Have you noticed the avalanche of IPOs in recent weeks? Remember the avalanche of IPOs in early 2000 and early 2007? John Hussman points out the inconvenient fact that 75% of the shitty recent IPOs lose money. Wall Street is dumping this crap on the muppets as fast as possible. They know it is late in the game and the party is just about over, but they will be dancing until the punchbowl is empty and everyone is puking in the bathroom. The lesson of history is that people never learn the lessons of history. Profits and cash flow matter in the long run. Accounting fraud and currency debasement have never sustained an economic system before and they won’t this time. Keep dancing if you choose, but you know the game is rigged and you aren’t part of the privileged rigger class.

Fed-induced yield seeking is alive and well, but the desire for new “product” is being satisfied not with mortgage debt, but with low quality covenant lite debt and equity market speculation.With regard to the debt markets, leveraged loan issuance (loans to already highly indebted borrowers) reached $1.08 trillion in 2013, eclipsing the 2007 peak of $899 billion. The Financial Times reports that two-thirds of new leveraged loans are now covenant lite (lacking the normal protections that protect investors against a total loss in the event of default), compared with 29% at the 2007 peak. European covenant lite loan issuance has also increased above the 2007 bubble peak. This is an important area for regulatory oversight.

Meanwhile, almost as if to put a time-stamp on the euphoria of the equity markets, IPO investors placed a $6 billion value on a video game app last week. Granted, IPO speculation is nowhere near what it was in the dot-com bubble, when one could issue an IPO worth more than the GDP of a small country even without any assets or operating history, as long as you called the company an “incubator.” Still, three-quarters of recent IPOs are companies with zero or negative earnings (the highest ratio since the 2000 bubble peak), and investors have long forgotten that neither positive earnings, rapid recent growth, or a seemingly “reasonable” price/earnings ratio are enough to properly value a long-lived security. As I warned at the 2000 and 2007 peaks, P/E multiples – taken at face value –implicitly assume that current earnings are representative of a very long-term stream of future cash flows. One can only imagine that recording artist Carl Douglas wishes he could have issued an IPO based his 1974 earnings from the song Kung Fu Fighting, or one-hit-wonder Lipps Inc. based on Q2 1980 revenues from their double-platinum release Funkytown.

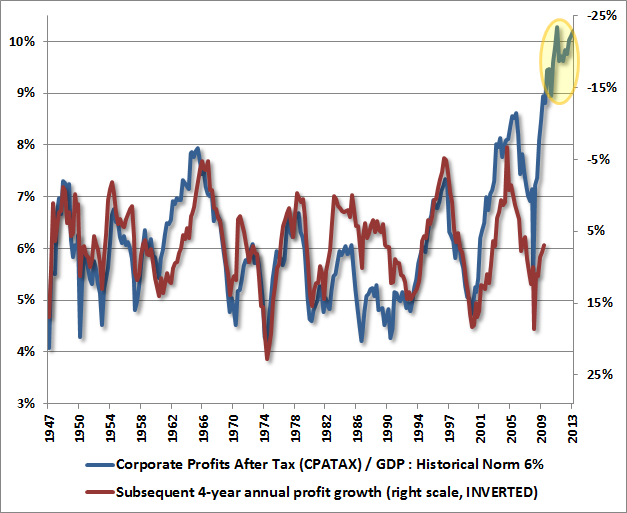

The same representativeness problem is evident in the equity market generally, where investors are (as in 2000 and 2007) valuing equities based on record earnings at cyclically extreme profit margins, without considering the likely long-term stream of more representative cash flows.

Corporate profits appear likely to contract over the next few years from a mean-reversion perspective. The chart below shows corporate profits relative to GDP, against subsequent 4-year growth in corporate profits (right scale inverted). While relationship is not exact, there is little reason to believe that the current near-record share of profits will be sustained indefinitely. A high share of profits relative to GDP is related, even in recent economic cycles, to weak subsequent profit growth over the next several years. Arguments that the economy that has “changed” in a way that invalidates this regularity had better identify something that has permanently invalidated all of economic history prior to about 2010.

Read the rest of John Hussman’s Weekly Letter.

I like this article by Hussman even though, in general, I always take things said by people whose living depend on blogging with a grain of salt. I think there is value in owning blue chip stocks provided you take physical possession of the shares. It is going to be a sad day for a lot of people when they find out their stock shares don’t exist just like their ‘money’. Oh well, what can you expect from people who see ‘Federal Reseve Note’ on a dollar bill and don’t realize it is basically an IOU for money which begs the question, “What is money?”

This Is How Much “Net Income” Today’s Four IPOs Generated Last Year

Submitted by Tyler Durden on 04/04/2014 12:02 -0400

Earlier today, four “buzzing” US-based IPOs priced, raising hundreds of millions in cash, namely GrubHub ($193 million), OPower ($116 million), Five9 ($70 million), and Corium ($52 million), for a grand total of nearly half a billion in proceeds. So how much actual net income do these supposedly post-VC stage companies generate? Instead of boring readers with more numbers, here is a simple chart.

[img [/img]

[/img]

It’s pretty hilarious.

“Those that don’t learn from the past are bound to repeat it”

All the Muppets that got fleeced during the 2000 internet bubble and crash are long forgotten, and Wall Street pulls the exact same thing again in 2014. Another internet stock bubble, but it’ll be different this time, right? I’m sure there won’t be a crash and everyone loses all their money (except the banksters and IPO underwriters). People are infinitely gullible and stupid when it comes to greed.

[img [/img]

[/img]