This is the 3rd and final chapter of my series about the destruction of the middle class. In Part 1 of this series I addressed where and how the net worth of the middle class was stolen. In Part 2, I focused on the culprits in this grand theft and in Part 3, I will try to figure out why they stole your net worth and what would be required to restore sanity to this world.

Dude, Why Did They Steal My Net Worth?

“I have no problem with people becoming billionaires—if they got there by winning a fair race, if their accomplishments merit it, if they pay their fair share of taxes, and if they don’t corrupt their society. Most of them became wealthy by being well connected and crooked. And they are creating a society in which they can commit hugely damaging economic crimes with impunity, and in which only children of the wealthy have the opportunity to become successful. That’s what I have a problem with. And I think most people agree with me.” – Charles Ferguson – Predator Nation

It is clear to me that a small cabal of politically connected ultra-wealthy psychopaths has purposefully and arrogantly stripped the middle class of their wealth and openly flaunted their complete disregard for the laws and financial regulations meant to enforce a fair playing field. Why did they gut the middle class in their rapacious appetite for riches? Why did the scorpion sting the frog while crossing the river, dooming them both? It was his nature. The same is true for the hubristic modern robber barons latched on the backs of the middle class. Their appetite for ever greater riches will never be mollified. They will always want more. They promise not to destroy the middle class, as that will surely extinguish the last hope for a true economic recovery built upon savings, investment and jobs, but it is their nature to destroy. A card carrying member of the plutocracy and renowned dog lover, Mitt Romney, revealed a truth not normally discussed by those running the show:

“I’m not concerned about the very poor. We have a safety net there. I’m not concerned about the very rich, they’re doing just fine.”

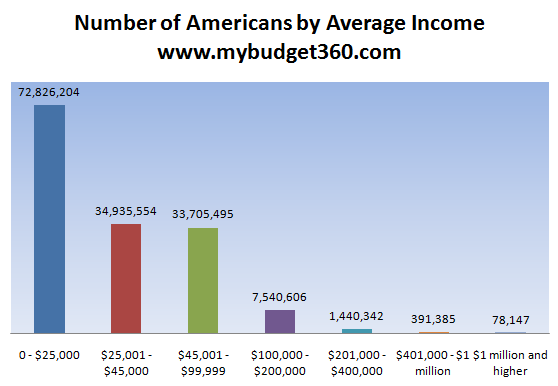

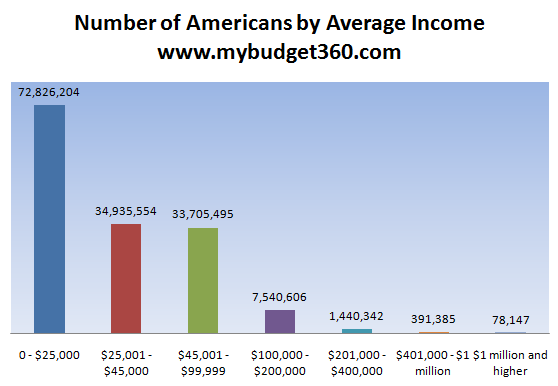

The data from the Fed report confirms Romney’s assertion. The poorest 20% were the only household segment that saw an increase in their real median income between 2007 and 2010, while the richest 10% saw only a modest 5% decrease in their $200,000 plus, annual incomes. Meanwhile the middle class households experienced a brutal 8% to 9% decline in real income. Table 2 in Part 2 of this article reveals why the poorest 20% were able to increase their income. Transfer payments (unemployment, welfare, food stamps, SSDI) increased from 8.6% of their income in 2007 to 11.1% in 2010. Government transfer payments rose from $1.7 trillion in 2007 to $2.3 trillion today, a 35% increase in five years. I’m sure the bottom 20% are living high on the hog raking in that $13,400 per year. Think about these facts for just a moment. There are 23 million households in this country with a median annual household income of $13,400. That means half make less than that. There are 58 million households that have a median household income of $45,800, with half making less than that.

The reason Mitt Romney isn’t concerned about the very poor is because his only interaction with them is when they cut the lawn at one of his six homes. The truth is the bottom 20% are mostly penned up in our urban ghettos located in Detroit, Chicago, Philadelphia, NYC, LA, Atlanta, Miami, and the hundreds of other decaying metropolitan meccas. They generally kill each other and only get the attention of the top 10% if they dare venture into a white upper class neighborhood. They are the revenue generators for our corporate prison industrial complex – one of our few growth industries. They provide much of the cannon fodder for our military industrial complex. They are kept ignorant and incapable of critical thought by our Department of Education controlled public school system. The welfare state is built upon the foundation of this 20%. It is certainly true that the bottom 30 million households in this country, from an income standpoint, do receive hundreds of billions in entitlement transfers, but Table 2 clearly shows that 80% of their income comes from working. The annual $72 billion cost for the 46 million people on food stamps pales in comparison to the hundreds of billions being dispensed to the Wall Street banks by Ben Bernanke and Tim Geithner, and the $1 trillion per year funneled to the corporate arm dealers in the military industrial complex. The Wall Street maggots (i.e. J.P. Morgan) crawl around the decaying welfare corpse, extracting hundreds of millions in fees from the EBT system and the SNAP program as they encourage higher levels of spending.

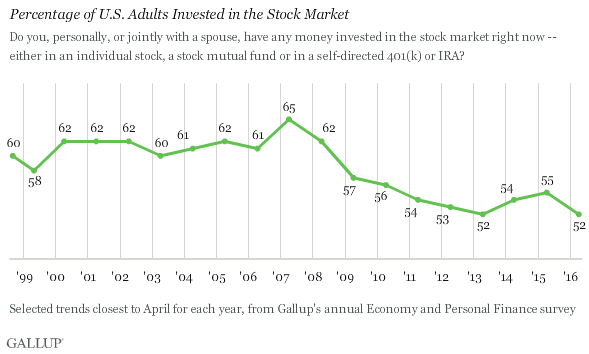

This is all part of the diversion. Forty five years after the War on Poverty began, there are 49 million Americans living in poverty. That’s a solid good return on the $16 trillion spent so far. It’s on par with the 16 year zero percent real return in the stock market. We have produced a vast underclass of ignorant, uneducated, illiterate, dependent people who have become a huge voting block for the Democratic Party. Politicians, on the left, promise more entitlements to these people in order to get elected. Politicians on the right will not cut the entitlements for fear of being branded as uncaring. The Republicans agree to keep the welfare state growing and the Democrats agree to keep the warfare state growing -bipartisanship in all its glory. And the middle class has been caught in a pincer movement between the free shit entitlement army and the free shit corporate army. The oligarchs have been incredibly effective at using their control of the media, academia and ideological think tanks to keep the middle class ire focused upon the lower classes. While the middle class is fixated on people making $13,400 per year, the ultra-wealthy are bribing politicians to pass laws and create tax loopholes, netting them billions of ill-gotten loot. These specialists at Edward Bernays propaganda techniques were actually able to gain overwhelming support from the middle class for the repeal of estate taxes by rebranding them “death taxes”, even though the estate tax only impacts 15,000 households out of 117 million households in the U.S. The .01% won again.

It is easy to understand how the hard working middle class is so easily manipulated by the corporate fascists into believing their decades of descent to a lower and lower standard of living is the result of the lazy good for nothings at the bottom of the food chain sucking on the teat of state with their welfare entitlements. I drive through the neighborhoods of West Philadelphia every day, inhabited by the households with a net worth of $8,500 and annual income of $13,400. They inhabit crumbling hovels worth less than $25,000, along pothole dotted streets strewn with waste, debris and rubbish. More than half the people in this war zone are high school dropouts, over 30% are unemployed, and drug dealing is the primary industry. When a drug dealer becomes too successful and begins to cut into the profits of the “legitimate” oligarch sanctioned drug industry, he is thrown into one of our thriving prisons. Marriage is an unknown concept. The life expectancy of males is far less than 79 years old. But something doesn’t quite make sense. Every hovel has a Direct TV satellite dish. The people shuffling around the streets all have expensive cell phones. There are newer model cars parked on the streets, including a fair number of BMWs, Mercedes, Cadillac Escalades and Volvos. How can this be when their annual income is $13,400 and they have $8,500 to their names?

This is where our friendly neighborhood Wall Street oligarchs enter the picture. These downtrodden people are not bright. They are easily manipulated and scammed. They believe driving an expensive car and appearing successful is the same as being successful. Therefore, they are easily susceptible to being lured into debt. Millions of these people represented the “subprime” mortgage borrowers during the housing bubble. The tremendous auto “sales” being reported by the mainstream media in an effort to boost consumer confidence about an economic recovery, are being driven by subprime auto loans from Ally Financial (85% owned by the U.S. Treasury/you the taxpayer) and the other government back stopped Wall Street banks. This is the beauty of credit. The mega-lenders reap tremendous profits up front, the illusion of economic progress is created, poor people feel rich for a while, and when it all blows up at a future date the middle class taxpayer foots the bill. Real wages for the 99% have been falling for three decades. You make poor people feel wealthy by providing them easy access to vast quantities of cheap debt. I’m a big fan of personal responsibility, but who is the real malignant organism in this relationship? The parasite banker class, like a tick on an old sleepy hound dog, has been blood sucking the poor and middle class for decades. They have peddled the debt, kept the poor enslaved, and have used their useful idiots in the media to convince millions of victims to blame each other through their skillful use of propaganda. They maintain their control by purposely creating crisis, promoting hysteria, and engineering “solutions” that leave them with more power and wealth, while stripping the average citizen of their rights, liberty, freedom and net worth (i.e. Housing Bubble to replace Internet Bubble, Glass-Steagall repeal, Patriot Act, TARP, NDAA, SOPA). Jesse cuts to the heart of the matter, revealing the darker side of our human nature:

“Sometimes when faced with problems that are confusing and troubling it is easier to think what someone tells you to think, particularly something that touches a deep and dark nerve in your nature, rather than carry the burden and ambiguity of struggling with the facts and thinking for yourself. Repeating a party line is a shorthand way of avoiding real thought. And the predators are always there to take advantage of it. They welcome trouble and often foment crisis in order to advance their agendas.”

“Anyone can be misled by a clever person, and no one likes to readily admit that they have been had. It is a sign of character and maturity to realize this, and admit you were deceived, and to demand change and reform. But some people cannot do this, even when the facts of the deception are revealed. It seems as though the more incorrect that the truth shows them to be, the louder and more strident they become in shouting down and denying the reality of the situation. And anyone who denies their perspective becomes ‘the other,’ someone to be feared and hated, shunned and eliminated, one way or the other.”

Until Debt Do Us Part

I sense signs of desperation amongst the plutocracy. Their propaganda machine is sputtering. Their storylines are growing tired. They have fended off the fury of the Tea Party movement by successfully high jacking it and neutralizing their impact under the thumb of the Republican establishment. The oligarchs called out their armed thugs to crush the OWS rage, while using their media mouthpieces to misrepresent the true purpose of the movement – Wall Street greed and criminality with Washington DC collusion. The Savings & Loan Crisis of the late 1980s resulted in 800 bankers being thrown into prison. After the greatest banker heist in history, not one banker has been thrown in jail. Obama and Holder have been neutered by their masters. The power elite openly brandish their glee at avoiding accountability for their crimes. They are desperately attempting to re-inflate the debt bubble, as debt is the lifeblood of these vampire squids. The key piece of their current propaganda campaign is to convince the people they have effectively deleveraged and their continuing austerity efforts are actually detrimental to economic recovery. It’s nothing but a confidence game to keep the Ponzi going. The Ponzi operators want to extract every last dime from the masses before the engineered collapse. The data does not confirm the deleveraging narrative. Total credit market debt in the United States is now at an all-time high and stands at 345% of GDP. In 1977 it stood at 155% of GDP and at 250% in 2000.

Total credit market debt is now $4 trillion higher than it was in 2007, prior to the financial collapse. It has gone up by $1 trillion in the last 12 months. Does this sound like deleveraging? The chart below details the truth the moneyed interests don’t want you to understand. The bastions of capitalism on Wall Street have dumped $3.4 trillion of their toxic debt and $1 trillion of mortgage and credit card debt onto the backs of middle class taxpayers and future unborn generations. They did this under the auspices of saving the economic system. Their sole purpose has been to save themselves from becoming part of the middle class. The transfer of wealth from the quarry (middle class) to the predators (moneyed interests) continues unabated.

The faux journalists in the mainstream media have been pounding the consumer deleveraging mantra. They babble on about the austere masses methodically paying down their debts. It’s a specious lie. The chart below shows that banks have written off $218 billion of credit card debt since 2008. It also shows outstanding revolving debt falling from $1.01 trillion to $819 billion, a $191 billion decrease. For the math challenged, like any Wall Street shill paraded on CNBC, this means consumers have added $27 billion of credit card debt since 2008. Does that sound like deleveraging? Households have also taken on $300 billion of additional student loan debt since 2008, buying into the government sponsored scam to keep the unemployment rate lower by offering the false hope of jobs with useless on-line degrees from the University of Phoenix. Does that sound like deleveraging?

Consumer Credit Card Debt and Charge-off Data (in Billions):

|

Outstanding Revolving Consumer Debt |

Outstanding Credit Card Debt |

Qrtly Credit Card Charge-Off Rate |

Qrtly Credit Card Charge-Off in Dollars |

| Q1 2012 |

$819.4 |

$803.0 |

4.37% |

$8.8 |

| 2011 |

$864.9 |

$847.6 |

|

|

| Q4 2011 |

$864.9 |

$847.6 |

4.53% |

$9.6 |

| Q3 2011 |

$826.2 |

$809.7 |

5.63% |

$11.4 |

| Q2 2011 |

$819.2 |

$802.8 |

5.58% |

$11.2 |

| Q1 2011 |

$810.7 |

$794.4 |

6.96% |

$13.8 |

| 2010 |

$857.4 |

$840.2 |

|

$77.9 |

| Q4 2010 |

$857.4 |

$840.2 |

7.70% |

$16.2 |

| Q3 2010 |

$836.0 |

$819.2 |

8.55% |

$17.5 |

| Q2 2010 |

$847.5 |

$830.5 |

10.97% |

$22.8 |

| Q1 2010 |

$860.3 |

$843.1 |

10.16% |

$21.4 |

| 2009 |

$921.9 |

$903.4 |

|

$85.6 |

| Q4 2009 |

$921.9 |

$903.4 |

10.12% |

$22.8 |

| Q3 2009 |

$922.2 |

$903.7 |

10.1% |

$22.8 |

| Q2 2009 |

$933.1 |

$914.4 |

9.77% |

$22.3 |

| Q1 2009 |

$946.1 |

$927.2 |

7.62% |

$17.7 |

| Q4 2008 |

$1,010.3 |

$990.1 |

|

|

(Source: CardHub.com, Federal Reserve)

They only people with the courage to tell it like it is are skeptics and outcasts from polite society inhabited by the power elite – people like Ron Paul, Michael Burry, and deceased critical thinkers like Frank Zappa and George Carlin. In one of his final appearances, Carlin brutally lashed out with a torrent of truth, only spoken by courageous people not worried about the consequences of their blunt honesty:

“Politicians are put there to give you that idea that you have freedom of choice. You don’t. You have no choice. You have owners. They own you. They own everything. They own all the important land, they own and control the corporations, and they’ve long since bought and paid for the Senate, the Congress, the State Houses, and the City Halls. They’ve got the judges in their back pockets. And they own all the big media companies so they control just about all the news and information you get to hear. They’ve got you by the balls.

They spend billions of dollars every year lobbying to get what they want. Well, we know what they want; they want more for themselves and less for everybody else. But I’ll tell you what they don’t want—they don’t want a population of citizens capable of critical thinking. They don’t want well informed, well educated people capable of critical thinking. They’re not interested in that. That doesn’t help them. That’s against their interest. You know something, they don’t want people that are smart enough to sit around their kitchen table and figure out how badly they’re getting fucked by a system that threw them overboard 30 fucking years ago. They don’t want that, you know what they want?

They want obedient workers, obedient workers. People who are just smart enough to run the machines and do the paperwork and just dumb enough to passively accept all these increasingly shittier jobs with the lower pay, the longer hours, the reduced benefits, the end of overtime and the vanishing pension that disappears the minute you go to collect it. The table is tilted folks, the game is rigged. Nobody seems to notice, nobody seems to care. Good honest hard working people, white collar, blue collar, it doesn’t matter what color shirt you have on. Because the owners of this country know the truth, it’s called the American Dream, because you have to be asleep to believe it.”

Grotesque Casino of Corporate Fascism

“The illusion of freedom will continue as long as it’s profitable to continue the illusion. At the point where the illusion becomes too expensive to maintain, they will just take down the scenery, they will pull back the curtains, they will move the tables and chairs out of the way and you will see the brick wall at the back of the theater.” – Frank Zappa

“Specifically, over the past 15 years, the global financial system – encouraged by misguided policy and short-sighted monetary interventions – has lost its function of directing scarce capital toward projects that enhance the world’s standard of living. Instead, the financial system has been transformed into a self-serving, grotesque casino that misallocates scarce savings, begs for and encourages speculative bubbles, refuses to restructure bad debt, and demands that the most reckless stewards of capital should be rewarded through bailouts that transfer bad debt from private balance sheets to the public balance sheet. What is central here is that the government policy environment has encouraged this result. This environment includes financial sector deregulation that was coupled with a government backstop, repeated monetary distortions, refusal to restructure bad debt, and a preference for policy cowardice that included bailouts and opaque accounting. Deregulation and lower taxes will not fix this problem, nor will larger stimulus packages.” – John Hussman

None of the solutions put forth by Obama or Romney will fix the problems facing the country today. They are two handpicked figureheads representing the same owners. Both political parties are responsible for the grotesque casino that passes for our financial system. These political hacks have been in alternating control of our government system for the last 150 years. They don’t want to come up with real solutions to the problems they created. The owners want obedient slaves, distracted by technology and shallow entertainment, subjugated by debt used to buy things they want but don’t need, believing waging wars in distant lands keeps us safe, and favoring the imprisonment of petty thieves and drug users while the grand thieves run the country and control our currency. Keeping the willfully ignorant masses in the dark and confused is a vital part of the plan. Debt is the ingredient that enriches the issuers and keeps the dupes in check. Wall Street bankers, Federal Reserve governors, captured financial “experts”, journalists paid by corporations, economists with an ideological agenda and bought off politicians all repeating the same theme with the same unquestioning, strident conviction is a sure sign that we are being played. The never ending series of titanic bailouts of Wall Street did not avert a catastrophic economic collapse. They protected the corporate fascists from experiencing the consequences of their monstrous predatory actions over the last few decades. And it was all done for money. Simple human greed and an insane desire by a few psychotic men to control and manipulate others for their own selfish pleasure is what has turned this country into a corporate fascist state bereft of its soul and original founding principles, as stated by Ron Paul:

“We’re not moving toward Hitler-type fascism, but we’re moving toward a softer fascism: Loss of civil liberties, corporations running the show, big government in bed with big business. So you have the military-industrial complex, you have the medical-industrial complex, you have the financial industry, you have the communications industry. They go to Washington and spend hundreds of millions of dollars. That’s where the control is. I call that a soft form of fascism — something that’s very dangerous.”

The soft form of fascism easily transforms into the hard form as those in control exhibit their supremacy with displays of military potency in our cities (Boston, St. Louis, Pittsburgh, Chicago), passage of liberty stripping legislation like the Patriot Act and NDAA, along with announcements about thousands of drones patrolling our skies over the next five years. When propaganda begins to lose its effectiveness, brute force is the next step. Whenever I write about the slow methodical disintegration of our once great republic into a dysfunctional banana republic controlled by bankers, mega-corporations and arms dealers; the apologists for the empire scoff and cynically ask for my solutions. I, along with many other rational thinking realists, have proposed solutions, but they don’t have a snowballs chance in Syria of ever even being debated by the existing ruling class. The unholy alliance between bankers, corporate interests and politicians must be broken. These proposals would go a long way towards breaking that alliance:

Political System

- Since politicians cannot be trusted to exhibit courage or intelligence when it comes to public policy, a balanced budget amendment to the Constitution needs to be passed, with a five to ten year implementation period to ameliorate the pain.

- Term limits of 6 years for Congressmen and Senators. Serving in Congress should not be a career. It is a duty to the country. The purpose of Congress is to represent the existing generations of citizens and ensure that future generations have a country that offers opportunity to live a better life than their parents.

- The entire election process would be scraped. It would be transformed into a 3 month publicly financed election. No money from corporations, unions, or individuals would be allowed. Multiple candidates would have an opportunity to debate on public TV. The two party domination of our political process must be broken.

- Corporations are not people. Extreme wealth does not give someone the right to buy elections. Rich oligarchs operating in the shadows and spending billions on negative advertising is not how a republic should elect their representatives. Lobbyists, special interests and PACs and would be eliminated from the political process.

- The President could no longer issue Executive Orders, undercutting the legislative process.

- Every bill before Congress would immediately be put online. The constituents of every Congressmen and Senator would be allowed to voice their opinion by voting yes or no online.

- Every bill that is proposed by a Congressman must have a funding mechanism. If the proposal increases costs to the American taxpayer, something else must be cut to pay for the new proposal. This would be unnecessary if a balance budget amendment was passed.

- No American troops could be committed to war in a foreign country without a full vote of Congress as required by the U.S. Constitution.

- A cost benefit analysis would be conducted regarding every department and agency in the Federal Government by the GAO. Those failing to meet minimum requirements would be drastically reduced or eliminated.

- The education of children would be delegated to localities, without Federal mandates. Every child in America would receive vouchers for grade school, high school and college. They could choose any school to attend – public or private. If the private school cost more than the voucher, the family would pay the difference. Excellent schools would flourish, poor schools would be forced to improve or they would close. Teacher tenure would be eliminated. Teaching excellence would be rewarded.

Economic Policy

- The first thing to be done is to abolish the Federal Reserve. It is owned by and operated for the benefit of the biggest banks in the world. Its sole purpose has been to enrich the few at the expense of the many through its insidious use of inflation and debt issuance. It has been around for less than 100 years and has debased the USD by 96%. The U.S. Treasury has the authority to issue the currency of the country. It did so from 1789 until 1913.

- The 2nd thing to do would be to reinstitute the Glass-Steagall Act because Wall Street cannot be trusted to manage their risk properly. This would separate true banking activities from the high risk gambling that brought the economic system to its knees. Privatizing the profits and socializing the losses is unacceptable.

- The FASB would be directed to make all banks and financial corporations value their assets at their true market value. This would reveal the mega Wall Street banks and corporations like GE to be insolvent. An orderly bankruptcy of all insolvent financial firms involving the sell-off of their legitimate assets to well-run risk adverse banks that didn’t screw up would ensue. Bondholders and stockholders would realize their losses for awful investment decisions. The economic system would be purged of its bad debt.

- The currency of the US would be backed by hard assets. A basket of gold, silver, platinum, uranium, and some other limited hard commodities would back the USD. If politicians attempted to spend too much, the price of this basket would reflect their inflationary schemes immediately.

- The 16th Amendment would be repealed and the income tax would be scrapped. It would be replaced with a national consumption tax. The more you consume, the more taxes you pay. Wages, savings and investment would be untaxed. The tax code is the source for much of politicians’ power. Its demise would further reduce Washington DC control over our lives.

- A downsizing of the US Military from $1 trillion to $500 billion annually would be initiated through the withdrawal of troops from Afghanistan, Iraq, Germany, Japan and hundreds of other bases throughout the world. Policing the world is bankrupting the empire.

- All corporate, farm, education, and social engineering subsidies would be eliminated. All Federal employees would have their pay slashed by 10% and the workforce would be reduced by 20% over 5 years. Federal health benefits and pension benefits would be set at average private industry levels.

- The Social Security System would be completely overhauled. Anyone 50 or older would get exactly what they were promised. The age for collecting SS would be gradually raised to 72 over the next 15 years. Those between 25 and 50 would be given the option to opt out of SS. They would be given their contributions to invest as they see fit if they opt out. Anyone entering the workforce today would not pay in or receive any benefits. The wage limit for SS would be eliminated and the tax rate would be reduced from 6.2% to 3%.

- The Medicare system is unsustainable. It would be converted from a government program to private market based program. The Federal mandates, rules and regulations would be eliminated. Senior citizens would be given healthcare vouchers which they would be free to use with any insurance company or doctor based on price and quality. Insurance companies would compete for business on a national basis. Doctors would compete for business. The GAO would have their budget doubled and they would audit Medicare fraud & Medicaid fraud and prosecute the criminals without impunity.

- The healthcare bill would be repealed. Insurance companies would be allowed to compete with each other on a national basis. Tort reform would be implemented so that doctors could do their jobs without fear of being destroyed by slimy personal injury lawyers. Doctors would need to post their costs for various procedures. Price and quality would drive the healthcare market.

- The entitlement state would be dismantled. The criteria for collecting welfare, SSDI, food stamps and unemployment benefits would be made much stricter. Unemployed people collecting government payments would be required to clean up parks, volunteer at community charity organizations, pick up trash along highways, fix and paint houses in their neighborhoods and generally keep busy in a productive manner for society.

- A free market method for stabilizing the housing market would be for banks to voluntarily reduce the mortgage balances of underwater homeowners in exchange for a PAR (Property Appreciation Right). The homeowner would agree to pay off the PAR to the Treasury (and administered through the IRS) out of future price appreciation on the existing home or subsequent property. The homeowner would be excluded from taking on any home equity loans or executing any “cash out” refinancing until the PAR was satisfied. The maximum PAR obligation accepted by the Treasury would be based on the value of the home and the income of the homeowner.

I’m sure there are many more solutions which non-captured, intelligent, reasonable citizens could put forth to save this country. None of these ideas would be acceptable to the country’s owners. They would reduce their wealth and power. What these oligarchs do not realize is that we are in the midst of a Fourth Turning. Those who experienced the last one have died off. The existing social order will be swept away. It is likely to be violent and bloody. Good people and bad people will die. When the Crisis reaches its climax we will have the opportunity to implement good solutions. There is also the distinct possibility that our increasingly ignorant populace will turn to a messianic psychopath that promises them renewed glory. Decades of delusional decisions will lead to a future that will not be orderly or controllable.

“The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained growth and recovery. If the suffering becomes great enough, change will inevitably come, but it may not be orderly or as controllable as the moneyed interests often like to think.” – Jesse

Parts 1 & 2 can be accessed here:

PART 1

PART 2

Photo credit: ORF

Photo credit: ORF