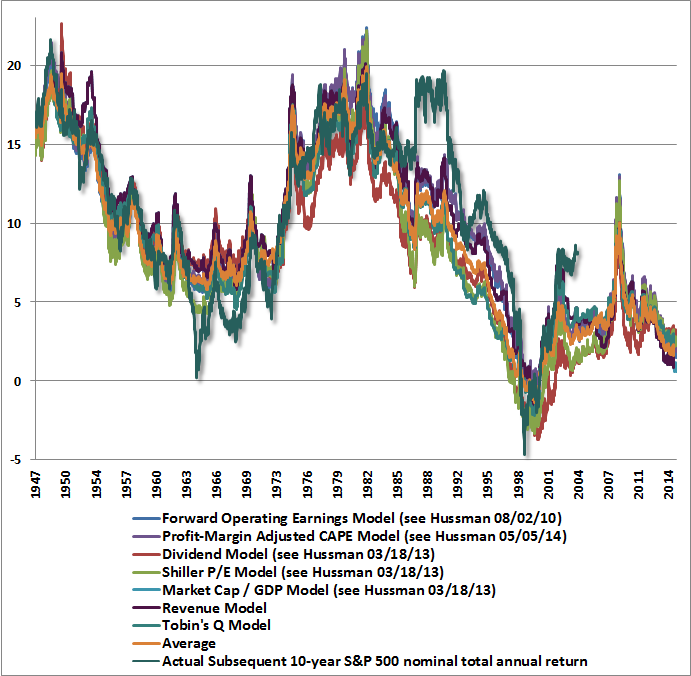

I’ve posted this chart from John Hussman a number of times in the past. It’s an amalgamation of seven different stock market valuation methods that have been historically accurate in assessing whether the stock market is undervalued, fairly valued, or overvalued. These measurements would have told you to buy in 1947, sell in 1965, buy in 1980, sell in 1999, buy in 2009, and sell in 2014. Nominal returns in the market over the next ten years will be less than 1.5% annually. Real returns will be negative. Unless, of course, this time is different. That’s what Wall Street shysters, Ivy League economists, government apparatchiks, and CNBC bimbos and boobs will tell you. Do you believe them, or historical precedent that has proven to be accurate over the last century?

Hussman describes the new highs reached last week and their meaninglessness:

Last week’s advance had the earmarks of a short-squeeze, featuring a low-volume advance to marginal new highs on a number of indices including the S&P 500, on hopes that a Greek bailout and a firming in oil prices will put a floor under global economic deterioration. On factors that affect our estimate of the market return/risk profile, credit spreads remain broadly wider than they were a few months ago, and our primary measures of market internals remain unfavorable. Meanwhile, equity valuations – on the most historically reliable measures we identify – are now fully 117% above their pre-bubble norms, on average. As of Friday, our estimate of prospective 10-year S&P 500 annual nominal total returns has declined to just 1.4%, suggesting that even the dismal 2% yield-to-maturity on 10-year bonds is likely to outperform equities in the decade ahead.

The upshot is that equities are likely to produce total returns close to zero over the coming decade. But they still present something of an “inventory” problem. The basic inventory problem is to accumulate inventory prior to advances in price, to hold that inventory as long as it appreciates in price, and to release that inventory when prices are elevated. What we observe at present is a market where the inventory now fetches record prices and is likely to enjoy little return for long-term holders, and suffer severe losses over the completion of the present cycle. But should short-term demand become even greater, one can’t rule out a move to even higher prices and even more dismal long-term prospective returns – something to be celebrated by those who hold out long enough to sell at that point, but tragic for those who actually buy the inventory in the hope that it will be rewarding over time.

All the big swinging dicks on Wall Street think they are the smartest guys in the room. Of course, all they do is follow computer programs telling them when to buy or sell. It will be very entertaining when they all try to exit at the same time.

Still, there is an even narrower and much more speculative approach to this inventory problem, which is focused on a shorter horizon than the complete cycle, attempts to fully capture returns even in segments of the market cycle that have already reached extreme valuations, and ridicules full-cycle investors who might, in hindsight, miss such opportunities. The typical problem with this approach is that speculators invariably wear out their welcome by holding inventory even after indications of growing investor risk-aversion have emerged. The eventual attempt of speculators to exit a narrow door simultaneously at rich valuations is chronicled in air-pockets, free-falls and crashes across a century of market history.

The skeptics contend Hussman is the boy who cried wolf. Yes he has been warning of a potential crash for the last year. It hasn’t happened. So people ignore his warnings, which are based upon facts, data, and history. He is not wrong. Ignoring the truth doesn’t make it not so. The crash will come in its own due course. It always has and it will this time.

Suffice it to say that current equity markets are no place for long-term investors, and that even a resumption of risk-seeking investor preferences would demand a considerable safety net. For now, we believe the best interpretation of recent market action is as a hopeful, low-volume short-squeeze to marginal new highs, despite early deterioration in market internals following a period of extreme overvalued, overbought, overbullish conditions. This pattern is much like we observed in September 2000 and October 2007.

Read John Hussman’s Weekly Letter

2015-02-17 10:06 by Karl Denninger

No, Enron Accounting Did Not Really Die

I’ve written on this before in terms of specific companies, but this Ticker is not about any one specific firm.

Rather, it’s about a rather nasty (but legal, at least at this point) practice that appears to be all the rage among a fairly material number of companies, especially those in the “tech”, “media” and “social” spaces.

All of these sorts of firms have very heavy costs associated with technology in one form or another. The traditional way to deal with rapidly-escalating capital cost requirements is through leasing of some form (although it’s not always called leasing, particularly when we’re talking about things that will not hurt you if you drop them on your foot, usually because there’s nothing to drop.)

The problem is that these “expenses” are not being recognized when contracted for, but rather only when actually consumed. That is, these “contracted for” but not yet consumed services and goods are being held off-balance sheet and yet they are contractual obligations of the firm in question!

As far as I can determine this is legal but god-awful misleading. It is my position that if it quacks like a debt and contracts like a debt it is a debt, which means it should be recognized on the balance sheet as a long-term liability (like a debt.)

The problem with not doing this comes down the road; that particular obligation is very-much real and will be required to be serviced in coming quarters and years. If you took that obligation onto the balance sheet at the signing of said contract and then retired it as the contract was performed I argue you’d get a much more-accurate view of the firm’s financial health — including a means of discounting future cash flow (which, incidentally, is one of the necessary things to know in order to value a stock!)

This is almost-universally not being done and the result is that utterly-enormous future obligations are for all intents and purposes not represented in the balance sheet.

You could quite-easily argue that this bit of financial engineering is simply about pumping a firm’s stock price, and you’d probably be correct. But from an investor’s perspective this sort of game is extremely dangerous because when (not if) the cash flow constraint is exposed the price of the firm’s stock is subject to a huge and rapid haircut as expectations for future cash flow get reset back to reality.

My point here is quite simple: The market is vulnerable on a broad basis in this regard as many of the “high flyers” are using this sort of technique. If you’re holding individual equities you need to take a very close look at the financials, including the footnotes, to see exactly what sort of exposure you have to this.

You’re unlikely to like what you find.

“Enron accounting” indeed. Until and unless we return to GAAP and mark-to-market, all the numbers being reported are garbage and unless someone is keeping a 2nd set of books that DO conform to standards, who the hell even knows what reality is?

How much has Hussman and Maudlin cost clients over the years?

Quit a lot given all the bad advice.

So is there MORE or LESS stuff sitting around without a buyer?

If MORE, that is good for the survivors of the coming collapse.

If LESS, well, that just means the there will be a second culling.

(Hussman’s articles are like reading the FOMC – as sleep inducing as a cargo container of Ambien.)

Capital flight from around the world will push up US asset prices. Especially, given all the competitive devaluation going on.

We are heading for a booming stock market and simultaneous greater recession as unemployment rises due to dollar strength.

I know little about accounting (but I do know a lot about math and energy) and I suspect that the Federal Govts accounting practices might very well put Enron to shame when it comes to fraud.

Also, I have noticed the term non-GAAP accounting keeps turning up everywhere. I suggest we begin using the term MUBS accounting instead.

(Made Up BullShit)

How is it that you post Martin Armstrong articles, yet are surprised when Hussman is wrong?

Which is it that is on the more unsustainable trend Government or the private sector? Pick one and then move your money into it.

Either treasuries and currency, ie dollar euro yen etc or the stock market.

One of the two has an endless buyer that is required to purchase any and everything you want to sell.

Most dangerous market in the world. You will get an 8% return before inflation over the next 6 years.

http://www.marketwatch.com/story/why-the-us-market-is-one-of-the-most-dangerous-in-the-world-2015-02-18?dist=lcountdown

Crap –

This makes more sense.

Pushing the US stock market higher and you continuing to be wrong yet again.

The US Stock Market is at its Most Overvalued Level in History

http://www.acting-man.com/?p=35921#more-35921

Marty had a lot of time to work on his model while in prison for 8 years for fraud.

I saw a letter written by Armstrong in 1999 to GATA about gold being a lousy investment. Gold then proceeded to go up for 12 straight years. It has dropped for two years and he is still saying it is a bad investment. What a guru.

I’m sure his movie that he hawks incessantly on his site, along with his full proof system that you can purchase for thousands of dollars, will be huge successes.

His computer has called all the turning points in Gold and stocks since I’ve been watching him personally in 08. Called Ukraine before it even made the news.

Yea he really wants everyone to see how badly the bankers and politicians screwed society. He definitively does plug it a lot.

He keeps all his writings on his site through 2009. Go back and look for yourself. Your an accountant.

I remember Jim Willie the nut quoting Armstrong calling for Gold to go up during the years your falsely implying. But I do remember when he correctly called the top Willie pitching a bitch about Armstrong.

I called the top in 2008 too. Big fucking deal.

Look up his writings in 1999.

Tbessi

Falsely implying?????

You are a sucker for the latest “expert”. Try thinking for yourself.

Here are his exact words in 1999:

May 14, 1999

Dear Chris:

I understand your frustration that gold has been perhaps the worst investment for the past 20 years. But to argue that it is being manipulated due to large short positions is not justified.

There is no interest in gold at this time and the central banks are all sellers. After they sell their gold, then we will see a bull market. Once those supplies are gone, no one will be able to lean on that supply and your bull market will begin.

I hate to tell you, but gold will drop to under $200 before it turns…

http://www.zerohedge.com/news/2015-02-15/gata-and-martin-armstrong-have-gone-it-nearly-17-years

Follow the link to his site on the above Zero hedge article he never claims it drops that low.

So someone claims to have gotten an email from Martin stating it will drop to $200 and you trust this Gold hack because?

Just follow his calls there are plenty big ones coming just this year alone. If you prefer to trust other peoples writings about him then keep losing money. Get your info from the source not someone’s comment.

He has Gold not reaching its bottom until September this year.

The someone was one of the founders of GATA who had the email dialogue with Marty. He said it. Did he call the 12 year gold bull market? Let me see his prognostications in 1999 where he predicted the NASDAQ crash. Let me see his prediction of the 2008 crash. I want proof, not your blatherings.

Wasn’t good old Marty making license plates in 2008?

You are so clueless you actually think his computer makes the calls. Who programmed the computer?

There’s a sucker born every minute, and you’re proof.

Yea they claimed he stole hundreds of millions from a bank. How do you get $3 billion out of a bank with out a paper trail?

You don’t suppose the bank stole the money and framed him and bought off the judge do you? Na all banks are legitimate, just read that Quinn guy.

You should really look into the case before siding with the bankers.

http://www.nytimes.com/2007/02/16/business/16jail.html?ref=topics&_r=0

Mr. Armstrong, an intelligent and imperious man who claimed to have made his first million by age 15, seems to have begun having trouble in 1999 when trading losses turned up in accounts that were held for the firm at Republic Bank. The problems appeared as the HSBC Group conducted a financial review before acquiring Republic.

“The government said that Mr. Armstrong had improperly commingled accounts and overstated the value of the account’s securities in client statements.

Mr. Armstrong said that he did not authorize the transactions that produced losses and that he was not involved with commingling of the accounts. He was indicted in September and released on $5 million bond.”

Gee what do we have here a bank laundering money?:

http://www.bbc.com/news/business-31516416

Swiss police raid HSBC’s Geneva office

Everyone in prison claims they are innocent.

He strikes me as a shyster with his constant hawking of his system and his movie.

Keep believing in gurus. The only person who gets rich is the guru who sells his system to dupes.

Make sure you’re not the dupe.

When did you buy gold again, within the last two year?

How many years you been wrong on the Dow?

You should really stop reading and posting Martin Armstrong then.

Wouldn’t want to change your trend or publish articles by a Quack.

tbessi

You seem to be getting hot under the collar. Relax.

Maybe you should find a guru who can help you get in touch with your feelings.

I’ll post anything I like. It’s my website. I actually can agree with someone on one issue and disagree with them on other issues.

Armstrong is selling his system and his movie. He will only post things and comments from people that support his position. He is thin skinned. Maybe his anger comes from dropping the soap in the shower too much while in prison.

He doesn’t charge to view the website. The calls are there ahead of time. They aren’t allowing the movie to play in the U.S.. What’s to buy?

LOL: Pot – Kettle -Black.

No one wants to see the movie. Who is the mysterious they keeping it from the U.S.? Inquiring minds want to know. Did Marty tell you “they” are stopping his movie. LOL

Are you serious? He doesn’t give the investment advice on his site for free. He hawks his special reports and they are not free. You aren’t seriously making your investment decisions based on some ramblings on the internet? Yikes. A sucker is born every minute.

What is important to understand in this valuation debate is that the current level of valuation in the financial markets is extreme and suggest lower annualized returns in the future. HOWEVER, it is when valuations begin to CONTRACT that signals real trouble for investors in the not so distant future.

At 27.75 times earnings, based on the latest price/earnings data, the markets are now trading at the second highest valuation level in history. Given the ongoing deterioration in earnings, combined with market exuberance, valuations are still expanding. That is for now. However, it should be noted that forward rolling 5-year returns have already begun to decline, and it is likely only a function of time before valuations begin to contract as economic realities collide with Central Bank driven fantasies.

http://www.zerohedge.com/news/2015-02-20/3-things-forward-estimates-valuations-vs-returns-told-you-so