The once and former bond king has lost it. After a long lament about deflation and the failure of massive money printing to ignite growth, jobs and incomes in the real economy, his most recent missive comes up with a better idea. Bigger public deficits!

The real economy needs money printing, yes, but money spending more so, and that must come from the fiscal side — from the dreaded government side — where deficits are anathema and balanced budgets are increasingly in vogue,” he writes.

Let’s see. In the case of the US, real economic growth has been faltering since the year 2000. During the last 14 years real GDP growth has averaged 1.8% per annum—-the lowest rate of growth for an equivalent period in modern times. In fact, it is barely half the average growth rate during the second half of the 20th century.

Not only is there no correlation between fiscal deficits and economic growth over those 50 years, but the real evidence is more nearly the opposite. During the the golden era of sound money and fiscal rectitude between 1953 and 1963, for example, real economic growth averaged 4.0% per annum. And that was achieved during a period in which the budget deficit averaged only 1% of GDP—with Washington actually recording surpluses during much of the Eisenhower presidency.

It might also be noted that during this same period, the inflation rate averaged only 1.2% annually—–far lower than today’s phony 2% target peddled by the Fed. Except no one called it deflation. Nor did they wring their hands about impending economic doom because the dollar’s purchasing power was not shrinking fast enough.

Instead, they called it sound money, and such price stability was especially welcomed by bond managers of the day. The latter made their living by investing capital, not front-running the central banks of the world as do speculators like the bond king. Accordingly, bond managers during the golden era would have been utterly mystified by the babble that Gross unloaded in his call for moar deficit spending.

The manager of the Janus Unconstrained Bond Fund is concerned about deflation, in Japan, in the eurozone and in the U.S. Central bankers, he says, have tried to ward it off……….“They’ve made a damn fine attempt at it — have they not?

So there you have it. The Fed has been on an utterly berserk spree of money printing and has inflated its balance sheet from $500 billion to nearly $4.5 trillion during the last 14 years when real GDP growth has tumbled into the sub-basement of historical results. And even that meager growth rate is probably exaggerated owing to the systematic under-reporting of inflation by the Washington statistical mills since 1990.

Yet Gross manages to argue that even the Greenspan/Bernanke/Yellen money printing madness has not been enough. Nope. The Fed’s financial repression now needs to be supplemented with more public spending and borrowing because the specter of “deflation” hovers over the economy.

Well, you do need a statistical microscope to spot any actual deflation during the entire 21st century to date. Except for a couple of months when red hot world oil prices took a tumble, the consumer price index has been in a steady upward climb. The embedded 14-year average in the chart below is actually 2.3%—or even more than the Fed’s Keynesian doctors actually ordered.

The truth of the matter is there is no deflationary threat, and the recent slight abatement from the 25% hit to savers shown above is a welcome development, not a 12-alarm emergency. Indeed, this latest twist in the Keynesian blather from the likes of Gross and his legions of group think compatriots on Wall Street and in Washington amounts to the infliction of cruel and unusual economic punishment on main street Americans.

First, they crushed savers with 70 months of zero interest rates. Now they propose to drive returns from savings even deeper into negative territory by pounding their pans for more inflation—even though consumers are getting a slight break since the Fed’s favorite indicator of inflation, the PCE, is up by 1.6% during the past year.

Finally comes the utterly unsupportable claim that growth and full time jobs have faltered because Washington has not manufactured enough “aggregate demand” by burying future taxpayers even deeper in debt. Needless to say, this economic ether does not exist in the real world; “aggregate demand” is merely a construct embedded in Keynesian economic models.

Gross calls for “more spending” to lift the US economy out of its alleged deflationary malaise, but here’s the thing. Unlike the Keynesian ether of aggregate demand, actual current period “spending” by business, households and governments can only be obtained from current production and the incomes it generates or by leveraging balance sheets with claims on future incomes.

It is evident by now that the latter channel of “spending” growth is busted and done. The private sector has reached a condition of “peak debt”. In fact, household leverage ratios have drifted lower since 2007 after three decades of relentless rise. Likewise, business has raised its aggregate debt from $11 trillion to $14 trillion since the eve of the Great Recession, but virtually all of the proceeds have gone into financial engineering maneuvers such as stock buybacks and M&A, not investment in productive assets.

In short, by Gross’ own admission money printing has not helped the real economy. So the default option, apparently, is to repair to good old fashion Keynesian fiscal stimulus.

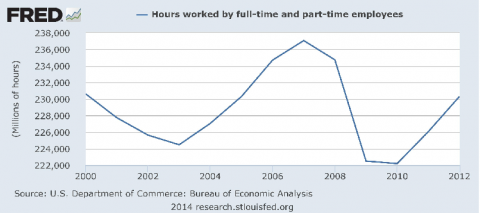

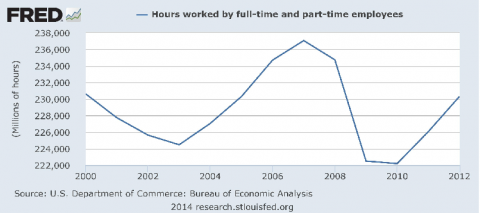

Really? The graph below suggests that insufficient government deficits have absolutely nothing to do with the growth malaise of the American economy during the last 14 years. The public debt has tripled during that period, while the median real household income has dropped by nearly 8% and the true measure of employment—-labor hours supplied—– has stagnated at 1999 levels.

For whatever reason, Gross’ former colleagues recently invited him to repair to the shuffleboard courts. They were surely on to something.