I know the evil oil companies are the boogeyman for high oil prices. Congress loves to bloviate about them whenever oil prices rise much above $100 a barrel. The fact that they don’t control virtually any of the oil reserves in the world seems to go unnoticed by the bloviating morons. Oil companies make a lot of money because they are the only entities capable of extracting, transporting, refining and delivering oil and oil based products to customers around the world. Countries control the oil reserves. Those are the facts.

Royal Dutch Shell is one of the biggest companies on the planet. They are a profit machine. They just announced that their 4th quarter profits would fall by 70% versus last year. It seems that extracting the remaining oil in the earth is costing a lot more than it used to. It seems their investment in U.S. shale acreage has proven to be a disaster. They are writing off billions of shale oil investments.

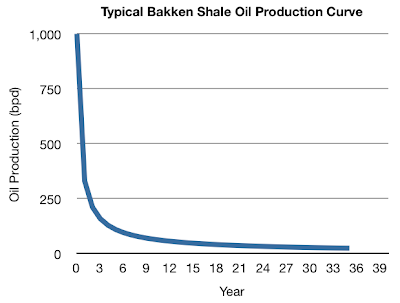

Does this jive with the storyline being peddled by Wall Street, Obama, and the mainstream media? If one of the biggest corporations in the world cannot make a profit extracting shale oil, how is it going to make the U.S. energy independent.

It will make us energy independent at $150 per barrel cost. Of course, our economy would collapse at $150 per barrel oil. It seems we have a dilemma. Enjoy the ride. It’s gonna be a little bumpy.

Shell warns over profit, citing exploration costs

By MarketWatch

LONDON– Royal Dutch Shell PLC warned Friday that fourth-quarter profit would be significantly weaker than recent levels partly because of higher exploration costs.

The company also cited lower upstream volumes and weaker industry conditions in downstream oil products for the weaker performance.

The oil major expects to post fourth-quarter earnings of $2.2 billion on a current cost of supplies basis–a figure that factors out the impact of inventories, making it equivalent to the net profit reported by U.S. oil companies–down from $7.3 billion a year earlier. Full-year earnings on a CCS basis are expected to be about $16.8 billion, down from $27.2 billion last year.

The company expects to publish full fourth-quarter figures on Jan. 30.

“Our 2013 performance was not what I expect from Shell,” Chief Executive Ben van Beurden said. “Our focus will be on improving Shell’s financial results, achieving better capital efficiency and on continuing to strengthen our operational performance and project delivery.”

The profit warning is rare for an oil major prized by investors for slow but steady profits. Despite relatively high and stable oil prices, Shell has struggled in 2013 with costs and some big investments that haven’t worked as planned, taking a large write down for example on its U.S. shale assets. It has also looked to sell off assets worth billions of dollars.

All majors have struggled with spiraling costs in many of their projects, but Shell has also been hit by lower volumes at a time when it has had to undertake more maintenance than expected. It said it would take a $700 million charge on its core exploration and production unit because of costs and lower volumes.