Applications for mortgages to purchase a house are 17% below last years level. They are 30% below levels in 2009/2010 during the depths of the recession. They are 12% below the level of 2012 when national home prices bottomed out.

The Case Shiller price index is up 25% from its low and is now back to mid-2008 levels. In mid-2008 mortgage applications to purchase homes were 100% higher than they are today. So we have mortgage applications dramatically lower since 2008, now at levels seen in 1997, but home prices have been driven 25% higher in the last two years. How could that be?

The chart below provides the reason. It’s certainly not growth in real household income, as that has plunged by 8% since 2008 and remains stagnant. Average hourly wages haven’t moved upwards in five years. How can people buy homes when their income is falling? They can’t.

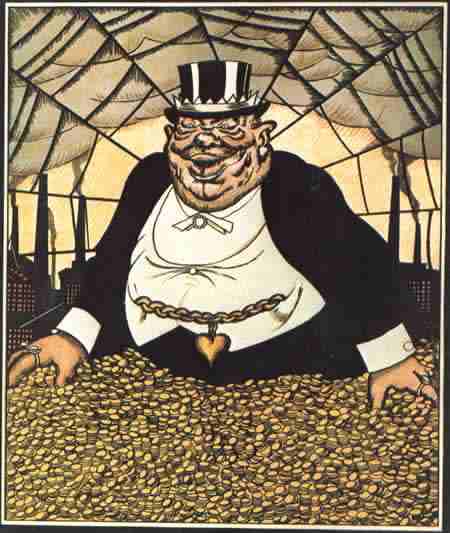

The yellow line tells the story. Helicopter Ben and Bubbles Janet have printed fiat at a phenomenal rate and shoveled it into the troughs of their Wall Street owner pigs. The Wall Street shysters then created a fake housing shortage by withholding foreclosures from the housing inventory while buying up millions of homes in their own to rent scheme. Throw in the Chinese laundering their ill-gotten cash by buying up luxury real estate, and you’ve got a 25% increase in home prices.

Would a spineless, captured politician in Congress dare ask Bubbles Yellen about this immoral, criminal, treasonous act against the American people? Not a chance. So keep believing the economy is recovering, jobs are being created and the housing market is in great shape. The wealth of the oligarch pigs depends upon it.

AP News reported today that homes sales, and building permits are the highest since January. Your chart proves otherwise.

I guess the faster and the more outlandish the lies become, the closer we’ll get to the truth.

Yep, it’s part of the largest and fastest transfer of wealth from the poor and middle class to the upper .1 percent in the history of mankind.

card,

Home sales can be up somewhat as well as permits especially with cash purchases, but with mortgages tanking, the lifeblood of home purchases for the middle class tanking, it has become clear that the vivisection of the middle class is almost complete. You cannot grow a middle class without a livable wage that allows family formation and the creation of households. This entire paradigm has been turned on its head with exploding student debt, the extension of adolescence to 30, asset inflation/bubbles that put home ownership out of reach even with 3% mortgages, and the virtual dearth of middle class paying jobs. This country stands on a strange and steep precipice, unlike it has ever seen before. While many in power look to hold onto what they have, I think even many of them will be in for a big surprise when this all unwinds.

Bob.

“While many in power look to hold onto what they have, I think even many of them will be in for a big surprise when this all unwinds.”

That’s one of the other things that scare me the most, the FSA taking what they want, and those in power passing laws to steal what they want to remain in power.