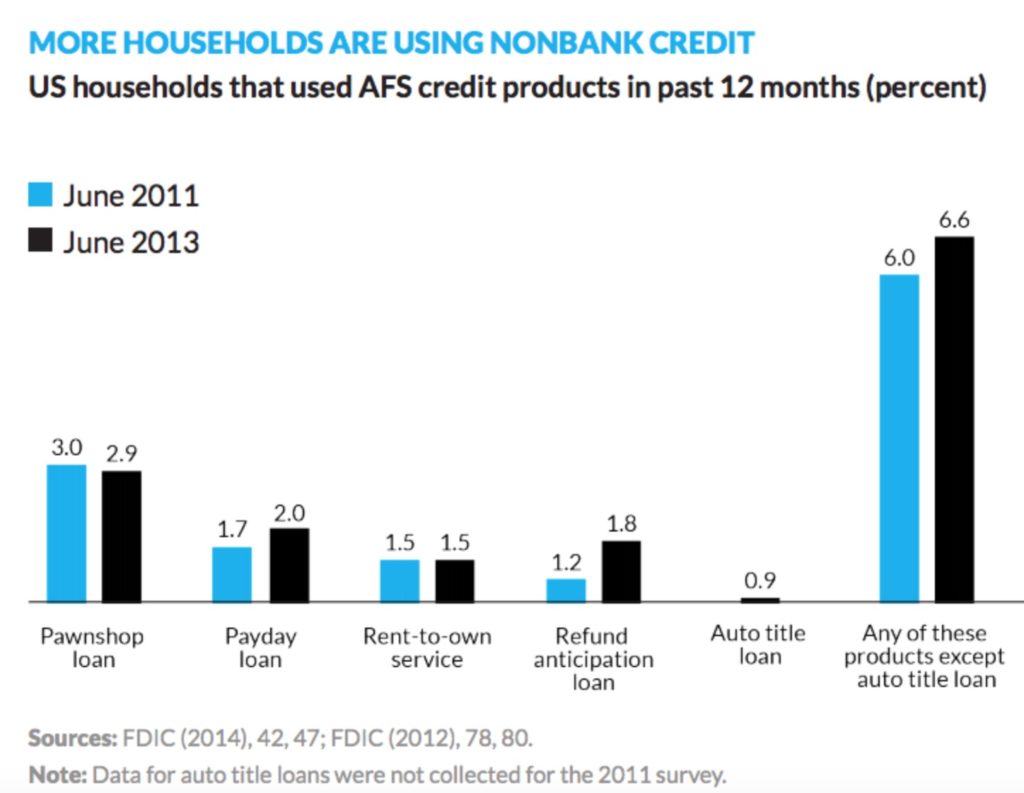

Families’ savings not where they should be: That’s one part of the problem. But Mills sees something else in the recovery that’s more disturbing. The number of households tapping alternative financial services are on the rise, meaning that Americans are turning to non-bank lenders for credit: payday loans, refund-anticipation loans, pawnshops, and rent-to-own services.

According to the Urban Institute report, the number of households that used alternative credit products increased 7 percent between 2011 and 2013. And the kind of household seeking alternative financing is changing, too.

– From the Citylab article: Half of All American Families Are Staring at Financial Catastrophe

It’s an economic recovery so lopsided, corrupt and fraudulent only an oligarch could love it.

One of the key themes at Liberty Blitzkrieg since inception has been to point out that the current economic recovery is largely a sham. While there are certainly meaningful innovations happening in the less regulated and corrupt parts of the economy, such as the technology sector, much of the landscape is riddled with waste, fraud, cronyism and stagnation. So much so, that I have gone ahead and characterized the entire post crisis economic environment to be the “oligarch recovery.”

Nowhere is this more evident than within the many statistics demonstrating that things for the growing American underclass are getting worse, not better. An article published last week by Citylab makes the point. It notes:

The most frightening finding in the Federal Reserve’s Report on the Economic Well-Being of U.S. Households in 2014 concerns a matter of $400. Four-hundred bucks. Twenty twenties. Four Benjamins.

Or just enough to crush half of all American households.

“Forty-seven percent of respondents say they either could not cover an emergency expense costing $400, or would cover it by selling something or borrowing money,” reads this year’s annual report.

Families’ savings not where they should be: That’s one part of the problem. But Mills sees something else in the recovery that’s more disturbing. The number of households tapping alternative financial services are on the rise, meaning that Americans are turning to non-bank lenders for credit: payday loans, refund-anticipation loans, pawnshops, and rent-to-own services.

According to the Urban Institute report, the number of households that used alternative credit products increased 7 percent between 2011 and 2013. And the kind of household seeking alternative financing is changing, too.

Take a long hard look at the image above. As the public was repeatedly told that the economy was recovering and the stock market was booming, use of payday loans and other “alternative financial services” increased.

While that figure might seem small—it’s an increase of about 750,000 households total—it’s a significant figure for the economy in recovery. Families that are looking for credit aren’t finding it in mainstream financial institutions. “You used to be able to get small loans for reasonable rates, below 36 percent,” Mills says. “That’s what’s opened the door for more predatory products.”

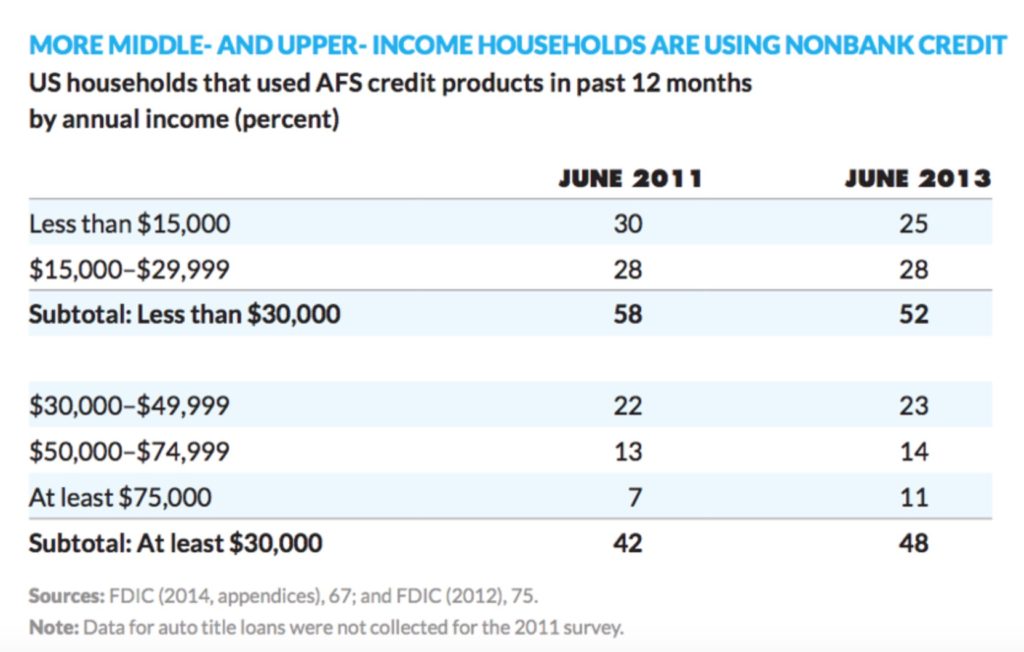

The nature of households looking for alternative financial products, including predatory loans, has morphed during the recovery. According to Mills’s research, the share of households seeking non-bank credit with incomes above $30,000 increased from 42 to 48 percent between 2011 and 2013. And the share making more than $75,000 increased from 7 to 11 percent over the same span.

We may as well go ahead and place that as the tombstone for the socio-economic entity previously known as the middle class.

It’s not the case that every one of these middle- and upper-class households turned to pawnshops and payday lenders because they got whomped by an unexpected bill from a mechanic or a dentist. “People who are in these [non-bank] situations are not using these forms of credit to simply overcome an emergency, but are using them for basic living experiences,” Mills says.

For related articles, see:

Pennsylvania Looks to Legalize Payday Loans by Calling Them “Mirco-Loans”

TBTF Banks Enter Payday Loan Business with 500% Interest Rates

Just Another Tale from the Oligarch Recovery – $100 Million Homes Being Built on Spec

Portrait of the American Oligarchy – The Very Troubling Income and Wealth Trends Since 1989

In Liberty,

Michael Krieger

[img [/img]

[/img]

Despite the fact that payday loans come at high interest rates, people are still attracted to them. This is mainly because payday loans are accessible on a very short terms notice without a credit check. These qualities make them alluring.