There is no doubt that fracking stopped the long-term decline in U.S. oil output. Since the all-time low output in 2006, daily oil production has increased by 30%. Natural gas production has soared even higher, but seems to have leveled off. Ignoring the environmental impacts of fracking, just the economics alone show that shale oil and gas are not the miracle that will save us from the perils of peak cheap oil. Fracking extraction of oil is extremely expensive. If oil prices were to fall to $80 per barrel, there would be no profits for frackers. They would stop drilling wells. So don’t plan on ever paying less than $3 per gallon for gasoline ever again.

Other inconvenient truths about fracking are self evident, but covered up by the MSM and Wall Street shysters.

- To maintain production of 1 million barrels of oil a day from Iraq one needs to drill just 60 new wells a year. Extracting the same amount from the Bakken would require 2,500 new wells.

- A typical fracked well poked in the ground in Oklahoma in 2009 debuted with an output of about 1,200 barrels of oil per day. Just four years later, however, output from the same well has fallen to just 100 barrels of oil per day.

- To double that output from the Bakken, for instance, would require 5,200 new wells a year, and tripling it would require 7,800 and so on. Then, to the horror of all, less than a decade after all that was done, that additional million barrels of oil a day in production would be reduced to just 100,000, no matter what the oil companies do, because of the nature of the formation where the well was drilled.

- California’s Monterey Shale, which the U.S. Energy Information Agency thought contained 13.7 billion barrels of oil in 2011, came up a little light in the loafers. Closer examination revealed the formation to be much more broken up underground than previously thought — so much so that only around 600 million barrels may ultimately be recovered with current technology. That’s a 97 percent downgrade, and there is no guarantee that other rosy predictions of shale oil riches both in the U.S. and elsewhere won’t have similar outcomes.

The best fracking locations were selected first. As time goes on, the new locations will be less productive. The existing locations deplete rapidly. The shale oil and gas boom will be peaking out over the next few years. Don’t believe in miracles.

You will find more statistics at Statista

First it was “THE NEW ICE AGE!!!” Then it was a hole in the ozone layer. Then it was polar ice melting. Then it’s global warming. Then it’s climate change. Then it’s the rising sea level. Then it’s fish dieoffs, algae blooms, save the fuckin whales, hug a tree, dude, it’s the BEES!!, big Ag, big Pharma, fluoride in the water, GMO crops….

And now, no oil.

Just stop already… really.

Billy ,you should really be concerned about the mocking bird crisis in Kentucky. It will be a pandemic by the end of the month.Better bug out while you still can.

But what about abiotic oil. The earth is like a big truffle filled with liquid hydrocarbons. No worries mates. The Huffington Post says so …

First, the graphic says “Fracking Well”, which shows whoever put it together doesn’t have much experience. I have no idea what a “Fracking Well” is.

The news is somewhere in between the doom and gloom, and rampant exuberance. The first phase was combining horizontal drilling and hydraulic fracturing. This is when they predicted 400,000 bpd max at the Bakken. Then came phase 2, which was multi-zonal fracking. By the way, this was the new technology that the reporters screwed up on and caused the “oil companies are experimenting on our water supply” scare. No, the new tech was fracking multiple zones on a 1 mile horizontal bore. We can now “easily” frack about 30 zones.

We are now in phase 3, which is multi well pad drilling. Basically the oil companies were stuck in the traditional mindset. Now they realized its all about the drilling. So you set up 3-4 wells (drilled by the same rig) and get your production and pipeline equipment set up. You run a few years, then come back to the same pad and drill another set of wells. You can get about 16 wells on one pad.

That being said, I think the Bakken tops out at 1.5 million barrels per day by 2016, kind of bumps along, and is in serious decline around 2025.

Texas appears to be in better shape because they have a lot of shale oil formations. They’ll probably add another million in production.

So we’ve bought some time, and we need to be developing thorium with the time we’ve bought ourselves. There is still a lot of oil left in Venezuela and Colombia, but there are political problems there. Also, if we can get Keystone, we’ll get more production out of Canada and lower the expense of the Bakken Crude (Bakken is slated for up to 400,000 bpd. on Keystone).

Obviously the answer is to find an alternative source of energy. There are new solar cells on the way with much more efficiency and that could be a partial game-changer.

About the best thing I can say about fracking is, in a post apocalypse America we would have a diverse ready source of crude, even if in small volumes, to feed the need of regional areas with “shade-tree” refineries.

I believe the article is correct. I have been up in the Bakken for three years and have seen the decline in oil from a well that is fracked. Wells that started out producing 250 bbl a day and a year later produce 30 bbl a day. I have worked on seven new wells and not one is producing and they were fracked a year ago all just produce water. At a minimum 5 million each to drill. we will be lucky to pay $5 a gallon in the near future. Maybe Andy Hall is right.

“We need to be developing thorium with the time we’ve bought ourselves. ”

—-JamesD

Excellent comments overall, but I take exception to the sentence quoted.

You’re mixing apples and oranges. Oil is mainly transportation energy. Thorium is for production of electricity, and it is still an expensive pipe dream. Not ready for prime time. Probably never will be. Nuclear, James, nuclear. Ready, willing, and able.

After the full exhaustion of all fossil fuels resources. Man shall have to back the days of lighting farts by the campfire.

http://www.youtube.com/watch?v=XsRwfUyAsHY

“If oil prices were to fall to $80 per barrel, there would be no profits for frackers.”

—-Admin

Quite true. But the domestic market price of oil today is based largely on ill conceived government policy and not market driven. Open up proven and potential sources of oil currently blocked by stupid government edicts, and I’ll bet within 5-10 years, the price of gas would be far less than $3 per gallon.

SSS, where are these proven oil sources of oil?

Also, oil is a fungible commodity and the price is set on a global basis.

The overall supply increases as the US (domestic) production increases, and given all other inputs constant (not real), decreases price.

Your extrapolation of opening up proven and potential sources of oil and reducing the prices of gasoline to below 3 dollars a gallon is brave. Have you been consulting bb?

World discovery of oil peaked in the 1960s, and has declined since then.

Today we consume around 4 times as much oil as we discover.

Gas prices will only drop under $3 if there is a worldwide economic collapse like 2008/2009.

Maybe SSS is rooting for that to happen.

“SSS, where are these proven oil sources of oil?”

—-HalfPint

Do you have the memory bank of a gnat, HalfWit?

ANWR. 6-16 billion barrels of oil. Rest of U.S., including offshore. 120 billion barrels. All blocked by the federal government, blue states like New York and California, and radical environmental allies who sue in court at the very mention of the word drilling. Drilling on private land is skyrocketing. Drilling on public land is down 34% since Obama became president.

“Gas prices will only drop under $3 if there is a worldwide economic collapse like 2008/2009. Maybe SSS is rooting for that to happen.”

—-Admin

So you’re saying that the global price of oil won’t drop if the U.S. brings another 2-3 million barrels of domestic oil on line, which will greatly lessen overall demand for oil on the foreign market. Is that what you’re saying?

SSS

Worldwide demand grows by 2% per year. Existing wells deplete. You don’t bring 2 to 3 million barrels online overnight. You do it over the course of years. Meanwhile demand has continued to outpace discoveries. Discoveries peaked in the 1960s.

At what price does it cost to add the additional 2 to 3 million barrels? You don’t know.

It’s math dude. The easy to access, plentiful, cheap oil is long gone. If oil prices drop below $80 a barrel, producers stop producing because they aren’t in business to lose money. Maybe you want the Feds to nationalize oil so price won’t matter.

Another ass kicking economics lesson for the spook.

SSS, I Googled where you got your information on ANWR. You should read the whole article. Lots of speculation, and most certainly not proven reserves. I tend to read looking for a basis for my thinking, you tend to read only whats necessary to support what you want to believe.

I’m not going to pursue the other 120 billion barrels, because I have better things to do than disprove a man with his mind made up. Go play some more golf, take as many mulligans as you want to support your handicap.

doom

DOOM

DDOOOOOOOOOOOOOOMMMMMMMMMMMMMMMMM!!!!!!!!!!!!!!!!!!!!!!!!

@ Admin

“Worldwide demand grows by 2% per year. Existing wells deplete. You don’t bring 2 to 3 million barrels online overnight. You do it over the course of years.” (Well, duh. Tell me something I didn’t know.)

“At what price does it cost to add the additional 2 to 3 million barrels?” (A lot.) You don’t know. (And neither do you.)

“If oil prices drop below $80 a barrel” (I never said it would. I said it would put downward pressure on the price of oil on the international market whatever it happens to be at the time. And it would. Oh, how about all those oil wells sitting idle or underused in war torn countries like Iraq and Libya? What happens when the dust settles? More oil. A lot more oil.)

“Another ass kicking economics lesson for the spook.” (And for the creative accountant.)

If the price of oil doesn’t fall below $80 a barrel how the fuck does gas fall below $3 a gallon? Duh!!!!

When the dust settles????

WTF are you talking about? Do you really think the Middle East is going to settle down? Geez. Are you smoking medical marijuana? Have you been paying attention? Fourth Turnings DO NOT settle down. They intensify to a crescendo of war, bloodshed and chaos.

Has alzheimers begun to ravage your thought process?

@ HalfWit

I gave estimates, not speculation. The oil is there. How much is the key issue. You won’t know until you actually start drilling.

Administrator says to SSS:

“If the price of oil doesn’t fall below $80 a barrel how the fuck does gas fall below $3 a gallon? Duh!!!!”

Simple. You use the formula of inverted overhead costs X transportation costs per mile to the nearest refinery divided by bbl produced per day per well. You must factor in an AVERAGE annual 2% increase of operational inflation at the refinery and each well head (electricity, water, labor, etc). It varies from state to state.

All major oil companies use this formula. Check their profits. It has worked for decades.

I gave you the simple formula because that’s all you can handle.

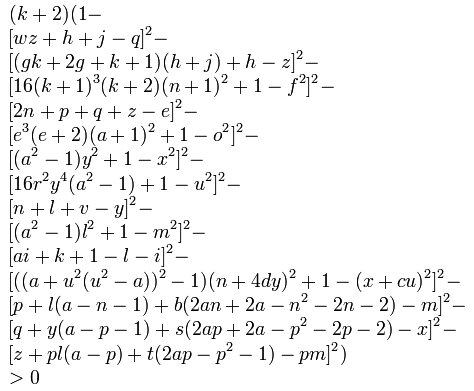

Here is the complete formula. The answer is $78.27. See if you come up with the same number. [/img]

[/img]

[img

The funniest story of the year was when Eike Batista lost most of his wealth on deep water oil speculation. Funny because he is such an arrogant prick. He listened to the same people SSS listens to. Remember back two years when they said there were billions and billions of oil down there off the coast of Brazil. I believe they were “proven” reserves. Yup, proven to stay put forever. We are running short on time as far as transitioning off of liquid fuels. Admiral Rickover warned us back in 1956 that basing a civilization on oil was insanity. Instead we went all in. All the other forms of energy will not replace liquid fuels. We need the liquid fuels to mine all the natural resources we use to create everything in our lives. It is the basis of our civilization. To have corporations and governments give us a “no worries” attitude is insanity. This coming forth turning has many facets, and the decline of oil is one of them, one that guarantees the forth turning. I don’t know if I buy into the forth turning, but I believe in shit storms, and we are heading into the biggest one ever.

The formula provided is a fractured polynomial, but doesn’t apply in this case because of the hyperbolic paraboloid behavior of the partial paraparamic variables. Any normal guy should be able to see that, after two bong hits of medical marijuana.

Oh, I did come up with $78.27 too, but that was the cost of 4 grams of medical marijuana, including tax.

“Admiral Rickover warned us back in 1956 that basing a civilization on oil was insanity.”

—-HalfWit

Is this the same Rickover who was the father of the nuclear sub. Why, yes, I believe it is. There is no bigger advocate of nuclear energy on this site, HalfTwit. None.

I figured out energy independence of this nation 5 years ago, from Maine to Hawaii. How about you? Still struggling with the subject? I bet you are.

“The funniest story of the year was when Eike Batista lost most of his wealth on deep water oil speculation.”

—-HalfTwit

Ha, ha, ha. Hundreds of investors lost tens of millions of dollars investing in Ferdinand de Lesseps’ 19th Century project to build a sea-level canal across Panama. After all, he did the same thing with the Suez Canal in Egypt, didn’t he? Epic ……………. fail.

What’s your point, DickPint?

Missed this over here, caught it on ZH this morning.

I got a Podcast scheduled up on this with David Hughes for October.

This is the most massive BUBBLE we got going now, it dwarfs just about everything, even the IPOs of Ali-Fucking Baba and Facepalm.

I’ll cross post on Saturday. I am saturated with Stucky, Tony Cartalucci and my own shit for tomorrow.

I keep it to 3 a day so as not to overwhelm the Diners with Doom on any given Day.

RE