Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Americans across the country have been priced out of the U.S. housing market since the “recovery” began due to a combination of factors; stagnant wages, private equity purchases and money laundering foreigners. As such, many potential first time buyers have been sidelined despite the availability of meager 3% downpayment loans from the FHA as well as Fannie Mae and Freddie Mac. Fortunately for the U.S. ponzi scheme economy, the U.S. government has a solution. Lower mortgage insurance premiums.

First-time homebuyers are finally jumping into the U.S. property market.

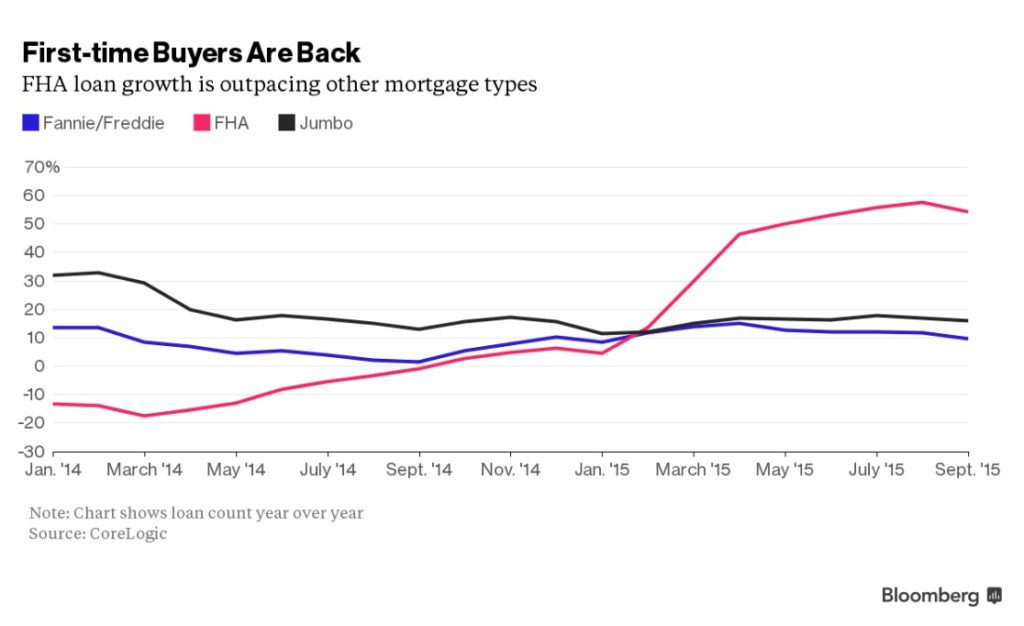

Need proof? Look at the mortgage market’s fastest-growing segment: loans with low down payments insured by the Federal Housing Administration.

Originations of FHA-backed mortgages, used predominately by first-time buyers, were up 54 percent in September from a year earlier, according to the most recent data from CoreLogic Inc. By December, the FHA insured 22 percent of all loan originations, up from 17 percent a year earlier, according to data compiled by Ellie Mae Inc.

Yes you read that right. Up 54%.

President Barack Obama’s administration, in January 2015, reduced mortgage-insurance premiums for FHA loans. That lowered the cost of getting a home loan and brought in at least 75,000 new borrowers with credit scores of less than 680, according to a November report from the U.S. Department of Housing and Urban Development.

The rate of FHA lending, which had been in decline through most of 2014, tripled the month after the insurance premium was cut, according to CoreLogic.

This chart says it all:

The FHA estimates that borrowers save $900 a year on average as a result of the lower premium. The move made FHA-backed mortgages more competitive with other loans that have low-down-payment options, said Guy Cecala, publisher of the newsletter Inside Mortgage Finance. While mortgage giants Fannie Mae and Freddie Mac have an option for borrowers to put down as little as 3 percent, they require private insurance with risk-adjusted premiums based on credit scores, debt-to-income ratios and other factors.

If $900 a year is the difference between buying a home and not buying a home, it might not be such a good idea.

“Last year’s decision to lower premiums was designed to open the door to those previously priced out of homeownership,” HUD Secretary Julian Castro said in an email. “We’ve seen positive results with new buyers entering the market and making the American dream of homeownership a reality.”

As usual, muppets always get fleeced before the cycle turns.

We had a kid here at work who got a 3.75% loan on a 150K + house ( I thought it was around 185K originally ) with 3% down . He makes 18.00 an hour. His wife works some but her past work history is spotty . I hope they can keep the house over the long haul . The house was a repo flip….the flipper did a nice job .

I am still seeing the FC market still going fairly strong…and that’s in New England where supposedly those are down. The worst part of my job is going to a house that has just gone to the FC auction and talking to the former owners about their “options”. Never gets easier.

“Hi, my name is_____________and I am a real estate agent that has been contracted by your bank. Are you aware your home has gone to foreclosure?” BLANK STARE.

Response: “I didn’t know…I was doing a loan modification, and I know my loan was sold about 5 times already….”

Me: “I understand. No one is coming here to throw you out on the street. The bank will work with you to come to a resolution. They do offer money for you to move out. Is that something you would be interested in?”

Response: “How long do I have? I have a two year old and my wife just got laid off….”

That is pretty much verbatim what I hear every time.

Someone refresh my memory, how’d this end last time?

Oh, right. Total shitshow. And now we are doing it with cars, too.

After 40 showings we got four bids, two were ZERO down. I found that suspicious. I’ll be in Grand Junction in three weeks. Scared to death!

Gator,

That shitshow was for the rest of us. The TBTF banks and a few others at the top made off like bandits ,and probably will again. And again.

Incidentally, when I took my car for an inspection last month, there was a sign posted, “ask us about financing your car repairs”. God help us…

Gator,

That means save up your cash and get ready for some bargains to be coming on the market a few years from now (or maybe less).

Hmm.. maybe it’s getting time to sell and run. I have a place I like, completely paid for, but I am NOT happy with my fellow condo-owners and am sick of being the “go-to” person for a bunch of parasitical, shirking landlord- investors.

And I’m noticing sudden and steep appreciation in the recent sales prices of units in my building, due partly to escalating rents, but partly, I’m sure, to the loosening lending standards.

‘new surge in sub prime FHA loans’ ……………………………. Unpossible !!

@Teri, thats pretty sad, financing auto repairs, but its not really surprising. Its been posted on TBP before and I forget the specifics, but most americans don’t have 1K to cover an emergency such as a car repair, etc.

I noticed something while driving today that I’ve never really thought about before – loans against your future tax return. Im sure this has been going on for a while, but I never really thought about it before. Those loans are most definitely very high interest, so people doing that have to be desperate. Those loans are going to carry higher interest than just a credit card. So, if people are willing to do that, that means not only do they not have 1000$ to their name, they don’t even have 1000$ in AVAILABLE CREDIT to their name, since why would they borrow at a higher interest rate when they could just put what they think they need on a credit card for a lot less money.

I bring up that thought because these are probably the very same people with terrible credit and no money buying houses.

http://www.blacklistednews.com/America_Will_Spend_More_on_Taxes_than_Food%2C_Clothing%2C_and_Housing_Combined_%28Graphic%29/48469/0/38/38/Y/M.html

America Will Spend More on Taxes than Food, Clothing, and Housing Combined

deep state banking/CIA banking

http://www.marketskeptics.com/2011/06/the-esf-and-its-history.

https://youtu.be/j61dWtJrsgY

As usual Obama was able to find several of the least competent people on the planet to run the housing bureaucracies, I would have thought he had run out of idiots by now with the rest of his cabinet and administration. If he is not careful there will be none left for Hillary.

Merry go round and round. My younger sister and her metrosexual husband went BK in 2009, lost their McMansion (tract home built by border jumpers with inferior Chinese material) they paid over

600k for. Short sold it for 180K. They are in the process of closing on a 800k Chinese tract home in Temecula,CA. Zero down, 100% financing. Did I mention they are Obama voters? You guys probably already had them pegged as such. I would like to apologize in advance for these 2 fucking morons fleecing you hard workers a 2nd time, as I know in my soul they will be BK again in a few years. The stoopid, it Berns!

goofyfoot, it shouldn’t be possible for people not even a decade out of BK to buy an $800K house with no money down. But you left out other info, such as what is their combined income and do they have other debt? I’m willing to bet they also have $40K cars bought with 7 year loans, and a mountain of card debt.

We now have a system that lavishes awards on the dishonest and parasitical, while punishing people who earnestly try to do right. Buyers who come with 10%-20% down and low to nonexistent ‘back end’ debt, are being turned down for conventional fixed loans, but a scammer has no problem buying an expensive new subdivision house priced in the high 6 digits because the developer will see to it that the buyer gets financed no matter how shaky his credit, or how outlandish the debt-income ratio is for the loan. The loan your relatives are getting is probably an ARM- they are being written again, you know, and when it resets, these people will be in default again.