Originally posted in September 2010 – RIP Ray Bradbury

“Out of the nursery into the college and back to the nursery; there’s your intellectual pattern for the past five centuries of more. School is shortened, discipline relaxed, philosophies, histories, languages dropped, English and spelling gradually neglected, finally almost completely ignored. Life is immediate, the job counts, pleasure lies about after work. Why learn anything save pressing buttons, pulling switches, fitting nuts and bolts?” – Captain Beatty in Fahrenheit 451

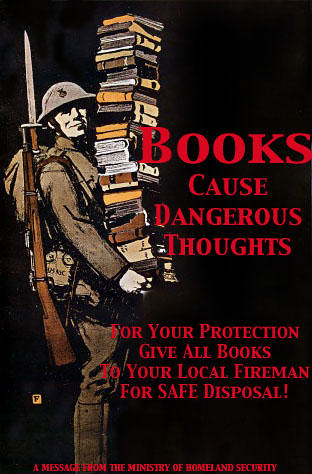

Ray Bradbury wrote his dystopian novel Fahrenheit 451 in 1950. Most kids were required to read this book when they were seventeen years old. Having just re-read the novel at the age of forty-seven makes you realize how little you knew at seventeen. It is 165 pages of keen insights into today’s American society. Bradbury’s hedonistic dark future has come to pass. His worst fears have been realized. The American public has willingly chosen to be distracted and entertained by electronic gadgets 24 hours per day. Today, reading books is for old fogies. Most people think Bradbury’s novel was a warning about censorship. It was not. It was a warning about TV and radio turning the minds of Americans to mush.

It is now sixty years later and his warning went unheeded. A self imposed ignorance by a vast swath of Americans is reflected in these statistics:

- 33% of high school graduates never read another book for the rest of their lives.

- 42% of college graduates never read another book after college.

- 80% of U.S. families did not buy or read a book last year.

- 70% of U.S. adults have not been in a bookstore in the last five years.

- 57% of new books are not read to completion.

- There are over 17,000 radio stations and over 2,000 TV stations in America today.

- Each day in the U.S., people spend on average 4.7 hours watching TV, 3 hours listening to the radio and 14 minutes reading magazines.

- The projected average number of hours an individual (12 and older) will spend watching television this year is 1,750.

- In a 65-year life, the average person will have spent 9 years glued to the tube.

- Number of 30-second TV commercials seen in a year by an average child – 20,000

- Number of videos rented daily in the U.S. – 6 million

- Number of public library items checked out daily – 3 million

- Percentage of Americans who can name The Three Stooges – 59%

- Percentage who can name at least three justices of the U.S. Supreme Court – 17%

When Ray Bradbury wrote his novel in the basement of the UCLA library on a pay per hour typewriter, television was in its infancy. In 1945 there were only 10,000 television sets in all of America. By 1950, there were 6 million sets. The US population was 150 million living in 43 million households. Only 9% of these households had a TV. There was one TV for every 25 people. Americans read books and newspapers to be aware of their world. Today, there are 335 million television sets in the country. The US population is 310 million living in 115 million households. There is a TV in 99% of these households, with an average of 3 TVs per household. Your reality is whatever the corporate media decides is your reality.

Bradbury envisioned gigantic flat screen wall TVs that interacted with the audience and people wearing seashell earbuds so they could listen to the radio. Anything to keep from reading, thinking, questioning or wondering. Today, anesthetized kids and non-thinking adults sit in front of the boob tube with their Playstation controllers in hand and a microphone attached to their ear, killing zombies while talking to their fellow warriors, sitting in their own living rooms somewhere in the world. Apple has sold 260 million iPods since 2001 that allow people to zone out and live in their own private music world, never needing to interact or associate with their fellow humans. Millions of Blackberry addicts roam the streets of our cities like androids, forcing alert pedestrians to bob and weave to avoid head-on collisions with these connected egomaniacs. They are overwhelmed with their self importance.

For those who have not read the book since high school, or have never read the novel, here is a quick summary of Fahrenheit 451:

Guy Montag is a fireman who burns books in a futuristic American city. In this dystopian world, firemen start fires rather than putting them out. The people in this society do not read books, enjoy nature, spend time by themselves, think independently, or have meaningful conversations. Instead, they drive at extreme speeds, watch excessive amounts of television on wall-size sets, and listen to the radio on “Seashell Radio” sets attached to their ears. Guy meets a girl that makes him rethink his priorities. He starts to question book burning and why people fear books. After not showing up for work, his boss Beatty comes to his house and explains why books are now banned. According to Beatty, special-interest groups and other “minorities” objected to books that offended them. Soon, books all began to look the same, as writers tried to avoid offending anybody. This was not enough, however, and society as a whole decided to simply burn books rather than permit conflicting opinions.

Montag connects with a retired English professor named Faber. He tells him that the value of books lies in the detailed awareness of life that they contain. Faber says that Montag needs not only books but also the leisure to read them and the freedom to act upon their ideas. After Montag’s wife turns him in and he is forced to burn his own house to the ground, he turns his flamethrower on Beatty. He is hunted by a mechanical hound and the chase is broadcast on national TV. He escapes to the forest where he finds a group of renegade intellectuals (“the Book People”), led by a man named Granger, who welcome him. They are a part of a nationwide network of book lovers who have memorized many great works of literature and philosophy. They hope that they may be of some help to mankind in the aftermath of the war that has just been declared. Montag’s role is to memorize the Book of Ecclesiastes. Enemy jets appear in the sky and completely obliterate the city with atomic bombs. Montag and his new friends move on to search for survivors and rebuild civilization.

Knowledge versus Willful Ignorance

“Give the people contests they win by remembering the words to more popular songs or the names of state capitals or how much corn Iowa grew last year. Cram them full of non-combustible data, chock them so damned full of ‘facts’ they feel stuffed, but absolutely ‘brilliant’ with information. Then they’ll feel they’re thinking, they’ll get a sense of motion without moving. And they’ll be happy, because facts of that sort don’t change. Don’t give them any slippery stuff like philosophy or sociology to tie things up with. That way lies melancholy.” – Captain Beatty in Fahrenheit 451

In Bradbury’s novel the fireman’s duty is to destroy knowledge and promote ignorance, in order to equalize the population and promote sameness. Any impartial analysis of the current state of affairs must conclude that he was absolutely right. In an interview with the LA Weekly in 2007, Bradbury clarified his views:

“Television gives you the dates of Napoleon, but not who he was,” Bradbury says, summarizing TV’s content with a single word that he spits out as an epithet: “factoids.” His fear in 1953 that television would kill books has, he says, been partially confirmed by television’s effect on substance in the news. “Useless,” Bradbury says. “They stuff you with so much useless information, you feel full.”

Bradbury wrote his novel shortly after WWII, at the outset of the Korean War, during the early stages of the Cold War and in the midst of McCarthyism. The novel reflects these influences. Orwell’s 1984 used television screens to indoctrinate citizens. Bradbury envisioned television as an opiate, keeping the public sedated. The wall televisions in Fahrenheit 451 allow characters to interact with those watching. Bradbury captured the future of reality TV. Entertainment today is dominated by reality TV. We are blasted by the likes of Jersey Shore, Jerseylicious, American Idol, America’s Got Talent, Survivor, Big Brother, Project Runway, Dancing With the Stars, Amazing Race, Housewives of OC, NJ, NY, DC, and Atlanta, I Didn’t Know I Was Pregnant and fifty other mind numbing reality shows. Morons with names like Snookie and The Situation are better known by teenagers than George Washington and Thomas Jefferson. In Bradbury’s world, television was used to broadcast meaningless drivel to divert attention, and thought, away from an impending war. Today, television is used to broadcast meaningless drivel to divert attention, and thought, away from ongoing wars, government corruption, impending financial collapse, and truth.

Bradbury still lives in Los Angeles and observes the alienation aspects of his novel playing out exactly as he envisioned:

“In writing the short novel Fahrenheit 451 I thought I was describing a world that might evolve in four or five decades. But only a few weeks ago, in Beverly Hills one night, a husband and wife passed me, walking their dog. I stood staring after them, absolutely stunned. The woman held in one hand a small cigarette-package-sized radio, its antenna quivering. From this sprang tiny copper wires which ended in a dainty cone plugged into her right ear. There she was, oblivious to man and dog, listening to far winds and whispers and soap-opera cries, sleep-walking, helped up and down curbs by a husband who might just as well not have been there. This was not fiction.”

Bradbury directly foretells this incident early in his novel:

“And in her ears the little Seashells, the thimble radios tamped tight, and an electronic ocean of sound, of music and talk and music and talking coming in.” – Fahrenheit 451

Montag spends the entire novel seeking truth. Professor Faber becomes his mentor, leading him toward the truth. It is not a coincidence that Bradbury named the Montag character after a paper company and the Faber character after a pencil company. Faber was the instrument through which Montag was taught. Montag was clearly fighting an uphill battle. The majority had stopped thinking and seeking truth decades ago. The majority always wants things to remain the same.

“But remember that the Captain belongs to the most dangerous enemy of truth and freedom, the solid unmoving cattle of the majority. Oh, God, the terrible tyranny of the majority.” – Professor Faber

Government did not need to ban books. As technology advanced and filled the days with 24 hours of entertainment, infomercials, propaganda, and trivia, the population willfully stopped reading books. Why think, ponder, or question when you can be entertained and directed to believe in whatever the state thinks is best? When entertainment wasn’t enough, the population would drive their cars at speeds exceeding 100 mph with a goal of running animals and people over. Today, the mainstream media is controlled by a few mega-corporations that do the bidding of the state. They are responsible for keeping the population sedated, entertained, confused, and misinformed. The public willfully accepts the reality presented by those in power, rather than thinking, questioning or seeking the truth.

“Remember the firemen are rarely necessary. The public stopped reading of its own accord. You firemen provide a circus now and then at which buildings are set off and crowds gather for the pretty blaze, but its a small sideshow indeed, and hardly necessary to keep things in line. So few want to be rebels anymore.” – Professor Faber

In America’s pleasure society we drive as fast as we want, heedless of danger. We care only for our own gratification, not for the welfare of others. For enjoyment, we memorize lyrics to Eminem rap songs. Thinking is not pleasurable so we envelop ourselves with flat screen HDTVs that provide nonstop distraction. Reading books is no longer necessary in our world. This is reflected in the fact that 40% of all adults in America can be classified as functionally illiterate. The U.S. public school system has been so dumbed down, with equality of all as the mantra that one wonders whether the state purposefully wants to process non-thinking, non-questioning autobots into society. A thinking, questioning public is dangerous to the state.

“We must all be alike. Not everyone born free and equal, as the Constitution says, but everyone made equal. Each man the image of every other; then all are happy, for there are no mountains to make them cower, to judge themselves against.” – Captain Beatty

Political Correctness & Censorship

“It didn’t come from the Government down. There was no dictum, no declaration, no censorship, to start with, no! Technology, mass exploitation, and minority pressure carried the trick, thank God. Today, thanks to them, you can stay happy all the time, you are allowed to read comics, the good old confessions, or trade journals. Colored people don’t like Little Black Sambo. Burn it. White people don’t feel good about Uncle Sam’s Cabin. Burn it.” – Captain Beatty

Bradbury imagined a democratic society whose diverse population turns against books. He imagined not just political correctness, but a society so diverse that all groups were “minorities.” It was essential that all thought become like vanilla tapioca. First they condensed the books, stripping out more and more offending passages until ultimately all that remained were footnotes. Only after people stopped reading on their own did the state employ firemen to burn books. Once you sacrifice liberty to the state, the state will not restore it without a fight. Political correctness has been taken to the extreme by those in power in America. The text books used to educate our children have had all “offensive” facts extracted. History has been revised to satisfy the agendas of those in power. The truth is inconsequential when a minority group might be offended. History books used in our public schools have more references about Marilyn Monroe than George Washington. Bradbury was prescient in his ability to see the future denigration of those who sought wisdom.

Our public schools have the power to place students into roles such as runner, football player or swimmer. By being placed in a role, a person is doing what is expected of him and not being an individual. We dread the unfamiliar. To be an individual is to be unfamiliar. Thus, to conform is easier.

“With school turning out more runners, jumpers, racers, tinkerers, grabbers, snatchers, fliers, and swimmers instead of examiners, critics, knowers, and imaginative creators, the word `intellectual,’ of course, became the swear word it deserved to be. You always dread the unfamiliar. People want to be happy, isn’t that right? Haven’t you heard it all your life? I want to be happy, people say. Well, aren’t they? Don’t we keep them moving, don’t we give them fun? That’s all we live for, isn’t it? For pleasure, for titillation? And you must admit our culture provides plenty of these.” – Captain Beatty

The ruling elite and the mainstream media are openly scornful and antagonistic toward those they label intellectuals. Fox News and MSNBC prefer talking points, misinformation, and dogmatic ideology from their anchor entertainers and insipid guests. The numbskulls on these shows are never in doubt and always wrong. There is no true debate between reasonable people. These entertainment shows appeal to the baser emotional instincts of the public, not to their reason or intellect. The American public no longer has the capability to critically analyze what they are told by the mainstream corporate media. They gave up reading books decades ago, leading to a steady decline in critical thinking skills. No need to think when you can go bungee jumping, mountain biking, sky diving, yachting, or paint balling.

In the ultimate irony, Bradbury found out in 2003 that over the years editors from Ballantine had censored 75 separate sections of his novel, fearful that it would contaminate the minds of our young. The idea of today’s censorship is not to burn books, but to remove every controversial word or phrase that could offend anyone. Books are made so generic and bland that no one would want to read them anyway. Bradbury is still full of piss and vinegar, sixty years after writing his masterpiece:

“The point is obvious. There is more than one way to burn a book. And the world is full of people running about with lit matches. Every minority, be it Baptist/Unitarian, Irish/ Italian/ Octogenarian/ Zen Buddhist, Zionist/ Seventh-day Adventist, Women’s Lib/ Republican, Mattachine/ Four Square Gospel feels it has the will, the right, the duty to douse the kerosene, light the fuse. Every dimwit editor who sees himself as the source of all dreary blanc-mange plain porridge unleavened literature, licks his guillotine and eyes the neck of any author who dares to speak above a whisper or write above a nursery rhyme.”

Never Ending War

“Someday the load we’re carrying with us may help someone. But even when we had the books on hand, a long time ago, we didn’t use what we got out of them. We went right on insulting the dead. We went right on spitting in the graves of all the poor ones who died before us. We’re going to meet a lot of lonely people in the next week and the next month and the next year. And when they ask us what we’re doing, you can say, We’re remembering. That’s where we’ll win out in the long run. And someday we’ll remember so much that we’ll build the biggest goddamn steam-shovel in history and dig the biggest grave of all time and shove war in and cover it up. Come on now, we’re going to go build a mirror-factory first and put out nothing but mirrors for the next year and take a long look in them.” – Granger

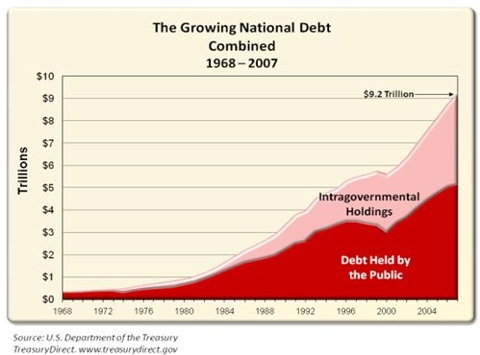

Bradbury had known nothing but war from the time he was 18 until he wrote Fahrenheit 451 at the age of 30. He describes the sound of bombers continuously flying over the city. America had started two nuclear wars since 1990. The degenerative effects of mass media in today’s info-bite world can be clearly seen in how they are able to manipulate public opinion to support undeclared wars without question. If Americans were still able to think and interested in exercising their responsibilities as citizens of a Republic, they would have required that Congress exercise its responsibility to declare war rather than allow one man to declare and wage wars all over the globe. It is easy when the state controls the message.

“If you don’t want a man unhappy politically, don’t give him two sides to a question to worry him; give him one. Better yet, give him none. Let him forget there is such a thing as war.” – Beatty

Montag is stalked by the Mechanical Hound throughout the book. It was programmed to hunt down Montag and lethally inject him with poison. Bradbury didn’t know it, but he had described an early version of a predator drone. Today, a man can sit in front of his computer in the Pentagon and direct an unmanned predator drone to fire missiles at “enemies” without faces, halfway around the world. No danger, no consequences, no responsibility. The American public blindly believes the state is protecting them by murdering “enemies of the state”. They will think differently when predator drones circle the skies above their towns seeking out “domestic terrorists” and non-conformists.

The hunt for Montag was broadcast on national TV. Bradbury’s imagination produced a vision of fake reality TV, fifty years before it became an everyday reality.

“Mechanical Hound never fails. Never since its first use in tracking quarry has this incredible invention made a mistake. Tonight, this network is proud to have the opportunity to follow the Hound by camera helicopter as it starts on its way to the target…- TV announcer

They’re faking. You threw them off at the river. They can’t admit it. They know they can hold their audience only so long. The show’s got to have a snap ending, quick! If they started searching the whole damn river it might take all night. So they’re sniffing for a scape-goat to end things with a bang. Watch. They’ll catch Montag in the next five minutes! – Granger

The search is over, Montag is dead; a crime against society has been avenged. – TV announcer

They didn’t show the man’s face in focus. Did you notice? Even your best friends couldn’t tell if it was you. They scrambled it just enough to let the imagination take over. – Granger

As I read this passage visions of the OJ Simpson slow speed chase along the LA freeways appeared in my mind. It was immediately followed by the fake balloon boy video from a few months ago. Lastly, the streaming video of oil gushing into the Gulf of Mexico came into focus. When the cameras are turned off, the show is over. Cold blooded murderers are released due to political correctness. A child in danger was just a show. The effects of 200 million gallons of oil spilled in the Gulf of Mexico on the environment and the citizens of the Gulf region aren’t apparent when the cameras are turned off. So therefore, there are no effects. The world today is one big TV reality show. The populace wants to be entertained by its news. Sound bites are essential. Dazzling special effects are required. Beautiful people presenting the show are necessary. Facts are optional. The truth is a nuisance. There is only one requirement – THE SHOW MUST GO ON.

There are few builders left, while millions of burners lurk behind every bush. First it will be Korans and Mosques. Then it will be bibles and churches. Then it will be libraries. Eventually it will be your house. America was built by those who cherished liberty, freedom, responsibility, knowledge, and truth. A fog of complacency and malaise settled over America in the last six decades. It is almost as if Orwell’s 1984, Huxley’s Brave New World, and Fahrenheit 451 were used as instruction manuals rather than warnings by our society. The worst aspects from all three of these dystopian novels have been adopted or implemented in present day America. The citizenry has become dependent upon the state for information, direction, support, and protection. The unquestioning obedience toward the faceless, nameless, hapless state bureaucracy will lead to tyranny. The state will demand your compliance. The state will monitor your thoughts and movements. The state will tell you what to believe. The state will brutally punish anyone who attempts to think or question. The match is lit. The books are piled high.

“There was a silly damn bird called a Phoenix back before Christ: every few hundred years he built a pyre and burned himself up. He must have been first cousin to Man. But every time he burnt himself up he sprang out of the ashes, he got himself born all over again. And it looks like we’re doing the same thing, over and over, but we’ve got one damn thing the Phoenix never had. We know the damn silly thing we just did. We know all the damn silly things we’ve done for a thousand years, and as long as we know that and always have it around where we can see it, someday we’ll stop making the Goddamn funeral pyres and jumping into the middle of them. We pick up a few more people that remember, every generation.” – Granger

At the end of the novel, the city is destroyed by atomic bombs. The “Book People” begin to move back toward the city in an effort to rebuild their civilization and help it rise up from the ashes. Our society has gone so far off course that a peaceful reversal seems highly unlikely. A revolution that sweeps away the old order and provides an opportunity for America to start anew will occur during the next fifteen years. Just as in the novel, there are surely dark days ahead, with much suffering, pain and death. The majority do not see this revolution coming. Those in power are blinded by their own ignorance. It is up to the minority of thinkers, questioners, skeptics, and truth seekers to insure that America rises up based upon its founding principles of liberty, freedom and personal responsibility. I urge you to look up from your Blackberry. Turn off the TV. Take the iPod earbuds out of your ears. Log off your computer. Read Shakespeare, Twain, Orwell, Bradbury, Huxley, Dickens, Tolstoy, Hemingway, or Faulkner. Don’t believe anything that the mainstream media declares as fact without verifying it yourself. Question everything. Question everyone. Believe no one. The state is not your protector. Government cannot replace reason. Montag was responsible for memorizing the Book of Ecclesiastes in order to pass along that wisdom to future generations. Ask yourself – What are you leaving for future generations?

“To everything there is a season, and a time to every purpose under the heaven.” – Book of Ecclesiastes

Sep 07 2010

Sep 07 2010