Originally posted at Dispatches from Reality, by Scipio Eruditus. dfreality.substack.com

Tag: Big oil

Millennials Really Do Ruin Everything, And Big Oil Is Next

Authored by Julianne Geiger via OilPrice.com,

It sounds harsh, but it’s true: millennials really do ruin everything. And the oil industry will be no exception. From talent acquisition to courting investors, to finding new end uses for petroleum, the oil industry is facing a whole new set of challenges – one that extends far beyond geopolitical risk premiums and barrel prices.

Oil companies who are quicker to adapt to this changing of the guard will have first pick of investment dollars and top talent, while those who are slow to change will get the leftovers.

Continue reading “Millennials Really Do Ruin Everything, And Big Oil Is Next”

PEAK OIL – THE LONG & THE SHORT

Does it seem like we’ve been here before?

A barrel of Brent Crude (the truest indicator of worldwide oil scarcity) sits at $118, up from $75 per barrel in July 2010 – a 57% increase in eleven months. In the U.S., the average price of gasoline is $3.69 per gallon this week, up 37% in the last year and up 100% in the last 30 months.

The pundits and politicians are responding predictably. They blame the Libyan revolution, the dreaded speculators and that old fallback – Big Oil. When the Middle East turmoil began in earnest in January, gas prices had already risen 15% in three months, spurred by increased worldwide demand and by Ben Bernanke’s printing press. Congressmen have reacted in their usual kneejerk politically motivated fashion by demanding that supplies be released from the Strategic Oil Reserve.

Congress has a little trouble with the concept of “strategic.” They also have difficulty dealing with a reality that has been staring them in the face for decades. Politicians will always disregard prudent, long-term planning for vote-generating talk and gestures.

The Long Term

Peak oil has been a mathematically predictable occurrence since American geophysicist M. King Hubbert figured out the process in 1956. His model predicted that oil production in the United States would peak in 1970. He wasn’t far off. In 1971, when the U.S. was producing 88% of its oil needs, domestic production approached 10 million barrels per day and has been in decline ever since.

(Source: http://www.eia.doe.gov/energy_in_brief/images/charts/

Consumption_production_import_trends-large.gif)

The Department of Energy was established in 1977 with a mandate to lessen our dependence on foreign oil. At the time, the U.S. was importing 6.5 million barrels per day. In 1985 the country was still able to produce enough to cover 75% of its needs. Today, 34 years later, the U.S. imports 10 million barrels per day, almost half of what it uses.

President Obama’s 2011 Budget proposal included priorities for the DOE:

- Positions the United States to be the global leader in the new energy economy by developing new ways to produce and use clean and renewable energy.

- Expands the use of clean, renewable energy sources such as solar, wind and geothermal while supporting the Administration’s goal to develop a smart, strong and secure electricity grid.

- Promotes innovation in the renewable energy sectors through the use of expanded loan guarantee authority.

That’s what goes on in talk space.

Back on planet Earth, not a single U.S. oil refinery or nuclear power plant has been built since 1977. Decades of inaction and denial have left our energy infrastructure obsolescent and decaying. Pipelines, tanks, drilling rigs, refineries and tankers have passed their original design lives. The oil industry is manned by an aging workforce of geologists, engineers and refinery hands. Many are nearing retirement, and there are few skilled personnel to replace them.

Denial of peak oil becomes more dangerous by the day. The Obama administration prattles about clean energy, solar, wind and ethanol, when petroleum powers 96% of the transportation sector and 44% of the industrial sector. Coal provides 51% of the country’s electricity, and nuclear accounts for another 21%. Renewable energy contributes only 6.7% of the country’s energy needs, mostly from hydroelectric facilities.

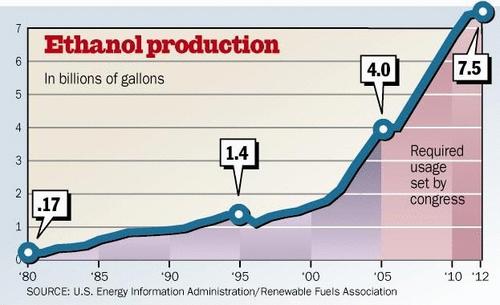

Ethanol works nicely as a slogan but poorly as a solution. The ethanol boondoggle diverts 40% of the U.S. corn crop to fuel production. The real cost to produce a gallon of ethanol (tariffs, lost energy, higher food costs) exceeds $7 and has contributed to the price of corn rising 112% in the last year. The 107 million tons of grain that went to U.S. ethanol distilleries in 2009 would have been enough to feed 330 million people for one year.

(Source: http://perotcharts.com/category/challenges/energy/)

The most worrisome aspect of peak oil is that our government leaders have known of it and have chosen to do nothing. The Department of Energy requested a report from widely respected energy expert Robert Hirsch in 2005. The report clearly laid out the dire situation:

The peaking of world oil production presents the U.S. and the world with an unprecedented risk management problem. As peaking is approached, liquid fuel prices and price volatility will increase dramatically, and, without timely mitigation, the economic, social, and political costs will be unprecedented. Viable mitigation options exist on both the supply and demand sides, but to have substantial impact, they must be initiated more than a decade in advance of peaking.

Some of his conclusions:

- World oil peaking is going to happen, and will likely be abrupt. World production of conventional oil will reach a maximum and decline thereafter.

- Oil peaking will adversely affect global economies, particularly the U.S. Over the past century, the U.S. economy has been shaped by the availability of low-cost oil. The economic loss to the United States could be measured on a trillion-dollar scale.

- The problem is liquid fuels for transportation. The lifetimes of transportation equipment are measured in decades. Rapid changeover in transportation equipment is inherently impossible. Motor vehicles, aircraft, trains and ships have no ready alternative to liquid fuels.

- Mitigation efforts will require substantial time. Waiting until production peaks would leave the world with a liquid fuel deficit for 20 years. Initiating a crash program 10 years before peaking leaves a liquid fuels shortfall of a decade. Initiating a crash program 20 years before peaking could avoid a world liquid fuels shortfall.

World liquid oil production has never exceeded the level reached in 2005. It becomes more evident by the day that worldwide production has peaked. Robert Hirsch was correct. The world will have a liquid fuel deficit for decades.

The Short Term

The International Energy Agency has been increasing its estimates for world oil consumption to over 90 million barrels per day by the 4th quarter of 2011, led by strong demand from China, India and the rest of the emerging world. World supply was already straining to keep up with this demand before the recent tumult in the Middle East. The mayhem in Tunisia, Egypt, Libya, Bahrain, Yemen and Iran has already taken 1.5 million barrels per day off the market, according to the IEA.

(Source: http://omrpublic.iea.org/)

The Obama administration and mainstream media continue to downplay the economic impact of the conflagration spreading around the world. The risk that oil prices gush toward the 2008 highs is much greater than the likelihood that this turmoil will subside and oil prices fall back to $80 per barrel. As the following chart shows, the daily oil supply coming from countries already experiencing revolution or in danger of uprisings is nearly 8 million barrels per day, or 9% of world supply. No country can ramp up production to make up for that shortfall.

| Proven Oil | Oil | |

|

Country

|

Reserves (billion barrels) | Production Per Day |

| Saudi Arabia |

265

|

9,000,000

|

| Iran |

137

|

3,700,000

|

| Iraq |

115

|

2,700,000

|

| UAE |

98

|

2,300,000

|

| Kuwait |

102

|

2,300,000

|

| Libya |

46

|

1,600,000

|

| Algeria |

12

|

1,300,000

|

| Qatar |

25

|

820,000

|

| Oman |

6

|

810,000

|

| Egypt |

4

|

742,000

|

| Syria |

3

|

376,000

|

| Yemen |

3

|

298,000

|

The Washington DC spin doctors are now assuring the American people that Saudi Arabia can make up for any oil shortfall. Saudi Arabia has declared it has already turned the spigot on and will produce 10.0 million bpd, up from 8.5 million bpd.

Is this replacement production real? A leading industry expert revealed that the Saudis were already producing 8.9 million bpd in January. Hype and misinformation won’t fill your SUV with cheap gas. Saudi production peaked at 9.8 million bpd in 2005. When prices spiked to $147 per barrel in early 2008, their production grew only to 9.5 million bpd. Saudi oil fields are 40 years old and are in terminal decline. Their “spare capacity” doesn’t exist.

And the media ignore the quality difference between Libyan crude and Saudi crude. Libya’s oil is a perfect feedstock for ultra-low-sulfur diesel. The oil Saudi Arabia will supply to replace it is not. It takes three barrels of Saudi crude to yield the same quantity of diesel fuel as one Libyan barrel of crude, and only specially designed refineries can process high-sulfur Saudi oil.

The problem isn’t just turmoil in the Middle East. The Persian Gulf provides 17% of U.S. imports; 22% comes from Africa, 10% from Venezuela and 15% from Mexico. Many of these countries hate us. Mexico, although a relatively friendly country, will become a net importer of oil in the next five years, as its Cantarell oil field is in rapid decline. They’ll have nothing to sell to us.

The long and the short of it is that sunshine, corn and wind will not keep Americans from paying $5 per gallon or more for gas in the near future. The financial implications are that oil and energy investments will produce solid returns over the coming years.

This article was originally published in the Casey Report.

HOW MANY SENATORS DOES IT TAKE TO SCREW A TAXPAYER? (Featured Article)

“Today, the government decides and they misdirect the investment to their friends in the corn industry or the food industry. Think how many taxpayer dollars have been spent on corn [for ethanol], and there’s nobody now really defending that as an efficient way to create diesel fuel or ethanol. The money is spent for political reasons and not for economic reasons. It’s the worst way in the world to try to develop an alternative fuel.” – Ron Paul

When bipartisanship breaks out in Washington DC, check to make sure your wallet is still in your pocket. Every time you fill up your car this winter you are participating in the biggest taxpayer swindle in history. Forcing consumers to use domestically produced ethanol is one of the single biggest boondoggles ever committed by the corrupt brainless twits in Washington DC. Ethanol prices have soared 30% in the last year as the supplies of corn have plunged. Only a policy created in Washington DC could drive up the prices of gasoline and food, with the added benefits of costing the American taxpayer billions in tax subsidies and killing people in 3rd world countries.

The grand lame duck Congress tax compromise extended a 45-cent incentive to ethanol refiners for each gallon of the fuel blended with gasoline and renewed a 54-cent tariff on Brazilian imports. The extension of these subsidies, besides costing American taxpayers $6 billion per year, has the added benefit of driving up food costs across the globe, causing food riots in Tunisia, and resulting in the starving of poor peasants throughout the world. This taxpayer boondoggle is a real feather in the cap of that fiscally conservative curmudgeon Senator Charley Grassley. He was joined in this noble effort by another fiscal conservative, presidential hopeful John Thune. It seems these guys hate wasteful spending, except when it benefits their states. The bipartisanship in this effort was truly touching, as Democrats Kent Conrad and Tom Harkin also brought home the pork for their states.

- Promoting ethanol reduces our dependence on foreign oil

- Ethanol is green renewable energy

- Ethanol is cheaper than gasoline

As we all know when dealing with a politician, “half the truth, is often a great lie.”

Amaizing

Corn is the most widely produced feed grain in the United States, accounting for more than 90% of total U.S. feed grain production. 81.4 million acres of land are utilized to grow corn, with the majority of the crop grown in the Midwest. Although most of the crop is used to feed livestock, corn is also processed into food and industrial products including starch, sweeteners, corn oil, beverage and industrial alcohol, yogurt, latex paint, cosmetics, and last but not least, fuel Ethanol. Of the 10,000 items in your average grocery store, at least 2,500 items use corn in some form during the production or processing. The United States is the major player in the world corn market providing more than 50% of the world’s corn supply. In excess of 20% of our corn crop had been exported to other countries, but the government ethanol mandates have reduced the amount that is available to export.

This year, the US will harvest approximately 12.5 billion bushels of corn. More than 42% will be used to feed livestock in the US, another 40% will be used to produce government mandated ethanol fuel, 2% will be used for food products, and 16% is exported to other countries. Ending stocks are down 963 million bushels from last year. The stocks-to-use ratio is projected at 5.5%, the lowest since 1995/96 when it dropped to 5.0%. As you can see in the chart below, poor developing countries are most dependent on imports of corn from the US. Food as a percentage of income for peasants in developing countries in Africa and Southeast Asia exceeds 50%. When the price of corn rises 75% in one year, poor people starve.

The combination of an asinine ethanol policy and the loosest monetary policy in the history of mankind are combining to kill poor people across the globe. I wonder if Blankfein, Bernanke, and Grassley chuckle about this at their weekly cocktail parties while drinking Macallan scotch whiskey and snacking on mini beef wellington hors d’oeuvres. The Tunisians aren’t chuckling as food riots have brought down the government. This month, the U.N. Food and Agricultural Organization (FAO) reported that its food price index jumped 32% in the second half of 2010 — surpassing the previous record, set in the early summer of 2008, when deadly clashes over food broke out around the world, from Haiti to Somalia.

Let’s Starve a Tunisian

“What is my view on subsidizing ethanol and farmers? Under the constitution, there is no authority to take money from one group of people and give it to another group of people for so called economic benefits. So, no, I don’t think we should do that. Besides, bureaucrats and the politicians don’t know how to invest money.” – Ron Paul

The United States is the big daddy of the world food economy. It is far and away the world’s leading grain exporter, exporting more than Argentina, Australia, Canada, and Russia combined. In a globalized food economy, increased demand for corn, to fuel American vehicles, puts tremendous pressure on world food supplies. Continuing to divert more food to fuel, as is now mandated by the U.S. federal government in its Renewable Fuel Standard, will lead to higher food prices, rising hunger among the world’s poor and to social chaos across the globe. By subsidizing the production of ethanol, now to the tune of $6 billion each year, U.S. taxpayers are subsidizing skyrocketing food bills at home and around the world.

The energy bill signed by that free market capitalist George Bush in 2008 mandates that increasing amounts of corn based ethanol must be used in gasoline sold in the U.S. This energy legislation requires a five-fold increase in ethanol use by 2022. Some 15 billion gallons must come from traditional corn-blended ethanol. Nothing like combining PhD models and political corruption to cause worldwide chaos. Ben Bernanke and Charley Grassley have joined forces to bring down the President of 23 years in Tunisia. People tend to get angry when they are starving. Bringing home the bacon for your constituents has consequences. In the U.S. only about 10% of disposable income is spent on food. By contrast, in India, about 40% of personal disposable income is spent on food. In the Philippines, it’s about 47.5%. In some sub-Saharan Africa, consumers spend about 50% of the household budget on food. And according to the U.S.D.A., “In some of the poorest countries in the region such as Madagascar, Tanzania, Sierra Leone, and Zambia, this ratio is more than 60%.”

The 107 million tons of grain that went to U.S. ethanol distilleries in 2009 was enough to feed 330 million people for one year at average world consumption levels. More than a quarter of the total U.S. grain crop was turned into ethanol to fuel cars last year. With 200 ethanol distilleries in the country set up to transform food into fuel, the amount of grain processed has tripled since 2004. The government subsidies led to a boom in the building of ethanol plants across the heartland. As usual, when government interferes in the free market, the bust in 2009, when fuel prices collapsed, led to the bankruptcy of almost 20% of the ethanol plants in the U.S.

The amount of grain needed to fill the tank of an SUV with ethanol just once can feed one person for an entire year. The average income of the owners of the world’s 940 million automobiles is at least ten times larger than that of the world’s 2 billion hungriest people. In the competition between cars and hungry people for the world’s harvest, the car is destined to win. In March 2008, a report commissioned by the Coalition for Balanced Food and Fuel Policy estimated that the bio-fuels mandates passed by Congress cost the U.S. economy more than $100 billion from 2006 to 2009. The report declared that “The policy favoring ethanol and other bio-fuels over food uses of grains and other crops acts as a regressive tax on the poor.” A 2008 Organization for Economic Cooperation and Development (O.E.C.D.) issued its report on bio-fuels that concluded: “Further development and expansion of the bio-fuels sector will contribute to higher food prices over the medium term and to food insecurity for the most vulnerable population groups in developing countries.” These forecasts are coming to fruition today.

It Costs What?

The average American has no clue about the true cost of ethanol. They probably don’t even know there is ethanol mixed in their gasoline. The propaganda spread by the ethanol industry and their mouthpieces in Congress obscures the truth and proclaims the clean energy mistruths and the thousands of jobs created in America. The truth is that producing ethanol uses more energy than is created while driving costs higher. The jobs created in Iowa are offset by the jobs lost because users of energy incur higher costs and hire fewer workers as a result. It takes a lot of Saudi oil to make the fertilizers to grow the corn, to run the tractors, to build the silos, to get the corn to a processing plant, and to run the processing plant. Also, ethanol cannot be moved in pipelines, because it degrades. This means using thousands of big diesel sucking polluting trucks to move the ethanol – first as corn from the fields to the processing plants, and then from the processing plants to the coasts.

The current ethanol subsidy is a flat 45 cents per gallon of ethanol usually paid to the an oil company, that blends ethanol with gasoline. Some States add other incentives, all paid by the taxpayer. On top of this waste of taxpayer funds, the free trade capitalists in Congress slap a 54 cent tariff on all imported ethanol. Ronald R. Cooke, author of Oil, Jihad & Destiny, created the chart below to estimate the true cost for a gallon of corn ethanol. Cooke describes a true taxpayer boondoggle:

It costs money to store, transport and blend ethanol with gasoline. Since ethanol absorbs water, and water is corrosive to pipeline components, it must be transported by tanker to the distribution point where it is blended with gasoline for delivery to your gas station. That’s expensive transportation. It costs more to make a gasoline that can be blended with ethanol. Ethanol is lost through vaporization and contamination during this process. Gasoline/ethanol fuel blends that have been contaminated with water degrade the efficiency of combustion. E-85 ethanol is corrosive to the seals and fuel systems of most of our existing engines (including boats, generators, lawn mowers, hand power tools, etc.), and can not be dispensed through existing gas station pumps. And finally, ethanol has about 30 percent less energy per gallon than gasoline. That means the fuel economy of a vehicle running on E-85 will be about 25% less than a comparable vehicle running on gasoline.

Real Cost For A Gallon Of Corn Ethanol |

|

| Corn Ethanol Futures Market quote for January 2011 Delivery | $2.46 |

| Add cost of transporting, storing and blending corn ethanol | $0.28 |

| Added cost of making gasoline that can be blended with corn ethanol | $0.09 |

| Add cost of subsidies paid to blender | $0.45 |

| Total Direct Costs per Gallon | $3.28 |

| Added cost from waste | $0.40 |

| Added cost from damage to infrastructure and user’s engine | $0.06 |

| Total Indirect Costs per Gallon | $0.46 |

| Added cost of lost energy | $1.27 |

| Added cost of food (American family of four) | $1.79 |

| Total Social Costs | $3.06 |

| Total Cost of Corn Ethanol @ 85% Blend | $6.80 |

Multiple studies by independent non-partisan organizations have concluded that mandating and subsidizing ethanol fuel production is a terrible policy for Americans:

- In May 2007, the Center for Agricultural and Rural Development at Iowa State University released a report saying the ethanol mandates have increased the food bill for every American by about $47 per year due to grain price increases for corn, soybeans, wheat, and others. The Iowa State researchers concluded that American consumers face a “total cost of ethanol of about $14 billion.” And that figure does not include the cost of federal subsidies to corn growers or the $0.51 per gallon tax credit to ethanol producers.

- In May 2008, the Congressional Research Service blamed recent increases in global food prices on two factors: increased grain demand for meat production, and the bio-fuels mandates. The agency said that the recent “rapid, ‘permanent’ increase in corn demand has directly sparked substantially higher corn prices to bid available supplies away from other uses – primarily livestock feed. Higher corn prices, in turn, have forced soybean, wheat, and other grain prices higher in a bidding war for available crop land.”

- Mark W. Rosegrant of the International Food Policy Research Institute, testified before the U.S. Senate on bio-fuels and grain prices. Rosegrant said that the ethanol scam has caused the price of corn to increase by 29 percent, rice to increase by 21 percent and wheat by 22 percent. Rosegrant estimated that if the global bio-fuels mandates were eliminated altogether, corn prices would drop by 20 percent, while sugar and wheat prices would drop by 11 percent and 8 percent, respectively, by 2010. Rosegrant said that “If the current bio-fuel expansion continues, calorie availability in developing countries is expected to grow more slowly; and the number of malnourished children is projected to increase.” He continued, saying “It is therefore important to find ways to keep bio-fuels from worsening the food-price crisis. In the short run, removal of ethanol blending mandates and subsidies and ethanol import tariffs, in the United States—together with removal of policies in Europe promoting bio-fuels—would contribute to lower food prices.”

The true cost of the ethanol boondoggle is hidden from the public. The mandates, subsidies and tariffs take place out of plain view. The reason blenders (and gas stations) will pay the same for ethanol is because they can sell it at the same price as gasoline to consumers. A consumer will pay the same for ten gallons of E10 as for ten gallons of gasoline even though the E10 contains a gallon of ethanol. Consumers pay the same for the gallon of ethanol for three reasons. (1) They don’t know there’s ethanol in their gasoline. (2) There is often ethanol in all the gasoline because of state requirements, so they have no choice. (3) They never know the ethanol has only 67% the energy of gasoline and gets them only 67% as far. The result is that drivers always pay much more for ethanol energy than for gasoline energy, simply because they pay the same amount per gallon. When gasoline prices are $3.00 per gallon, Joe Six-pack pays $4.50 for the same amount of ethanol energy.

You know a politician, government bureaucrat or central banker is lying when they open their mouths. Whenever evaluating a policy or plan put forth by those in control, always seek out who will benefit and who will suffer. Who benefits from corn based ethanol mandates and subsidies? The beneficiaries are huge corporations like Archer Daniels Midland and Monsanto, along with corporate farming operations (80% of all US farm production), and Big Oil. The mandated ethanol levels are set in law. By providing tax subsidies we are bribing oil companies with taxpayer dollars to do something they are legally required to do, resulting in a $6 billion windfall profit to oil companies. The other beneficiaries are the Senators and Representatives from the farming states who are bankrolled by the corporate ethanol beneficiaries and their constituents who will re-elect them. The environment does not benefit, as many studies have concluded that it requires more fossil fuel energy (oil & coal) to produce a gallon of ethanol than the energy created. The jobs created in the farm belt at artificially profitable ethanol plants are more than offset by job losses due to the added costs in the rest of the economy. When subsidies are removed or oil prices drop, the ethanol plant jobs disappear, resulting in a massive capital mal-investment.

Our supposedly wise PhD and MBA leaders have created a perfect storm. The unintended consequences of government intervention in the markets are causing havoc, food riots, starvation and intense suffering for the poor and middle class. Brazil produces sugar cane ethanol in vast quantities and can export it to the U.S. much cheaper than we can produce corn ethanol. Fuel prices would be lower without tariffs on Brazilian ethanol imports. The average cost of food as a percentage of disposable income for an American is 10%. Averages obscure the truth that the cost is probably .0001% for Lloyd Blankfein, Ben Bernanke and Chuck Grassley, while it is 30% for a poor family in Harlem. America’s horribly misguided ethanol policy combined with Ben Bernanke’s Wall Street banker subsidy program are resulting in soaring fuel and food prices across the globe. Poor people around the world suffer greatly from these policies. Below are two assessments of ethanol.

“Everything about ethanol is good, good, good.” – Senator Chuck Grassley, Iowa

“This is not just hype — it’s dangerous, delusional bullshit. Ethanol doesn’t burn cleaner than gasoline, nor is it cheaper. Our current ethanol production represents only 3.5 percent of our gasoline consumption — yet it consumes twenty percent of the entire U.S. corn crop, causing the price of corn to double in the last two years and raising the threat of hunger in the Third World.” – Jeff Goodell

Who do you believe?