Quotes on a Screen and Blotches of Ink

John P. Hussman, Ph.D.

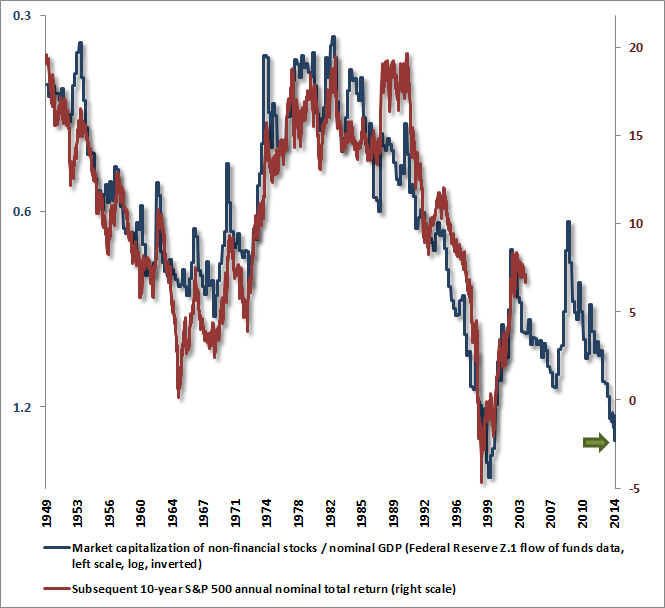

With the fresh high in the S&P 500 Index last week, our estimates of prospective 10-year S&P 500 nominal total returns have fallen below 1.8% annually. At shorter horizons and on historically reliable measures, our estimates of S&P 500 total returns are now negative at every horizon shorter than 8 years. Investors who feel that zero interest rate policy offers them “no choice” but to hold stocks are likely choosing to experience negative returns instead of zero. While millions of investors appear to have the same expectation that they will be able to sell before everyone else, the question “sell to whom?” will probably remain unanswered until it is too late.

In this context, the fact that historically reliable valuation methods imply negative total returns at every horizon shorter than 8 years does not simply reflect the expectation of 8 years of zero interest rate policy, but 8 years of zero interest rate policy combined with zero compensation for the substantial additional risk of holding equities. Assuming that a modest risk premium is appropriate for an asset class that has proven itself quite capable of repeatedly losing half of its value, current equity valuations are reasonable only if one assumes more than two decades of zero interest rate policy. Even in that case, “reasonable” would still imply commensurately low equity returns in the mid-single digits over the next two decades.

At a time when we should be pounding the table about risk, we are quietly stating our case. At this point even that is something of a lightning rod for disdain. As we observed after the 2000-2002 and 2007-2009 plunges, our concerns have a tendency to hold weight only after the fact (see Setting the Record Straight and This Time is Different, Yet With the Same Ending to understand our experience in the half-cycle since 2009). There’s certainly no point in urging anyone to sell – doing so only means that some other poor investor would have to hold the bag over the completion of this cycle.

It’s an unfortunate situation, but much of what investors view as “wealth” here is little but transitory quotes on a screen and blotches of ink on pieces of paper that have today’s date on them. Investors seem to have forgotten how that works. Few are likely to realize that apparent wealth by selling, and those that do will essentially be redistributing it from the investors who buy. Meanwhile, don’t confuse time to sell with opportunity to sell. Trading volume remains quite tepid, and the majority of that volume represents existing owners exchanging what they hold rather than outright entry and exit. The investors who successfully leave the equity market at current valuations will exit through a needle’s eye.

Those who forget the past are condemned to relive it.

Read the rest of John Hussman’s Weekly Letter

Pretty section of content. I just stumbled upon your website and in accession capital to assert that I acquire in fact

enjoyed account your blog posts. Any way I will be

subscribing to your augment and even I achievement you access consistently quickly.