“Fraud and falsehood only dread examination. Truth invites it.”

Samuel Johnson

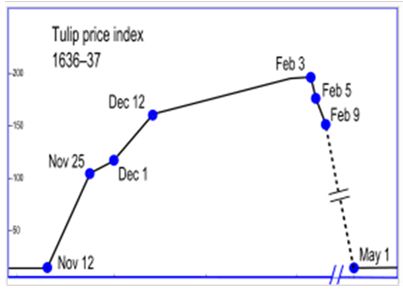

“Financialization is profit margin growth without labor productivity growth. That sounds like a small thing, but I tell you it is everything.

Financialization is squeezing more earnings from a dollar of sales without squeezing at all, but through tax arbitrage or balance-sheet arbitrage.

Financialization is the zero-sum-game aspect of capitalism, where profit-margin growth is both pulled forward from future real growth and pulled away from current economic risk-taking.

Financialization is the smiley-face perversion of Adam Smith’s invisible hand and Joseph Schumpeter’s creative destruction.

Financialization is a global phenomenon. In China, it’s transmitted through the real-estate market. In the U.S., it’s transmitted through the stock market.”

Ben Hunt

“God whispers to us in our pleasures, speaks in our consciences, but shouts in our pains. It is his megaphone to rouse a deaf world.”

C. S. Lewis