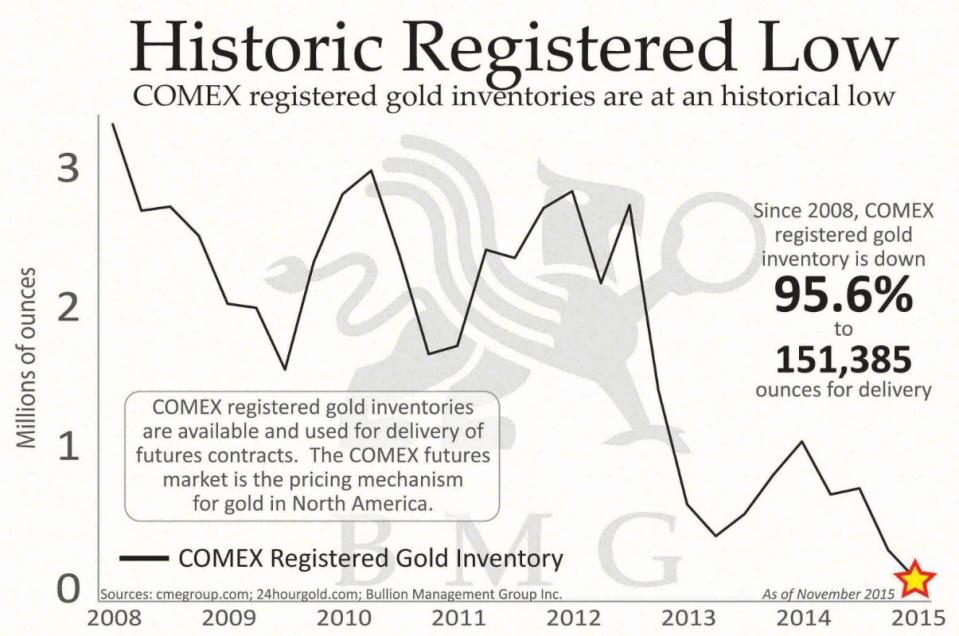

The charts below reveal a dramatic decrease in physical gold on hand in the U.S. to back up all the paper derivatives floating out there. The physical gold has flowed from West to East over the last few years. The price of gold has been driven to 5 year lows through the use of paper derivatives, as the physical supply isn’t keeping up with the demand by any stretch of the imagination.

The question is how long can this go on? In a real market, constrained supply and huge demand means higher prices. Higher prices would reveal the fallacy of central banks having everything under control. Can bankers manipulate derivatives forever to keep the price of gold from reaching its true fair value?

Yes…..five minutes after the shit hits the fan (for real).

The push against supply vs demand AND mark to fantasy will result in a take-down of our financial system. Cracks are appearing daily.

Be prepared (to kill and loot them when they make a run for their jets and yachts).

The IMF is supposed to announce at the end of the month that the Chinese renminbi will be included in the SDR’s as part of their basket of reserve currency’s, along with the Yen, Euro, Dollar and the Pound Sterling. Officially this won’t take place until October of 2016.

This probably wont change the price of gold today, but as China has been a net purchaser, at some point in the future China could use this as an advantage, no?

I’m just along for the ride.

Remember that price is set at the margin. The vast majority of assets (houses, bonds, stocks, precious metals, etc.) are not traded at any one time. There is a bidding process which settles on a price for trades that do occur. This bidding process results in price discovery, which in turn sets the current price range for the entire asset class. If any investor or group believes that the price-setting mechanism is broken, they can and probably will rush into the market and bid up or bid down the price to either accumulate or unload the ‘mis-priced’ asset. If there is any ‘scarcity’, it is probably due to hoarding. This ‘scarcity’ has obviously not yet affected the demand/supply parameters that drive price increases. Therefore, the hoarders are holding a currently depreciating asset.

Is there anyone out there who thinks they can, by acting alone, produce an ounce (or many ounces) of Gold, and obtain a price that varies significantly from the daily quotes? There is no fraud here, folks — just wishful thinking. Right now, in a macro-deflationary environment, with real interest rates trending up, the US Dollar is also trending up, and the price quotes for Gold in US Dollar terms are trending down. This should not be a surprise at this point, whatever conspiracy theories one clings to.

Bob, I take your point. Technically speaking there may not be fraud. If the commodity market as a whole takes a plunge, gold goes down also. If oil dives, ditto for gold. But, isn’t it the case that what’s being traded is just paper gold, or rather digital gold. If you take a child and put before him a piece of paper on which it’s written 1oz.gold, and a real 1 oz. gold eagle, and ask him if they are the same thing, he will look at you as if you are a retard. And yet, in our “markets” the two are the same.

That’s the real fraud, no?

Good point, Archie. So many things economists spew would fail the same test. Take negative interest rates: ask a child to loan you a dollar and later you will pay him back 95 cents. Again, he will look at you like you are a retard. Yet most adults just buy into whatever the economists say…

so, who are the stupidest people on this particular totem pole?

Drud, yes I agree. The entire financial edifice is fraudulent in this sense. A child, who has not been given the disservice of being brainwashed by our schools and universities, not to mention our corrupt media, is smarter than Paul “sack of shit” krugman, may he roast on a spit in hell for eternity.

This is this country we live in, with a giant funhouse mirror put to us daily. It is a toilet bowl filled with turds, a lunatic asylum of stuffed shirts, a Chinese fire drill repeated endlessly inside a midget circus freak show.

Die Amurrica! Die already!

So Bob believes that all markets are valued properly at all times and there are no games being played by anyone using derivatives. Bob believes the Wall Street banks haven’t been caught rigging the LIBOR market, the stock market, the currency markets, and just about every market there is. Bob believes the Fed doesn’t intervene in the markets whenever they deem it necessary. Bob believes the Fed and Wall Street banks didn’t create the largest housing bubble in history by using control fraud, deception, and misuse of derivatives.

Bob is such a trusting fellow. Everyone plays fairly in our free markets and there can’t be bubbles in stocks, bonds, and real estate because the market is always right. Just like it was with internet stocks in 2000, home prices in 2005, and stock prices in 2008.

It seems the Chinese believe price discovery will eventually reveal what stinks in the state of Denmark.

Bob must be right.

Bob,

Wow, where did you get all that wisdom ?

Perhaps your sister sets her prices at the margin as well ?

How about I flood the market with paper promises to bang your sister ?

How long after she gives up when her cunt is leveraged 300 to 1 ?

In a few years you will be checking Ebay to see what your bullion is worth – not the spot price.

well I’m sitting here thinking Oil is Money Too…for a time is was $140.00 Us dollars per barrel almost crushed us…Will oil rise to those levels again? Mike in Ct

Don’t care what these fuckers are doing in the metals market. Got some physical gold and silver. Might need it, might not. If not, my heirs will get it. It won’t disappear when I die.

The deal is that the economy is now nothing but a monopoly board game. Nothing is real and they always collect $200 when they pass go. They make sure that there are extra get out of jail cards, it all makes much more sense when you look at it like this.

out of town again few days, but I got to chime in ,

@ Bob in your bidding process you have customers going long and going short and boom price is indeed discovered , but the RAMPANT ‘naked’ shorts is where the problem begins . If im selling something I don’t have but I can ‘settle’ in fiat that I create out of thin air um there is a problem sir . I actually made a coin or 2 because COMEX would not deliver , but on the other hand offered a decent premium to me for looking the other way and not taking delivery . Fraud? Absolutely . Lets look at housing also does Mark to Market mean anything? Not anymore due to MBS which were marketed to pension funds ,soveireign welth funds etc,but does MERS ring a bell? If they were all on the market ,all the reposed houses um it would have collapsed due too much supply . Bankers lobbied for mark to unicorn fucking prices lol and here we are today ,nothing resolved . Fraud? Are you fucking kidding me ? So much its still stupid lol .

On price discovery for PM’s , how can you value a tangible? with any fiat currency ? Why did USA go off international gold standard in 1971? Up till 1981 the gold/fiat currency was pretty fixed I.E nation state created more currency gold went up , now it is so outta whack their is no real fiat currency price . So based on whatever purchasing power of PM’s or fiat or whatever the fuck you wish to use what gained or lost? If you simply play paper games with fiat you can actually earn a buck , or so it seems ? Is it real and 100 years from now it retains its PURCHASING power then its real. Artifiacialy created currency units are not REAL and only serve the purpose of the privately owned central banks . Why its called fiat . Fraud is rampant ,play that game accordingly

What if there is not a total worldwide economic collapse?

What if gold and silver at some point become at least a part of a new reserve currency, whether it’s one country’s currency or a basket of currency’s? There is a slow transition away from the dollar and the acceptance of a new reserve currency.

People talk about $100k gold and I agree, who would want $100k if the dollar was no longer the top dog. But if all the reports are true and the east really does have all the PM’s they say they have, then wouldn’t if stand to reason they will use those PM’s to back a new reserve?

So the house that was bought for $18k, that is now “worth” $98k would now be “worth” whatever the new reserve is, or maybe $300k in dollars.

I’m probably wrong but to me wealth is not how much paper you have, but assets that can be traded for whatever the currency of the day might be.

Another thought-what about the BRICS consortium creating their own gold backed trade medium and forcing the USA to do the same. Our gov. may create an international trade currency with gold backing and leave we the people with our own in-house currency which is strictly fiat.

[img [/img]

[/img]

Admin, Archie, etc, I am talking about prices, which fluctuate by the millisecond, and have to be reckoned with by everyone who decides to hold an asset. Of course prices can be manipulated and influenced — we see that all the time, as our esteemed Admin discussed. But paper contracts get settled by being offset or delivered — just as the majority of oil in a storage tank at any given time is not drained out to settle futures contracts!

Please wake up and realize the price of Gold is declining for some very real reasons, and the trend has not ended. If you want to fight it, go out and buy, buy, buy — see if that influences the trend. At least you can console yourself that you didn’t pay $1900 for every ounce you hold…

And when the price turns around, and I definitely believe it will, the same people who cried conspiracy will probably hail the return of ‘normally functioning markets’ — except, that undoubtedly, there will be some upward price manipulation and influencing going on as well. The problem is, we don’t know when that will happen, and if it takes long enough, many of us will be dead.