The bulls declared victory on Friday with a large bounce back. But, the chart below from John Hussman will provide you with some perspective. Bull markets are boring and methodical. Volatility is low and the gains are slow and steady. Volatility spikes dramatically during bear markets. It works in both directions. Large down moves are followed by large up moves, but the overall direction is down. We’ve entered a world of pain. The up days will keep people believing, while they get their hearts ripped out and their net worth gets gutted again. Market internals have turned negative, as Dr. Hussman notes:

Abrupt market losses typically reflect compressed risk premiums that are then joined by a shift toward increased risk aversion by investors. In market cycles across history, we find that the distinction between an overvalued market that continues to become more overvalued, and an overvalued market is vulnerable to a crash, often comes down to a subtle but measurable shift in the preference or aversion of investors toward risk – a shift that we infer from the quality of market action across a wide range of internals.

Once market internals begin breaking down in the face of prior overvalued, overbought, overbullish conditions, abrupt and severe market losses have often followed in short order. That’s the narrative of the overvalued 1929, 1973, and 1987 market peaks and the plunges that followed; it’s a dynamic that we warned about in real-time in 2000 and 2007; and it’s one that has emerged in recent weeks (see Ingredients of A Market Crash).

At this point, the news story of the day, whether it be ebola, ISIS, or the EU collapsing, is just an excuse for what was going to happen anyway.

Central to those criteria are factors such as deterioration in the uniformity of market internals, widening credit spreads, and other measures of growing risk aversion. Once that shift occurs, market declines often bear little proportion to whatever news item investors might latch onto in order to explain the losses.

The collapse is due to the underlying conditions, not to the particular event used to explain the collapse. No one can point to any particular event that caused the 20% one day crash in 1987.

Think of a ruler held up vertically on your finger: this very unstable position will lead eventually to its collapse, as a result of a small (or an absence of adequate) motion of your hand or due to any tiny whiff of air. The collapse is fundamentally due to the unstable position; the instantaneous cause of the collapse is secondary. In the same vein, the growth of the sensitivity and the growing instability of the market close to such a critical point may explain why attempts to unravel the local origin of the crash have been so diverse. Essentially, anything would work once the system is ripe… exogenous, or external, shocks only serve as triggering factors.

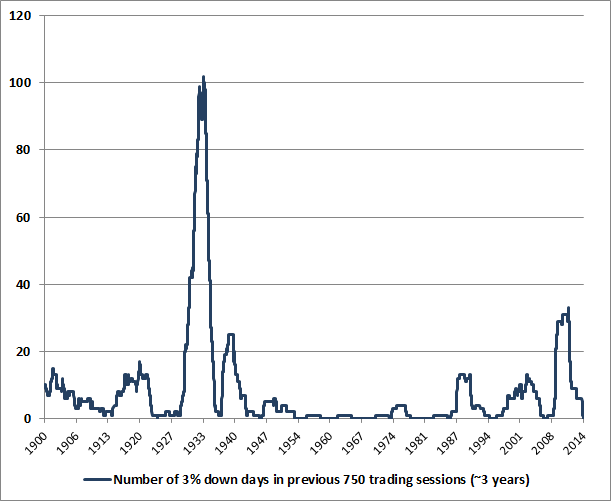

The smartest guys in the room always think they can exit before the other guys. Greed and fear drive humans. The 3% down days will be followed by 2% up days, giving bulls hope the whole way down. That’s why a market crash, like 2000 – 2001 and 2008 – 2009, ends up destroying the portfolios of millions. The Wall Street shysters and CNBC mouthpieces will keep telling you it’s the best time to invest during the entire bear market.

A market crash comprises of a series of one-day losses that may be large, but are not particularly extraordinary in and of themselves. The problem is that they tend to occur in sequence rather than independently. In the chart above, you’ll notice that the cumulative total of 3%+ down days often spikes nearly vertically from zero, meaning that large down days tend to cluster. We may wish to believe that a 25-30% market plunge has zero probability since we know that the probability of a one-day loss of several percent is quite low, making a whole series of them seemingly impossible. But that view overlooks the tendency of large losses to occur in succession. It also overlooks the tendency for monetary easing to support stocks only when low- or zero-interest risk-free assets are considered inferior holdings in comparison to risky ones.

I would read Hussman’s words carefully. Don’t be fooled again.

At present, conditions remain unfavorable, and the potential for abrupt and vertical losses should not be taken lightly.

Read all of John Hussman’s Weekly Letter

How do you invest in or short the Dow. I want to make bets entirely based on the Dow number going up or down and want to do it on short notice.

DXD, SDOW are ultra short DOW or you can do what I did… buy long-dated VIX call options. It was cheap insurance when VIX was at $11.

DOG is a Dow Short ETF

DOG shorts the DOW. You must keep in mind that it is only a “daily” direct correlation. If the DOW goes up and down, but doesn’t overall move, DOG will lose approximately 1/2 % per month, or 6%+ a year. 2x and 3x short ETF are even worse.

All are free to do what they wish, it’s their money.

That said, shorting is mathematically less rewarding (and thus more difficult) than going long. A market or a stock can go up 10%, 100%, 1000% but

1. A stock can only go down 100%.

2. A market index will NEVER go down 100% unless it’s TEOTWAWKI, especially a managed index like the DJI which periodically replaces crappy-returning stocks with better-returning stocks.

All the inverse and/or leveraged inverse index ETF’s have price decay. In a sideways market they lose money, because of the mechanisms employed in trying to invert the return of the underlying.

All inverse index ETF’s make all their money in “3rd wave” declines. For example, QID (2x inverse QQQ, the NASDAQ 100 ETF) by far hit its highest in the fall collapse of 2008, NOT in the final decline of QQQ in March 2009 (which admittedly did not reach a new low, when the SPX & DJI did.)

My point?

Unless you plan on starting with a large pile of money and turning it into a small pile of money, be very careful about playing the downside. Few people do it successfully, and there is no faster way to lose than to make a pile of $$$ in a downtrend and then embrace your omniscience shortly thereafter, only to discover that the market usually takes back that which it first gives.

You want to short the DJI?

1. Open an option account, fund it with money you can burn, buy some puts with several months or more in life left, out of the money, when the bulls declare victory after several days of rally.

2. Open a margin account, fund it with money you can burn, and directly short-sell DIA at the same times.

In both cases, if you plan to jump in and out you better have $25,000 to open, to meet Pattern-Day-Trader minimums, or on the fifth in-and-out before the trade can settle your account locks up for ?? a couple weeks?? (not sure, used to know) by government regulation.

It is a widely-known truth that 90% of people who trade stocks lose money. It is less well known that in the aggregate, no one makes money in a bull market (because everyone chases performance.) It is even less well known but easily inferred that most people who brag about big gains are either lying or have easily more than offset their gains with losses.

<10% of people make money in stocks over time.

I can get in and out of DXD, SDOW and DOG daily?

What are the fees?

@Glock-N-Load,

If you’re asking questions like that, you are waaaaaaaay too much of a neophyte to consider the short side.

Not trying to be a dick, but I’ve been getting chewed up trying to make money on the short side for 20 years, have spent more money than you even HAVE (I’m guessing, but my guess is likely true) trying to get better at it, and for the most part wish I’d have simply parked my $$$$ in a CD all those years.

I’d actually have more $$$.

Cramer called the bottom last week Friday.

“As of Friday, the “Mad Money” host thinks investors are in the clear to do some buying again.

“We got movement on every single issue I have needed to find an investable bottom, and that’s exactly what we might have found here,” Cramer said.”

Wip:

Do what I did. Give yourself an imaginary amount, say $10,000. Then start doing imaginary trades, but don’t cheat. Book the prices when you decide to buy or sell. Charge yourself $10 per trade. Remember the wins are taxed as capital gains, but the losses can’t offset the wins due to the wash rule, since your are trading the same security. See how good you do over 1-2 months. I did something similar, that cured me from trading, specially short ETF’s.

Sell covered calls.

So long as the Fedgov is gaming the market, you’ll not win by shorting “the dow”.

Wip,

You want to play?

Follow Crat’s advice, but go one better.

Open an account at Trademonster.com but DON’T FUND IT (you have a little while before that becomes a problem.) Use their paper-trading account to fiddle with what you’re reading, and see how you do.

Sadly, if you do well on paper it will embolden you to fund the account and go wild. I give you an 80% chance that within two years you burn all your capital.

Back in 2008 I doubled my money (a trivial amount of capital at risk) in a short time in QID. A coworker was “watching” what I was doing and decided to copy me. I stopped shorting the market in November 2008 but he was convinced it would just keep crashing so he kept trying to position in QID until he lost more than half his money.

I called the 2009 low within 5 f-ing days, but because I was convinced it would be a small-degree rally (and not the crazy ass moon shot of the last 5 years) I failed to flip to longs and then twice in the last 5 years I thought we’d topped and I positioned too early.

Maybe everyone does better than me. Maybe I’m the dumb one.

On the other hand, maybe I’m the only one willing to admit I failed. Lots of folks play in the market, directly or via mutual funds. In the aggregate, most lose. Given that NO ONE but me admits I’ve lost, I think I’m that rare person whose ego is not so fragile that I can’t own up to my limitations.

@westcoaster,

Disagree. If the goobermint could keep stocks going up forever, there would never be a bear market.

The people running the goobermint are the same as you and me (minus the conscience.) They get worried and defensive just like the rest of us, and that’s what drives bear markets.

The rally of the last 5 years is already a result of two forces: mass psychological optimism and Fed/Government willingness to goose prices higher within it.

This is the nature of asset bubbles, and nothing has changed since the invention of money.

PS: I have recently adopted a trend-following indicator approach, and while the weekly trend is still up, the daily has turned down.

If the SPX stays weak for another month or two it will turn the weekly trend down…an event that last occurred in 2011.

If that happens, the question will remain: It is a pause in a rally (like 2011) or is this the early stages of the Great Bear Market, the one where all the Credit Inflation of the last 40-ish years comes out of prices across the board?

NO ONE KNOWS in advance, but no trend lasts forever. All the necessary ingredients are present today for the most epic bear market in 300 years.

I don’t play. I’m debt-free and child-free, so I can make enough working six months to support myself the entire year … I invest in taking time off and enjoying my life – that’s not rigged. And it puts me in a much lower tax bracket, another “game” I’m avoiding.

Just in case the financial markets make it another thirty years, I have a little nest egg in retirement accounts. Just in case they don’t, I have a little nest egg in gold and silver.

In the meantime, I work half the year and enjoy the rest. I’ll work part-time until I’m 70 and don’t expect “retirement” to last long. There won’t be any public money around to keep fixing my ailments by then, so when my body wears out and I can’t take care of myself, I’ll just die. You mean I won’t get to spend ten years in a nursing home getting my bedpan changed? Well, guess that’s another game I have already won.

“If you continue to go down the wrong road, at a certain point something happens. At a certain point when the financial system is wrong it falls apart. And it did. And it will fall apart again.”

John Ralston Saul