The mainstream media is not extensively reporting on the “experimental” bail-in that the EU imposed on Cyrus. The bail-in, that they swore would never be applied to Europe, will officially begin in January. This new power will be in the interest of taxpayers as they will no longer be forced to pay for failed banks that were created by the childish structure of the euro that was created by lawyers who never understood the economy. But wait a minute — aren’t taxpayers the people with deposits in banks? Hm. Moving to electronic money is also about preventing bank runs. The bottom-line here is that they will just take your money to save bankers. Eliminating cash accomplishes two things: (1) they get to tax everything, and (2) you cannot withdraw money from banks.

The bail-in directive was agreed upon on January 1, 2015, and the bail-in system will take effect on January 1, 2016. So here we are, just in case you missed this one. Their website states:

Parliament and Council Presidency negotiators reached a political agreement Wednesday on the draft bank recovery and resolution directive, the first step towards setting up an EU system to deal with struggling banks. This directive will introduce the “bail-in” principle by January 2016, thereby ensuring that taxpayers will not be first in line to pay for bank failures.

The entire system of insuring banks after their collapse during the Great Depression was to restore confidence to end the hoarding and revitalize the economy. Now they have allowed bankers to do everything they did before, and they have reversed the insurance created to restore confidence in banking. They justify this by claiming taxpayers will not have to pay for the failed banks.

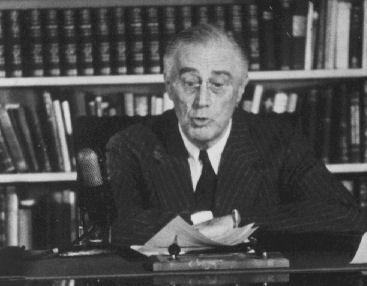

Over 9,000 banks failed during the Great Depression in the United States; an estimated 4,000 banks failed in 1933 alone. Roosevelt’s fifteen-minute radio address to the American people on Sunday evening, March 12, was his first Fireside Chat. He told the public that only sound banks would be licensed to reopen by the U.S. Treasury: “I can assure you that it is safer to keep your money in a reopened bank than under the mattress.”

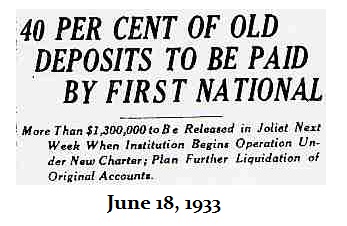

When the institutions reopened for business on March 13, 1933, depositors stood in line to return their hoarded cash to neighborhood banks. Within two weeks, Americans had redeposited more than half of the currency that they had withdrawn from the banks due to the collapse in confidence.

Banks failed even after the bank holiday. The process was indeed a “bail-in”. People would get whatever the scraps were worth upon the collapse of the bank. Absolutely everything the governments did to restore confidence has been reversed in Europe. Yet, they try to “stimulate” the economy with QE? Just brain-dead.

Even if it is not law here. The natural course of life says, we the people, are bailed in too. 19,000,000,000,000.00 says so.

Oh, the unintended consequences of “for the greater good” public policy of the last 50 years. They’re happening faster and faster now.

In (my novice understanding of) chaos theory, the oscillations within a system have a tendency to randomly grow wilder and wilder until catastrophic cessation. This – to me – would sure seem to explain the extremes we’re seeing today in the financial, governmental and sociological realms.

We’ve been watching TPTB kick the can down the road for decades now. As the end of the free-goodies-for-all-road nears, the measures necessary to meet previously-agreed-upon obligations require ever greater extremes of central control and money printing. What we will witness in the next few years will be epic.

It’s obvious the big which is the smart , Money, will transfer its money first. Somewhere, where it is safer.

The dumb subservient little guy gets what he deserves.

The Catastrophic Threat Of Bail-Ins

Submitted by Jeff Nielson via SprottMoney.com,

It has now been more than two and a half years since the Cyprus Steal, the first “bail-in” perpetrated in the Western world, occurred. Before reviewing the history of this newest financial atrocity, it is necessary to define the terms.

The term “bail-in” describes a scenario in which a bank confiscates private property to indemnify itself for losses it has suffered. A bail-in is a totally lawless theft of assets, as there is no principle of law (of any kind) that could authorize such a seizure of private property. And in fact, there are many principles of law that demonstrate the lawlessness at work here. As with much of the financial crime jargon, “bail-in” is simply another gibberish euphemism like “quantitative easing” or “derivatives.”

As custodians of the financial assets of their clients, banks represent a form of trustee. The purpose of any trust relationship is to provide absolute security to the beneficiary of the trust (i.e., the legal owner of the property). Thus, one of the most fundamental principles of our legal system is non-encroachment regarding the property held in the custody of a trustee.

From a legal standpoint, it is like there is an invisible and impenetrable wall that surrounds the trust property. The only exceptions to this wall (ever) occur when the trust beneficiary makes a legal request for some disbursement or related transaction, when the trust itself directs some form of action (in the interests of the trust beneficiary), or when the trust allows the trustee to manage the trust assets on behalf of the beneficiary.

The idea of trustees using assets for their own benefit or (worse) claiming ownership of any trust assets represents one of the most serious forms of financial crime in Western civilization. Given this context, how did the government of Cyprus respond when its own Big Banks whined and claimed that they “needed” to confiscate deposits in order to pay off their own gambling debts? It meekly rubber-stamped the lawless theft.

How did other Western governments react to the violation of one of the most sacred legal principles in our entire financial system? They simply nodded their heads in unison, and, as a single chorus, called the Cyprus Steal “a precedent” – a template for future systemic financial crime in their own regimes.

Beyond the perfect choreography demonstrated by Western governments immediately after this act of theft, how do we know that the Cyprus Steal was a scripted event orchestrated by the Big Banks? To begin with, all of the Big Money deposit holders in Cyprus had already moved their money out of Cyprus banks before the Big Banks began their pillaging and plundering. The “fix” was in.

Not a single Western government raised the slightest qualm about violating one of the most sacred principles of law in our legal system. Rather, these puppet regimes went about creating their own “rules” as to how/when the Big Banks would be allowed to steal property from the accounts of their own account holders. The Harper regime entrenched “the bail-in” in Canada’s official budget, while other puppet regimes were sneakier and more circumspect when “legalizing” this crime.

Here it is necessary to back up and address the “reason” (excuse) behind this newest form of systemic bank crime. The “bail-in” is the ultra-insane culmination of the “too big to fail” doctrine. By this doctrine, any and all assets, public or private, in our financial system can and will be sacrificed (stolen by the Big Banks) to prevent any of the Big Banks from “failing” – that is, going bankrupt as a consequence of their own reckless gambling .

The legal and economic principles violated by the concept of “too big to fail” are too numerous to list. However, they begin with the following objections:

1) The concept of “too big to fail” is contrary to numerous tenets of capitalism. In any capitalist/free market system, insolvent entities are supposed to fail in order to correct the misallocation of assets. Any entity that grows to become an existential threat to the system is simply too big to exist.

2) Banks should never be allowed to gamble. Period. There would have been no need for the $10’s of trillions in “bail-outs” given to this crime syndicate following the Crash of ’08 if our puppet governments had not previously erased our laws that prevented such gambling.

3) “Too big to fail” is based on an overtly criminal premise called systemic blackmail: “Give us everything we demand, or we’ll blow up the financial system.” It is extortion in perpetuity: financial slavery.

Note how (2) and (3) relate directly back to (1). Why shouldn’t banks gamble with their clients’ assets? Because by doing so they not only jeopardize the property they are holding in trust but also become a threat to the financial system. Why shouldn’t financial entities be allowed to grow so big they become an existential threat to the system? Because size (as we now see) gives these Big Banks the leverage necessary to blackmail our corrupt, limp-wristed governments, perpetually.

So what is the only possible way to put an end to this Big Bank blackmail? Well, should our corrupt governments ever decide to once again enforce our anti-trust laws , we can end the cycle by smashing these Big Banks “down to size,” or down to the largest size allowed by law . Indeed, “too big to fail” is the ultimate example of why we need anti-trust laws and why they need to be vigorously enforced.

Anti-trust laws are anti-corruption laws. For decades, there has been almost no enforcement of our anti-corruption laws. The result is a global economy now almost totally dominated by just one of the major (and illegal) oligopolies that has emerged: the crime syndicate readers know as the One Bank .

It is this crime syndicate that engages in the systemic blackmail of “too big to fail,” supposedly to indemnify its Big Bank tentacles for the losses they incur. However, in almost every case, these “losses” are nothing but an accounting sham: paper losses owed by one Big Bank tentacle to another. No entity could ever be bankrupted by a “debt” owed to its right hand by its left.

The “losses” do not even exist, but the blackmail and fraud is all too real. Having totally depleted the public treasuries of most Western nations with its “bail-out” extortion following the Crash of ’08, the One Bank needed a new mechanism of theft by which to continue its permanent, institutionalized blackmail.

The bankers demanded that they be allowed to steal private assets (already in their custody), directly, any time they claimed to suffer a “substantial loss.” Our puppet governments, as usual, caved to the crime syndicate’s demands, and the “bail-in” was born.

What is at risk with a “bail-in?” According to the (perversely named) Financial Stability Board : any and every paper asset in the custody of the Big Banks and (potentially) any paper asset in the custody/control of our governments. The Financial Stability Board is one of the propaganda mouthpieces of the Big Bank crime syndicate, and its “guidelines” have been directly cited as authority by several of these puppet regimes, including the Canadian goverment.

How do people protect themselves from the massive bail-ins that are imminent as the Next Crash approaches? There is only one way: get your assets (i.e., your wealth) out of all paper instruments. This includes the fraudulent paper currencies of our fiat-currency/ fractional-reserve Ponzi scheme system. Hold only enough wealth in paper instruments to satisfy current cash-flow requirements and short-term “emergencies.”

For the longer term financial Armageddon that is now inevitable, the only secure form of wealth-preservation is the oldest-and-surest tool for that task: precious metals . Rather than offering holders short- or medium-term protection for their wealth, gold and silver represent lifetime security, what people are supposed to have, and what most people still think they have when they entrust their wealth to a bank.

Once upon a time, we had strong, vigorously enforced laws that made a bank the safest place to store paper assets. That is no longer. Now banks are where your wealth is most likely to be stolen – and by the bank itself. Thanks to the bail-in, the term “bank robbery” now has an entirely different meaning.

When you put money in a bank it is no longer your money, it belongs to the bank. The bank is free to use that money as they see fit withing legal boundaries the same way you are when you, say, take a cash advance on your credit card.

This has already been ruled by the courts, your legal status is essentially that of an unsecured creditor to the bank.

all of this “bail in” discussion is for naught

bankers do not have a right to take depositors monies…

regardless how many euphemisms they dream up…

it is called stealing.

A gov. that allows it’s citizens to be whip-sawed, and then

have their paltry savings stolen deserves…………..fill in the blank.

suzanna,

They do.

As I mentioned, it isn’t the depositors money (it it’s in an account and not a safe deposit box) it is the bank’s money and the “depositor” is just a creditor of the bank.

Otherwise they would not be able to do any banking business (loans, mortgages, etc.) other than having a vault full of bills you can make deposits to and withdrawals from on an even basis and for a storage or transaction fee (which is a service that it actually unavailable to the best of my knowledge, but I’d like to find one if it is available).

The banks have EVERY right to take and use your money as they see fit!!!!

There is no such thing as a “depositor” – you are the “lender”. Check their terms and conditions… you know….. that form you signed when you opened your account? – the one that has over 10 pages of extremely fine print?, there you will find the terms and conditions.

The bank is no different than your kid who asks to borrow money from you and doesn’t pay you back – only offering excuses. Your only recourse is not to lend them anymore money!

Except bankers are more stealthy…… they offer you “shares” in the institution, you know….. those pieces of worthless paper called stocks in exchange for “their” theft of your loan to them.

People need to wake up!!! Go watch “It’s a Wonderful Life” again and forget about George and Mary – but pay special attention to how the bankers play their game!! Same game – but different actors this time.