Deferred gratification is an unknown concept to most Americans. Wall Street and Madison Avenue have colluded to brainwash a dumbed down populace into going into perpetual debt in order to keep up with the Joneses and live for today. Saving for the future is for suckers. When 65% of Americans roll a credit card balance at 10% to 25% interest, you know our government run public educational system has succeeded in producing brain dead dumbasses. Charge!!!!

Credit cards are an addiction that most Americans never shake.

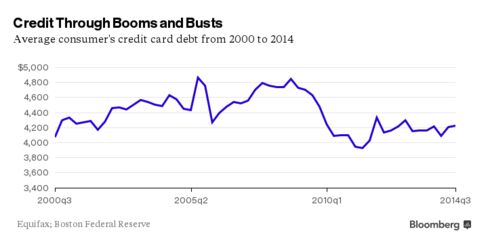

Through the booms, busts, and recessions of the last 15 years, U.S. credit habits have been remarkably consistent, according to a recent study from the Federal Reserve Bank of Boston. Most people carry over a balance from month to month, the study said, and they eagerly gobble up any additional credit their card-issuers offer.

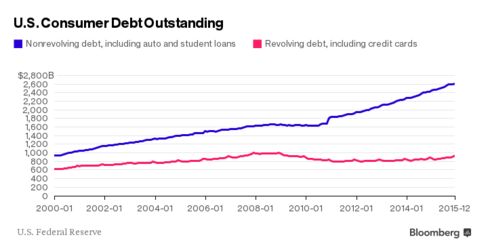

It adds up fast. Consumers owed a total of $936 billion in credit-card and other revolving debt in December, according to Federal Reserve data released on Feb. 5. They’ve added $103 billion since April 2011, but they still have less revolving debt than just before the financial crisis in 2008, when they owed $1.02 trillion.

To see how individual Americans’ relationships to credit cards has changed through time, researchers at the Boston Fed’s Consumer Payments Research Center analyzed a huge data set, a sample of 5 percent of U.S. credit report accounts from 2000 to 2014. Here are some findings:

1. The Typical American Is Always in Credit-Card Debt

About 35 percent of those aged 25 to 50 with credit cards are “convenience users,” who pay off their balances each month. The majority, whom researchers call “revolvers,” carry debt forward from month to month and usually pay high interest charges in the process.

Americans don’t really taper their credit-card borrowing until their fifties. Even at age 70, 45 percent of credit-card users aren’t paying off their credit cards each month. And the typical 80-year-old still has more than $600 on a credit card. “The median person is always borrowing, although at the end of life she is not borrowing much,” the study concludes.

2. Americans’ Debt Addiction Begins in Their Twenties

Between ages 20 and 30, Americans rush to embrace credit-card debt. Their credit-card limits jump about 450 percent in that time, while their debt rises almost as quickly, by more than 300 percent.

For young adults just starting out, credit cards become a substitute for savings. “People in their 20s don’t seem to save much,” said Scott Fulford, a Boston College professor who wrote the study with Scott Schuh, director of the Boston Fed’s Consumer Payments Research Center. “Well, maybe they’re not saving very much because the way they’re ‘saving’ is just by getting higher credit limits. That provides the funds for emergencies that they need,” Fulford said.

3. Old Habits Die Hard

As Americans get older and more mature, they still rely heavily on credit cards. While 20-year-olds use more than half their available credit on average, 50-year-olds use almost 40 percent.

The study finds that individuals have “very stable” credit habits over time. Some might typically use more of their available credit and others less, but each person’s use of credit cards doesn’t vary much during the course of his or her life. Finances are sometimes disrupted by shocks—perhaps a car repair, a medical emergency, or even a bonus—that do cause people to alter their credit habits. Any disruption is temporary. Within two years, an individual’s credit use is mostly back to its ordinary pattern.

4. If You Can Borrow More, You Probably Will

Americans borrow more in good times and less during recessions. The driving factor isn’t our mood about the economy. Borrowing seems driven by our credit limits. When banks offer us a higher limit, we use it. When they cut us off, we tighten our belts.

Banks are constantly adjusting how much credit they give customers. The average credit-card limit rose about 40 percent from 2000 to 2008, then plunged about 40 percent during 2009.

Credit limits have the biggest effects on people who carry debt forward from month to month. When offered a 10 percent increase in credit limits, these “revolvers” subsequently increase their debt by 9.99 percent, the study finds. In other words, revolvers—the majority of U.S. consumers—typically use almost every extra cent offered by their credit card issuers.

This is a striking statistic, but it’s hard to know what conclusion to draw from it. Are most people just incapable of resisting temptation? Or are they in such desperate economic straits that they need more credit to get by? It may be a combination of the two, and the study’s co-authors are planning follow-up studies on these questions.

[img [/img]

[/img]

IS as a matter of fact, it is starting to look like it will be this way “forever”, or at least as much forever as I have left. I have been convinced that the S is going to HTF since the late 1970s. I didn’t really start “prepping” until I purchased my first property in the 199os – a duplex on 12 acres so I could rent out the other half to pay over half of the mortgage yet still have some land for gardens, animals, etc if/when needed. I set up some shelves in the basement and started collecting canned goods, rice, flour, etc. That was before we even called it prepping and I was doing it anyway. I didn’t get into firearms until after my hubby moved in – he taught me well so I have that covered now, too, as well as having him around to guard my back. I should have been collecting large amounts of PMs back then, but I was only buying one coin here or there. Since then I have amassed some PMs, but most of those are under water at this point and really, how much PMs do you need? The value of PMs vs the current currency can go down significantly as we see right now. If the S really HTF there could be a significant period where PMs are pretty much useless – you can’t eat PMs and it is also likely that the govt will confiscate them when they get into a serious crunch- they did it before, and you can only carry so much PMs if you have to get out of dodge (if you even have the time to go get them), so I don’t see a point to having too much saved in PMs. You can only stash so much toilet paper, and it looks like real estate (at least where I live) still has a ways to drop. Besides if the S really HTF how much meaning is there going to be in a piece of paper that says that you own some property if you’re not physically occupying it?

At this point I have been prepping my whole life and I have very little to show for it. I have been planning for a big SHTF, but it’s starting to look like that won’t happen in my lifetime. Even if it does, hubby and I are too old and sick to live without the creature comforts this society still supplies and I’m just tired. Most of the pundits are talking about it being at least a year or so (still!) before TSHTF so I’m thinking I should just buy the big screen TV and the fancy couch and sit here and watch American Idol if that’s what I feel like doing. Or maybe I should liquidate everything and take to the road in an RV and see the sights before they’re all gone. Or maybe just go on a cruise. So what if I waste what money I have left? Either the S won’t HTF and I’ll have SS and medicare to live on or I won’t. I’m not sure it makes that much difference.