“All that is human must retrograde if it does not advance.” – Edward Gibbon

“Woe, destruction, ruin, and decay; the worst is death and death will have his day.” – William Shakespeare, Richard II

We moved to our corner of Montgomery County, Pennsylvania twenty-seven years ago. We raised our three boys here. We spent hundreds of hours on local baseball fields, in hockey rinks, in school gyms for basketball games, concerts, plays and donuts-with-dads. It’s still a nice place to live, with virtually no crime, decent roads, and reasonable property tax rates. But I would have to say there has been a degradation in the overall quality of life in my community, which is consistent with the downward spiral of our society in general. When we planted our roots in this community it was still more farm-like than suburban. Family farms and open space were more prevalent than housing tracts, strip malls, fast food joints and cookie cutter commercial buildings. A beautiful farmhouse a few miles from our home, freshly painted white, proudly displayed the iconic yellow smiley face. It symbolized good times.

We’ve been driving on this road for twenty-seven years on the way to baseball games, hockey practices, the car dealer for service, and lately to our gym, as we try to fend off father time. Driving by that barn in the early days would always brighten your day. A bright yellow smiley face against a white background represented a positive, happy view of the world.

Continue reading “FADING SMILE OF A DYING EMPIRE”

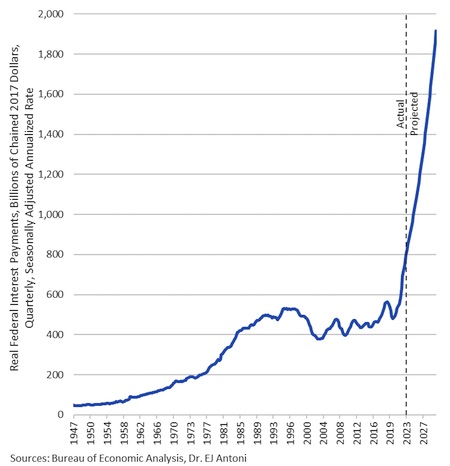

A new billboard launched in New York City’s Times Square is sounding the alarm on America’s growing national debt crisis. “Scared of the national debt? You should be.” US national debt spiked past $34 trillion at the top of the year and continues to rise due to massive spending packages. Now that America is committed to funding two largescale wars and 7.2+ million new migrants, America will continue sinking deeper in a hole.

A new billboard launched in New York City’s Times Square is sounding the alarm on America’s growing national debt crisis. “Scared of the national debt? You should be.” US national debt spiked past $34 trillion at the top of the year and continues to rise due to massive spending packages. Now that America is committed to funding two largescale wars and 7.2+ million new migrants, America will continue sinking deeper in a hole.