to disaster. The percentage of used car loans to prime borrowers is now at an all-time low, while the percentage of loans to subprime borrowers is near all-time highs reached just prior to the 2008 crash. When lenders cared about being paid back in the early 2000’s, they rarely made loans longer than five years. Today, more than 77% of all subprime used car loans are longer than five years and average FICO scores are now well below 600. Just to clarify – if your FICO score is below 600 – YOU ARE A DEADBEAT.

When you start to connect the dots, things that didn’t seem to make sense begin to crystallize. This is all part of the master plan concocted by Bernanke, Geithner, Obama and the Wall Street Shysters. The auto section of my local paper now makes sense. Offers of 7 year financing at 0% interest and monthly lease offers of $150 to $200 for brand new cars now are understandable. The newer model BMWs, Cadillac Escalades, Volvos, and Jaguars I see parked in front of the low income luxury gated townhome community in West Philadelphia now makes sense. A pizza delivery guy driving a new Lexus is now explainable.

The master plan is fairly simple. The Federal Reserve lends money to the Wall Street banks for 0% interest. These banks then turn around and provide credit card debt at 13% interest, new & used car loans to prime borrowers at 5% interest, and new & used car loans to subprime borrowers at 16%. When you can borrow for free, you can take a chance that a significant number of your borrowers will default. Essentially, Ben Bernanke is screwing the prudent savers and senior citizens by paying them 0.15% on their savings in order to subsidize the bankers that destroyed the country so they can make auto loans to the same people who took out the zero percent down interest only no doc mortgage loans in 2005. In addition, Wall Street knows the Bernanke Put is still in place. If and when these subprime loans explode in their faces again, Bennie, Timmy and Obamaney will come to the rescue with your tax dollars. Its heads you lose, tails you lose, again.

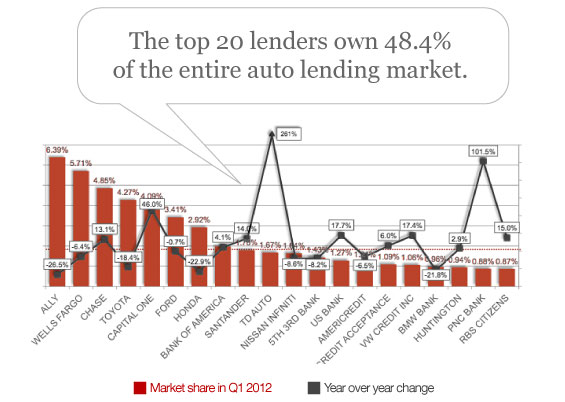

The chart below is like a who’s who of TARP recipients. The top 20 auto lenders control half the market. And look at the leader of the pack. Our friends at Ally Bank are the market share leader. You remember Ally Bank – they conveniently changed their name from GMAC (also known as Ditech – biggest subprime mortgage lender) after losing billions and being bailed out by you. They still owe you $11 billion and are 85% owned by the U.S. Treasury. No conflict of interest there. You have the biggest auto lender on earth controlled by the Obama administration. Do you think they have an incentive to make as many loans as humanly possible to help Obama create the illusion of an auto recovery? The only downside is for the American taxpayer when we have to eat billions more in Ally/GMAC losses. This insolvent excuse for a lending institution has been extremely aggressive in the subprime auto lending market and has forced the other wannabes – Wells Fargo, JP Morgan, Capital One and Bank of America – to lower their lending standards. Does this scenario ring a bell?

We’ve become a subprime auto nation, addicted to easy debt, living lives of hope, delusion and minimum monthly payments. Storylines about economic recovery, fraudulent government statistics showing lower unemployment, feel good propaganda from the corporate mainstream media, and a return to easy money debt fueled spending does not constitute a real recovery. Until the bad debt is purged from the system and saving takes precedence over spending, the country will stagger and ultimately fall under the weight of its immense debt. We are lost in a blizzard of lies. This subprime fueled engine of recovery will propel the country into the same canyon of reality we entered in 2008. The crack up boom approaches.

I don’t if anyone remebers but back after the collapse Car payment defaults were astonishing. Now the normal number of days for Repo is 66. It had climbed into the 90s as there was just a deluge going on. The autolenders learned a trick: Loan reworking. They reduce payments upfront and loaded the balance on the back end; problem solved!!!

Cash flow is king today and with ZIRP length of loans have no accountability. What is happening out there is they are signing anyone up for a car loan. If trouble arises at a later date they will work the magic of loan reworking. Do they care some slob is going to take 11 years to pay back for that 14 mpg Silverado? absolutely not!!! Their only goal is “CASH FLOW”.

Is this a sign the U.S. is scratching the bottom of the barrel? you betcha! is it a sign that things are going to get a whole lot worse? ………… I actually started “prepping”.

[img]http://thepeoplescube.com/peoples_resource/image/15549[/img]

[img ?w=350[/img]

?w=350[/img]

Admin – thanks again for all you do. You have the intellect of a titan and the hide of an elephant. I am getting pissed of watching the morons that post who are incapable of reason, and can only imagine your angst.

I have not too much problem when 2 people look at the same set of facts and draw different forecasts – for instance, Persnickety and i had a reaonable conversation on China, agreeing, I think, on the facts but not the outlook.

But I really get fucking ropable when the fucking asshats cannot even see the facts, much less draw conclusions from them ( Thunderbird, you moron, in case you are wondering, I am referring to you). I can only imagine your angst, given the efforts you make presenting facts.

Thanks again.

Thanks llpoh

It appears that my funk was caused by a new medicine my doctor put me on last month. It messed me up. It created a brain fog that kept me from thinking properly. I stopped taking it a little over a week ago and I think I’m back to normal. I was able to write this article in a few hours.

I’m back baby!!!

Loopy , angst is for pussies who can’t deal with reality. Real men like admin ,cock, lock and hammer until the nothings left of the ideologue rock heads but pebbles.

He’s back

This auto post was on ZH. Nice

What was the med? (to make sure I don’t give it to anyone)

[img [/img]

[/img]

AWD

I had been sleeping like shit, so he prescribed Ambien.

I slept like a baby, but that shit messes up your brain. I couldn’t focus and think properly.

I’ll never touch that shit ever again.

Jean-yutz: “If a dealership wants to sell a car to a poor credt risk individual, that is their business, so long as you are not on the hook through bailouts and the like.” Sure, and if we all sprouted wings out our arses, we could soar like eagles and would have no need for cars. But since we don’t live in such a frou-frou fantasyland, the point is entirely moot. We are on the hook, and the hook is getting bigger and digging deeper every day.

“Virtually all” is the epitome of weasel language. Tell us how many lenders (and, more importantly, in what volume) are REALLY requiring the assurances you claim they are seeking?

“A huge number of people in the U.S. have “subprime” credit, so it would stand to reason that many auto loans are subprime.” So since there’s a huge number of credit risks out there, it’s fine to loan them large sums for consumer items that lose most of their value in a few short years? Does the fact that there is a large number of them somehow make these hordes of sub-prime borrowers more likely to pay off their debts? Of course, it’s not and it doesn’t.

The lack of rigor in your thinking is terrifying.

Damn, I could have told you “don’t ever take Ambien” ever, never ever.

People wander around outside in the night, walk into other people’s houses, drive impaired in the middle of the night, and don’t remember anything. That shit should be taken off the market.

AWD

Thanks for telling me now. How can the FDA let that shit stay on the market?

It fucked up Tom Brokaw the other day on MSNBC.

Administrator: Fine article… The sheer numbers of fools in their new cars will always perplex me.

Did you get those weird lizard-brain sleepwalk/munchie monster side effects from the pills? I heard that was a real side-effect.

LLPOH: One way I can see financing at 7 years, 0%…. which you have to admit is a temptation. It’s free money, and if it’s not attached to pre-payment penalties double-payment would be the way to go….

Now if you had the cash on hand, 0% financing can simply be used so as to keep your phat stacks and get a return… even if it’s 2% (liquid and possible at credit unions)…. One could just optimize the principle and pay when equal or ride the loan out… The latter being a GREAT idea if the vehicle is being utilized as a capital good where, in all reality, your returns should be at least double a depreciation of 10%. Very possible and maybe a good idea for a small business person who doesn’t want to front their own cashola.

Really, though, unless you’re going to be making money with the dam vehicle, financing is a bad way to express pecuniary habit.

Colma

My problems were during the day. I didn’t give a shit about anything. I didn’t feel like reading or writing anything. That’s why I was ready to throw in the towel.

When I stopped taking it, I could barely sleep for a few days. But the fog has cleared and I’m feeling normal again.

^^^^^See the doctor’s comment for translation of “Lizard-Brain sleep-walking munchie-monster”^^^^^

I would not doubt it one bit if the Causeway Cannibal was on that shit along with the reported bath salts.

Admin kept finding himself in this lady’s bedroom in the middle of the night. Can’t blame him, really, too bad he can’t remember it.

[img [/img]

[/img]

Admin’s doctor got his degree from U. of Phoenix

[img [/img]

[/img]

Didn’t you pay your bill or something?

Ambien must be what folks are on that disagree with me. I knew there was a logical explanation.

I thought Admin had something wrong with his ears for not rocking the BR, but alas, it was something wrong between his ears….

Anyone want a consult or an opinion about a medication, a procedure or test, or something medically related, I’d be happy to help. Admin has my email. Only takes a second.

“another woman defecated during the night in her closets and on the basement floor”

Stick with the beevos, mister admin. Avalon hates cleaning up random piles of crap.

[img]http://www.s2ki.com/s2000/gallery/page__module__images__section__img_ctrl__img__122541__file__med[/img]

AWD

I’ve had an erection for the last four hours after taking 500 mg of this:

[img [/img]

[/img]

What should I do?

My Life As An Ambien Zombie

By Damon Orion

I cheerfully take Ambien again the following night, curious to find out if last night’s loopy feeling and wacky visuals were some kind of fluke.

In wordless answer, The Cupcake People appear before my closed eyes. That probably needs some explanation: The Cupcake People are four living, breathing cupcakes—a mom, a dad and their two adorable cupcake children—who are riding a roller coaster together. With their pink frosting, strawberry mouths and bright, rosy smiles, they’re the very picture of wholesome family fun except for the fact that they’re … you know … human cupcakes.

Naturally, I begin to look forward to the two nights a week when more gloriously idiotic short films will be projected onto my inner eyelids as I wait to fall asleep on Ambien: a ram with horns made of candy cane; Gene Shalit grinning obnoxiously as a Frisbee spins on his upraised middle finger; a huge, stupid seaweed monster stumbling blindly through an airport wrecking everything in his path as a tiny human family tries to guide his way; the Trix rabbit using a giant tobacco pipe as a golf club; a view through the eyes of a spider that a Mexican family is trying to crush; a buffalo dressed up as a superhero, looking incredibly pissed off about the whole affair; a black elephant with bat wings for ears, wearing diapers as he flies through the clouds; a statue of Boba Fett in the pose of Rodin’s “The Thinker” and many, many others, some of them too complex to explain in words. There are even visual puns, like a hippopotamus/platypus hybrid that is obviously named a “hippoplatypus,” or a large door with two knockers—and a plaque above them that looks like a female face.

It doesn’t stop with visuals, though. On Ambien, your head becomes a late-night surrealist radio station, broadcasting little snippets of songs, quick phrases (“rent-a-rhino”), poems (“And so I find the rodent signs that splitter-splat a kitty cat”) and just plain whacked-out noises. One evening, I am treated to a piece of an epic Wagnerian opera in which a male tenor sternly commands his buddy to buy him a beer. In the disoriented state that the drug brings on, it’s hard to discern that these sounds aren’t coming from outside sources; at times I think I’m inside some kind of chat room where people communicate in song and poetry.

One night, for reasons unknown, the Ambien hits much faster than usual, and as I lie there reading, I can’t help noticing that the tapestry on my wall is breathing. Mind you, I’ve only taken the recommended dose of Ambien: one pill.

As I continue to study the tapestry, I notice the moving face of a dejected-looking monster in a spot on the lower right. He has the sullen, ashamed look of a child who’s just lost the game for his baseball team. My attempts to cheer him up by making funny faces at him don’t seem to help. At this point, it occurs to me that my sanity is riding a giant kite to the lollipop factory, and I should probably hit the hay before I start trying to stick my toes up my nostrils.

While it’s hard to disagree Americans overspend and have a history of buying fuel inefficient vehicles, I have a sneaking suspicion that, like most fuel economy zealots, the author has a lifestyle that has little use for a pickup, crossover, or SUV. Also, there is a big difference between driving 12mpg Suburbans and 22mpg crossovers.

Not everyone can get by with a veritable clown car. (or wants to).

Also, people make CHOICES. YOU may prefer spending your cash on travel, fine wine, furniture, a nicer home, drinks at the bar, nights at the movies, and freeze dried provisions. Perhaps some of these people simply want a bigger, safer, more comfortable, more practical vehicle, and are willing to make offsetting sacrifices elsewhere.

Yes, many overspend and have not learned their lessons. That is obvious. But I’m not keen on the blanket indictment of vehicle choices. Especially as “trucks” as a class are far more efficient than they were just several years ago.

Combined EPA fuel economy ratings:

2013 Ford F150 (up to 6 passengers) 18 mpg combined

2013 Ford escape (5 passenger capacity) 25mpg combined

2012 Toyota RAV 4 (up to 7 passengers, kids only in the 3rd row) 24 mpg combined

2013 Mazda CX-5 (up to 4 or 5) 29mpg combined!

All of the above probably show as “trucks” in the statistics. So why use a graph that lists “trucks” and “cars” as the only categories?

Honda Civic (4 in cramped conditions, 5 in hellish discomfort) 31 mpg combined.

Toyota Corolla (4 cramped) 30 mpg combined.

So, per passenger, many “trucks” can equal or out-perform the clown cars. And even with just 2 passengers, they offer more comfort and safety,( ceterus paribus), for a fuel economy penalty of just about 20%. That’s about $800/year. The typical American family spends more than that on soda.

These are some great columns, but the lapses into hysteria and the agenda based presentation undermines the message.

Sounds like BrunoT owns a car dealership. Probably a GM dealership. BrunoT thinks Hummers are for real men.

PS. Another example of what is either statistical naivete or obfuscation:

“Three of the top eight selling vehicles are pickups” is presented to the reader as some sort of proof we buy too many trucks.

Well, when you need a truck ,you need a truck. And usually a big one.

There are a total of FIVE full size pickup models made. (gmc/chevy combined numbers and HD models are included in sales figures I believe).

There are many many more small and medium car varieties made. Each car size also has a nameplate among the leaders.

Therefore, that is a contributing factor to the F150/Silverado/Ram being up near the top. If there are 26 competitors in one class and 5 in another, it’s easier for some of the 5 to be among the sales leaders.

Bruno T.: Bro, with a brain like your’s, I’m impressed you can actually use a word like “obfuscation.” Seriously, do you think this post is about trucks? Please tell me you’re wearing an Obama Worship Beanie and I’ll feel better…..

“using the piexdiameter=circumference formula, the diameter of your shit log works out to be .96 inches. Given the 14 inch length, this would be one skinny dude evacuating your body. Now, what WOULD be too much information is HOW you measured the circumference of said log” – SSS

I was going to ignore SSS’s fascinating question regarding Mr. Poopy, but since I ain’t got nothing else to do, I will.

I have been told here before that I have my head up my ass. Clearly this is nonsense, as I can barely touch my toes, so head in ass is pure speculation on your part, … and impossible.

I have also been told to get my thumb outta my ass. Now, there’s something I can work with.

I immediately tried to stick my thumb up my ass. Simply couldn’t do it. I then proceed with the remaining four fingers, working my way down to my pinky. I was only able to achieve some modicum of success with forthwith mentioned pinky. I was able to get about one-fourth of it up there, just past the nail part. I then measured that part of Mr. Pinky, and it came out to exactly .48 inches … half the diameter of Mr. Poopy. And since eliminating Mr. Poopy was twice as painful as inserting Mr. Pinky, I was able to deduct the circumference of the shit in question.

The experiment also verified the theorem that I am a tight ass.

Any further questions?

Eric Tyler was impressed with Bruno’s usage of “obfuscation.”

Me? I’m pretty fuckin impressed with “ceterus paribus”. Fucken A !!! That there says sumthin’ about him … just not sure what.

Here’s Bruno’s quote — “So, per passenger, many “trucks” can equal or out-perform the clown cars. And even with just 2 passengers, they offer more comfort and safety,( ceterus paribus) …”

I had to look it up. It means “with other things the same”. Although he spelled “ceterus” incorrectly. It should be “ceteris”. hmmmm Trying to impress with some Latin shit and then misspelling it? Not so impressive, after all.

From cars to shitlogs to boner pills to fucking Salma.

Another fine thread on TBP !!!!!

The article is way too long to wrestle with but the original statement about car company profits should have been explored more. Both GM & Ford are suffering badly in Europe as its economy falls into oblivion. GM’s Opel and Vauxhall have been on life support for many years and current conditions have only exacerbated the problem. And most of GM’s current offerings are actually Opels. GM’s 2nd bankruptcy is imminent.

Here you go, http://www.youtube.com/watch?v=3uu7Wi7rXZE

majority of the numbers are new vehicles for recruitment centers, city water and street divisions.. since most town and cities sub all their work out . the 100’s of titled workers have nothing to do but drive around like foremann and perodically stop home for snacks or to poop..

Nonanonymous a video on a saggy titted, cigarette sucking dizzy ditz with absolutely nothing of importance to say gets almost 6 million hits , while this video put by young man with a real message that all should hears get a paltry thousand hits…sheesh..just ain’t no fixing stupid.

https://www.youtube.com/watch?v=GNTrVGudOls

Well done, Admin. Though I miss the pop culture themes, this is a great piece. Only a few people in my life could tell you who Ally bank used to be or what happened to them. Damn few people could tell me they are still mostly owned by Uncle Sugar.

“Just to clarify – if your FICO score is below 600 – YOU ARE A DEADBEAT.”

This gem reveals my true deadbeat nature to the the world. I have tried to keep it hidden, ashamed of myself and my rotten, sub-par FICO score.

I long for the power and status of “640”.

Nightly I dream of the vast wealth available at “720”.

I torture myself with fantasies of a near perfect “780”.

Target recently turned me down for an in store credit card. My bank denies me even the smallest line of credit for my business. If only I had incurred massive amounts of debt directly out of high school. If only I had valued the American dream of living beyond your means, I would not be carrying the embarrassment of being a financial deadbeat like so many others carry credit cards.

Punk

Someone who has a low credit score because they never got lured into the credit card living beyond your means lifestyle is not a deadbeat. Deadbeats earn that mantel by defaulting on their debts and coming back for more.

🙂

I know what you meant, Admin. Though I am a deadbeat from the perspective of Ally bank. I am a shitty consumer, paying for things with money I saved instead of buying on credit.

Very un American.

I dropped five hundred bucks down for a new TV at Target. (Holy Shit! They have wifi enabled TV’s! WTF! Its been a little while since I stepped into a department store) Obviously I can afford the $1.50 minimum payment on some in store credit.

Odd, that ability to pay a bill denies access to credit, says a lot about the state of finance and business. The ability to charge interest, irrespective of the ability to pay, is placed higher than the possibility of making actual sales. Quantity of borrowers is prioritized over quality. Seems backward to me.

But what do I know, these people who run these companies are smart and educated. They must have learned something in college that I don’t know.

Punk

They learned how to cheat, steal, outsource, and lie.

Admin,

Great post.

Try melatonin if you have trouble sleeping. When I occasionally have insomnia, it works for me.

I had a sister-in-law on Ambien who telephoned our house in the middle of the night talking gibberish. She was probably taking it because all of the OTHER pills she was prescribed kept her awake. Stay away from that shit and pill-pushing MDs.

Ambien = a restful nights sleep?

[img][/img]

Brent North Sea crude for delivery in October gained 73 cents to $114.98 a barrel in London morning trade.

New York’s main contract, light sweet crude for October, climbed 15 cents to $96.57 a barrel.

“Friday’s unexpectedly poor US labour market data are giving a boost to commodity prices… for this makes it appear almost certain that the US Federal Reserve will announce a further round of quantitative easing (stimulus) at its meeting later this week,”

~~~~~~~~~

Thanks Ben. Moron.

THEY’RE GOING TO MAKE IT UP ON LOWER VOLUME

GM Loses Over $49,000 On Every Chevy Volt

Submitted by Tyler Durden on 09/10/2012 10:48 -0400

Watching Phil LeBlow providing Ford with a reacharound this morning reminded us of total farce that is both the forest and the trees of the US auto industry. We have discussed the FUBAR channel-stuffing and the subprime-lending SNAFU but now, as Reuters reports, we see the ugly truth about GM’s little baby “the Volt is over-engineered and over-priced”. Nearly two years after the introduction of the path-breaking plug-in hybrid, GM is still losing as much as $49,000 on each Volt it builds.

…

Furthermore, there are some Americans paying just $5,050 to drive around for two years in a vehicle that cost as much as $89,000 to produce. And while the loss per vehicle will shrink as more are built and sold, GM is still years away from making money on the Volt, which will soon face new competitors from Ford, Honda and others.

…

The weak sales are forcing GM to idle the Detroit-Hamtramck assembly plant that makes the Chevrolet Volt for four weeks from September 17, according to plant suppliers and union sources. It is the second time GM has had to call a Volt production halt this year.GM acknowledges the Volt continues to lose money, and suggests it might not reach break even until the next-generation model is launched in about three years. “It’s true, we’re not making money yet” on the Volt, said Doug Parks, GM’s vice president of global product programs and the former Volt development chief, in an interview. The car “eventually will make money. As the volume comes up and we get into the Gen 2 car, we’re going to turn (the losses) around,” Parks said.

…

Estimates on the cost to build a Volt range from $76,000 to $88,000, according to four industry consultants contacted by Reuters with one concluding: “I don’t see how General Motors will ever get its money back on that vehicle,”

…

The Obama administration, which engineered a $50-billion taxpayer rescue of GM from bankruptcy in 2009 and has provided more than $5 billion in subsidies for green-car development, praised the Volt as an example of the country’s commitment to building more fuel-efficient cars.

[img [/img]

[/img] [/img]

[/img] [/img]

[/img]

[img

[img

My friends at the University of Phoenix win in a landslide.

University of Phoenix Tops Debt Slave Racket with 35,049 Student Loan Defaults (Top Public School has 786)

[img [/img]

[/img]

Unbelievable.

35, 049 defaults?

The law should require U. of Phoenix to return the money. What a scam. Just another American skim and scam fraud operation. How do they get away with it? Oh yea, they pay off politicians and hire lobbyists. Disgusting, thanks, needed a little more anger today.

I’ll bet they used to money to buy a Chevy Volt…

[img]http://thepeoplescube.com/peoples_resource/image/15620[/img]

Damn – not an Ivy on that list. How is that possible? We all know Ivy graduates are not smart enough to pour piss out of a boot, yet somehow they manage to make enough to pay off their student loans. It is an elitist plot, I tell you!

[img [/img]

[/img]

We have been on the ripoff ride probably starting with the Johnson Administration. This is no accident, this is intentional wealth transfer from the taxpayers to ? The question is when the building comes crashing down on our heads will we let them get away witht he largest white collar crime in human history. Or like the proverbial Marshal of the old West are we going to track them all down and make them pay for this horrendous crime of arrogance and exploitation. I suspect the rash of 60’s assassinations had a lot to do with the fact those politicans were not going along with the game plan and could spill the beans publicly. My gut tells me these things are linked.

Thank you for this Jim.

My machinist’s less than ten year old Ford Explorer went tits up for the last time (for her) over Labor Day weekend.

She went out and bought a brand new Ford Edge. Talked about “what a great deal” she got ($27k) and that they were “giving the cars away.”

1.99% interest, 7 years, payments of $460 a month. That didn’t sound right to me, so I went and did the math. They do you the “favor” or adding Gap Insurance to your principle. You then pay for it over the lifetime of the loan. She thinks she is paying $27k, she is actually paying $38.6k, more than she makes a year. Plus insurance (about $2k a year), plus tags, plus, plus, plus.

I’ve tried educating her before this purchase. She sees that my hub and I drive older, paid for, vehicles.

While a great machinist, she doesn’t understand math, and doesn’t even try the most basic of equations (such as $460 x 84 + $14k ins + $2100 tags).

And, my favorite part, she is 100% informed of the tenuous nature of our business. Our building note is up right now, we have not a clue if BoA will refi, nor if we can go elsewhere. Maximum unemployment is $350 a week before taxes. Simply insanity that she won’t be able to pay to both live in a house and drive a car.

Ah well, we do all make our own choices. I choose to not be beholden to a finance company for my means of transport. She chooses to be a debt slave.

It will end in tears, but at least the car salesmen, finance officer and CEOs got them theirs.

Americans are, by and large, tools. Ignorant, non-math doing, tools of the elitists.

Look at the striking teachers in Chi town. The people charged with teaching our children mathematics do not even know how to do it themselves.

I hate the futility I feel. People will not open their eyes and change for the better en masse. We can dream, but without millions dead, I don’t see it happening. Even then, the change may not be for the better.

Yes this country is in trouble. We have to learn the hard way it seems, a total collapse!

My Advice:

If we want to save our asses we better start listening to the smartest people on the planet (Scientist and Engineers). Politicians, lawyers and bankers aren’t even in the same class.

“Be Smart!” – FIGHT THE CAUSE – NOT THE SYMPTOM

U.S. Citizens

Read “Common Sense 3.1” at ( http://revolution2.osixs.org )

Non U.S. Citizens

Read “Common Sense 3.2” at ( http://SaveTheWorldNow.osixs.org )

You have choice!

flash at 9:19 am

That was a damn fine link.

[img [/img]

[/img]

“It should be interesting to see what happens with all these fancy late model cars with seven year loans when the SHTF. I suspect there will be a long line of tankers transporting slightly used cars across the Pacific for people that can afford them: the Chinese. Maybe they can send us their used bicycles.”

The Chinese have a trade policy – import taxes on anything whose manufacture is important to an economy is so high as to make it restrictively expensive to tap the major portion of the consumer market without manufacturing there – i.e. a sane trade policy. You probably won’t see many of those cars moving over there – you may be right, though -we’ll see.