Submitted by Tyler Durden on 05/02/2016 23:01 -0400

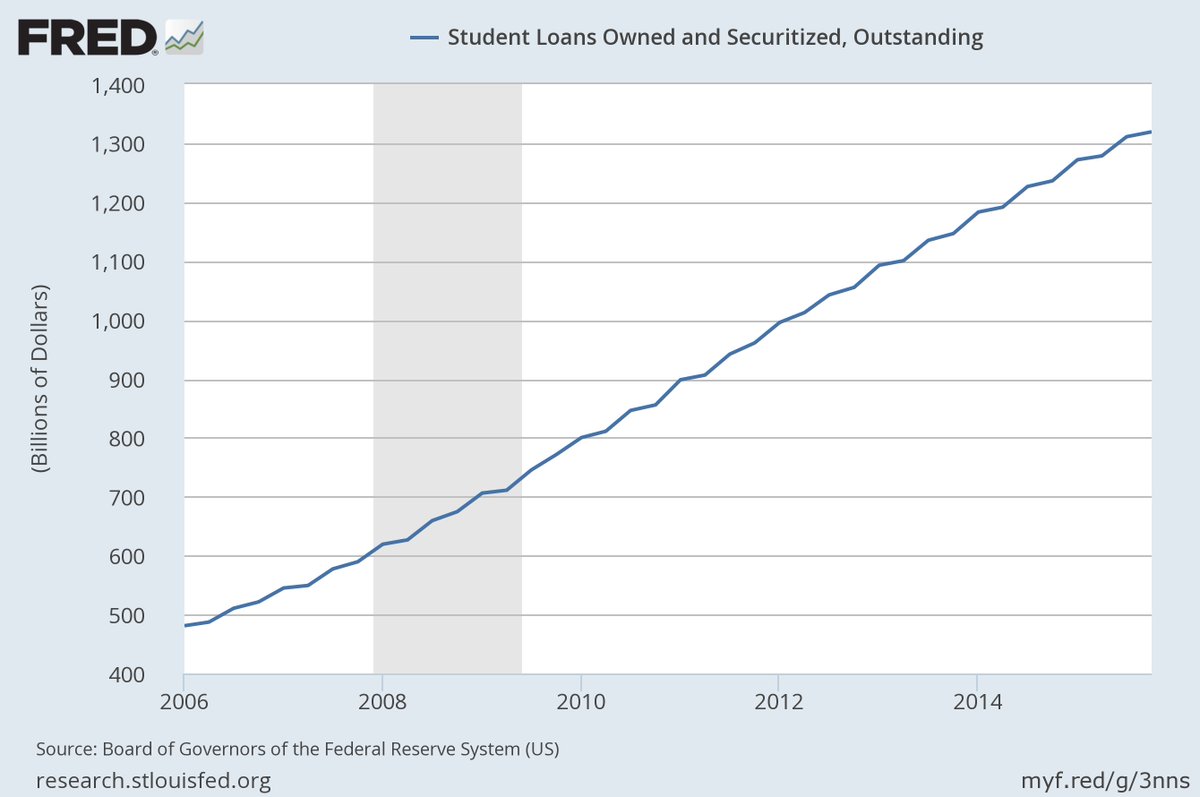

For anyone concerned that $800 billion in student loans over the last decade simply won’t be enough debt burden for millennials to carry, worry no more, a solution has been found.

$800 billion in new student loans in the past decade but aside from that “consumers are deleveraging”

Visa has come up with a plan to add infinitely more debt to millennials who are working diligently as bartenders and waiters: credit cards. Visa has even unveiled a detailed timeline by which they can accomplish the task.

The thought process is as follows:

First, Visa estimates that all of those minimum wage jobs will be adding up to $8.3 trillion in personal income for millennials by 2025.

Next, Visa believes that millennials use cards for 57% of their spending, making them an attractive “target” for massive amounts of additional debt credit card marketing.

And finally, as a percentage of total available users, millennials use revolving credit more than any other generation.

How long will it take to market the idea, sell the credit, and wait for the debt to pile up? Why, not soon after college of course. Visa estimates that if done properly, banks and other credit card issuers can have millennials saddled with billions in new debt by the young age of 28. The company even puts together a nice infographic to add to their excitement.

In summary, everyone can rest assured that while young millennials may not have their future mapped out quite yet, Visa and other institutions have that all taken care of for them – just make sure to pay that monthly interest.

How did we manage to become a society where workers need a degree and a resume to even apply for much less be considered for a job as a simple file clerk or warehouse worker?

It’s supply and demand, Anonymous. Over the last couple of decades, a lot of the easier jobs have been automated or are being done by people who will work for pennies. The supply of labor is enormous and the demand is weak. There are just too many people, and most of them simply do not have the skills nor the intelligence to learn the skills needed to support themselves.

It’s a good idea to not have kids and to stop caring what eventually happens to the human race.

Billions in debt – hell Trillions in debt. The millennials can pay off the $20 Trillion federal debt. I can’t see any 3% – 4% GDP growth on the horizon – that would allow the economy to pay off the debt.

Ha, ha, ha, free college – just pay the $20 trillion!

what a bunch of money grubbing basterds there at the VISA!!

“It’s a good idea to not have kids and to stop caring what eventually happens to the human race.”

Nah…you’re just kiddin, right?

What is the percentage of Visa debt holders NOT paying their monthly bill that will bankrupt that company? Seriously. I have no idea. But, I’m guessing it’s a single digit. Maybe some millennial leader will organize a Bust Visa!! movement … where about 8% of Visa customers simply won’t make a payment for a few months. kaboom!! What the fuck could Visa do about it?

@Pirate Jo: “It’s a good idea to not have kids and to stop caring what eventually happens to the human race.”

WTF – what twised logic. The Neegrows, SPICS, FSA, and Mooslims are gonna keep pumping out bastards.

Vultures.

Report is interesting, but is seriously flawed on one point. Yes, Millennials use their cards more often (cashless society, here we come), and they may have more revolvers than transactors (for now).

HOWEVER, Millennials are a generation that saves more than Gen X and Boomers. So don’t expect that they’re going to be the same kind of consumers as they get married and have kids. They’re not as stupid — or as motivated by marketing gimmicks — like previous generations.

[img ?uuid=37a8722c-f649-11e5-8c16-0015c588dfa6[/img]

?uuid=37a8722c-f649-11e5-8c16-0015c588dfa6[/img]

The report clearly is trying to convince investors and member banks that Visa isn’t in trouble because of the “upside” of Millennial spending, but it just isn’t true.

That’s why I keep getting letters from the credit card companies to increase my limit.

I don’t respond…………….

They call me at home!!!

But Fiatman!!! your pre-approved!!……. because you pay your account off every month!!!

I’m retired you idiots!! I have a fixed income…….

“Doesn’t matter” they say. Think of the vacations you could have with $30,000 limit!!!

“CLICK”

Stucky, what about the opposite? What percentage of Visa Card holders paying off their cards every month and NOT carrying a balance would bankrupt the company? I know Visa makes money off of each use of the card (is it 3%?) but I doubt that would be enough to keep the company going. The benefit of doing it this way is that it is perfectly legal, but still sticks it to them. This is what I normally do. I also use cash a large percentage of the time when I’m shopping, avoid Visa altogether. But, then again, I’m a Boomer.

Precisely, Dutchman. That was my whole point. What are you going to do about it? You simply don’t have control over all those people’s lives – only your own.

You’re a still step behind me. You have observed the rotten truth, but you haven’t yet figured out that there is nothing you can do about it.

Once you reach that point, you will get to where I am: Enjoy what you can of life and stop caring about things you can’t change. I have a moral obligation to do no harm to others. Beyond that, the rest of the human race is not my circus and not my monkeys. Once I get old and kick the bucket, there will be no future participation in this nonsense for any offspring of mine to suffer.