Based on the average of four separate valuation models that have been accurate in assessing whether the stock market is overvalued or undervalued over the last century, the stock market is currently over valued by 89%. The stock market was overvalued by 88% before the 1929 Crash. It was “only” overvalued by 74% in 2007 before the last Crash. It has only been more overvalued once in market history – 2000. I wonder what happened after that?

If you were paying attention in Statistics class in college, you know that when something reaches 2 standard deviations from the mean, you’ve reached EXTREME levels. The market valuation is now past 2 standard deviations. Anyone staying in the market or buying today is betting on the market to reach 2000 internet bubble proportions. I’ll pass. You will be lucky to “achieve” a negative 2% nominal return over the next ten years. After taking inflation into account you will likely end up with a -5% to -10% annual return, with a crash thrown in for good measure.

Betting on a 2000 level of overvaluation is even more foolish when you take into account the fact the overvaluation was centered solely on tech and internet stocks. Large cap value stocks were significantly undervalued in 2000. The chart below from former perma-bull Jim Paulson at Wells Fargo reveals the foreboding truth. The median price/earnings ratio is now the highest in U.S. history. It is 45% higher than it was in 2000. It is 15% higher than it was in 2007.

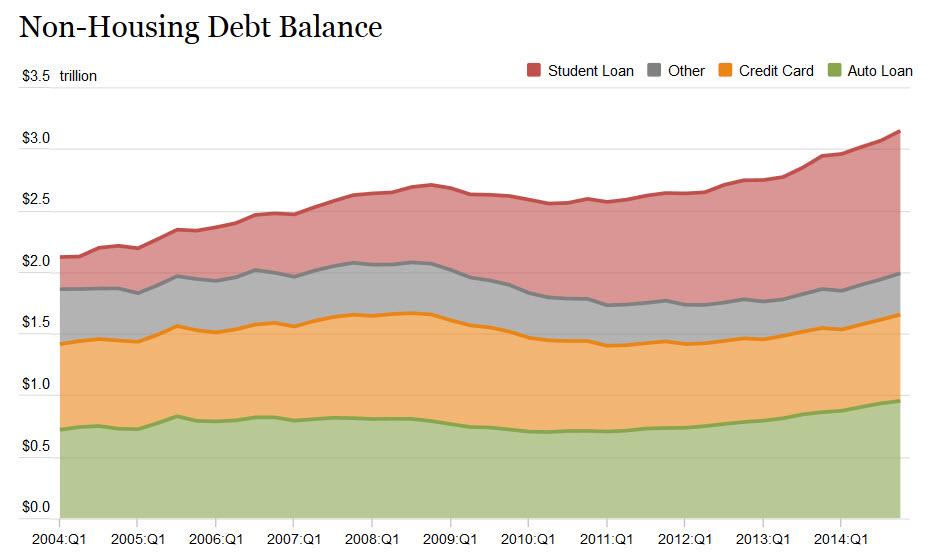

John Hussman answers a few pertinent questions below. But the gist of the situation is simple. The stock market is overvalued equal to or more than it was in 1929, 2000, and 2007. The reason it has gotten this far is the $3.5 trillion of Federal Reserve fiat handed to the Wall Street banks and the ridiculous faith in these Ivy League educated puppets to engineer never ending stock market gains.

Greed has been winning for the last five years. Fear has been creeping in, especially since QE3 ended in October. The increased volatility is a warning signal. Fear will be reasserting itself, and it will happen suddenly. Buying the dip will stop working. Faith in central bankers will dissipate and reality will be a bitch. This episode of delusion will end just as all the previous episodes of delusion ended. See the chart above. What goes way up, eventually goes way down.

Q: Doesn’t QE, zero interest rate policy and (insert your excuse for ignoring history here) mean that this time is different?

A: Not really. The main thing that has been legitimately “different” in the half-cycle since 2009 is that QE loosened the overlap and increased the delay between the emergence of extremely overvalued, overbought, overbullish syndromes and the onset of risk aversion among investors. The fact that QE-induced yield-seeking could induce such a sustained gap between these two was clearly a surprise to us. However, it remains true that once market internals and credit spreads indicate a shift in investor risk preferences, stocks are prone to abrupt losses – particularly when overvalued, overbought, overbullish conditions have recently been in place. This has been true even in instances since 2009.

Q: Why are market internals and credit spreads deteriorating?

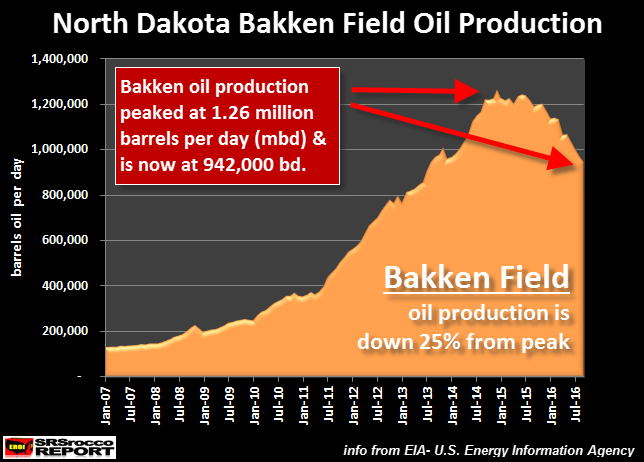

A: Historically, the “catalysts” that provoke a shift in risk aversion typically become clear only after the fact. Our impression is that the plunge in oil prices and safe-haven Treasury yields, coupled with the rise in yields on default-sensitive assets such as junk debt is most consistent with an abrupt slowing in global economic activity.

Q: Is the market likely to crash?

A: We certainly wouldn’t rely on a crash, but frankly, we currently observe nothing that would prevent something that might feel like an “air pocket” or “free fall.” Crashes represent points where many investors simultaneously shift toward risk-aversion and too few investors are on the other side to buy the stock offered for sale – except at a sharp discount. They have tended to unfold after the market has already lost 10-14% and the recovery from that low fails. We would allow for that possibility, but our discipline is firmly centered on responding to observable market conditions as they emerge, and shifting as those conditions shift.

Read all of John Hussman’s Weekly Letter