Guest Post by John W. Whitehead

“Whether he wrote DOWN WITH BIG BROTHER, or whether he refrained from writing it, made no difference … The Thought Police would get him just the same … the arrests invariably happened at night … In the vast majority of cases there was no trial, no report of the arrest. People simply disappeared, always during the night. Your name was removed from the registers, every record of everything you had ever done was wiped out, your one-time existence was denied and then forgotten. You were abolished, annihilated: vaporized was the usual word.”—George Orwell, 1984

The government long ago sold us out to the highest bidder.

The highest bidder, by the way, has always been the Deep State.

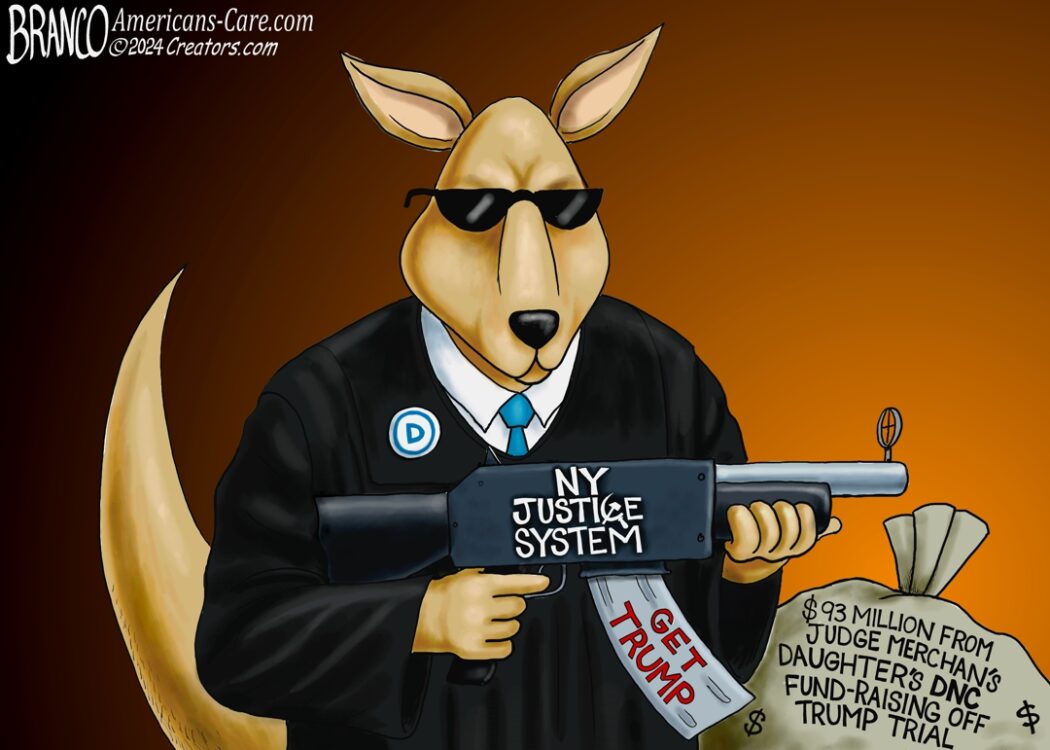

What’s playing out now with the highly politicized tug-of-war over whether Section 702 of the Foreign Intelligence Surveillance Act gets reauthorized by Congress doesn’t just sell us out, it makes us slaves of the Deep State.

Read the fine print: it’s a doozy.

Continue reading “Down with Big Brother: Warrantless Surveillance Makes a Mockery of the Constitution”