Drastic actions result in drastic consequences.

In easy terms: pic.twitter.com/TW1Qo2oBkZ

— Roadside Reveille (@RoadRedpills) August 1, 2023

Drastic actions result in drastic consequences.

In easy terms: pic.twitter.com/TW1Qo2oBkZ

— Roadside Reveille (@RoadRedpills) August 1, 2023

Guest Post by David Stockman via International Man

In light of Sleepy Joe’s new $1.9 trillion package of free stuff, it’s time to get out our magnifying glasses. The purpose is to compute the size of the hole in America’s collective paycheck that purportedly requires such continued, beneficence from our not-so-rich Uncle Sam.

There is no reason in the world why the February (pre-Covid) level of wage and salary disbursements is not an appropriate benchmark for measuring the pocketbook hit from the Covid-lockdowns that have wreaked havoc on the US economy since March. This happened after Dr. Fauci convinced President Donald to pull the plug on MAGA and his own tenure in office, too. (Of course, 80-year-old Dr. Fauci is still there, preparing to bamboozle yet another “elected” president.)

Last February, The Donald was boasting that he had delivered the greatest economy the world had ever seen, and Wall Street agreed, pushing stocks high into the nosebleed section of history.

As it happened, the February run rate (annualized) of wage and salary disbursements was $9.659 trillion, which comes to about $805 billion per month. So we would suggest that if $805 billion in monthly wages was enough to justify celebration of the Greatest Economy Ever, then the shortfall from that benchmark is a solid measure of the hit to US worker earnings that has occurred since February.

The Covid wage and salary loss is as follows:

The total of $276 billion in lost paychecks compares to $8.05 trillion in wages and salaries that would have been earned during that period at the February rate ($805 billion). Therefore, the cumulative shortfall through year-end amounted to just 3.4%.

More importantly, the $0-$6 billion monthly shortfall since September has been so small as to constitute a rounding error in the scheme of things, as suggested by the fact that American households spend far more—about $8 billion per month—on pet food and pet care alone.

Yet Sleepy Joe has teed up another $850 billion of direct aid to households, which, in the aggregate, are no longer suffering any material paycheck shortfall. And what is especially egregious about filling a nonexistent income hole in this manner is that 53% of this amount goes to “stimmy” checks and child tax credits, which are not means-tested except at the top of the income scale ($200,000 for a married couple):

Sleepy Joe’s $850 Billion of Direct Handouts to Households:

Still, to paraphrase Walter Mondale’s famous campaign slogan from 1984: Another $850 billion for income replacement but “Where’s the Hole?”

Of course, there are other ways to measure the hit to the national economy from the Covid lockdown, which we will amplify below. But first, it would be well to summarize the “solution” that Washington’s fiscally incontinent politicians have thrown at the “problem” during the last 12 months—a “problem” that they have never bothered to quantify.

With the new Biden package, new spending authorized by the five major Covid relief measures can be summarized as follows (IN billions):

The Washington politicians are preparing to throw nigh onto $6 trillion at a $274 billion hole in the nation’s wage bucket. That’s a solution 22X bigger than the putative problem!

The overwhelming share of the economic harm occurring since March is due to the misguided (and unconstitutional) lockdown policies of the government and the public hysteria fanned by Dr. Fauci, and not the disease itself. But if the state gets into the business of fully compensating the public for the endless harm wrought by its policies, insolvency will be guaranteed.

Why does Washington have the right to burden future taxpayers with permanent debt service payments in order to make whole a $276 billion loss of income and 3.4% inconvenience among taxpayers today?

The simple fact is that the overwhelming share of this $276 billion of wage losses has fallen on low-wage and part-time workers in the social–congregation sectors of the economy (bars, restaurants, gyms, hotels, cinemas, ballparks, etc.) that the Virus Patrol has shut down. The right solution is to send the Virus Patrol packing and let these unfairly penalized employees go back to work.

Even if you think that the total wage and salary loss above understates the economic damage caused by the lockdowns, the massive fiscal overkill by way of bailouts cannot be denied.

For instance, GDP is the most comprehensive measure of economic activity that we have (despite its flaws), but the loss of GDP after February has also been only about 3.6%. In fact, based on the Atlanta Fed’s GDPNow forecast, we project that nominal GDP during Q4 will post at about $21.650 trillion, a figure only 0.46% below the Greatest Economy Ever level of Q4 2019.

If we assume that Q4 2019 is a reasonable pre-Covid benchmark for the level of total economic activity in the USA, we get the following shortfall, including an estimate for Q4 based on the Atlanta Fed’s latest outlook.

Quarterly GDP Change From Q42019 Benchmark:

Even if you want to count everything, including losses from the $2.5 trillion of imputed activity in the GDP, the pending $6 trillion of Everything Bailouts is 7.7X the size of the problem!

By contrast, it is well worth looking at the other side of the coin: namely, the surge in transfer payments since last February stemming from a combination of the built-in safety net (principally unemployment insurance, food stamps and Medicaid) and disbursements of stimmy checks, enhanced Federal UI benefits as authorized by the Everything Bailouts.

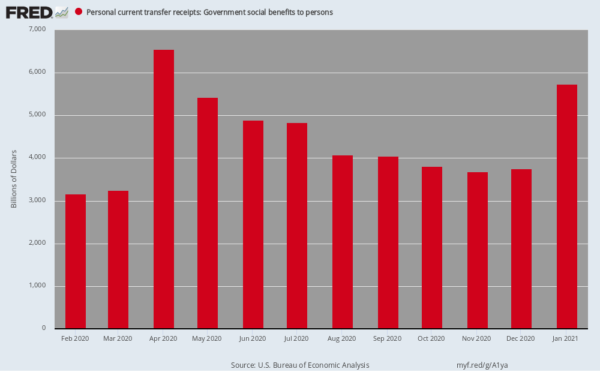

At the pre-covid level in February, total government transfer payments (including state and local) were running at a $3.165 trillion annual rate or about $265 billion per month. As shown in the chart below, however, that monthly figure skyrocketed by 107% to $546 billion in the month of April alone.

And, no, that latter figure is not the annualized rate: In their infinite generosity, government programs pumped more than one-half trillion dollars into the household sector during April alone. That’s $18.2 billion per day!

Thereafter, the tsunami of transfer payments began to abate but was still running at a level of $400 billion monthly in July and $306 billion in November. Overall, the 10-month total of incremental transfer payments above the February level totaled $1.05 trillion.

You can’t make this up. Transfer payments to households during the past 10 months have exceeded the loss of household wages and salaries ($276 billion) by nearly four times.

So the question recurs: Why does Sleepy Joe think we need another $850 billion of transfer payments to households on top of the immense generosity already dispensed per the chart below?

Total Government Transfer Payments, Annualized

He’s doing it because he can—because the nation-wreckers in the Eccles Building have determined to purchase $120 billion of government debt and GSE securities per month for the indefinite future. As Fed Chair Powell rattled on recently, they are not even thinking about tapering this tsunami of fake money created from thin air by the Fed’s digital printing presses.

When it comes to the rampant fiscal incontinence in Washington DC enabled by the Fed, did the election outcome make any difference?

It did not. Sleepy Joe is about to give the once and former King of Debt a run for his money when it comes to the annals of fiscal infamy in America.

As we said, free lunches for one and all… except the debt is never going away, and future generations will surely rue the day.

Editor’s Note: The truth is, we’re on the cusp of a economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming.

That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse. Click here to download the PDF now.

Guest Post by Mike Shedlock

“Free Money” experiments are underway in several places: Canada, California, and Finland.

“Living wage” advocates are elated.

Ongoing Free Money Experiments

The alleged studies are all fatally flawed because they do not scale. It’s one thing to give a few hundred people or a few thousand people free money, but it’s another thing to scale the experiment across an entire nation.

Free Money – Dauphin, Canada Experiment

Huffington Post author Zi-Ann Lum proclaims A Canadian City Once Eliminated Poverty And Nearly Everyone Forgot About It.

The problem with superficial analysis by Lum and others is they only focus on half the equation. Yes, citizens of Dauphin benefited, but it was at the direct expense of everyone in all of Manitoba that had to contribute “free money” to the residents of Dauphin.

Were the same scheme available to everyone in Manitoba, the money would have had to come from all of Canada.

And for all Canadians, the money would have had to come from Martians.

Nonetheless, in spite of such obvious flaws, economic illiterates have latched on to the free money scheme.

Continue reading “Living Wage Idiocy and Free Money Experiments”

When I came home earlier this week there was a flier on the kitchen counter that had been taped on our mailbox. It was from a company called SAS Claims Service. In big bold capital letters shaded in yellow at the top of the flier was:

The entire business plan for this company is based upon driving around neighborhoods looking for houses with missing roof tiles and then convincing them to scam their insurance companies. The flier then goes on to try and scare you about mold, home price devaluation, expensive roof repairs, and evil insurance companies denying claims.

But guess who can come to my rescue?

That’s right, Myron Mendelow will fight for my right to commit insurance fraud. He doesn’t get paid until I get paid. He wants to be my advocate. Here is his pitch, directly from the flier:

We make the calls, file the claim and take on all the aggravation of negotiating with your insurance company adjuster on your behalf, to get you the FREE MONEY that you deserve.

Myron is going to get me some free money for my non-existent damage. He even promises to find more associated damages I didn’t notice.

A couple roof tiles did fly off during a storm several years ago. I had someone replace them, and the tiles are not the exact color of the original tiles. Myron assumed the different colored tiles were actually missing tiles.

Fast forward to Saturday morning. My youngest son and I were finishing up spreading the six yards of mulch dumped in my driveway earlier in the day. I was drenched in sweat and filthy from head to toe. Up the street comes a silver Mercedes who parks in front of my house. A wheeler dealer type gets out and boisterously tells me he wishes he were me. I’m thinking to myself WTF are you talking about dude. He explains that he lives in a condo and can’t get his hands dirty anymore.

I was in the presence of Myron Mendelow. His shirt was unbuttoned to show a massive gold star of david necklace. His picture should be next to the term Shyster in the dictionary. He then proceeded to make his pitch about my damaged roof. Even though I explained my roof was not damaged, he insisted he could get an insurance payout if I put my trust in him. He seemed exasperated that I didn’t want some of that FREE MONEY. After I made it clear he wasn’t talking to someone with interest in committing insurance fraud, he handed me the parting gift of a refrigerator magnet. Now when I’m grabbing a brewsky from the fridge, I can be reminded there is FREE MONEY with my name on it just a phone call away.

This is the kind of country we’ve become. Everyone has an angle to get something for nothing. Everyone is doing it, so why shouldn’t I get in on the scam. The oligarchs set the tone. Politicians set the tone. Everyone is on the take. Greed and avarice are considered legitimate goals of all Americans. The country revolves around fraud, corruption, scams, and swindles. Wall Street bankers rig the system, politicians accept bribes to pass legislation benefiting whichever special interest pays the most, millions watch shyster law firm commercials and realize they are eligible for Social Security disability, or have been wronged by some corporation. What’s a little food stamp fraud or earned income tax credit fraud? I really need to get with the game. This honesty and taking responsibility for my own life concept is really antiquated. I must have been mentally scared by those twelve years of Catholic teaching. Maybe Myron can help me file a claim.