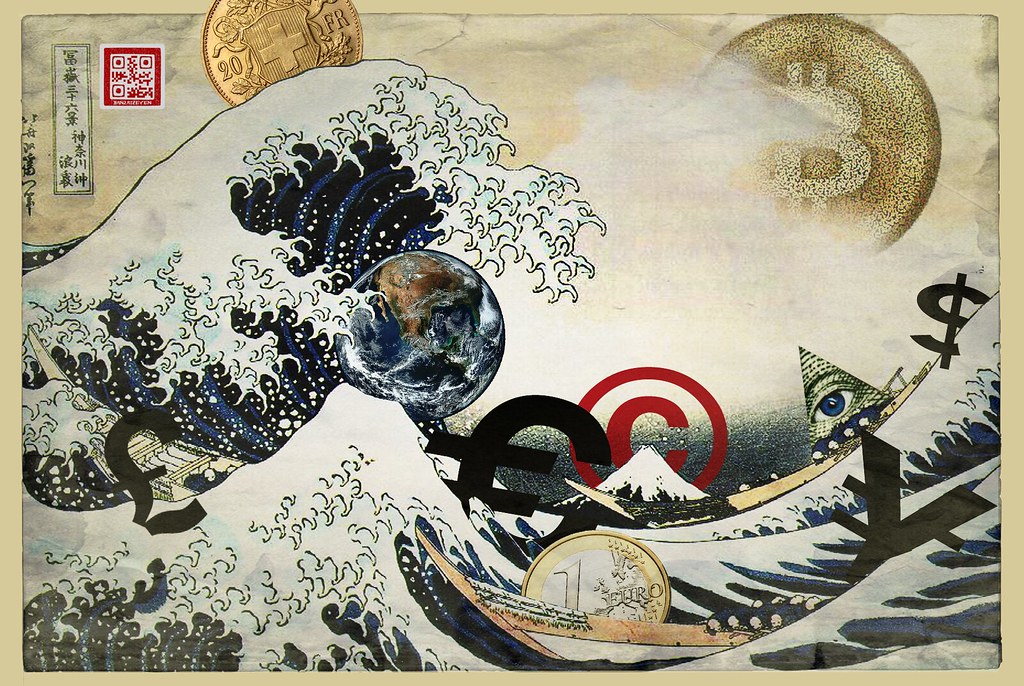

Doug Casey: Why the Euro Is a Doomed Currency

By Doug Casey

For a long time, I’ve advocated that the world’s governments should default on their debt. I recognize that this is an outrageous-sounding proposal.

However, the debts accumulated by the governments of the U.S., Japan, Europe and dozens of other countries constitute a gigantic mortgage on the next two or three generations, as yet unborn. Savings are proof that a person, or a country, has been living below their means. Debt, on the other hand, is evidence that the world has been living above its means. And the amount of government debt and liabilities in the world is in the hundreds of trillions and growing rapidly, even with essentially zero percent interest rates. This brings up several questions: Will future generations be able to repay it? Will they be willing to? And, if so, should they? My answers are: No, no and no.

The “should they” is one moral question that should be confronted. But I’ll go further. There’s another reason government debt should be defaulted on: to punish the people stupid enough, or unethical enough, to lend governments the money they’ve used to do all the destructive things they do.

I know it’s most unlikely you’ve ever previously heard this view. And I recognize there would be many unpleasant domino-like effects on today’s overleveraged and unstable financial system. It’s just that, when a structure is about to collapse, it’s better to have a controlled demolition, rather than waiting for it to collapse unpredictably. That said, governments will perversely keep propping up the house of cards, and building it higher, pushing the nasty consequences further into the future, with compound interest.

With that in mind, a few words on the euro, the EU and the European Central Bank are in order.

Continue reading “Doug Casey: Why the Euro is a Doomed Currency”