In Part 1 of this article I detailed the insane solutions proposed and executed since 2008 by our owners as they attempt to retain and further expand their ill-gotten wealth, acquired through fraud, deceit, swindles, and the brilliant manipulation and exploitation of the masses through Bernaysian propaganda techniques. Madness has engulfed the entire world, with a concentration of power in the hands of a few psychopathic financial elite wielding an inordinate and dangerous expanse of power over the lives of the common man. They are a modern day version of Al Capone, except their weapons of choice aren’t machine guns, but a printing press, peddling debt, creating derivatives of mass destruction, and peddling heaping doses of disinformation. The contemporary criminal class wears Hermes suits, Rolex watches and diamond studded pinky rings, drops $500 to dine at Masa in NYC, travels by chauffeured limo, lives in $10 million NYC penthouse suites, occupies luxurious corner offices in hundred story glass towers, and spends weekends hobnobbing with the other financial elite at their villas in the Hamptons. They have nothing but utter contempt for the lowly peasants who depend upon a weekly paycheck to make ends meet. Why work when you can steal $1 or $2 billion from farmers with no consequences?

The willfully ignorant masses are kept at bay by the selling them a false dichotomy of Republicans versus Democrats, conservatives versus liberals, and capitalism versus socialism. The ruling class distracts the public with fake wars on poverty, drugs and terror, while using these storylines to further enrich themselves and keep the public alarmed and frightened. We’ve been “fighting” the wars on poverty and drugs for over four decades and poverty is at record levels, while drugs are easier to obtain than candy in a candy store. The war on terror is nothing more than a corporate arms dealer welfare plan. The end of the Cold War put a real crimp in the bottom lines of Lockheed Martin and the rest of the peddlers of death. 9/11 and the subsequent undeclared wars in Iraq, Afghanistan, Libya and now Syria, with Iran on the horizon, have been a godsend to the bottom lines of the corporations Eisenhower warned about in 1961. In reality, the politicians are interchangeable and bought off by corporate and special interests. The people are sold a fable, and controlled opposition is the fairy tale. They perpetuate the welfare/warfare state that enriches Wall Street, the military industrial complex, the healthcare service complex, politically connected mega-corporations and the corporate media propaganda complex. The American people are given the illusion of choice by their keepers. The system is rigged. The real decisions are made by unelected secretive men who operate in the shadows and use their wealth to direct the decision making of the politicians, government bureaucrats, and corporate entities that benefit from those decisions. Edward Bernays described a society that existed in the 19th Century, 20th Century, and has now grown to immense proportions in the 21st Century:

“Political campaigns today are all sideshows…A presidential candidate may be ‘drafted’ in response to ‘overwhelming popular demand,’ but it is well known that his name may be decided upon by half a dozen men sitting around a table in a hotel room…The conscious manipulation of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country.” – Edward Bernays

The manipulation of the masses has been perfected by the ruling class through decades of corporate mass media messaging the purposeful dumbing down of the populace through government public school education that teaches children how to feel rather than how to think. The conscious manipulation of the masses has been designed to produce obedient non-thinking consumers of corporate products, educated to believe the accumulation of material goods with debt constitutes wealth, to fear whatever the government tells them to fear, and never look up from their iGadgets long enough to actually think for themselves. We are bombarded with Orwellian memes designed to keep us sedated and pliant, as the ruling class pillages the national wealth and expands their power and control over our lives.

Conform; Stay Asleep; Do Not Question Authority; Obey; Consume; Reproduce; Submit; Watch TV; Buy; Follow; Doubt Humanity; No New Ideas; Feel, Don’t Think; Fear; Accumulate; Honor Apathy; Believe Experts; Surrender; Spend; No Independent Thought; Win; Want More; Hate; Succumb To Desire; Yield To Power; Choose Safety Over Liberty; Choose Security Over Freedom

This insane world was created through decades of bad decisions, believing in false prophets, choosing current consumption over sustainable long-term savings based growth, electing corruptible men who promised voters entitlements that were mathematically impossible to deliver, the disintegration of a sense of civic and community obligation and a gradual degradation of the national intelligence and character.

Are You Sane?

“A sane person to an insane society must appear insane.” – Kurt Vonnegut – Welcome to the Monkey House

Vonnegut and Huxley’s social commentary reveals a basic truth that societies and human beings have been prone to bouts of madness over the course of decades and centuries. Humans are a weak species, susceptible to the vagaries of greed, lust, gluttony, wrath, sloth, envy and pride. The seven deadly sins are in full bloom today, as the American empire descends through Dante’s inferno of reality TV, celebrity worship, religious zealotry, adulation of wealthy titans, military conquest and worship of false idols. Over the centuries humans have gone mad over tulips, farm land, stocks, and real estate. The easily duped American populace has been victimized by multiple bubbles bursting since the creation of the Federal Reserve in 1913. The contention that a central bank run by private banking interests would promote a safer financial system and a stable currency is laughable. The Federal Reserve and the bankers who control it have created three stock bubbles, the largest housing bubble in history, a bond bubble and the mother of all debt bubbles, while destroying 95% of the dollar’s purchasing power in the last 100 years.

There is a common denominator in all the bubbles created over the last century – Wall Street bankers and their puppets at the Federal Reserve. Fractional reserve banking, control of a fiat currency by a privately owned central bank, and an economy dependent upon ever increasing levels of debt are nothing more than ingredients of a Ponzi scheme that will ultimately implode and destroy the worldwide financial system. Since 1913 we have been enduring the largest fraud and embezzlement scheme in world history, but the law of diminishing returns is revealing the plot and illuminating the culprits. Bernanke and his cronies have proven themselves to be highly educated one trick pony protectors of the status quo.

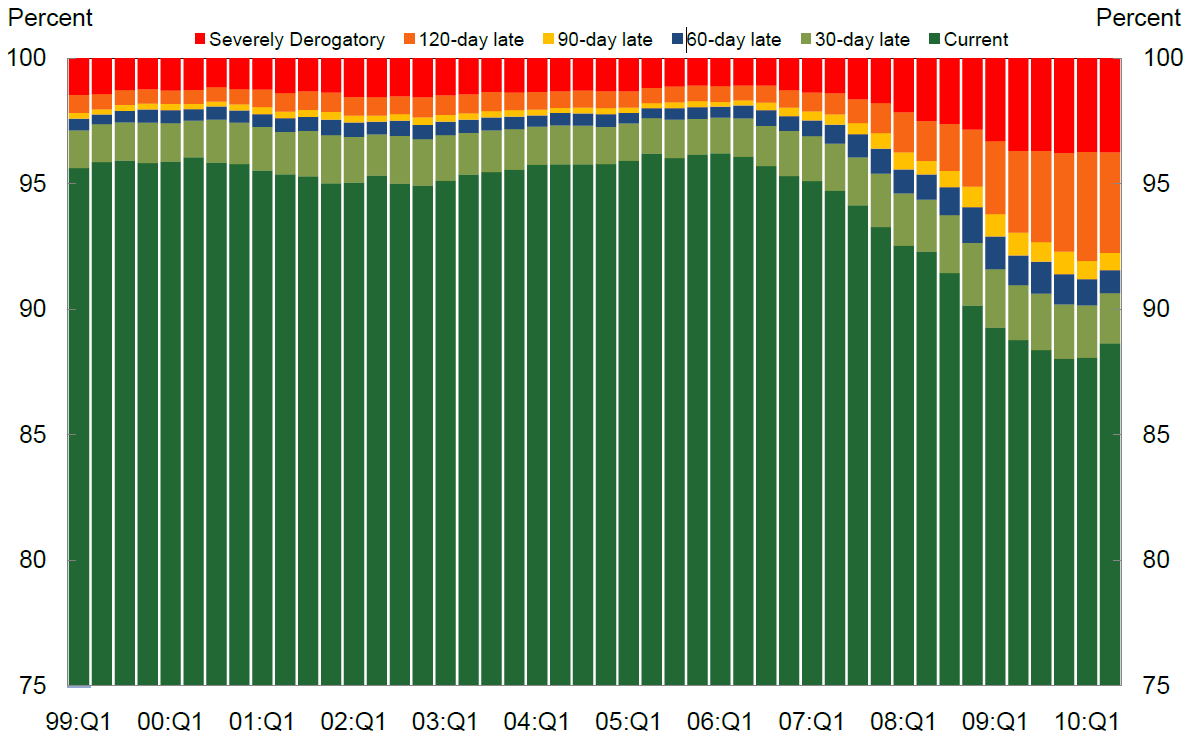

Greenspan’s easy money policies, manufacturing of negative real short term interest rates, regulatory malfeasance and unspoken promise to bail out Wall Street whenever their excessive risk taking threatened to burn down the financial system, led to 50% stock market crash in 2000/2001, a 40% plunge in national home prices, and another 55% stock market crash in 2008/2009. While Ivy Leaguers Bernanke, Paulson, Hubbard, Krugman, and Bush were too obtuse or too blinded by their ideology to recognize the fraudulent housing and stock market bubbles, honest clear thinking men like Robert Shiller, John Hussman, and Ron Paul recognized the bubbles well in advance and understood the consequences to the average American.

“Like all artificially-created bubbles, the boom in housing prices cannot last forever. When housing prices fall, homeowners will experience difficulty as their equity is wiped out. Furthermore, the holders of the mortgage debt will also have a loss.” – Ron Paul – 2003

What Ron didn’t realize was the peddlers and packagers of fraudulent mortgage debt on Wall Street would walk away unscathed when the bubble they created popped. Trillions of net worth was vaporized due to the policies, solutions, and programs designed and implemented by Bernanke and his Wall Street co-conspirators. The losses should have been borne by those who made the loans. Instead they were borne by the American taxpayer and future unborn generations. David Stockman, in his no holds barred book about the Wall Street and K Street crony capitalist criminals, rails against the Federal Reserve led rescue of the profligate destroyers of capital markets:

“At the end of the day, this trillion-dollar infusion of capital and liquidity from the public till had a single overarching effect: it nullified in its entirety the impact of Mr. Market’s withdrawal of a similar magnitude of funding from the wholesale money market. So the very monetary distortion – the availability of cheap overnight funding in massive quantities – upon which the Wall Street financial bubble had been built had now been recreated at the lending windows of the Fed, FDIC, and the US Treasury.

The opposite path of liquidating the Wall Street bubble was eschewed, of course, not only because it would have meant massive losses to speculators in the stock and bonds of Goldman Sachs, Morgan Stanley, JP Morgan, and the remaining phalanx of the walking wounded. Crony capitalism also triumphed because in muscling the system during the white heat of crisis, Wall Street had plenty of intellectual cover. The fact is, mainstream economists of both parties were trapped in a Keynesian dead end, proclaiming that the solution to the crushing national debt load which had actually triggered the financial crisis was to pile on more of the same.

Accordingly, banks which were “too big to fail” couldn’t be busted up, since they were allegedly needed to shovel more credit onto already debt saturated household and business balance sheets. Likewise, speculators who should have suffered epochal losses during the meltdown were resuscitated by Fed-engineered zero interest rates in the money market, thereby quickly reviving the same massively leveraged “carry trades” in commodities, currencies, equities, derivatives, and other risk assets which had brought on the crisis in the first place.” – David Stockman – The Great Deformation – The Corruption of Capitalism in America

The working middle class was forced at gunpoint to bail out billionaire bankers who had been fraudulently inducing feeble minded dupes and trailer trash to purchase $500,000 McMansions with negative amortization no doc subprime mortgages, while bullying appraisers into inflating appraisals, buying off the rating agencies, selling the toxic derivatives to their clients, and then shorting the very same derivatives. They subsequently committed foreclosure fraud by robo-signing legal documents. Describing these modern day Shylocks as heartless, cruel, lecherous, avaricious demons understates the vileness and contemptibility of their nature. Ben Bernanke and Hank Paulson blatantly lied to the depraved, gutless members of Congress and to the easily hoodwinked fearful American public about the threat of our financial system collapsing unless the Wall Street banks were saved. This false storyline is still peddled today and believed by millions of willfully ignorant crony capitalist devotees. The financial system wasn’t going to collapse. The stock prices of JP Morgan, Goldman Sachs, Citigroup, Bank of America, AIG, Morgan Stanley, GE, and Wells Fargo were collapsing. The wealth of the financial elites that run the country was in peril. The depositors in these banks wouldn’t have lost a penny, but the shareholders and bond holders would have been wiped out. The personal wealth of Dimon, Mack, Lewis, Prince, Immelt, Blankfein and the other titans of finance took precedence over the rule of law and the negative consequences of excessive risk taking and control fraud.

True free market capitalism embraces the concept of creative destruction. Poorly run companies fail and are replaced by well-run companies. Bankruptcy law worked perfectly during the liquidation of Washington Mutual. The orderly liquidation of the Too Big to Trust Wall Street banks would have resulted in billions of bad debt being discharged, with the losses being borne by the executives who mismanaged the banks and the investors who were foolish enough to fund the disastrous schemes perpetrated by those executives. The FDIC would have kept depositors whole. The privatization of illicit bank profits from 2002 through 2007 and the socialization of the 2008 through 2010 bank losses are proof that we are experiencing a warped, immoral, crony capitalism that enriches the well-connected and impoverishes the working middle class. Our political, economic and financial systems have been captured by corporate and special interests. This corruption will prove fatal, as the vested interests destroy the system through their myopic greed. We’ve allowed a small cadre of malevolent men to gamble away the nation’s future with impunity from all laws, regulations and any sense of morality, under the guise of capitalism. These men and the nation will pay a high price for these transgressions. The punishment will fit the crimes.

“People of privilege will always risk their complete destruction rather than surrender any material part of their advantage.” – John Kenneth Galbraith – The Age of Uncertainty

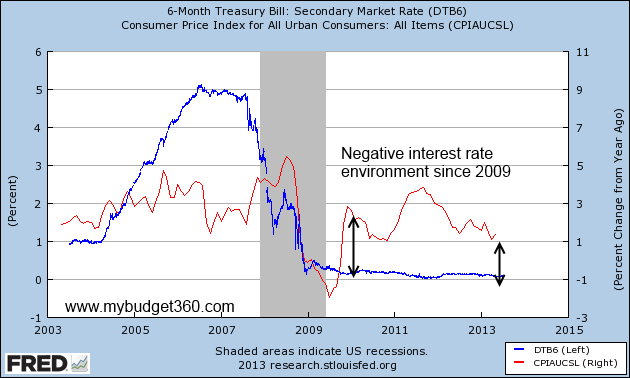

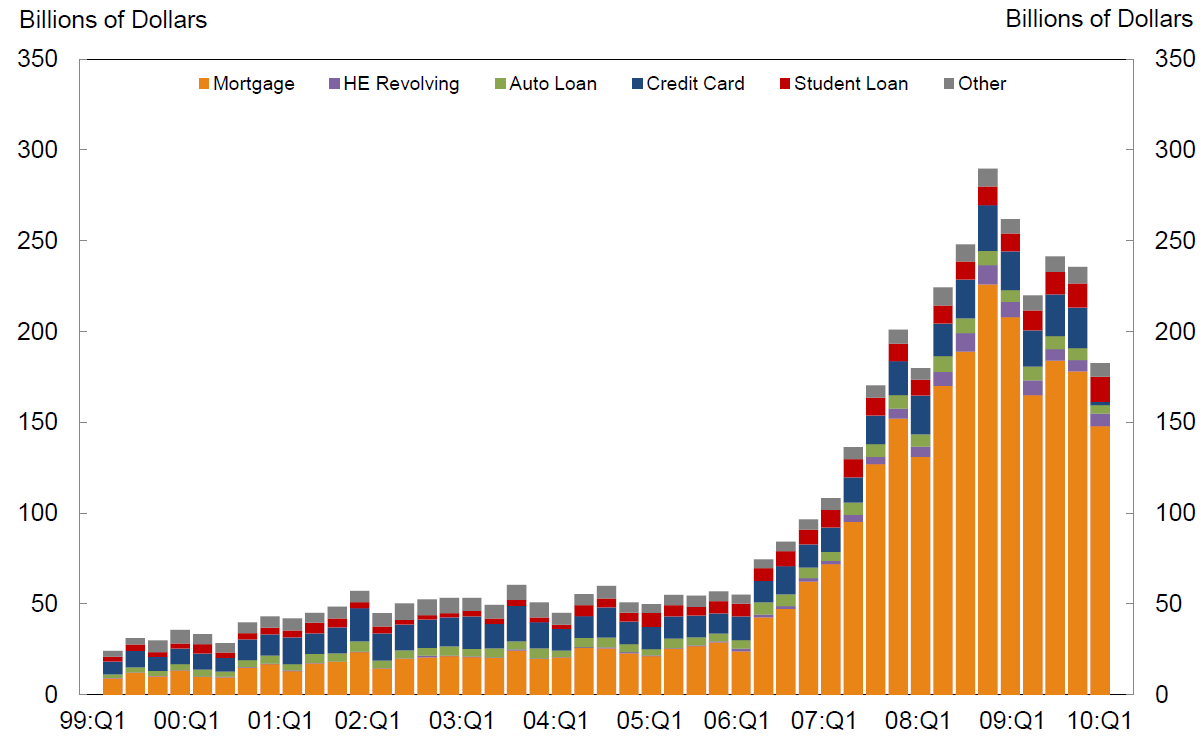

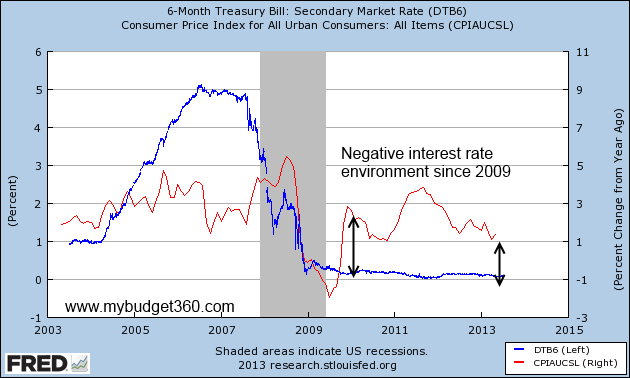

The chart below reveals the criminal plan as implemented by Bernanke, the Obama administration and the Wall Street banks. Instead of allowing insolvent financial institutions to fail, $700 billion of taxpayer funds were syphoned from the economy and handed to them. Bernanke has since stuffed their coffers with another $2.4 trillion he printed out of thin air. The purpose of this insane transfer of national wealth from the people to the parasites was not to help Main Street. Forcing the FASB to allow these criminal bankers to mark to unicorn rather than mark to market, buying their toxic mortgages, and providing billions in free money was done to cover-up the fact they are insolvent. Their balance sheets and the Federal Reserve balance sheet are choking on bad debt. The ongoing foreclosure/rent to own scam was designed to drive up home prices and allow the bankers to exit their toxic mortgages with a profit. The criminally insane bankers have used the trillions in excess funds to syphon off billions in stock market gains, with assurances from Ben that QE to infinity will always be there. They know if their gambling leads to losses, Ben will come to the rescue.

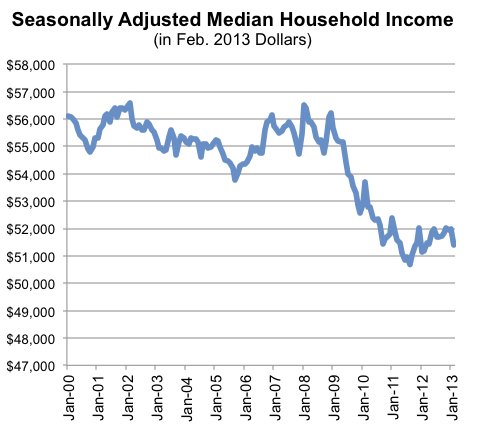

The purpose of banks was supposed to be to lend money to businesses and consumers so they could make long-term investments that helped expand the economy. These Wall Street cretins didn’t loan money to people and businesses in the real world. It was much easier to generate risk free returns and program their HFT supercomputers to buy, buy, buy. By driving real interest rates below zero for the last four years, Bernanke has stolen $400 billion per year from senior citizens living on the edge and transferred it to bloodsucking bankers. Anyone with money in a bank account is losing money. This was designed to force muppets back into the stock market where they will be fleeced for the third time in the last thirteen years.

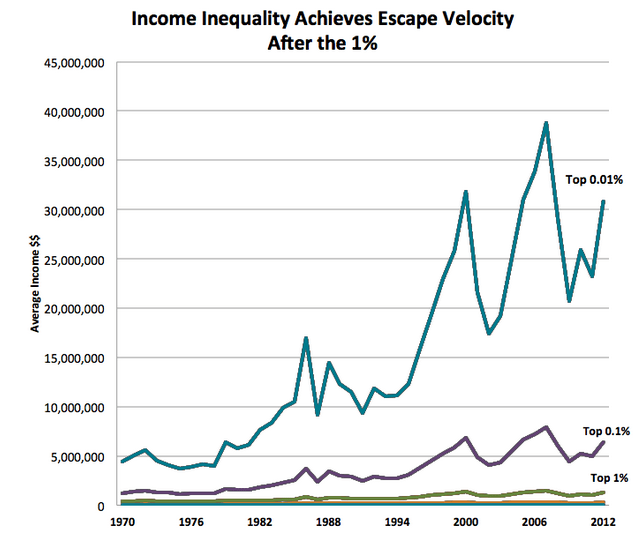

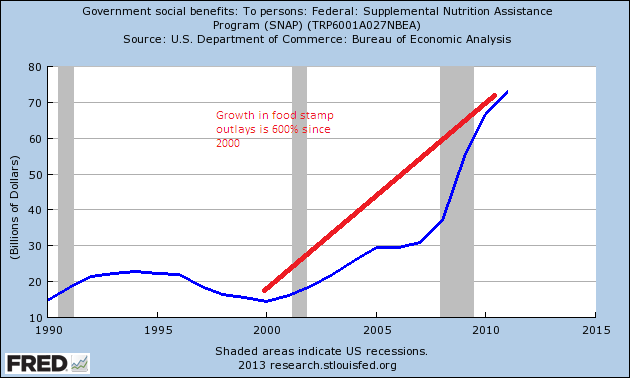

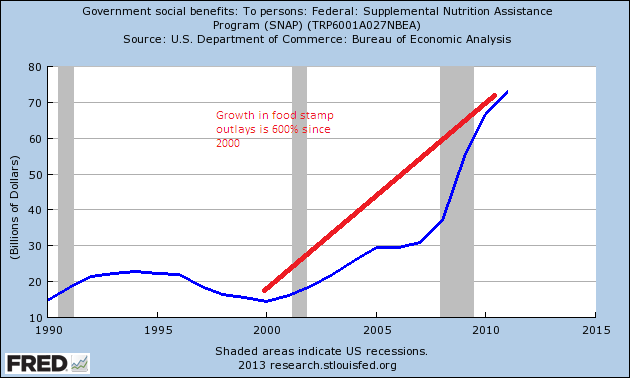

Bernanke’s rescue measures have been a smashing success for the .1%. Wall Street is generating record levels of profits and paying out record levels of bonuses to themselves for a job well done. The stock market is at an all-time high, while the middle class is eviscerated by relentless inflation in energy, food, healthcare, clothing, tuition, rent and taxes. Reality does not match the propaganda touted by the financial elite. Ask the 47.7 million people on food stamps.

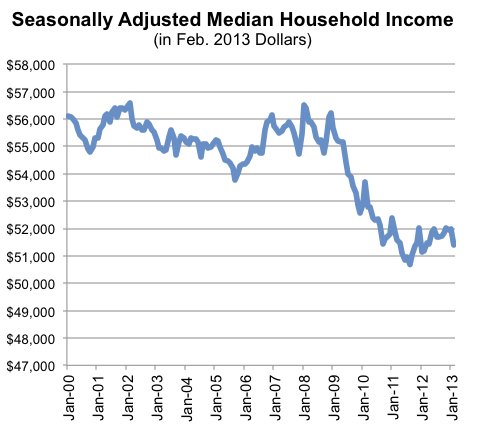

The economic recovery narrative propagated by Wall Street paid economists, Wall Street controlled media pundits, and Wall Street bought off politicians is nothing but unmitigated bullshit. True unemployment, that doesn’t falsely exclude the unemployed who have thrown in the towel, is north of 20%, with youth unemployment exceeding 40%. The “solutions” implemented by our owners have led to a 10% collapse in the median household income since 2008. If the middle class is seeing their real incomes decline, while their living expenses are rising by 5% per year, how can the economy be recovering? It can’t. Bernanke’s banker welfare program and Obama’s $1 trillion deficits, along with accounting fraud and under-reporting of inflation, have produced the illusion of recovery.

Dimitri Orlov summarizes our modern financial system and sets the table for the coming collapse:

“The main tools of modern finance are mystification, obfuscation and hypnosis. What is different now is that all the governments have already shot all of their magic bailout bullets. The guilty parties are still at large, richer than they were before this crisis and probably thinking that the next crisis will make them even richer.” – Dimitri Orlov – The Five Stages of Collapse

The questions that must be answered are: How did we allow this to happen? Are we blameless? Can our course be reversed?

Time to Look in the Mirror

“The America of my time line is a laboratory example of what can happen to democracies, what has eventually happened to all perfect democracies throughout all histories. A perfect democracy, a ‘warm body’ democracy in which every adult may vote and all votes count equally, has no internal feedback for self-correction. It depends solely on the wisdom and self-restraint of citizens… which is opposed by the folly and lack of self-restraint of other citizens. What is supposed to happen in a democracy is that each sovereign citizen will always vote in the public interest for the safety and welfare of all. But what does happen is that he votes his own self-interest as he sees it… which for the majority translates as ‘Bread and Circuses.’

‘Bread and Circuses’ is the cancer of democracy, the fatal disease for which there is no cure. Democracy often works beautifully at first. But once a state extends the franchise to every warm body, be he producer or parasite, that day marks the beginning of the end of the state. For when the plebs discover that they can vote themselves bread and circuses without limit and that the productive members of the body politic cannot stop them, they will do so, until the state bleeds to death, or in its weakened condition the state succumbs to an invader—the barbarians enter Rome.” – Robert A. Heinlein

Robert Heinlein has been dead for twenty five years. He wrote these words decades ago. His vision of a state bleeding to death is being played out as we speak. Ben Franklin had an inkling the Republic we were given would not be sustained. The success of our nation hinged upon the wisdom, self-restraint, morality, and civic mindedness of its citizens. Our form of governance was never perfect. Nothing is perfect. Adam Smith’s free market capitalism was based upon true competition, but with an underlying moral code. The rule of law meant something. Those who stole, cheated or broke the law were punished. Bankers and their usurious machinations were frowned upon. They were tolerated as a necessary evil, but they certainly weren’t admired and celebrated. When their greedy schemes to loot the populace went too far, a courageous leader would step forth and rout out the vipers and thieves:

“You are a den of vipers and thieves. I intend to rout you out, and by the eternal God, I will rout you out.” – Andrew Jackson

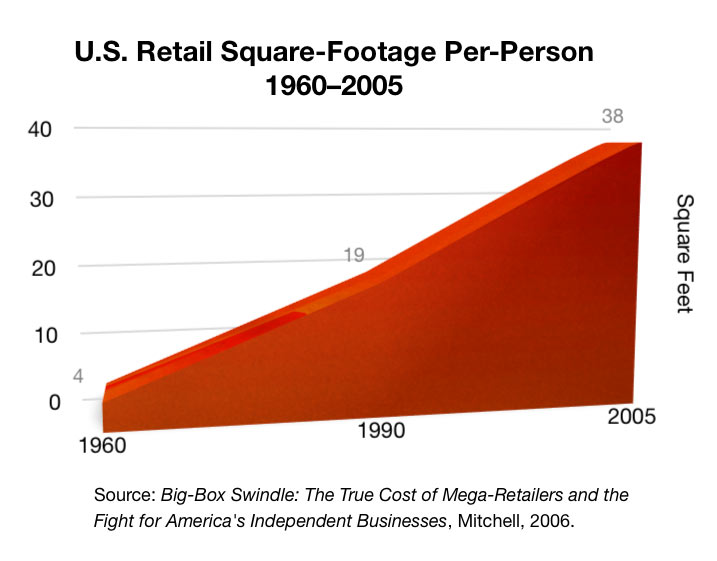

Bankers gained more power after the Civil War as oil was discovered, the country grew rapidly, and the robber barons built their fortunes on debt and the backs of the poor. But still, there were leaders like Teddy Roosevelt who stood up to the banking and corporate interests. The die was finally cast in 1913 with the introduction of the income tax, the creation of the Federal Reserve and allowing the people to directly elect their Senators. A century of central banking has led to: a century of war; a century of currency debasement; a transformation from a hard-working, saving, producing society into an irresponsible, debt based spending, consuming society; and the degradation of our society into a mob of egotistical techno-narcissists, who have chosen bread and circuses over freedom, liberty and self-reliance. At first it happened gradually, but accelerated rapidly once Nixon removed the last vestiges of control over greedy bankers, corrupt politicians, and gluttonous voters. The transformation from an industrious nation of savers into a slothful nation of consumers has reached its zenith. Financialization Nation has been built on a pyramid of debt. The youth of today have been left with an un-payable debt burden and as Bill Bonner points out, the endgame will likely be violent and bloody:

“That’s a heavy burden. It is especially disagreeable when someone else ran up the debt. Then you are a debt slave. That is the situation of young people today. They must face their parents’ debt. Even serfs in the Dark Ages had it better. They had to work only one day out of 10 for their lords and masters. As it stands, young people in the U.S., Europe and Japan are expected to work their whole lives to pay for things their parents and grandparents consumed decades earlier.

Let’s see. Deny a young person work and you deny him a career. Deny him a career and you deny him a way to support a family. Deny him a family life and who knows what happens? Will today’s young people accept their lot… and remain in docile debt servitude their whole lives? Or will they rise up and burn T-bonds in public spaces… rampage down Wall Street… and perhaps hang Ben Bernanke in front of the New York Federal Reserve?” – Bill Bonner

The pyramid of debt was built brick by brick over the last century, as an unelected, secretive, unaccountable cabal of private banker pharaohs has controlled the currency of the nation and worked on behalf of the vested corporate and banking interests that control the country. Shortly after its devious creation in 1913, they enabled Woodrow Wilson to wage a war he promised to keep the nation out of. The central bank’s easy money policies during the 1920s led to an unsustainable credit driven boom in stocks, bonds and real estate. As usual, their belated monetary tightening was too late to avoid the 1929 Crash. Federal Reserve and government intervention after the crash prolonged the Depression for over a decade. The Crash of 1929 proved once again that bankers could not be trusted. Their insatiable greed and reckless thirst for more and more riches required checks on their ability to destroy our economic system. The 38 page 1933 Glass-Steagall Act made sure commercial banking was kept separate from investment banking (gambling), keeping the productive activity of helping businesses grow isolated from the parasitic activity of speculation. This clear, concise, understandable law kept bankers from destroying the lives of millions for 66 years, until a bipartisan screw job repealed the law and unleashed the kraken upon the unsuspecting public. Bernanke’s QE to infinity driven stock market gains over the last few years are reminiscent of another historic time, and this story also hasn’t reached its ultimate climax.

“A major boom in real stock prices in the U.S. after ‘Black Tuesday’ brought them halfway back to 1929 levels by 1930. This was followed by a second crash, another boom from 1932 to 1937, and a third crash. Speculative bubbles do not end like a short story, novel, or play. There is no final denouement that brings all the strands of a narrative into an impressive final conclusion. In the real world, we never know when the story is over.” – Robert Shiller

The destruction of Europe, Russia and Japan during World War II and the Bretton Woods system that made the USD supreme across the world kept the economic peace for the next quarter century. A confluence of events in the late 1960s and early 1970s set the stage for the ultimate collapse of our faith based monetary system. LBJ’s Great Society welfare programs and our disastrous foray into Southeast Asia began the insane welfare/warfare dynamic that has required more and more debt to sustain. Nixon realized the debt expansion needed to pay for an ever expanding state could never be achieved with the Bretton Woods/gold pegged currency system. In 1971 Nixon unilaterally canceled the direct convertibility of the USD to gold. It ushered in the era of freely floating currencies, relentless inflation, financial bubbles, debt accumulation, consumerism, and the rise of the corporate/fascist propaganda state. Using government supplied CPI statistics, the dollar had lost 75% of its purchasing power between 1913 and 1971. Since 1971 it has lost 83% of its remaining purchasing power. And Ben Bernanke has the guts to publicly state his worries about the ravages of deflation.

The years 1913 and 1971 will be seen by future historians as infamous dates when marking the decline of the great American empire. Prior to 1971, the New York Stock Exchange barred the public listing of investment banks. After the exchange repealed this ban, the large investment banks (Lehman Brothers, Morgan Stanley, Merrill Lynch, Goldman Sachs, Bear Stearns) converted from partnerships, where the senior employees owned the company and were responsible for all of its liabilities, profits and losses, into publicly owned corporations, where executives’ incentives become aligned with outside shareholders, who demanded short-term profits and higher stock prices at the expense of long term sustainability. The partnership structure provided a mechanism of restraint, self-control, fiscal responsibility and cautiousness. If the bank failed, the partners’ net worth would be wiped out. Their incentives were for the long-term sustainability of the business and they were discouraged from taking undue risks that might produce huge short term profits, but might also destroy the firm. Shame and a sense of responsibility to fellow partners was a strong deterrent to obscene risk taking. The unholy combination of allowing investment banks to go public and repealing Glass Steagall in 1999, created a greed driven uncontrollable Too Big To Control brutish monstrosity consuming the world in its desire for more. It will only be stopped when it chokes to death while gorging on what’s left of the middle class.

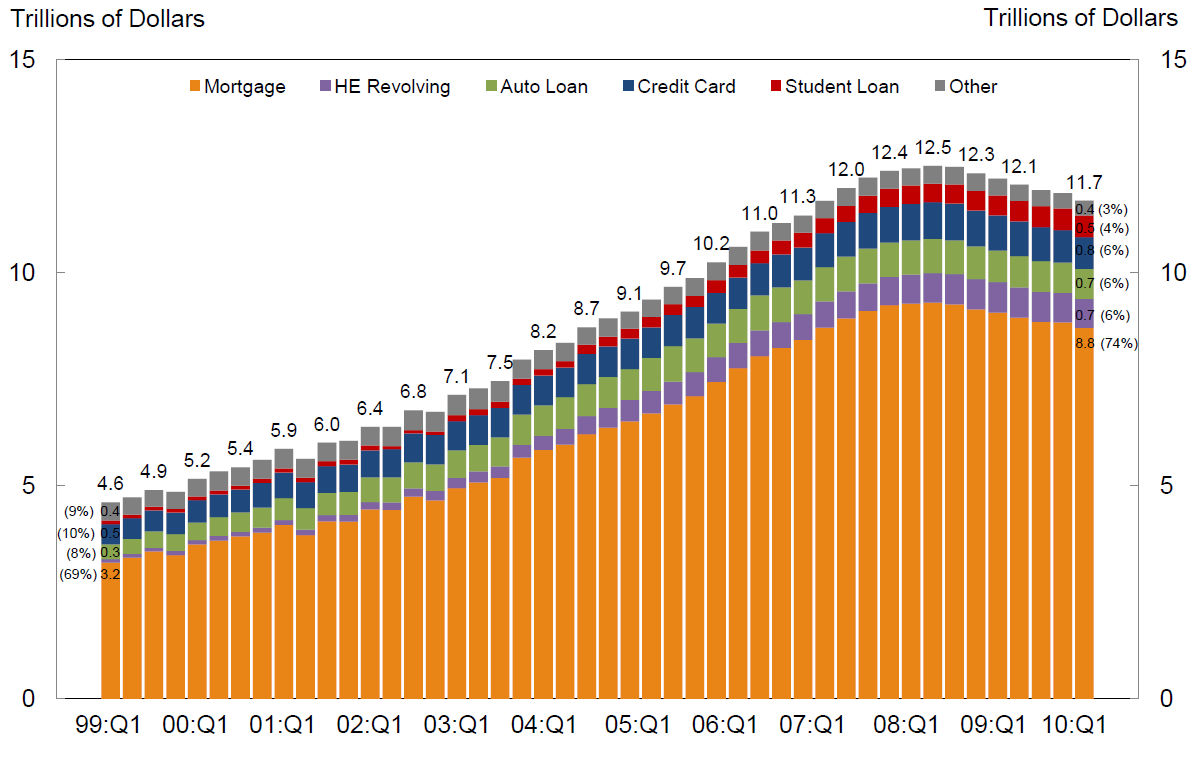

The citizens, formerly known as the hard working American middle class, must accept their share of responsibility for the desperate circumstances we face. Some are guiltier than others, but we only need look in the mirror to find the culprits in allowing the bankers, politicians, military industrial complex, mass media and vested corporate interests to gain control over our country. The introduction of the credit card by Wall Street bankers as a must have for every citizen in the early 1970s coincided with the inflationary demons unleashed from Pandora’s Box by Nixon and the Federal Reserve, along with the peak of cheap U.S. oil production. Thus began four decades of real wages declining and consumer debt soaring. A nation of people that believed in saving before purchasing were given the freedom to spend money they didn’t have. The statistics paint a picture of a society gone mad:

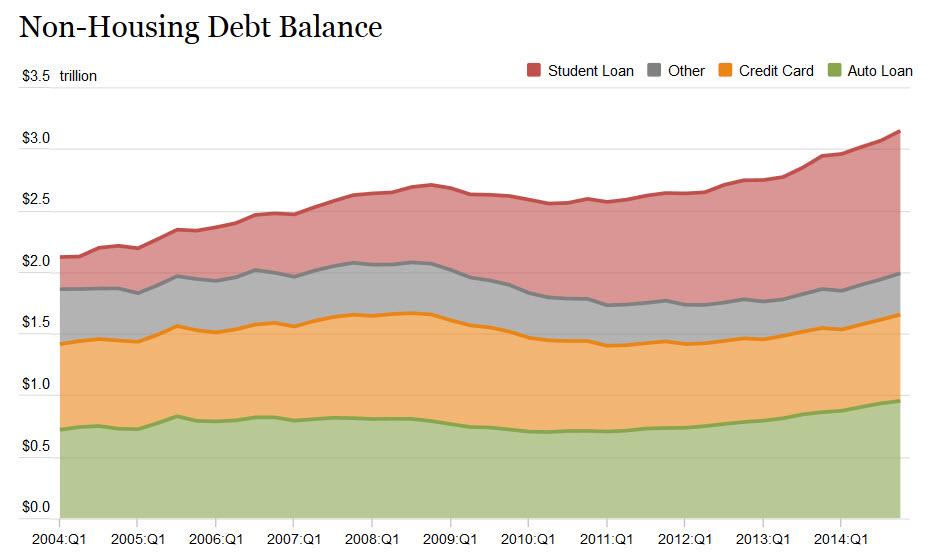

- Credit card debt grew from $5 billion in 1971 to $856 billion today, a 17,000% increase in forty-two years. GDP rose from $1.2 trillion to $16.6 trillion, a mere 1,400% increase. Real GDP only grew by 300%. Wages have grown from $600 billion to $7 trillion, a 1,200% increase. Real disposable personal income per capita grew from $17,200 to $36,800, a 200% increase.

- Non-revolving debt (auto, student loan) grew from $127 billion in 1971 to $1.98 trillion today, a 1,600% increase.

- There are over 600 million credit cards in circulation within the U.S. and Americans charged over $2.1 trillion last year.

- Over 40% of Americans carry a balance on their credit card from month to month, with an average balance of $8,200 and an average interest rate of 13%.

- 40% of all low and middle income households must rely on their credit cards to pay basic living expenses like rent, mortgage, utilities, groceries, real estate taxes, income taxes, along with their “needed” iPhones, HDTVs, bling, stainless steel appliances, and tattoo artwork.

- Wall Street banks have written off over $300 billion in credit card debt since 2008 (and passing the bill to taxpayers), while bilking their customers out of $60 billion per year in late fees and overdraft fees.

Despite the storyline of austerity, consumer credit outstanding has reached an all-time high of $2.84 trillion because Bernanke and his Wall Street puppeteers require perpetual debt expansion to keep their Ponzi scheme alive. Federal government dispensation of loans to subprime student borrowers has helped mask the true unemployment rate and Federal government doling out of subprime auto loans through Ally Financial and their crony Wall Street partners has created a fake auto recovery. The Blackrock/Wall Street “rent to own” faux housing recovery was designed by our owners to lure clueless math challenged dupes back into the housing market. Our entire economy is nothing but a confidence game at this point.

The four decade long orgy of debt couldn’t have ensued if our currency had remained linked to the barbaric relic – gold. The apologists and lackeys for the vested interests scorn and ridicule the notion of our economic system being burdened with any checks or balances. This is where the interests of those in power and those being ruled have coincided, as a fiat based monetary system allowed unlimited spending to keep the welfare/warfare state growing, enriching the crony capitalists, deepening the power of the state, and providing the masses with foreign made trinkets, baubles, corporate logoed clothing, techno-gadgets, and pimped out financed wheels. The concepts of self-restraint, discipline, saving for a rainy day, prudence, discretion, and deferred gratification are rarely displayed in modern day America. In a case of mass delusion, Americans have convinced themselves to live for today, recklessly ignore their futures, irresponsibly spend money they don’t have on things they don’t need, neglect their civic duty towards future generations, choose ignorance over knowledge, and vote for spineless politicians who promise them entitlements that are mathematically impossible to honor. The public’s foolish attitude towards debt accumulation matches the arrogance of our gutless intellectually dishonest leaders.

“When people pile up debts they will find difficult and perhaps even impossible to repay, they are saying several things at once. They are obviously saying that they want more than they can immediately afford. They are saying, less obviously, that their present wants are so important that, to satisfy them, it is worth some future difficulty. But in making that bargain they are implying that when the future difficulty arrives, they’ll figure it out. They don’t always do that.” – Michael Lewis – Boomerang

The manner in which our leaders are governing the country and citizens are living their lives can only be considered normal in relation to residing in a profoundly abnormal society. The American Dream of having the opportunity for upward mobility through educating yourself, working hard, accumulating wealth methodically by spending less than you earn, and reaching your full potential as a caring loving human being has been replaced by a perverted nightmare where we run on a hamster wheel for our entire lives trying to achieve the new American dream of accumulating throw away material goods, working to make the payments for McMansions, SUVs, stainless steel appliances, and iGadgets you rent from bankers, while driving yourself into an early grave by consuming mass quantities of processed poison and the stress created by trying to achieve the lifestyle sold to us by Madison Ave. maggots, Wall Street shysters and the mainstream media propagandists. The corporate fascists tell you what to believe, which “enemy” to fear, how you should look, what to eat, what drug to take for the illnesses caused by the food they lured you to eat, the kind of house you need to impress your friends and family, and the car you need to drive to impress your neighbors. As George Carlin aptly pronounced: “It’s called the American Dream because you’d have to be asleep to believe it.” – either asleep or insane.

“Normal is getting dressed in clothes that you buy for work and driving through traffic in a car that you are still paying for – in order to get to the job you need to pay for the clothes and the car, and the house you leave vacant all day so you can afford to live in it.” – Ellen Goodman

Our profoundly abnormal society of materialistic zombies, who mindlessly obey the commands and marketing messages of the financial elite, has staked their futures and the future of the country on the wisdom and brilliance of an Ivy League academic who never worked a day in the real world, didn’t spot the largest fraudulent housing bubble in world history, and whose unlawful acts as Federal Reserve chairman have enriched the banking whores who destroyed the country and impoverished what remains of the dying middle class. It’s the height of insanity for the American people to trust these crooked high priests of finance to cure a disease they spread with their immoral, traitorous policies over the last century. Bernanke and his lackeys, in a desperate last gasp gamble to prolong their fiat currency pillaging of the peasants, have rolled the dice with QE to infinity, accounting fraud, and further enrichment of their corporate masters.

“Viewed as a religious cult, modern finance revolves around the miracle of the spontaneous generation of money in a set of rituals performed by the high priests of central banking. People hang on the high priests’ every word, attempting to divine the secret meaning behind their cryptic utterances. Their interventions before the unknowable deity of global finance assure them of economic recovery and continued prosperity, just as a shaman’s rain dance guarantees rain or ritual sacrifice atop a Mayan pyramid once promised a bountiful harvest of maize.” – Dimitri Orlov – The Five Stages of Collapse

Bernanke will eventually roll craps. When he does, the collapse will be epic and 2008 will seem like a walk in the park. In Part 3 of this article I will speculate on the timing, scope and consequences of the coming collapse. It’s not going to be a happy ending, especially for the existing social order.