“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”― Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

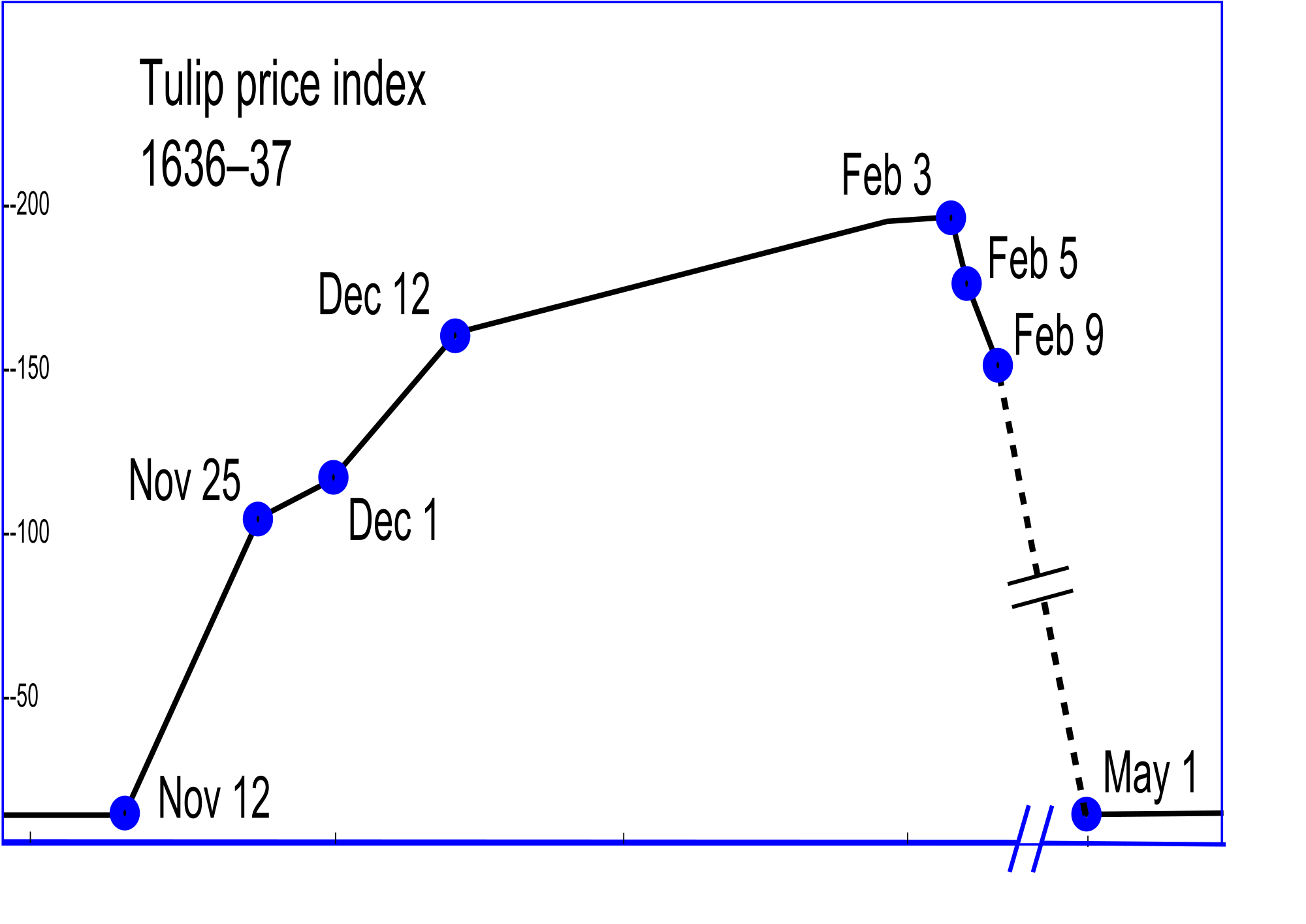

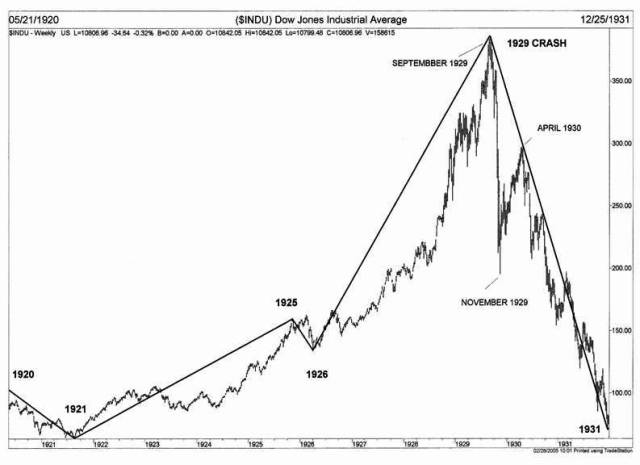

Human nature doesn’t change. It is the same across the world. We are driven by fear and greed. Overconfidence, lack of reason, poor math skills, herd mentality, and delusional thinking lead to bubbles. When the bubble reaches a tipping point, fear takes over and the herd all try to exit at the same time through a narrow pathway. The Crash ensues.

It happened in the 1600’s.

It happened in the 1700’s.

It happened in the 1800’s.

It happened in the 1920’s.

It happened in the housing market.

It happened in internet stocks and is now happening in Chinese stocks.

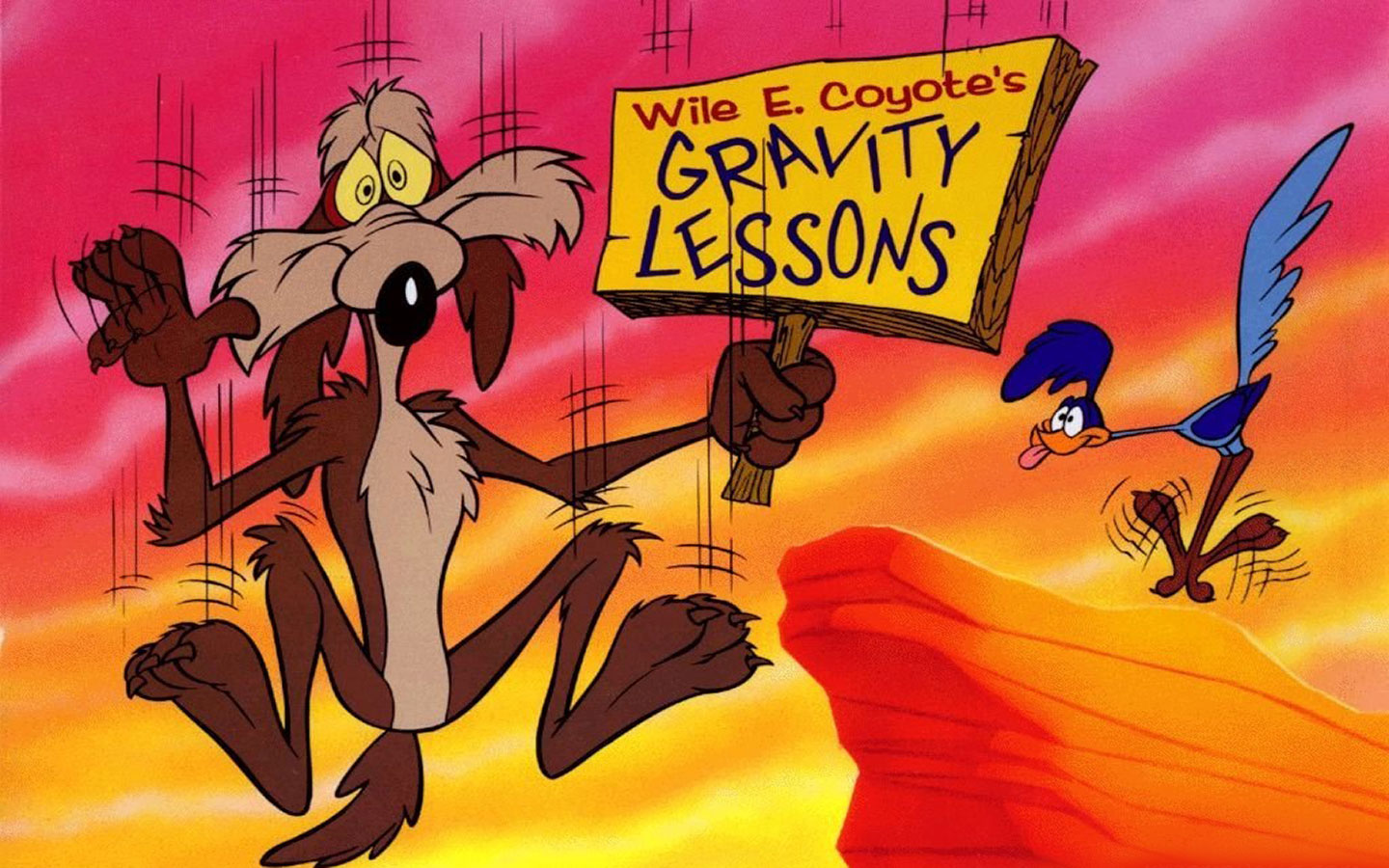

The herd is stampeding towards the cliff.

We all know what will happen next. Unless, of course, it is different this time.

“An enthusiastic philosopher, of whose name we are not informed, had constructed a very satisfactory theory on some subject or other, and was not a little proud of it. “But the facts, my dear fellow,” said his friend, “the facts do not agree with your theory.”—”Don’t they?” replied the philosopher, shrugging his shoulders, “then, tant pis pour les faits;”—so much the worse for the facts!”

― Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

The economy in 3… 2… 1…

[img [/img]

[/img]

“I’m Not Crazy, I’m Scared” – Why For One Trader, This Time It Is Different

Bloomberg’s Richard Breslow, author of “Trader’s Notes” is painfully accurate with his latest take on the “markets.”

I’m Not Crazy, I’m Scared

The SPX flirted with all-time highs. The Nasdaq Index made 15 year highs; Chinese equities, and so many other equity indices are flying. Bonds sold off this week, but the German 10-year yield is still ~17bps, the U.S. 10-year yield unable to get beyond 2%, and Greek bonds had a two-day rally that would be truly impressive if it wasn’t on volume that made it just an exercise moving wide bid/offer spreads, representing sentiment not trading.

The USD is selling off on the view that Greece is saved, the Fed is scared, and a “we can’t sit with positions because it never works” mentality. The only really new thing the market needs to digest is that commodities may be nearing a bottom

Happy days seemingly, but there have been some very discordant and troubling comments from the creme de la creme of smart – and big – investors.

Over the last three days, we have reported that some of the most important investment voices in the world are more than a little scared about the ravenous appetite for risk playing out in the market, and the fact that they have been ignored is beyond unnerving. Central banks are driving all investment decisions, and what this implies is that they are in this trade so deeply that there is no obvious or practical exit.

Over the course of this week we have heard Larry Fink of Blackrock talking about the severe risks of investing in Europe; Bill Gross of Janus saying German bonds are the short trader’s dream; Pimco warning that markets have not addressed the potential of a Fed tightening (I remember 1994); the incoming CEO of Allianz, that TWO trillion dollar asset manager, saying, “We see generally meager growth prospects, political dangers and risks of a stock market crash.” Even Abby Cohen thinks it is a stock pickers world, not a buy anything and kick back world. And yet, the market didn’t even blink.

What is different this time?

Central Banks and their sovereign wealth funds have become the major players dominating market activity. One central banker after another has admitted they are fixated on market reaction to their comments and actions. They are relying on markets blessing their actions even though it was market dysfunction (and regulatory malfeasance) that brought us here. This is a dangerous situation. The focus must return to the REAL economy; we cannot trade our way out of past mistakes.

And we must look at commodities. One thing central bankers do, because forward curves drive all their forecasts, is extrapolate ad infinitum current trends into the future. No central bank in the world got oil right, and that is arguably the most important commodity in the world. Well, oil has made new YTD highs. Why do you think TIPs auctions have been blowing off the shelves? If central bankers have this wrong, their forecasts are wrong, and the Fed, for one, will be way behind the curve. I posit that a lot of central bankers will be tacking right if Brent holds above $63.

So the big question to ponder is why all these very smart people who control trillions of dollars of assets don’t seem to be voting with their money. If the biggest fund managers and thought leaders of the world were radically changing their asset allocations, wouldn’t we see it? Not if central banks are all on the other side of the trade. Maybe they think they can just hold to maturity. A wise central banker told me I should learn to live with central banks being the dominant force in the market, whether I like it or not. I, unhappily, think he is right. Oh, how I wish Louis Rukeyser could get them on his couch.

Ohhhhhhh, ahhhhhhhh, ……….. CHARTS!!!! lol 🙂

Billy, I have 4 questions for you.

1) Are you handsome?

2) Are you smart?

3) Are you nice (to people you like)?

4) If so, is this you? [/img]

[/img]

[img

Dude, did you just wake up today and decide “Hey! I know! Imma fuck with B some.. that’s always good for a laugh!”

[img [/img]

[/img]

Imma go mow the lawn…. and then pick my boy up from school. He needs shoes. And then, if there’s time, I’ll start planting potatoes in the garden.

[img [/img]

[/img]

As far as the stock market goes. Your at least investing in company’s that make things.

If there is some form of currency crisis you at least have stock certificates that could be parsed up and traded. Their value to be determined by the parties engaged in the trade.

What’s the value of 1 share of BMW on the German stock exchange in a new currency? Answer, the value of 1 share of BMW = 1 share of BMW.

John Hussman and all his charts can’t figure this out. That is why he’s lost over half his and whatever advice he has been giving his clients.

Love that chart, Stuck! There are so many options out there – and it applies to both sexes too!

MA

Ooooops! Off subject! Sorry.

That other chart of the Chinese market is a bomb just ticking down to absolute disaster. Of course we can be smug and say “Well, if something can’t go up anymore, it won’t!” but that doesn’t include the sound effects of a crash and subsequent WAR which seems more and more likely.

My Mom and Dad timed me just right! Too young for WWII, just barely too young for Korea and way too smart to get involved in Vietnam. All I did was put in a few years steaming around the world in the Navy, got stuck in the Red Sea when the Brits para-dropped into the Suez and shot at by drunken Arabs with WWI Lee-Enfield rifles. Sitting outside the ET Shack door reading a book and “Whap-Ziinngg!” time to go inside and shut the door for a while. Next thing, the 3″ gun next to the bridge would go “Bang! Bang! Bang!” and I could go back outside with the book. Had to eat shit-on-a-shingle three times a day for a while and refueled twice by helo-tankers (talk about price per gallon!).

Since the Navy was way short of ET’s, when we’d pull into a port, the Chief would say, “Hey, Muck, pack a seabag and go catch that other Destroyer over there – they’re about to pull out for a month!”..

I joined to see the world and got to see the sea!

Now, I dunno.. Too old for a few things (still in the gym three times a week!) but I would hate to have to live through another war – especially one with nuclear aspects. I’d love to live to 1,000 years old as a fly on the wall just to see what we end up doing to ourselves but I don’t think I’d like to experience it “in body”!

It’s just that global crashes tend to force the human animal into aggressive action just to survive. It starts like Africa – flee if you can because where you are is too awful to bear. Then it’s flee and fight to stay where you tried to go (if you get there!).. Then it’s fight to hold back the herds by blowing up where they’re coming from.

There is no good solution for what’s coming down the pike..

MA

This is the largest credit bubble in recorded history.

It has lasted longer than any prior iteration because, I believe, people are more credulous now than before because we live our daily lives in what appears to be the Magic Kingdom. 99.9999% of people have no idea how anything they use daily works. They are cargo cultists, so when it comes time to decide whether to believe or disbelieve, they see their fellows (the herd) believe and they too sign up.

This has allowed this bubble to last longer, rise higher, and push beyond the boundaries of sanity. This is EXACTLY like it was in 1999 and early 2000 on the NASDAQ, and now as then there are no signposts that clearly indicate apogee in advance. Very few people who bought into the NASDAQ in early 1999 got out above their basis. I have little doubt that our future will spread that (now ancient history) to everything we see.

Mark, that’s far from true. Buying common stock is a simple gamble.

Lots of firms have issued vast $$$ in IOUs (bonds) in order to buy back their stock shares. This helps Upper Management because a big chunk of their king-like compensation is stock-price related. Shareholders love it, but what they don’t grasp is that if the firm falters, the holders of the IOU’s are in line ahead of stockholders. No one seems to realize that the value of their stock can plunge to zero faster than they can read their mutual fund statement.

I’m up for a job with a small cap firm that pays its employees in part via a generous stock option/ ESOP arrangement, and its share price has had a 600% rally in the last year. Current employees are GIDDY with their gains, but the firm just borrowed half a billion dollars to complete a major purchase. If the firm’s business plan falters or they can’t overcome barriers to its implementation, the lenders will walk away with every dime of value in the liquidation. Shareholders, including the firm’s employees who think they’re wealthy today, will watch their wealth disappear.

Or the firm may execute plan, hit a home run and obtain another 600% (or 6000%) share price rally. I don’t have a crystal ball.

What I do know is that buying common stock in a company is not the same thing as buying a true share of ownership in the firm and its downstream profits. It hasn’t worked that way for decades, no matter who claims the fairy tale is real.

@ Mark, also….

How many firms today exist only because of the forward pull of future demand, as a consequence of credit inflation?

For decades, people (as individuals, managers of firms, bureaucrats, etc.) have issued an ocean of IOU-in-the-future in order to over-consume today.

That “over-consume” today pumped up public corporations like the warmth and grow-lights of a greenhouse in Fargo ND in January pumps up the blooms of roses and lilies.

Turn off the power, and what happens to those roses and lilies? What happens if you own common stock in those flowers? Or are counting on the delivery of those IOU’s in the future, when the basis of them being “money good” collapses?

Take a good look at the South Sea Bubble. It was the “slam bang” beginning of a 64 year bear market on the London Stock exchange. SIXTY FOUR YEARS. It was over a century before prices began to approach the higher levels seen in 1720.

@Stuck, great chart.

Only discord I have is that not all gay men are handsome. I know a couple fat-ass’d gay men that could not be considered “handsome” even when you could still recognize their bodies as human.

But, totally understand the chart as I have never met a butt-ugly man that thought himself anything less than Adonis material. At first I thought these men had great senses of humor.

Then I got to know them, nope, they really believe it.

I know I’m not now, nor have I ever been, the prettiest rose in the field. I’ve felt beautiful sometimes, but I KNOW I’m “cute” maybe on a great day, “pretty” at best. Even my beloved Grandpa referred to me as the “smart one,” when describing my grouping of like-aged cousins. Tammy & Barbara were the “gorgeous” and “pretty” ones, and my gawd they WERE, absolutely beautiful girls, I was the “smart” one.

Funny thing that is though, flash forward about 20 years and my male cousins all of a sudden realized how fleeting beauty actually is when we had a family reunion after not having one for ten years.

Always loved the Judge Judy line, “Beauty is fleeting, Stupid is forever.”

D.C.

How much is a fixed rate Corprate bond worth in any type of hyper-inflation?

A blue chip company won’t have any trouble paying off low interst rate debt.

I’d rather have Mercedes Benz stock when the Euro caves.

Mercedes Benz stock dropped from 80 in late 2007 to 17 in early 2009. Definitely a safe bet in a crashing world economy.

TE

The Judge Judy line reminded me of this

[img [/img]

[/img]

Granted administrator the company or any blue chip company will lose money before they can lower wages and cut workers when the SHTF. But you still have a share of stock.

As long as they don’t become a Radio Shack and go to zero.

It’s all a crap shoot.

Just received this info last night from my main lumber supplier:

Hampton curtails six U.S. sawmills

Hampton Affiliates, Portland, Ore., has announced that all six of its western U.S. sawmill operations will be impacted by a “rolling curtailment” plan, starting with three facilities during the week of May 4 and shifting to the next three during the week of May 11. That schedule will be reviewed, then adjusted or continued according to changes in current market conditions. Overall board footage impacted by the curtailment will be over 30 million board feet, and involve all of Hampton’s U.S. stud and dimension operations. Shipping departments will remain open at all Hampton mills during the curtailment period, then be subject to closure during any future shutdown extension.

What this means is WOOD IS NOT SELLING and there is a glut!!

1) Exports of wood have dropped off the map

2) And who is building houses these days?

3) Strong dollar makes Canadian wood cheaper

Huh! Too much wood. Ms Freud has been telling me that for years.

Boob and butt implants are the current bubble. What will 60 and 70 yo women look like with gorgeous boobs? When women fall down on the job, pretty boys like Bruce Jenner or Billy will step in to fill their shoes.

A Sick Economy and a Frankenstein Stock Market

The durable orders number, ex-transportation which means aircraft, was very poor this morning marking seven months in a row of declines. It is the trend, not the headline number, that is most important.

Stocks were off to the races, with ‘tech staples’ leading the charge.

The Nasdaq set a new all time high.

The VIX is at its low for this year, an area of complacency we have not seen since the beginning of last December.

If you look closely at the composition of the market, you will find that in the major indices the declines were outpacing the advances.

What this means is that the index moved higher on selective buying in certain heavily weighted stocks.

All in all, this is a good time to take profits and pare back on stock holdings. Not necessarily go short unless you are very aggressive and a short term seasoned trader, but in anticipation that the market momentum wiseguys are expecting the Fed to bail them out further at these valuations.

Or the ECB and Bank of Japan for that matter. We are in one heck of a nasty little bubble here in financial paper.

You might miss another ten percent to the upside, but the risks here make my skin crawl unless something changes. A narrowing market on light volumes with a negative Advance-Decline number. Yikes!

Jesse

[img [/img]

[/img]

I lived thru the 74 collapse. I lives thru the early 80’s collapse. I lived thru the 91 collapse. I lived thru the 2000 collapse. I lived thru the 2007 collapse. I will live thru the ????! collapse.

WHO THE FUCK CARES! THIS SHIT GETS OLD!