The storyline all winter from the government, propaganda spewing media, and Wall Street shyster economists has been that consumers weren’t spending because it was cold and snowy. We know that is a shocking circumstance during the winter. Well Spring has sprung and March was a sedate weather month. Storyline OBLITERATED again. Consumers did not increase their spending over the level of February. Consumer spending was LOWER than last March.

If the unemployment rate has plunged in the last year from 7.5% to 6.7% how come real people living in the real world are spending less than one year ago? Inquiring minds want to know. Of course, maybe it has something to do with another 1.2 million working age people leaving the workforce, real wages declining, 90% of the “new” jobs paying less than $35,000 per year, Obamacare driving insurance costs up 20%, taxes being increased, and prices for food and fuel rising by 5% or more.

Credit card debt outstanding continues to decline month after month. And this is with more and more people using credit cards to pay their utilities, property taxes, and income taxes. Total consumer credit outstanding continues to skyrocket as our beloved corrupt politician leaders continue to hand out your tax dollars to subprime borrowers in West Philly so they can drive Cadillac Escalades until they default, and to subprime University of Phoenix dolts sitting in their basements in their boxer shorts seeking a degree in black lesbian African studies with a minor in basket weaving. The average student loan borrower is taking out $2,500 more than their actual tuition and materials bill. Do you think Obama and his minions are worried about your tax dollars being paid back?

Despite all the FREE MONEY being redistributed by Obama and the mainstream media propaganda about our economic recovery, the proof is in the spending. Average non-Free Shit Army Americans are tapped out. They’re broke. Credit card bills have to be paid back and carry an average interest rate of 13% to 20%. Americans are sustaining themselves on credit cards. Therefore, they are buying less and less unnecessary crap. That is why retailers are closing thousands of stores.

I can’t wait to hear about consumer spending being weak this summer because it was too hot.

Guest Post from David Stockman’s Contra Corner

No “Escape Velocity” Here: Gallup Reports First Y/Y Consumer Spending Decline Since 2009

by Jeffrey P. Snider •

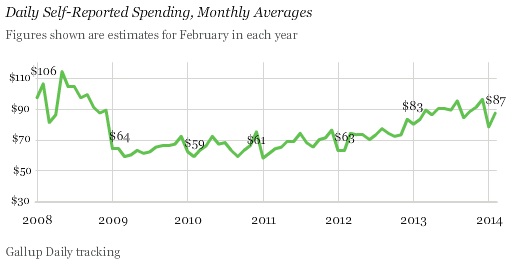

Gallup’s survey of consumer spending in February conformed largely to the orthodox script of weather-beaten households forgoing January purchases. The large drop in January was thus assumed a temporary condition that would simply spillover into February. And that was the sense gained by Gallup’s results, with a large increase in February over January.

Americans’ daily self-reports of spending averaged $87 in February, a solid recovery after dipping to $78 in January, which had been the lowest estimate in 14 months.

While that focus of January-to-February led this analysis into more optimistic conjecture, it left off another pertinent observation. Outside of a few monthly peaks, spending appears to have flat-lined overall since the early portion of 2013 (clearly captured in Gallup’s own results above). Since concentration remained on the January to February change, Gallup left its February report with that noted sanguinity and confidence.

Spending typically picks up over the course of the year, and Gallup has observed increases from February to March the past four years. This year’s strong February spending could be a positive sign of things to come.

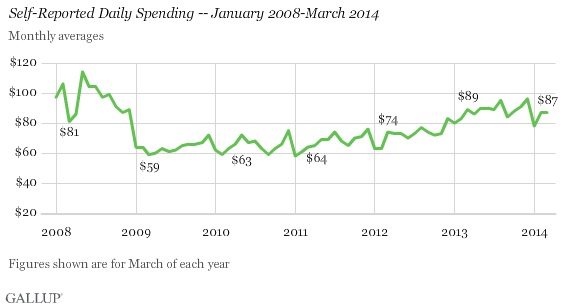

With the release of figures for March, it seems such weather-worn optimism was not as much warranted. There was, in fact, no change at all between February and March despite a much more favorable national weather pattern.

Worse than that, as Gallup commendably pointed out without qualification, March 2014 spending was actually below March 2013. That was the first negative March comp since 2009.

But the stall in spending, both month-over-month and compared with a year ago, most likely signals a continuation of the lackluster retail sales seen so far in 2014. Although government figures show that total retail sales, excluding motor vehicles (in line with Gallup’s definition of consumer spending), rebounded in February after January’s anemic sales, year-over-year sales were up by only 1.6% in January and 1.3% in February — the weakest retail growth figures since November 2009. Given the Gallup data, it is reasonable to expect that the March report, due April 14, will show more of the same.

That presents a fair and reasonable recap. What is left out is why. Again, as the calendar advances further away from winter we can put this silly appeal to temperature correlation behind. I have no doubt about the cleverness with which economists can find excuses for this sinking economic trajectory (the latest being demographic), however it should be increasingly clear that there is a larger macro component at work here (or, more precisely, a lack of work).

Thus the explanation for January’s deplorable state is not cold weather, but that consumers have reached an exhaustive point. Given that holiday sales were the weakest since the Great Recession, and further that even reduced spending in December led to such a slide in January, that does not position the economy for a robust rebound but rather toward the denouement of a cyclical slope inside a structural ruse.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: [email protected]

This is a syndicated repost courtesy of Alhambra Investment Partners – We Are Different.. To view original, click here.

Sorry to highjack this, but what I’m really surprised at is the fact that this didn’t/hasn’t received waaaaaay more attention. Zerohedge’s record is just too good to not walk away from the last paragraph with a new sense of ‘oh shit!’…..

Admin, you must’ve read it – and others, thoughts? The silence is creepy.

http://www.zerohedge.com/news/2014-04-08/triple-whammy-shocker-goldman-shutting-down-sigma-x

” basket weaving.”

Its underwater basket weaving. Theoretically, a basket weaver may have some use but by placing the activity underwater we achieve total uselessness.

Anecdotally: Our spending has dropped as the winter months have waned, gas/electricity is lower, we are more likely to walk/bike places, and we’ve started planting a garden to start offsetting the cost of the few things we don’t already get from local farmers/work/barter.

I’m not a single data point, my entire area sees people planting gardens and bartering wherever possible. Our economy is crumbling, and I think areas like mine will be ok when it finally implodes.

You do basket weavers a disservice.

OK

They are getting a minor in 16th Century Art History instead of basket weaving.

Tommy

I read the story on Zero Hedge and I didn’t understand the implications. I don’t know what it means. It probably isn’t good.

“I read the story on Zero Hedge and I didn’t understand the implications.”

A hundred trillion here, a hundred trillion there, pretty soon you’re talking quadrillions. Get used to that word, I predict you’ll be hearing it a lot in the not too distant future.

*heads out the door with homemade egg basket*

I interpreted it as the pretty girls (who really are the party) leaving the party to go to a better private party, even though they rang up a serious bar tab. Nobody knows where the next ‘it’ party will be, and if you don’t, you’re not invited. For the squid to pack up, shut down and get ready to leave, the party must be just.about.over. It’s like they know the booze is about to run out, the place is a mess and they don’t wanna clean, pay up, and hang with the losers.

Tommy

Visualization of America after the Vampire Squid leaves the party.

Escape Velocity… escape – yes that what we want!

What is look forward to? More laws? More regulations? More taxes? More gubmint? More entitlements? More gubmint scrools? More phoney degrees that pay nothing? More debt slavery? More illegal immigration? More third world immigrants?

More sports, more Direct TV channels (200+ is not enough!) More Myely Cyrus? More Kardashians? More losers with tatoos?

More gubmint lies? More survaliance? More militarized polize – that shoot homeless people? More wars? More TSA? More EPA? More global warming alerts?

More retial? More fast food? More iGadgets? More flight 370? More mass murders?

It’s not just an economic bubble. We as a nation are at the end of the line – the terminus.

Read between the lines, and it spells “RECESSION”, the only people that can afford to buy anything are the 0.1% and the FSA. They’re having a hay-day, spending their $10,000 earned income tax refund, which is a misnomer, since they don’t have any “earned income” since they don’t have jobs. The FSA I see are taking trips to Disney World, buying cars, and bags of king crab legs on their SNAP cards. You’d think they were the 0.1% in their shopping habits, but it’s free cash, so why not enjoy the finer things in life? I can barely afford to pay my taxes, food, utilities and insurance. I’m broke, and the FSA is buying cars and taking trips to Disney on my tax money. I’ve had about enough of this shit, I’ve had enough of socialism and the parasites living off people that try and work for a living. Obama is the worst fucking president in the history of this country, and has a bought-off majority of parasites that will forever vote liberal progressive democrats into office, and keep the free shit flowing.

We went over the cliff about 10 trillion dollars ago. There will be no recovery from the mess we are in unless there is a massive reset. Get yourselves prepared.Above all else be armed. There will be hell to pay when the money runs out. We will be entering a new Dark Age after SHTF.

This will be me and the rest of TBP…….

[img [/img]

[/img]

Greetings,

I’ve always viewed this in terms of total collapse but I could imagine a scenario where the FSA just simply demands everything produced by the 50% of the population that still works. Any madman that can appeal to this demographic stands a good chance of being elected. We are already seeing this in the run up to the mid term elections as the Dem’s are making a big stink about raising minimum wage and equal pay for both men and women. More give-a-ways.