Americans consume 5-10x more than they produce. They pay for this inflated standard of living by borrowing and creating debt. We exchanged a production economy for a financialization economy, which means debt creation above all else.

Keynesians like Paul Krugman believe debt doesn’t matter. But it does matter. We’re reaching the end of the line, where more debt creation finally takes it’s toll on GDP people’s living standards. Our entire standard of living has been a debt-fueled illusion. Debt creation can only drive economic growth for so long, then it’s game over.

Debt Is Failing as a Driver of Economic Growth

Submitted by Phoenix Capital Research on 11/25/2013

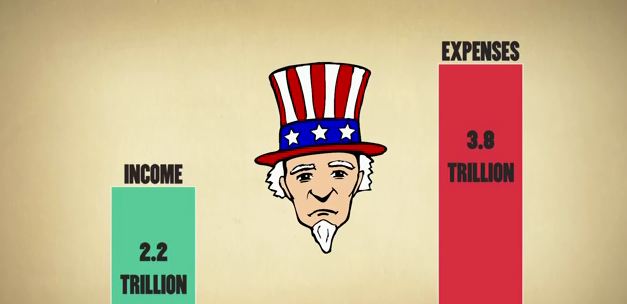

The US is heading towards a debt crisis.

Today, the US’s Debt to GDP ratio stands at over 105% (debt of $16.7 trillion on a GDP of $15.68 trillion). The only other time we’ve had more debt relative to our GDP was during WWII when the Debt to GDP ratio hit 112%:

Debt is not inherently evil. Debt that doesn’t create growth is.

In the 1960s every new $1 in debt bought nearly $1 in GDP growth. In the 70s it began to fall as the debt climbed. By the time we hit the ‘80s and ‘90s, each new $1 in debt bought only $0.30-$0.50 in GDP growth.

And today, each new $1 in debt buys only $0.10 in GDP growth at best.

Put another way, the growth of the last three decades, but especially of the last 5-10 years, has been driven by a greater and greater amount of debt. As you can see, after the Crisis began in 2007, the US moved into the point of debt saturation at which each new $1 in debt generates no additional growth.

This is why the Fed has been so concerned about interest rates. With a debt load of this size, every 1% rise in the US’s debt payments means another $100 billion in debt payments.

Unfortunately for the Fed, rates will eventually rise. It is guaranteed. As you can see in the below chart, rates have fallen almost nonstop since the early ‘80s. This is not sustainable. At some point rates will rise again. I cannot state expressly when, but that point is coming sooner rather than later.

As rates rise, the government will not be able to make interest on more than $17 trillion in debt.

And it now takes more than $35 dollars of government intervention to create $1 of economic growth:

The debt bubble, public and private debt is now more than $56 trillion. This amount can never be paid back. Therefore, A debt default is only a matter of time. The Federal Reserve money printing and bond-buying are only buying time. Sooner or later, treasury bond holders will realize they aren’t going to get repaid. Treasuries are much more risky than interest rates being falsely manipulated would indicate. The catastrophic debt problem will end our economic system as we know it, and the Fed and the government makes it worse every single day with more and more reckless spending.

I always thought of this as a pretty good deal, we give the Chinese funny money and/or debt, they give us a bunch of their finished manufactured goods and they even get to keep the pollution. We give the Saudis a bunch of petro dollars for their fine energy laden commodities that allow us to maintain our oversized lifestyles, and they get a promise that someday those dollars might be worth something. I am amazed how many countries have been suckered into this scheme since Nixon closed the gold window. When it blows up, and it will, we will probably be better off than most of the rest of the nations involved in this scheme. the problem is that we will probably end up eating ourselves because there are many who believe this illusion can go on forever, and when it melts down they will be in for a rude awakening. They will not want to give up their cushy highly subsidized lifestyles, hard work is an anathema to them.. It may not be fun, but it will be interesting.

Bob.

AWD – please explain the opening comment that Americans consume 5x to 10x more than they produce.

I ain’t buying it. Unless you are considering all service industries to be non-productive. In which case, you can say the same thing about virtually every nation on earth. US service sector is 80% of the economy. In Germany – the great producer – it is 70%. In China, service sector is about half the economy. In the UK service sector is about 80%. Etc.

That number is hard to support. Something about 80% of our economy being “service” related lend support to the fact that almost everything we consume was made someplace else. A service economy produces services, not goods or products. The government is a “service” industry, and a shitty one at that. Our service industry known as banking creates debt. Federal debt (bonds), state debt (bonds), city debt, personal debt. $56 trillion and it keeps going up every year. It’s the biggest bubble ever created, and when it blows, our consumption and standard of living are going to collapse. But that hasn’t stopped the creation of debt, even though, as the article I posted clearly shows, it’s not producing anything anymore. Credit lines get maxed out sooner or later, then comes the day of reckoning. It ain’t going to be pretty for our “exceptional” nation used to living way, way beyond our means.

Today’s Wealth Destruction Is Hidden By Government Debt

Submitted by Philipp Bagus via the Ludwig von Mises Institute

Still unnoticed by a large part of the population is that we have been living through a period of relative impoverishment. Money has been squandered in welfare spending, bailing out banks or even — as in Europe — of fellow governments. But many people still do not feel the pain.

However, malinvestments have destroyed an immense amount of real wealth. Government spending for welfare programs and military ventures has caused increasing public debts and deficits in the Western world. These debts will never be paid back in real terms.

The welfare-warfare state is the biggest malinvestment today. It does not satisfy the preferences of freely interacting individuals and would be liquidated immediately if it were not continuously propped up by taxpayer money collected under the threat of violence.

Another source of malinvestment has been the business cycle triggered by the credit expansion of the semi-public fractional reserve banking system. After the financial crisis of 2008, malinvestments were only partially liquidated. The investors that had financed the malinvestments such as overextended car producers and mortgage lenders were bailed out by governments; be it directly through capital infusions or indirectly through subsidies and public works. The bursting of the housing bubble caused losses for the banking system, but the banking system did not assume these losses in full because it was bailed out by governments worldwide. Consequently, bad debts were shifted from the private to the public sector, but they did not disappear. In time, new bad debts were created through an increase in public welfare spending such as unemployment benefits and a myriad of “stimulus” programs. Government debt exploded.

In other words, the losses resulting from the malinvestments of the past cycle have been shifted to an important degree onto the balance sheets of governments and their central banks. Neither the original investors, nor bank shareholders, nor bank creditors, nor holders of public debt have assumed these losses. Shifting bad debts around cannot recreate the lost wealth, however, and the debt remains.

To illustrate, let us consider Robinson Crusoe and the younger Friday on their island. Robinson works hard for decades and saves for retirement. He invests in bonds issued by Friday. Friday invests in a project. He starts constructing a fishing boat that will produce enough fish to feed both of them when Robinson retires and stops working.

At retirement Robinson wants to start consuming his capital. He wants to sell his bonds and buy goods (the fish) that Friday produces. But the plan will not work if the capital has been squandered in malinvestments. Friday may be unable to pay back the bonds in real terms, because he simply has consumed Robinson’s savings without working or because the investment project financed with Robinson’s savings has failed.

For instance, imagine that the boat is constructed badly and sinks; or that Friday never builds the boat because he prefers partying. The wealth that Robinson thought to own is simply not there. Of course, for some time Robinson may maintain the illusion that he is wealthy. In fact, he still owns the bonds.

Let us imagine that there is a government with its central bank on the island. To “fix” the situation, the island’s government buys and nationalizes Friday’s failed company (and the sunken boat). Or the government could bail Friday out by transferring money to him through the issuance of new government debt that is bought by the central bank. Friday may then pay back Robinson with newly printed money. Alternatively the central banks may also just print paper money to buy the bonds directly from Robinson. The bad assets (represented by the bonds) are shifted onto the balance sheet of the central bank or the government.

As a consequence, Robinson Crusoe may have the illusion that he is still rich because he owns government bonds, paper money, or the bonds issued by a nationalized or subsidized company. In a similar way, people feel rich today because they own savings accounts, government bonds, mutual funds, or a life insurance policy (with the banks, the funds, and the life insurance companies being heavily invested in government bonds). However, the wealth destruction (the sinking of the boat) cannot be undone. At the end of the day, Robinson cannot eat the bonds, paper, or other entitlements he owns. There is simply no real wealth backing them. No one is actually catching fish, so there will simply not be enough fishes to feed both Robinson and Friday.

Something similar is true today. Many people believe they own real wealth that does not exist. Their capital has been squandered by government malinvestments directly and indirectly. Governments have spent resources in welfare programs and have issued promises for public pension schemes; they have bailed out companies by creating artificial markets, through subsidies or capital injections. Government debt has exploded.

Many people believe the paper wealth they own in the form of government bonds, investment funds, insurance policies, bank deposits, and entitlements will provide them with nice sunset years. However, at retirement they will only be able to consume what is produced by the real economy. But the economy’s real production capacity has been severely distorted and reduced by government intervention. The paper wealth is backed to a great extent by hot air. The ongoing transfer of bad debts onto the balance sheets of governments and central banks cannot undo the destruction of wealth. Savers and pensioners will at some point find out that the real value of their wealth is much less than they expected. In which way, exactly, the illusion will be destroyed remains to be seen.

AWD – I am in full agreement that far more is consumed than produced – something like 500 billion in trade differentials per year, and the net number re the govt deficit is a pretty big number as well. Just not 5 times or ten times. More like 20% or some such. But rolled all together over the years, the US will have consumed way more than it has produced – perhaps multiples of GNP – and one day that differential must be paid back. Which is why I continuously say much the same thing you do.

“they will only be able to consume what is produced by the real economy”

It’s really amazing, American prosperity. The above law of economics has been violated for 50 years, without any baleful results, thanks to debt. One might consider the crash of the entire financial system in 2008 as contradictory, but it was merely the beginning, not the end. Nobody would have thought we could live above our means for so many years. Somehow we conned the rest of the world into taking our IOU’s while happily selling their products in our fine country. So, who are the bigger suckers, the people that will destroy themselves with debt, or the foreign people that went along with the fantasy?

AWD bitch-slaps Life liberty & pursuit of happiness.

Daffy Duck: “IT”S WABBIT SEASON!”

Bugs Bunny: “IT’S DUCK SEASON!” BOOM!

i love this place

ci

Thanks Ivan, and lay off the glue-sniffing for awhile…

[img [/img]

[/img]

I believe that the “fat lady” (China) just started singing. BC – LR to all

And the banks want to CHARGE people for their deposits:http://www.zerohedge.com/news/2013-11-24/banks-warn-fed-they-may-have-start-charging-depositors

Its hard to imagine how Krugman ever got his self inflated ginormous cranium out of the Ivory Towers drawbridge gate.

Don’t get all lovey-dovey with me AWD.

I found your rendition of the classic Bugs-Daffy dispute distasteful and repugnant.

At least llpoh has some class as do all wagon burners.

AWD – If crazy ivan feels you won our little discussion, I guess I need to revisit it. You said almost everything we consume was made somewhere else. Far from it. That is a common fallacy. The US is a huge producer of goods. The US imports a lot of goods, to be sure, but it exports a lot, and it produces a tremendous amount, the bulk of which is consumed locally.

“According to the latest research from the United Nations, China has… generating $2.9 trillion in output annually versus $2.43 trillion from the U.S., the world’s second-largest manufacturing economy.”

So, for the math challenged, the US produces around 2.5 trillion of goods, while consuming around 3 trillion of goods. That 500 billion differential is equal to approx. 3% of GDP. Therefore the federal deficit is not so much in goods but in services being consumed and not paid for.

Either way we are still doomed.Only collapse ,inflation ,war and the destruction of our nation.If it wasn’t for my mom,my best friend and his children I don’t think I would give a damn.

I really do want to know who the clueless motherfuckers are that hang around here these days. They hide in the shadows, and are too stupid to even recognize facts. They are too clueless to mount arguments of fact or logic. Just a bunch of sheeple trolling about with IQs of tapeworms. Why they hang around here is beyond me.

@LLPOH

Do those figures take into account the high cost of US production versus low and more subsidized cost of Asian output?

I don’t think so.

Which is why I can take a Chinese made set screw, which costs $0.01 each, then pay somebody to paint nyloc onto it, charge my customer $1.00 and then claim a win.

Truth is that the bolt is the more important part of the sale, but due to the US labor and regulatory costs it shows up in your stats as America “produced” $1.00 and China “produced” $0.01

This is why things are so much bleaker than most will admit to.

The China bolt producer employs hundreds, I employ one.

Hidden destruction of our manufacturing with the express consent of the (remaining) manufacturers.

When GM produces a $40k car the GDP increases the same as when the car was made up of 70% American made components.

Now it is made of 70% Asian components, yet no adjustment for the very real loss of production and GDP is EVER made.

Your figures look good as long as we don’t compare apples to apples.

Fed bullshit and kept in the dark, the new American way.