With central banks continuing to print and resistance being broken, the future is bright for gold. You won’t hear it on CNBC, but gold is up 15% in the last two months and up 11% since Christmas. Print baby print!!!!

Today’s chart provides some long-term perspective on this millennium’s gold market. As today’s chart illustrates, the pace of the bull market in gold that began back in 2001 increased over time. In late 2012, however, the parabolic trend in gold prices came to an end and a new downtrend began in earnest. However, due in part to increased global uncertainties, gold has trended higher in 2015. In fact, the current rally in gold has resulted in gold breaking above resistance of its three-year downtrend channel.

@Admin: What to you think will happen with the ECB unleashing a massive QE as of today to:

1) Gold.

2) Interest rates

3) Stocks (already going up)

Is the ECB massive QE the last gasp of the money printing experiment? Sure seems so.

Hope

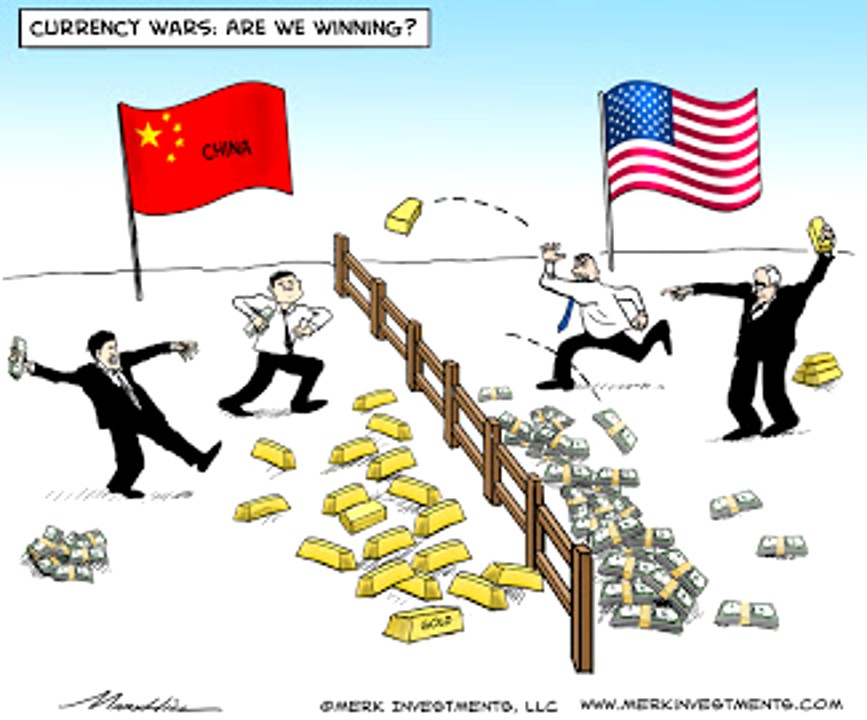

I think these men and their European and Asian counterparts will…..

End up like this when their criminal experiment blows up the worldwide economic system again.

[img.jpg) [/img]

[/img]

I think gold will go up, interest rates will decline as the worldwide economy collapses, and stocks will drop by at least 50%.

Hi Hope! Good to see a post from you fly by!

IMHO, we are well beyond the point of no return as far as debt is concerned. After all, $500 Trillion in unbacked liabilities/derivatives/bonds of no return and so on ad nauseam guarantees a prat fall of global proportions but makes no attempt at timing the crunch.

Given that – at a minimum – 90% of sheeple world-wide – cannot define much less understand the word “inflation”, conflate it with higher prices and most of them only bitch at the grocery store when their beer goes us $1 a 6-pack.

As far as on-subject comment, there is no telling how high or how low markets will go now that big players that include the Government, NGO’s, TBTF banks and such gambling with depositor funds and Governments buying/selling markets (stocks, real estate, metals, what ever) trying to push them higher-ever-higher to help convince the sheeple that all is will if so far beyond the understanding of even the so-called-investment professions, NO ONE really knows what the result will be when it comes a cropper – as it will. Things can fall apart in slow motion far longer than those of us who understand (at least more or less) what’s going one than one could imagine.

Then when it happens, it happens very fast – between Friday night (after market close) and before Monday market open.

The bears on Friday are happy as pigs without ever getting out of bed and the hedge fund kings, TBTF bankers and the multitude betting on a never ending font of theft, fraud, fiat and bullshit don’t bother to even get up and go to work – because there, an open window awaits..

As far as your questions:

1. You will not be able to find any to buy at any fiat money price.

2. Interest rates on gold backed bonds with settle out around 3% for short term instruments (after a period of huge turmoil, going higher interest on longer term paper. (this will take time to do as there will be turmoil to the point that A. initially no one has anything but fiat to loan out and B. TSHTF for an unknown length of time time that no one knows what’s going on.

3. The only stocks you want to hold at the time of the crunch are “money” stocks. Gold and silver and only a modest amount of that. I do trust your own personal G+S umbrella is fully rigged and full, in your personal possession in a safe spot. Pray that you get to give it all to your heirs and never have to delve into it.

Reference the ECB, never underestimate the stupidity of politicians and greedy people.

Things will continue to deteriorate, globally, until the sheeple lose confidence in the system to keep them secure, fed, beer’d, and entertained. When that confidence and belief evaporate (and it will), then we only have history to act as guidebook to what will happen but after the first absolute first, second and third explosions and implosion of public services, I suspect that Kuntsler’s World Made By Hand books – except for being way too optimistic, describes where we will eventually end up. I’d bet the population drop (world wide) would be in the range of 60%-70% or more and with such a shock takes a long time to overcome.

You can be sure the Four Horsemen will ride..

Hope you had a great holiday season, family is fine and you are doing ok! Hugs..

MA

Davos Man and High End Looting

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.”

John Dalberg Lord Acton

“When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.”

John Maynard Keynes

It was all about the ECB today. And do not think for a minute that this asset purchase program is designed to benefit the broader economy. It is a subsidy program for those who own financial paper and the Banks

Gold and silver were pushing higher against key resistance and a short term overbought condition on the word from Monsieur Draghi that the ECB will be handing over about a Trillion per year to misprice the risk in financial assets.

This asset purchasing will not have much impact on the real economy, but it will inflate the price of paper assets, especially the kind of debt held with leverage by the wealthiest one percent, delivering profits in tax subsidized forms of income.

Gold is consolidating nicely, and as we showed intraday with the NAV premiums, the gold-silver ratio has dropped back down to 70, which although quite high is not as stratospheric as it has been. Even the premiums of the trusts and funds in precious metals have normalized a bit.

The strong dollar is good for importers and the Banks. And that is why most of the developed world, particularly Japan and Europe, are trying to devalue their currencies. But is hard to imagine how all of fiat price rigging is going to provide a benefit to the real economy. It starts to look more like high class looting from a distance.

This is going to further taint genuine economic activity with financialisation, and make the task of prompting a recovery that is self-sustaining that much more difficult.

The US financial sector will be benefitting enormously from this European QE, such are things these days with the global multinationals.

And as for the rest of the people, the vast majority? Time to lower your expectations, for you and your children. At least you will be given the privilege of voting for one of the candidates of their pre-selected choice next year.

Jesse

JMO but I think it is prolly getting close to last call for the gold train, don’t be left behind at the station. Also, I have noticed that folks here rarely talk about silver. I am curious as to why???

I believe in storing wealth in gold much the same as the citizens of India but in the case of a global collapse you may stand to gain more from silver. So….buy some silver, it could work in your favor.

MA- Paper anything will be shite in a collapse. Just sayin……..