Energy And The Economy – Twelve Basic Principles

Submitted by Gail Tverberg via Our Finite World blog,

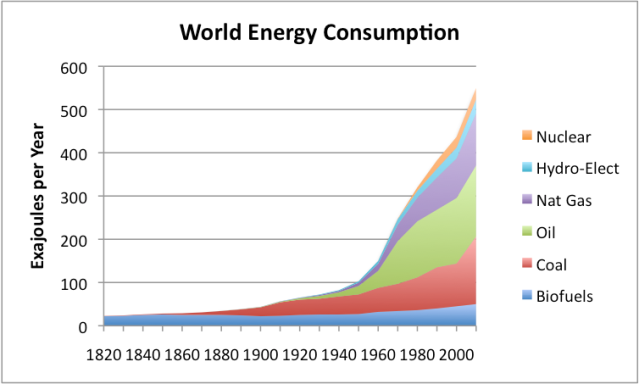

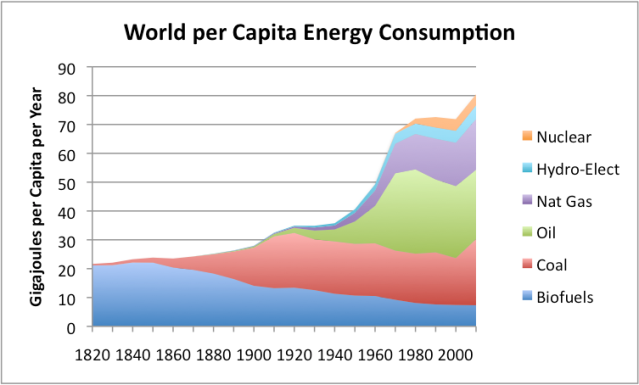

There is a standard view of energy and the economy that can briefly be summarized as follows: Economic growth can continue forever; we will learn to use less energy supplies; energy prices will rise; and the world will adapt. My view of how energy and the economy fit together is very different. It is based on the principle of reaching limits in a finite world. Let me explain the issues as I see them.

Twelve Basic Principles of Energy and the Economy

1. Economic models are no longer valid, as we start getting close to limits.

We live in a finite world. Because of this, the extraction of energy resources and of resources in general operates in a way that is not at all intuitive as we approach limits. Economists have put together models of how the economy can be expected to act based on how the economy acts when it is distant from limits. Unfortunately, these economic models are worse than useless as limits approach because modeled relationships no longer hold. For example:

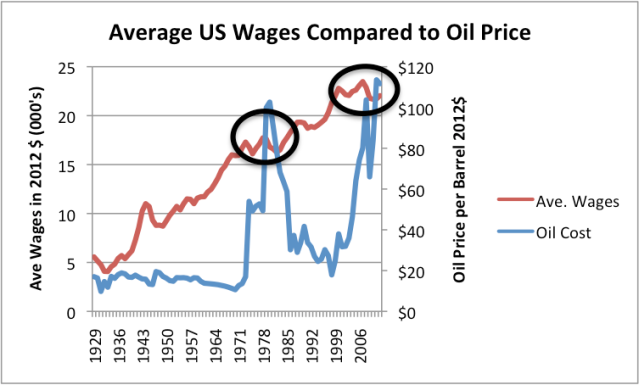

(a) The assumption that oil prices will rise as the cost of extraction rises is not necessarily true. Instead, a finite world creates feedback loops that tend to keep oil prices too low because of its tight inter-connections with wages. We see this happening right now. The Telegraph reported recently, “Oil and gas company debt soars to danger levels to cover shortfall in cash.”

(b) The assumption that greater investment will lead to greater output becomes less and less true, as the easy to extract resources (including oil) become more depleted.

(c) The assumption that higher prices will lead to higher wages no longer holds, as the easy to extract resources (including oil) become more depleted.

(d) The assumption that substitution will be possible when there are shortages becomes less and less appropriate because of interconnections with the rest of the system. Particular problems include the huge investment required for such substitution, impacts on the financial system, and shortages developing simultaneously in many areas (oil, metals such as copper, rare earth metals, and fresh water, for example).

More information is available from my post, Why Standard Economic Models Don’t Work–Our Economy is a Network.

2. Energy and other physical resources are integral to the economy.

In order to make any type of goods suitable for human use, it takes resources of various sorts (often soil, water, wood, stones, metals, and/or petrochemicals), plus one or more forms of energy (human energy, animal energy, wind power, energy from flowing water, solar energy, burned wood or fossil fuels, and/or electricity).

3. As we approach limits, diminishing returns leads to growing inefficiency in production, rather than growing efficiency.

As we use resources of any sort, we use the easiest (and cheapest) to extract first. This leads to a situation of diminishing returns. In other words, as more resources are extracted, extraction becomes increasingly expensive in terms of resources required, including human and other energy requirements. These diminishing returns do not diminish in a continuous slow way. Instead, there tends to be a steep rise in costs after a long period of slowly increasing costs, as limits are approached.

One example of such steeply rising costs is the sharply rising cost of oil extraction since 2000 (about 12% per year for “upstream costs”). Another is the steep rise in costs that occurs when a community finds it must use desalination to obtain fresh water because deeper wells no longer work. Another example involves metals extraction. As the quality of the metal ore drops, the amount of waste material rises slowly at first, and then rapidly escalates as metal concentrations approaches 0%, as in Figure 2.

The sharp shift in the cost of extraction wreaks havoc with economic models based on a long period of very slowly rising costs. In a period of slowly rising costs, technological advances can easily offset the underlying rise in extraction costs, leading to falling total costs. Once limits are approached, technological advances can no longer completely offset underlying cost increases. The inflation-adjusted cost of extraction starts rising. The economy, in effect, starts becoming less and less efficient. This is in sharp contrast to lower costs and thus apparently greater efficiency experienced in earlier periods.

4. Energy consumption is integral to “holding our own” against other species.

All species reproduce in greater numbers than need to replace their parents. Natural selection determines which ones survive. Humans are part of this competition as well.

In the past 100,000 years, humans have been able to “win” this competition by harnessing external energy of various types–first burned biomass to cook food and keep warm, later trained dogs to help in hunting. The amount of energy harnessed by humans has grown over the years. The types of energy harnessed include human slaves, energy from animals of various sorts, solar energy, wind energy, water energy, burned wood and fossil fuels, and electricity from various sources.

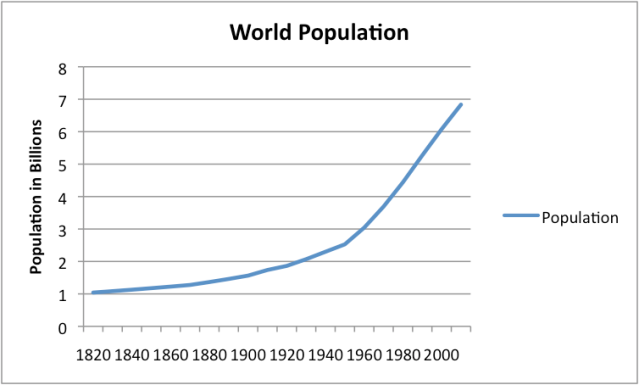

Human population has soared, especially since the time fossil fuels began to be used, about 1800.

Even now, human population continues to grow (Figure 4), although the percentage rate of growth has slowed.

Because the world is finite, the greater use of resources by humans leads to lesser availability of resources by other species. There is evidence that the Sixth Mass Extinction of species started back in the days of hunter-gatherers, as their ability to use of fire to burn biomass and ability to train dogs to assist them in the hunt for food gave them an advantage over other species.

Also, because of the tight coupling of human population with growing energy consumption historically, even back to hunter-gatherer days, it is doubtful that decoupling of energy consumption and population growth can fully take place. Energy consumption is needed for such diverse tasks as growing food, producing fresh water, controlling microbes, and transporting goods.

5. We depend on a fragile self-organized economy that cannot be easily replaced.

Individual humans acting on their own have very limited ability to extract and control resources, including energy resources. The only way such control can happen is through a self-organized economy that allows people, businesses, and governments to work together on common endeavors. Development of a self-organized economy started very early, as bands of hunter-gatherers learned to work together, perhaps over shared meals of cooked food. More complex economies grew up as additional functions were added. These economies have gradually merged together to form the huge international economy we have today, including international trade and international finance.

This networked economy has a tendency to grow, in part because human population tends to grow (Item 4 above), and in part because greater complexity is required to solve problems, as an economy grows. This networked economy gradually adds more businesses and consumers, each one making choices based on prices and regulations in place at the particular time.

This networked economy is fragile. It can grow, but it cannot easily shrink, because the economy is constantly optimized for the circumstances at the time. As new products are developed (such as cars), support for prior approaches (such as horses, buggies and buggy whips) disappears. Systems designed for the current level of usage, such as oil pipelines or Internet infrastructure, cannot easily be changed to accommodate a much lower level of usage. This is the reason why the economy is illustrated as interconnected but hollow inside.

Another reason that the economy cannot shrink is because of the large amount of debt in place. If the economy shrinks, the number of debt defaults will soar, and many banks and insurance companies will find themselves in financial difficulty. Lack of banking and insurance services will adversely affect both local and international trade.

6. Limits of a finite world exert many pressures simultaneously on an economy.

There are a number of ways an economy can reach a situation of inadequate resources for its population. While all of these may not happen at once, the combination makes the result worse than it otherwise would be.

a. Diminishing returns (that is, rising production costs as depletion sets in) for resources such as fresh water, metals, and fossil fuels.

b. Declining soil quality due to erosion, loss of mineral content, or increased soil salinity due to poor irrigation practices.

c. Rising population relative to the amount of arable land, fresh water, forest resources, mineral resources, and other resources available.

d. A need to use an increasing share of resources to combat pollution, related to resource extraction and use.

e. A need to use an increasing share of resources to maintain built infrastructure, such as roads, pipelines, electric grids, and schools.

f. A need to use an increasing share of resources to support government activities to support an increasingly complex society.

g. Declining availability of food that is traditionally hunted (such as fish, monkeys, and elephants), because an increase in human population leads to over-hunting and loss of habitat for other species.

7. Our current problems are worryingly similar to the problems experienced by earlier civilizations before they collapsed.

In the past, there have been civilizations that were confined to a limited area that grew for a while, and then collapsed once resource availability declined or population outgrew resources. Such issues led to a situation of diminishing returns, similar to the problems we are experiencing today. We know from studies of these prior civilizations how diminishing returns manifested themselves. These include:

(a) Reduced job availability and lower wages, especially for new workers joining the workforce.

(b) Spiking food costs.

(c) Growing demands on governments for services, because of (a) and (b).

(d) Greater disparities in wealth, as newer workers find it hard to get good-paying jobs.

(e) Declining ability of governments to collect sufficient taxes from common workers who are producing less and less (because of diminishing returns) and because of this, receiving lower wages.

(f) Increased reliance on debt.

(g) Increased likelihood of resource wars, as a group with inadequate resources tries to take resources from other groups.

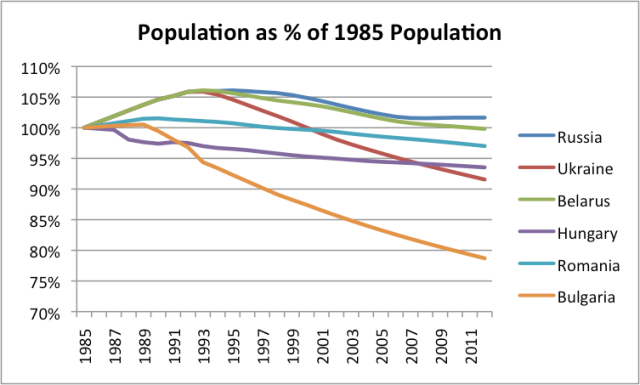

(h) Eventual population decline. This occurred for two reasons: As wages dropped and needed taxes rose, workers found it increasingly difficult to obtain an adequate diet. As a result, they become more susceptible to epidemics and diseases. Greater involvement in resource wars also led to higher death rates.

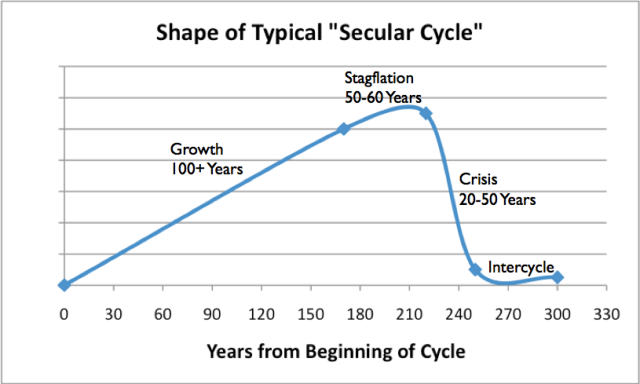

When collapse came, it did not come all at once. Rather a long period of growth was succeeded by a period of stagnation, before a crisis period of several years took place.

We began an economic growth cycle back when we began using fossil fuels to a significant extent, starting about 1800. We began a stagflation period, at least in the industrialized economies, when oil prices began to spike in the 1970s. Less industrialized countries have been able to continue growth their growth pattern longer. Our situation is likely to differ from that of early civilizations, because early civilizations were not dependent on fossil fuels. Pre-collapse skills tended to be useful post-collapse, because there was no real change in energy sources. Loss of fossil fuels would considerably change the dynamic of the outcome, because most jobs would become obsolete.

Most models put together by economists assume that the conditions of the growth period, or the growth plus stagflation period, will continue forever. Such models miss turning points.

8. Modeling underlying the book Limits to Growth shows why depletion can be expected to lead to declining economic growth. It also shows why extracting all of the resources that seem to be available is likely to be impossible.

We also know from the analysis underlying the book The Limits to Growth (by Donella Meadows and others, published in 1972) that growing demand for resources because of Items listed as 6a to 6g above will take an increasingly large share of resources produced. This dynamic makes it very difficult to produce enough additional resources so that economic growth can continue. The authors report that the behavior mode of the modeled system is overshoot and collapse.

The 1972 analysis does not model the financial system, including debt and the repayment of debt with interest. The closest it comes to economic modeling is modeling industrial capital, which it describes as factories, machines, and other physical “stuff” needed to extract resources and produce goods. It finds that inability to produce enough industrial capital is likely to be a bottleneck far before resources in the ground are exhausted.

As an example in today’s world, there seems to be a huge amount of very heavy oil that can be steamed out of the ground in many places including Canada and Venezuela. (The existence of such heavy oil is one reason the ratio of oil reserves to oil production is high.) To actually get this oil out of the ground quickly would require a huge physical investment in a very short time frame. As a practical matter, we cannot ramp up all of the physical infrastructure needed (pipelines, steaming equipment, refining equipment) without badly cutting into the resources needed to “grow” the rest of the economy. A similar problem is likely to exist if we try to ramp up world oil and gas supply using fracking.

9. Our real concern should be collapse caused by reaching limits in many ways, not the slow decline reflected in a Hubbert Curve.

One reason for being concerned about collapse is the similarity of the problems our current economy is experiencing to those of prior economies that collapsed, as discussed in Item 7. Another reason for this concern is based on the observation from physics that an economy is a dissipative structure, just as a hurricanes is, and just as a human being is. Such dissipative structures have a finite lifetime.

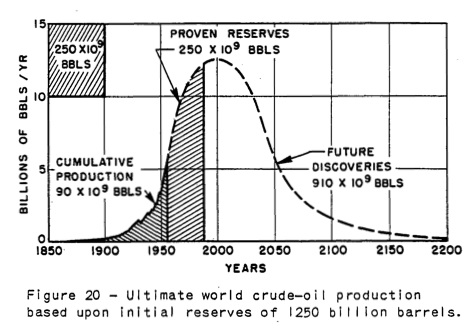

Concern about future collapse is very different from concern that one or another resource will decline in a symmetric Hubbert curve. The view that resources such as oil will gradually decrease in availability once 50% of the resources have been extracted reflects a best-case scenario, where a perfect replacement (both cheap and abundant) replaces the item that is depleting, so that the economy is not affected. Hubbert illustrated the kind of situation he was envisioning with the following graphic:

10. There is a tight link between both oil consumption and total energy consumption and world economic growth.

This tight link is evident from historical data:

The link between energy and the economy comes both from the supply side and the demand side.

With respect to supply, it takes energy of many types to make goods and services of all types. This is discussed in Item 2 above.

With respect to demand,

(a) People who earn good wages (indirectly through the making of goods and services with energy products) can afford to buy products using energy.

(b) Because consumers pay taxes and buy goods and services, growth in demand from adequate wages flows through to governments and businesses as well.

(c) Higher wages enable higher debt, and higher debt also acts to increase demand.

(d) Increased demand increases the price of the resources needed to make the product with higher demand, making more of such resources economic to extract.

11. We need a growing supply of cheap energy to maintain economic growth.

This can be seen several ways.

(a) Today, all countries compete in a world economy. If a country’s economy uses an expensive source of energy (say high-priced oil or renewables) it must compete with other countries that use cheaper fuel sources (such as coal). The high price of energy puts the country with high-cost energy at a severe competitive disadvantage, pushing the economy toward economic contraction.

(b) Part of the world’s energy consumption comes from “free” energy from the sun. This solar energy is not evenly distributed: the warm areas of the world get considerably more than the cold areas of the world. The cold areas of the world are forced to compensate for this lack of free solar energy by building more substantial buildings and heating them more. They are also more inclined to use “closed in” transportation vehicles that are more costly than say, walking or using a bicycle.

Back in pre-fossil fuel days, the warm areas of the world predominated in economic development. The cold areas of the world “surged ahead” when their own forests ran short of the wood needed to provide the heat-energy they needed, and they learned to use coal instead. The knowledge they gained about using coal for home-heating quickly transferred to the ability to use coal to provide heat for industrial purposes. Since the warm areas of the world were not yet industrialized, the coal-using countries of the North were able to surge ahead economically. The advantage of the cold industrialized countries grew as they learned to use oil and natural gas. But once oil and natural gas became expensive, and industrialization spread around the world, the warm countries regained their advantage.

(c) Wages, (non-human) energy costs, and financing costs are all major contributors to the cost of producing goods and services. When energy costs rise, the rise in energy costs puts pressure both on wages and on interest rates (since interest rates determine financing costs), because businesses need to keep the total cost of goods and services close to “flat,” if consumers are to afford them. This occurs because wages do not rise as energy prices rise. In fact, pressure to keep the total cost of goods low creates pressure to reduce wages when oil prices are high (perhaps by sending manufacturing to a lower-cost country), just as it adds pressure to keep interest rates low.

(d) If we look at historical US data, wages have tended to rise strongly (in inflation-adjusted terms) when oil prices were less than $40 to $50 barrel, but have tended to stagnate above that oil price range.

12. Oil prices that are too low for producers should be a serious concern. Such low prices occur because oil becomes unaffordable. In the language of economists, oil demand drops too low.

A common belief is that our concern should be oil prices that are too high, and thus strangle the economy. A much bigger concern should be that oil prices will fall too low, discouraging investment. Such low oil prices also encourage civil unrest in oil exporting nations, because the governments of these nations depend on tax revenue that is available when oil prices are high to balance their budgets.

It can easily be seen that high oil prices strangle the economies of oil importers. The salaries of consumers go “less far” in buying basics such as food (which is raised and transported using oil) and transportation to work. Higher costs for basics causes consumers cut back on discretionary expenditures, such as buying new more expensive homes, buying new cars, and going out to restaurants. These cutbacks by consumers lead to job layoffs in discretionary sectors and to falling home prices. Debt defaults are likely to rise as well, because laid-off workers have difficulty paying their loans. Our experience in the 2007-2009 period shows that these impacts quickly lead to severe recession and a drop in oil prices.

The issue we are now seeing is the reverse–too low oil prices for oil producers, including oil exporters. These low oil prices are contributing to the unrest we see in the Middle East. Low oil prices also contribute to Russia’s belligerence, since it needs high oil revenues to maintain its budget.

Conclusion

We seem now to be at risk in many ways of entering into the collapse scenario experienced by many civilizations before us.

One of areas of risk is that interest rates will rise, as the Quantitative Easing and Zero Interest Rate Policies held in place since 2008 erode. These ultra-low interest rates are needed to keep products affordable, since the high cost of oil (relative to consumer salaries) has not really gone away.

Another area of risk is an increase in debt defaults. One example occurs when student loan borrowers find it impossible to repay these loans on their meager wages. Another example is China with the financing of its big recent expansion by debt. A third example is the possibility that businesses extracting resources will find it impossible to repay loans with today’s (relatively) low commodity prices.

Another area of risk is natural disasters. It takes surpluses to deal with these disasters. As we reach limits, it becomes harder to mitigate the effects of a major hurricane or earthquake.

Clearly loss of oil production because of conflict in the Middle East or in other oil producing countries is a concern.

This list is by no means exhaustive. Many economies are “near the edge” now. Recent news is that Germany has slipped into recession as well as Japan. One economy failing is likely to pull others with it.