So yesterday we find that retail sales are FALLING. Today we find out that prices are SOARING. Sounds bullish to me. Buy stocks. Don’t miss the train to riches. We already know the government massages every data point to extract the best possible view, so when they report an inflation number like they did today, you know the shit is hitting the fan. They’ve run out of hedonistic adjustments and the other bullshit they use to fake the inflation numbers.

Even the number they reported today is a lie. Look at the supposed March and April PPI for Energy. The BLS drones are telling you that energy prices have fallen by 1.1% over that time period. Let’s add a little reality to their bullshit storyline of declining energy prices:

- National gas prices rose from $3.52 per gallon on March 1 to $3.66 per gallon on April 30. That is a 4% increase in two months.

- Oil prices were $101 per barrel on March 1, averaged about $102 per barrel over the two months and finished at $101 per barrel on April 30. No drop there.

- Natural gas on March 1 was $4.60 and on April 30 was $4.85. Based on my years of financial training, I believe that is an increase.

What energy product fell? Oil, gasoline and natural gas supply the vast majority of energy in this country and the prices of those products rose from March 1 through April 30, but the government tells you the prices fell. Who do you believe?

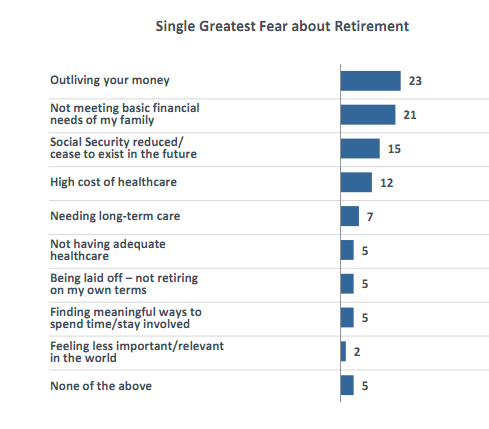

It’s all good. Yellen assures us the 3.6% year to date PPI is an aberration and QE hasn’t had any negative impact on the lives of average Americans. Tell that to the 85 year old widows getting $0 on their savings and eating Alpo for dinner.

Producer Prices Surge Most In Over Four Years As BLS Discovers Food Inflation

Submitted by Tyler Durden on 05/14/2014 08:51 -0400

And just like that, the BLS is reacquainted with soaring food prices.

Moments ago the US government reported that producer prices, as part of a newly reindexed PPI series, spiked by 2.1% from a year ago, or a whopping 0.6% surge in April, the biggest monthly jump since January 2010, and up from the 0.5% increase in March.

So what caused this surge in producer prices? Why food costs of course, which in April soared by 2.7%.

Here is the explanation for the finished goods price surge:

Special grouping, Finished goods: The index for finished goods moved up 0.7 percent in April. (The finished goods index represents about two-thirds of final demand goods, through the exclusion of the weight for government purchases and exports. The finished goods index represents about one-quarter of overall final demand.) The broad-based increase was led by the index for finished consumer foods, which advanced 2.4 percent. Prices for finished goods less foods and energy and for finished consumer energy goods rose 0.3 percent and 0.5 percent, respectively. Within finished goods, higher prices for meats, gasoline, light motor trucks, residential electric power, processed poultry, and eggs for fresh use outweighed lower prices for residential natural gas, passenger cars, and soft drinks.

It wasn’t just finished goods that was burned by food prices. Processed goods by intermediate demand…

In April, the index for processed eggs jumped 25.3 percent. Prices for ethanol, meats, gasoline, and commercial electric power also increased. Conversely, the index for jet fuel declined 5.3 percent. Prices for diesel fuel, primary basic organic chemicals, natural gas to electric utilities, and soybean cake and meal also fell

Unprocessed goods too…

The index for unprocessed goods for intermediate demand rose 0.4 percent in April after edging down 0.1 percent a month earlier. Leading the advance, prices for unprocessed foodstuffs and feedstuffs moved up 3.6 percent.

In April, a 9.4-percent jump in prices for slaughter chickens led the advance in the index for unprocessed goods for intermediate demand. The indexes for slaughter hogs, corn, soybeans, carbon steel scrap, and crude petroleum also moved up.

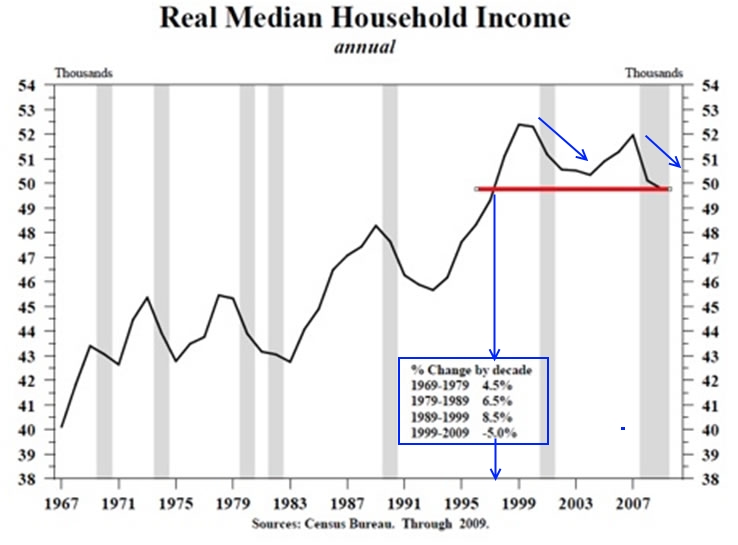

And so on. The good news however is that as food prices soar, and as rents hit all time highs, wages are rising in lockstep. Oh wait, never mind.

What Food Inflation?

Submitted by Tyler Durden on 05/14/2014 08:51 -0400

Oh, this food inflation.

Incidentally, the last time food prices spiked by this much in one month, the resulting Arab Spring wave of revolutions tumbled governments across north Africa and the middle east.

Keep a close eye on those who are not exactly participating in the global central bank cartel’s “wealth transfer effect” , and suddenly find they can’t afford food again.

Source: BLS