Guest Post by Nick Giambruno

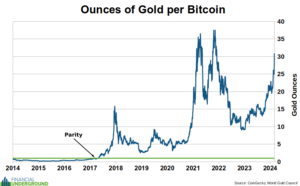

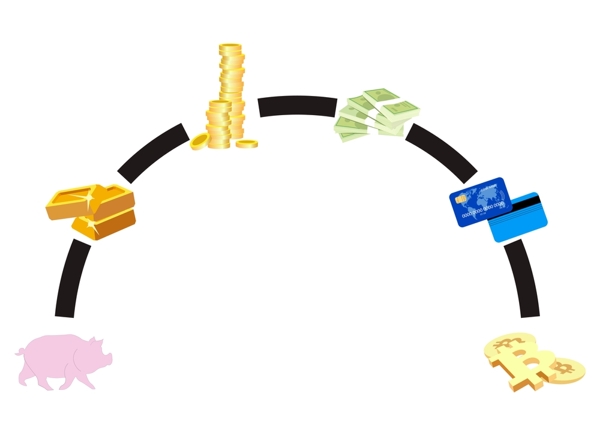

For thousands of years, gold has always been mankind’s hardest money.

That is all set to change in a few days, and most people have no idea.

“Hardness” does not mean something that is necessarily tangible or physically hard, like metal.

Instead, it means “hard to produce.” By contrast, “easy money” is easy to produce.

The best way to think of hardness is “resistance to debasement,” which helps make it a good store of value—an essential function of money.

Would you want to put your savings into something somebody else can create without effort or cost?

Of course, you wouldn’t.

Continue reading “A Unique Moment in Monetary History Is Days Away… and Most Have No Idea”