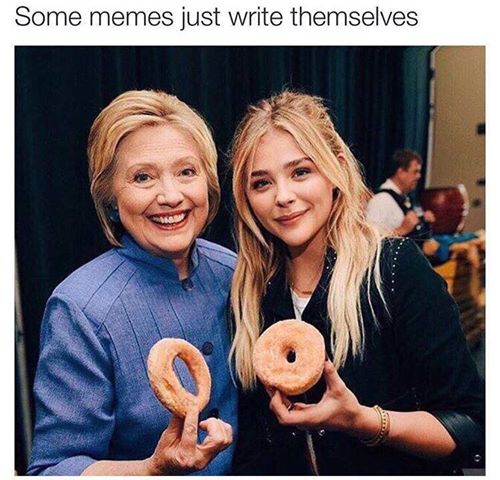

Tag: donuts

IRONY

CAPTION CONTEST

NYPD HERO

COP FUNERAL PROCESSION

DONUT EATER OF THE WEEK

This actually has a happy ending. It wouldn’t have unless a citizen stood up for their rights.

New York Deputy Slaps Citizen for Not Allowing him to Search Car (Updated III)

Saratoga County Deputy Shawn Glans had no idea he was being recorded as he tried to intimidate a man into allowing him to search his car, which is why he slapped him on the back of his head while yanking the keys out of his hand, tossing them to another deputy who searched the man’s car and found nothing illegal.

But he does know now after Adam Roberts uploaded the video to Facebook where it began going viral Friday.

In a Facebook message interview with Photography is Not a Crime, Roberts explained that he and his buddy, Colin Fitch, who owns the car, had parked it at a business that was closed and walked to a nearby party Thursday night. They didn’t spend much time at the party but when they walked back to the car, they were confronted by deputies who had spotted a rifle in the back seat and wanted to search the car.

Fitch had purchased a .22 rifle earlier that day and had left in the back seat, Roberts said.

When Deputy Glans asked to search the car, Fitch would not give him permission, insisting he had done nothing illegal.

“We’ll get a fucking search warrant, alright,” Glans said. “Wanna do that?””Let me see your fucking keys,” Glans said.

“Why?” Fitch responded.

“I’m going to search your fucking car, that’s why,” Glans replied.

“You can’t do that,” Fitch said.

“Wanna fucking resist?,” Glans said before striking him.

*****

“If you have nothing to hide in there, we’re just going to check and be on our fucking merry way. Understand? Asshole.”

Unfortunately, that slapping part was not caught on video, but the sound of the slap is loud and clear. But he followed it up by making more threats, proving to be the real asshole.

As they were searching the car, Firth showed them his receipt for the gun and they allowed him to leave.

UPDATE: PINAC reader Joseph Grabko dug up the following about Glans:

UPDATE II: Deputy Glans was suspended without pay, according to a press release from the Saratoga County Sheriff’s Office. Good work, guys.

UPDATE III: The Times-Union reached out to Glans and got him to comment about the incident, saying he would do it all over again – but not if he knew he was being recorded. Not exactly the brightest of the bunch.

Reached Saturday, Glans said there was more to the encounter than is captured on the video.

“You saw the video. It doesn’t look good,” Glans told the Times Union. “I’m all about doing the right thing. I had to go to that point because of the factors that came into play. There was a gun that was involved (that) I spotted in the vehicle.”

Asked if he would have handled the matter the same way again, Glans said he would, but not if he knew it was being filmed. He acknowledged that he did not know the incident was being videotaped.

“I was concerned. It was a public safety issue,” the sergeant said. “If I had to do it all over again … I’d probably do the same thing. If I knew the camera was there, no, because it does look bad.”

Saratoga Deputy Arrested for Slapping Citizen on Video

This is how Policing should work, a police officer steps to far over the line and they end up in Jail and fired.

Not like in NYC with a corrupt Union to keep the bottom of the barrel gang on the force to do more damage, pillaging and destruction ruining the image and name of good Police.

http://photographyisnotacrime.com/2014/11/saratoga-deputy-arrested-slapping-citizen-video/

The news was just announced on the department’s Facebook page with the following press release:

Shawn Glans’ mugshot

Two days after a video went viral,

showing a Saratoga County Sheriff’s deputy slapping a man because he

did not consent to having his car searched, the deputy was arrested and

jailed by his own department.

Sergeant Shawn Glans, who was placed on unpaid administrative leave,

was also forced to resign in what will probably go down as the quickest

internal investigation in the history of law enforcement.The news was just announced on the department’s Facebook page with the following press release:

Glans, who has been a law enforcement officer for almost three decades, told the local media that if he had to do it all over again, he would do nothing different – except if he knew he was being recorded.

“You saw the video. It doesn’t look good,” Glans told the Times Union. “I’m

all about doing the right thing. I had to go to that point because of

the factors that came into play. There was a gun that was involved

(that) I spotted in the vehicle.”Asked if he would have handled the matter the same way again, Glans said he

would, but not if he knew it was being filmed. He acknowledged that he

did not know the incident was being videotaped.“I was concerned. It was a public safety issue,” the sergeant said. “If I

had to do it all over again … I’d probably do the same thing. If I knew

the camera was there, no, because it does look bad.”http://photographyisnotacrime.com/2014/11/saratoga-deputy-arrested-slapping-citizen-video/

Read more at http://www.liveleak.com/view?i=f37_1419732894#544c1RAEXb5BSpmc.99

10 MOST DANGEROUS JOBS & NONE ARE COPS

Maybe if they included heart related deaths caused by excess donuts consumption, cops would make the top 10.

FAT COPS

PASS THE DONUTS & THE AMMUNITION

At least the average police officer has a below average IQ to go along with an above average waistline and an off the charts sociopathic desire to bully, intimidate and push citizens around. Plus they have lots and lots of military equipment provided by the DHS Gestapo with your tax dollars.

Hat tip Boston Bob

FBI: 80 Percent Of Police Officers Are Overweight

GARLAND (CBSDFW.COM) – The U.S. Federal Bureau of Investigation released a new statistic, which states 8 out of every 10 law enforcement members are overweight.

Their findings have spurred the Garland Police Department make a plan for their officers to improve their fitness.

“I think it’s important for all of us to keep the weight down and stay in shape-especially this job. The stress that we incur at this job… this is a great way to relieve the stress and to keep the blood pressure down,” said Garland Assistant Chief Jeff Bryan.

Bryan said he spends most of his time at work behind a desk, but still hits the departments on-site gym three days a week.

Researchers have said law enforcement personnel are 25 times more likely to die from weight related cardiovascular disease than the actions of a criminal.

“When you’re in a life or death struggle, you’ve got to win that fight, said Bryan about the importance of keeping fit.

But an estimated 80 percent of law enforcement officers are overweight, according to the FBI.

“Do we have some that are overweight? Sure we do. But, not to that percentage,” said Garland police spokesperson Joe Harn.

He said their department works to cultivate a culture of fitness for many reasons.

“Somebody that did a full career in law enforcement? Average age was 60 — that’s when they died, at 60 years old. So what we found out is if we’re going to improve and overcome that stress, we’ve got to stay in shape, we’ve got to control our weight if we want to live longer,” said Harns.

A number of local law enforcement agencies provide on-site gyms to encourage lifelong physical fitness but admit that beyond the academy, there are no formal policies in place.

CHRISTIE BALANCES BUDGET BY NOT MAKING $900 MILLION PENSION PAYMENTS

Chris Christie is displaying true leadership qualities by balancing his budget on the backs of future generations of NJ taxpayers. Governor Jellyroll has big plans for 2016. He doesn’t give two shits about a government pension crisis that will blow up after he leaves office. That will be the next sucker’s problem. He is a bully with no balls. He is just like every other captured politician with no courage to confront reality or deal with tough issues head on. He might lose those moderate voters. NJ, California, Illinois, PA and dozens of other states are on a rendezvous with disaster, as their promises cannot mathematically be fulfilled. Another feather in the cap of doughnut boy.

Jersey pension system beyond saving at any reasonable cost

For three years now PSI has been warning (see here and here ) that New Jersey had neglected its government employee pension system for so long that the state’s 2010 and 2011 reforms were inadequate to save the system. At some point we said (numerous times) the state would have to admit it could not possibly keep to the refunding schedule it had set for itself.

Yesterday Gov. Christie declared as much when he announced he would help erase the state’s current budget deficit by paring back its pension contributions. But even the payments that Christie announced he couldn’t afford to make amount to about half of what it would cost the state every year to adequately fund its pension system. The numbers, quite frankly, are staggering.

Christie said he would make a nearly $700 million pension payment this year, instead of the $1.6 billion the state originally committed to, and he’s planning to cut next year’s payment to $681 million, from a projected $2.25 billion. The lower figures are what the state estimates it costs to pay for pension benefits that state workers are earning this year; the additional costs are to pay back what Christie describes as the sins of past neglect.

But those higher costs are still just partial payments that understate the real price of fixing the system. In 2010, when the state committed to a new funding schedule for pensions, it gave itself seven years to gradually ramp up payments. We’re only in year four of that schedule. The true cost next year for funding the state’s pension system adequately isn’t even $2.25 billion, it’s about $4.5 billion. By 2018 it will be more than $5 billion.

The problem is that Jersey only collects about $32 billion in taxes and other revenues. States have never historically devoted 14 percent of their revenues to pensions. The norm has been about 3 percent to 4 percent. There is no plan under which a state pays its other bills, accounts for increases in costs, and spends 14 percent of its taxes–or even 10 percent of its taxes, frankly–on pensions.

(Municipalities, which don’t have costs such as Medicaid and transfer payments like local aid, spend a greater percentage of budgets on compensation, including pensions).

Jersey’s pension mess is the result of more than 20 years of shenanigans, detailed in section one of this report, which began with fiscal gimmicks to understate annual contributions, continued with politically motivated moves to increase benefits even as the state’s budget was cratering, eventually included lying to taxpayers and investors about the state of the pension system, and then simply ended with the state stopping all contributions into the system.

Even now, as Rick Dreyfuss, the actuary who co-authored this report, makes clear, the state is valuing the system’s debts optimistically because the cost of genuinely accounting for the shortfalls in Jersey’s pensions are too enormous to contemplate under acceptable accounting standards. The state is still assuming future annual investment gains of 7.9 percent annually though actuaries who serve public pensions are suggesting that the odds of achieving that over the next 10 years are less than 50 percent.

Under acceptable standards, Jersey is insolvent. To be fair (if that’s what you can call it), Jersey is not alone in this. The real cost of saving Illinois’ state pension systems are beyond the fixes the state has proposed. Even the $7 billion annually the state is now spending on pension contributions and repaying pension borrowings falls short. California’s Calstrs’ (teachers) pension system is on a path to insolvency and needs about $4.5 billion more annually for the next 30 years to fix the problem. That would come on top of the demands of its other big pension fund, Calpers, that government employers increase by 50 percent their contributions to it over the course of the next five years. Meanwhile, Chicago’s public safety pensions are less than 30 percent funded and the city is looking at a doubling of contributions–at a cost in property tax increases of more than 50 percent, perhaps, next year.

PROJECTED CHICAGO PENSION CONTRIBUTIONS

Los Angeles is headed towards spending 35 percent of its general fund just on pensions, a predicament faced by numerous other California municipalities. Around New York state, more and more municipalities like Albany are simply not making their full pension payments under a new state plan that allows municipalities to borrow from the pension system. Memphis can only afford about one-fifth the actual annual contribution necessary to wipe out the debt in its pension system.

What more and more places are doing is essentially holding on by their fingernails. They have enough money in their pension trusts to pay current retirees, but the drain on the system continues and reforms fall far short of putting the pension systems on a path to sustainability. The major reason for that in Jersey is that the true cost of fixing the system was simply too staggering for anyone to admit in 2011.

The Christie administration has said that it will offer new proposals for additional pension reforms, including possibly moving workers into defined contribution plans. That’s something the state should have done three years ago, although neither Christie nor Democrats who controlled the legislature proposed it at the time. Even a new system, however, doesn’t wipe out the debt from retirement credits that workers have already earned and that has kept building up thanks to unrealistic market return assumptions.

Democrats in NJ have proposed raising taxes (again), after about $3.6 billion in tax increases under McGreevey and another $2 billion under Corzine, which didn’t do a whole lot of good for the state’s economy and didn’t solve Jersey’s persistent budget and pension problems. But even their so-called millionaires’ tax proposal (actually a half-millionaires’ tax on top of the one McGreevey passed in 2004) wouldn’t begin to solve the state’s pension woes. Jersey simply can’t tax its way out of its staggering pension debt.

There is no precedent for where Jersey is heading now. The recent bankruptcies in Detroit and Stockton give us some guidance on how municipal insolvency will play out when pensions are a contributing factor. States are a different story. So far the solution is to keep putting off the problem because pension debts aren’t quite like, say, a bond payment or your monthly mortgage payment, where when you don’t make them you are in default. That’s how we got into this mess in the first place–by skipping pension contributions because they were too costly–and in many places it’s how we’re continuing to treat the problem.