Tag: income

Housing Recovery – Not So Much

Guest Post by Lance Roberts

“Everyone wants a house, and that’s a big problem.

We’ve noted in the past that there is a substantial issue in the housing market right now. Too few homes are being built for the number of people that want to move into them, thus driving up prices and keeping some lower-end or first-time buyers out of the market.“

It is quite amazing that amount of optimism surrounding the housing market which has yet to recover substantially from post-financial crisis lows given the exorbitant amount of monetary stimulants injected into it.

The chart below shows the Total Housing Market Activity Index which is a composite of new and existing home sales, permits and starts. Yes, housing has recovered, but remains well below levels seen in 1999.

But let’s not let a trivial matter of data get in the way of a good story.

“Meanwhile, according to the Conference Board, although the share of households planning on buying a home in the next six months ticked down in April to 5.4%, that is significantly above the average of 3.6% recorded since 1978,” wrote Matthew Pointon, property economist at Capital Economics.

While individuals may CLAIM they want to buy a home when asked, there is a massive difference between “wanting to do something” and actually being able to do it.

Notice in the chart above that the spike in “home ownership desires” spiked in 2011 and has been steadily climbing since then. Surely, if we have a record number of households planning to buy a home, that should be reflected in the home ownership rate as well.

Considering that almost 80% of Americans can’t meet small emergencies, 1-in-5 families have ZERO members employed, and incomes are less than they were in 2000 – the chart above makes a good deal of sense. It is also why we have seen the rise of the “renter nation.”

Of course, I am assuming that Matt Pointon wasn’t talking about the newest fad in housing for Millennials: The 150-sq. ft. micro-home.

California renter apocalypse

Guest Post by Dr. Housing Bubble

The rise in rents and home prices is adding additional pressure to the bottom line of most California families. Home prices have been rising steadily for a few years largely driven by low inventory, little construction thanks to NIMBYism, and foreign money flowing into certain markets. But even areas that don’t have foreign demand are seeing prices jump all the while household incomes are stagnant. Yet that growth has hit a wall in 2016, largely because of financial turmoil. We’ve seen a big jump in the financial markets from 2009. Those big investor bets on real estate are paying off as rents continue to move up. For a place like California where net homeownership has fallen in the last decade, a growing list of new renter households is a good thing so long as you own a rental. The problem of course is that household incomes are not moving up and more money is being siphoned off into an unproductive asset class, a house. Let us look at the changing dynamics in California households.

More renters

Many people would like to buy but simply cannot because their wages do not justify current prices for glorious crap shacks. In San Francisco even high paid tech workers can’t afford to pay $1.2 million for your typical Barbie house in a rundown neighborhood. So with little inventory investors and foreign money shift the price momentum. With the stock market moving up nonstop from 2009 there was plenty of wealth injected back into real estate. The last few months are showing cracks in that foundation.

Stucky Question #13: What INCOME Would Make You Happy?

Somehow I stumbled on this article yesterday from WSJ. It’s from 2010, so adjusting for inflation I guess today it would be about $100k per year.

The most I ever made in one year … and one year ONLY … was $155,000. The previous year, I swear to god, I made $40k. Once again being totally honest, I felt no difference whatsoever with happiness between the two years …. although I certainly felt a lot less pressure in the better year.

One of the happiest years I can recall was my first year as a computer programmer at northAmerican van Lines. I had my OWN office cubicle, a desk, a fancy schmancy computer terminal, and an electric stapler. It was the first time I had my name engraved on a shiny piece of blue plastic. And my boss introduced me to my users, the Fuel & Permits Department as “Mr. Stucky, your new programmer.” That was in 1980, and my salary (for working 60 hours a week) was $19,000 … NOT a lot of money even in ’79, but I was happy as a pig in shit.

With the Big Moolah I was making at NAVL, I was able to get rid of my 1975 Capri (which I could barely fit in), and bought a super low miles green with black roof 1971 Catalina Brougham. A fuckin’ enormous car, and I was happy as shit simply cuz my head didn’t hit the roof and my knees no longer banged against the dashboard! This one …

It’s never, ever been about money, for me. In fact, the more I made, the unhappier I became, because I made the fatal mistake of always buying more shit; a bigger or nicer house (7 or 8 times), fancier cars, and toys (motorcycle, electronics, etc etc). That only ultimately led to misery, actually. I hope you young people here don’t fall for that trap.

Sooooo …. what salary/income would raise you to a Happy Happy Joy Joy state of mind?

==========================================

The Perfect Salary for Happiness: $75,000

Continue reading “Stucky Question #13: What INCOME Would Make You Happy?”

As The “Prosperity” Tide Recedes, The Ugly Reality Of Wealth Inequality Is Exposed

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

This chart of median household income illustrates why so many of us feel poorer– we are poorer in terms of the purchasing power of our income.

A rising tide raises all boats, from rowboats to yachts–this is the narrative of “prosperity.”

A rising tide is also the political cover for rising inequality: if the guy in the rowboat makes $100 more a month, he feels like he’s participating in the prosperity.

Meanwhile, the guy in the speedboat is making $1,000 more a month and the guy in the yacht is making $1 million more a month.

But this doesn’t bother the guy in the rowboat, for two reasons:

1. He thinks of himself as a guy who is currently in a rowboat on his way to buying a speedboat

2. Studies have found that our sense of wealth and “falling behind” is not defined by our actual increases in income or wealth, but by how we’re doing relative to our peer group. If everyone else in rowboats is making $200 more a month in the rising tide of prosperity, the guy making only $100 more feels like he’s falling behind–even if his absolute income and wealth is rising.

Conversely, if his peers are all suffering declines in income while his income is holding steady, he feels like he’s doing pretty well for himself, even though his income is stagnant.

The fact that the wealthy are gaining far more in “prosperity” in both absolute and relative terms doesn’t bother him as long as he’s doing as well or better as his peers and feels he has a chance to eventually move up from a rowboat to a speedboat.

“Everyday Americans” Hillary And Bill Clinton Report $140 Million In Taxable Income Since 2007

Submitted by Tyler Durden on 08/03/2015 09:46 -0400

Clinton told ABC’s Diane Sawyer in a June interview, “We came out of the White House not only dead broke, but in debt.”

Ever since Mitt Romney’s tax disclosure fiasco in which allegations of tax avoidance and usage of offshore tax shelters played a major part in the democrat counter campaign, there has been great interest in the Adjusted Gross Income reported by presidential candidates. Which is why to avoid any surprises on the primary circuit, Hillary Clinton released the full data of her and Bill’s tax income going back to 2007.

So without further ado, here is the Clinton family’s adjusted gross income since 2007. The summary: $139.1 million in income since 2007, most of it thanks to speeches starting at $225,000 and going much higher.

And that is your “everyday Americans.”

Bidding Wars Stop; Millennials Leave Their Parents’ Basements, But Not For Homes; Pent Up Demand?

Guest Post by Mike Shedlock

Bidding Wars Stop

With cash-paying investors on full retreat, existing home sales dropped 1.8% in August, according to the National Association of Realtors.

Lawrence Yun, NAR chief economist says that’s a good thing because “first-time buyers have a better chance of purchasing a home now that bidding wars are receding and supply constraints have significantly eased in many parts of the country.”

While I agree it’s a good thing that bidding wars stopped, the fact of the matter is home prices are once again in la-la land, especially for cash-strapped millennials loaded up with student debt, in low-paying jobs.

Pent Up Demand?

Yun states, “As long as solid job growth continues, wages should eventually pick up to steadily improve purchasing power and help fully release the pent-up demand for buying.”

There is arguably a pent-up demand for homes by millennials if wages do catch up, but that assumes millennials have the same value-set and attitudes towards debt as their parents.

In reality, median wages have not gone up much but home prices have. More importantly, attitudes of millennials are not the same as that of their boomer parents.

Millennials Leave Their Parents’ Basements, But Not For Homes

Fortune reports Millennials Finally Leave Their Parents’ Basements.

Jed Kolko, chief economist at Trulia, put together this graph, which shows that Millennials are finally moving out of their parents’ houses, after years of living at home:

But that’s where the good news ends. Over the past two years, Millennials have been moving away from home, but they don’t actually have enough money, or desire, to form their own households. The homeownership rate among Millennials continues to fall:

The falling homeownership rate and falling “headship rate”—which is the share of Millennials who are the head of a household regardless of whether they own real estate—suggest that this generation is still doubling up with friends or other relatives even if they aren’t living with Mom and Dad.

The one bright spot in the Census data for the youngest workers: between 2012 and 2013, median income for those aged 15 to 24 shot up by 10% from $31,000 per year to roughly $34,000 per year. But this is the first time since 2006 that this age group has seen any increase in income at all, meanwhile the cost of shelter has risen 16% since that time. Income for the older half of the Millennial generation rose just 1.1% between 2012 and 2013.

This poor performance could mean that the housing industry is building too many homes, according to Kolka. This is quite the surprise given that single-family housing construction is still well below pre-crisis and even pre-bubble norms.

Census Data

I commend Fortune for linking to the actual data. Few mainstream media articles do.

For those who wish to take a closer look: Income and Poverty in the United States: 2013, Issued September 2014. Here are a couple of charts and stats that caught my eye.

Real Median Income

Full-Time Employment

Real Medium Income Notes

- Real median household income for those 15-24 shot up by 10.5% but only from $31,049 to $34,311. That’s not enough to support buying a nice house in most areas. Moreover, the 15-24 demographic has 6.3 million households and typically that age group does not buy houses anyway.

- Real median household income for those 25-34 (about 20 million households) was only up 1.1% to $52,702. Home prices rose more, making homes less affordable.

- Real median household income for those 35-44 (about 21 million households) was only op 0.7%, but to a better looking to $64,973.

- Those aged 45-54 and 55-64 actually saw incomes declines of 0.3% and 3.3% respectively on household populations over 23 million each.

Attitudes, Wages, Home Prices

That data is from 2013, but it’s very safe to conclude nothing much changed in 2014. None of the income data is supportive of more household formation. Wages have not kept up with home prices in the key demographic groups. Things are far worse if you factor in attitudes.

Attitudes – Fed’s Biggest, Most Futile Fight

I have been talking about attitudes for years. For example, please consider Please consider Teenagers Scared Over Plight of their Parents; Attitudes – Bernanke’s Biggest, Most Futile Fight

That 2010 post contains an email from “Nancy Drew” about her daughters, aged 15 and 17 with their friends scared half-to-death about their parents’ financial woes.

Such memories last a long time.

I wrote then and I repeat now … “Those fretting over base money supply and foolishly screaming hyperinflation (or even inflation), simply do not understand the dynamics of debt deflation, nor do they understand how small the increase in base money is compared to debt that will be written off, nor do they understand the role of changing social attitudes towards spending.”

Clash of Generations

On May 30, 2014 I wrote Clash of Generations – Boomers vs. Millennials: Attitude Change Will Disrupt Wall Street and Corporate America

If you haven’t read that, please do. And if you have, I suggest it’s well worth another look.

Pent Up Demand to Sell

Yun thinks another housing boom is just around the corner. He talks of a pent-up demand to buy.

I suggest there’s a pent-up demand to sell for three reasons:

- Aging boomers seeking to downsize

- All-cash equity buyers looking to take profits

- Some of those who were underwater and hoping to get out will do so if and when they get a chance

Will millennials be able to plug all of that pent-up selling pressure? I think not.

Mike “Mish” Shedlock

Read more at http://globaleconomicanalysis.blogspot.com/2014/09/bidding-wars-stop-millennials-leave.html#mZEyqB3h4dGgFCyT.99

MEANWHILE, WHILE WALL STREET PROFITS & BONUSES REACH ALL-TIME HIGHS….

WINNING!!!!

I thought Bloomberg was a man of the people. I guess just some people.

Explaining NYC’s Record Homelessness In One Disastrous Chart

Submitted by Tyler Durden on 06/07/2014 14:31 -0400

By any measure, New York City’s homelessness crisis broke every record during the final year of the Bloomberg administration. The already record-high homeless shelter population soared even higher, to more than 50,000 people per night. There are, of course, numerous reasons for this disastrous situation but we suspect the following chart, from the coalition of the homeless, may just be enough to wake up the average American to the reality of this ‘recovery’.

Over the past year, the average monthly number of homeless people sleeping each night in the New York City shelter system increased by 7 percent, from 50,135 people in January 2013 to 53,615 people in January 2014 – the highest level ever recorded.

The following are the tragic benchmarks of the past year in New York City:

- The average number of homeless children living in municipal shelters increased by 8 percent over the prior year, reaching an all-time-high 22,712 children in January 2014.

- The average number of homeless families in shelters increased by 6 percent over the past year, reaching a record-high 12,724 families in January 2014.

- The average number of homeless single adults sleeping each night in the New York City shelter system rose five percent to 11,342 women and men in January 2014, a new record.

- Average shelter stays for homeless families with children rose by two months (60 days), or 16 percent, during the past year. The average shelter stay for homeless families with kids reached a record-high 14.5 months (435 days) in January 2014.

- The average shelter stay for homeless families without children rose to more than 17 months (518 days), the longest ever recorded. Average shelter stays for childless families in emergency shelter rose by more than a month (34 days), or 7 percent, during the past year.

- The number of newly homeless families entering the shelter system, 13,465 families in FY 2013, was 12 percent higher than the previous City fiscal year.

- More New Yorkers sought emergency shelter: A remarkable 111,210 different men, women and children slept in the shelter system during FY 2013, a five percent increase over the previous City fiscal year.

- More children slept in NYC’s municipal shelter system: During FY 2013, City data show 40,189 different girls and boys lived in homeless shelters, a 7 percent increase from the previous City fiscal year.

And this is among the most critical reason why…

Thank you Ben Bernanke… working for Main Street once again

THE GREAT RETAIL RECOVERY

Retailers and restaurants always close stores by the thousands when the economy is growing, unemployment is plunging, and incomes are rising. Right?

Use your brains people. Stop believing the storylines. Open your eyes and see what is happening. Count the number of Space Available signs on your next road trip through suburban hell.

Does the story peddled by the government and legacy media match the reality you see with your own eyes?

This list of store closings is just the tip of the iceberg. There are tens of thousands to go over the next five years.

Guest Post by Tony Sanders

Jobs Recovery? 17 Retailers Shutting Down Stores (And Not All From Internet Competition)

This is the worst employment recovery in American history from a credit bubble. And the news just keeps getting worse and worse, particularly for service workers at retail shops. You can’t blame Amazon.com for stealing sales from Red Lobster, Ruby Tuesday’s, Sbarro’s or Quizno’s, however.

Here are 17 companies that have closed stores or will close stores soon:

* Office supply company Staples has announced plans to close 225 stores by 2015, which is about 15 percent of its chain. Staples already closed 40 stores last year.

* Office Depot, Staples’ main competitor, which bought OfficeMax last year, is expected to announce its own round of store closings soon.

* Radio Shack has announced plans to close 20 percent of its stores this year, which is as many as 1,100 stores. The company, which operates around 4,000 stores, reported that its sales fell by 19 percent last year.

* Albertsons closed 26 stores in January and February according to Supermarket News. Analysts expect many more Albertsons could soon be shuttered because Albertsons owner hedge fund Cerberus Capital Management just bought Safeway Inc. Some Safeway stores could soon shut down as well.

* Abercrombie & Fitch, the clothing retailer, is planning to close 220 stores by the end of 2015. The company is also planning to shut down an entire chain it owns, Gilly Hicks, which has 20 stores, 24/7 Wall Street reported.

* Barnes & Nobles is planning to shut down one third of its stores in the next year: about 218 stores. The chain has already closed its iconic flagship store in New York City.

* J.C. Penney is closing about 33 stores and laying off about 2,000 employees.

* Toys R Us has plans to close 100 stores according to The Record newspaper in New Jersey.

* The Sweetbay Supermarket chain will close all 17 of the stores it operates in the Tampa Bay area, The Herald Tribune newspaper reported. Many of the stores might open as Winn-Dixie Stores. Sweetbay closed 33 stores in Florida last year.

* Loehmann’s chain of discount clothing stores in the New York City area has entirely shut down. Loehmann’s once operated 39 stores, The New York Times reported, and was considered an institution by generations of New Yorkers.

* Sears Holdings, which owns both Sears and Kmart, to close another 500 stores this year, according to industry analyst John Kernan to CNN. Sears has already shut down its flagship store in Chicago.

* Quiznos has filed for bankruptcy, USA Today reported, and could close many of its 2,100 stores.

* Sbarro which operates pizza and Italian restaurants in malls, is planning to close 155 locations in the United States and Canada. That means nearly 20 percent of Sbarro’s will close. The chain operates around 800 outlets.

* Ruby Tuesday announced plans to close 30 restaurants in January after its sales fell by 7.8 percent. The chain currently operates around 775 steakhouses across the US.

* Red Lobster will sell an unknown number of stores. The chain is in such bad shape that the parent company, Darden Restaurants Inc., had to issue a press release stating that the chain would not close. Instead Darden is planning to spin Red Lobster off into another company and sell some of its stores.

* Ralph’s, a subsidiary of Kroger, has announced plans to close 15 supermarkets in Southern California within 60 days.

* Safeway closed 72 Dominick’s grocery stores in the Chicago area last year.

The culprit? Among other factors, personal consumption growth YoY has declined from 9.04% in March 2000 to 3.45% in January 2014. And real median household income has plunged as well.

And if I want fresh half-and-half for my White Russians (aka, Caucasians), I go to my neighborhood Ralph’s like Jeffrey Lebowski (not Amazon.com). I hope they didn’t close Lebowski’s neighborhood Ralph’s!!

THE MATH DOESN’T WORK

Below are two charts that tell a story of an unsustainable trend. Here are the facts:

- There are 144 million Americans employed, with 115 million employed full-time and 29 million employed part-time.

- There are 246 million working age Americans, of which 91 million are supposedly not in the work force and 11 million are officially unemployed.

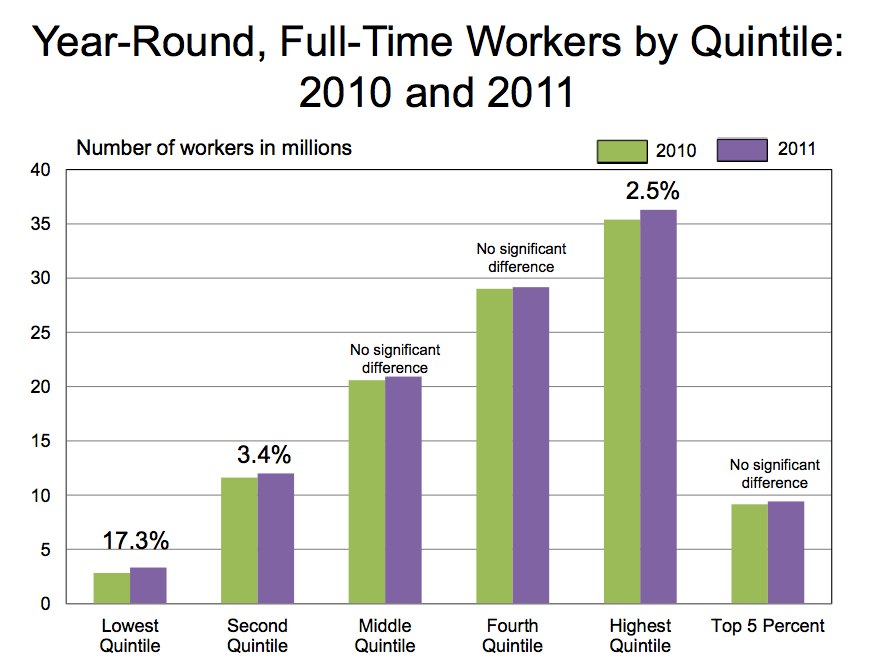

- Approximately 68 million of these workers are in the top two income quintiles.

- The bottom three quintiles receive more government entitlements than they pay in taxes. That means the top two quintiles pay 106% of all the taxes, while the bottom 60% of income producers get money back.

- There are 68 million workers paying taxes to support the 76 million lower income workers, the 11 million unemployed workers, the 91 million working age Americans who have supposedly “chosen” not to work, and the 70 million people either too young or too old to work.

- The workers in the top two quintiles represent 28% of the working age population and are paying 106% of the taxes to fund our welfare/warfare state.

What is shown on these charts is just the entitlement side of the equation. The taxes paid by 68 million people also have to fund our wars of choice in the Middle East, our ever growing surveillance state, prisons for the excess population, and the various other boondoggles that our beloved leaders pay for with our money. Do you understand why we are adding $1 trillion per year to the national debt? Today’s current scenario is a disaster.

We are only at the cusp of the Baby Boomers retiring and collecting what they are “owed”. Entitlement outlays are on automatic pilot and will soar, as 10,000 people per day turn 65 for the next 17 years. The math in this equation does not add up. It is simply unsustainable. The people in the 4th quintile making $88,000 per year can barely call themselves middle class in this hunger games society. Are the politicians in D.C. going to tax them more to cover the fiscal gap? Are the top .1% who write the tax laws going to allow themselves to be shaken down to pay for the bottom 72% who are net recipients of government goodies?

Can 68 million people pay the load for the other 248 million people, along with running a world empire? There is no solution to this dynamic. It’s a train wreck happening in slow motion. We are too far down the track and the bridge is out. Disaster beckons.

THE AGE OF MAMMON (Featured Article)

“Financiers – like bank robbers – do not create wealth. They merely distribute it. While the mob may idolize holdup men in good times, in the bad times it lynches them. What they will do to the new money men when their blood is up, we wait eagerly to find out.” – Mobs, Messiahs and Markets

As our economy hurtles towards its meeting with destiny, the political class seeks to assign blame on their enemies for this Greater Depression. The Republicans would like you to believe that Bill Clinton, Robert Rubin, Chris Dodd, and Barney Frank and their Community Reinvest Act caused the collapse of our financial system. Democrats want you to believe that George Bush and his band of unregulated free market capitalists created a financial disaster of epic proportions. The truth is that America has been captured by a financial class that makes no distinction between parties. These barbarians have sucked the life out of a once productive nation by raping and pillaging with impunity while enriching only them. They live in 20,000 square foot $10 million mansions in Greenwich, CT and in $3 million dollar penthouses on Central Park West.

These are the robber barons that represent the Age of Mammon. The greed, avarice, gluttony and acute materialism of these American traitors has not been seen in this country since the 1920’s. The hedge fund managers and Wall Street bank executives that occupy the mansions and penthouses evidently don’t find much time to read the bible in their downtime from raping and pillaging the wealth of the middle class. There are cocktail parties and $5,000 a plate political “fundraisers” to attend. You can’t be cheap when buying off your protection in Washington DC.

Lay not up for yourselves treasures upon earth, where moth and rust doth corrupt, and where thieves break through and steal: But lay up for yourselves treasures in heaven, where neither moth nor rust doth corrupt, and where thieves do not break through nor steal: For where your treasure is, there will your heart be also. No one can serve two masters, for either he will hate the one and love the other; or else he will be devoted to one and despise the other. You cannot serve both God and Mammon. – Matthew 6:19-21,24

It seems that Lloyd Blankfein, the CEO of Goldman Sachs, may have been overstating the case in saying his firm is doing God’s work. With his $67.9 million compensation in 2007 and payment of $20.2 billion to his co-conspirators, Blankfein appears to be a proverbial camel trying to pass through the eye of a needle. This compensation was paid in the year before the financial collapse brought on by the criminal actions of Lloyd and his fellow henchmen. After having his firm bailed out by the American middle class taxpayer at the behest of fellow Goldman alumni Hank Paulson, Lloyd practiced his version of austerity by cutting compensation for his flock to only $16.2 billion ($500,000 per employee) in 2009. I’m all for people making as much money as they can for doing a good job. But, I ask you – What benefits have Goldman Sachs, the other Wall Street banks, and hedge funds provided for America?

Never have so few, done so little, and made so much, while screwing so many.

In 2005, the top 25 hedge fund managers “earned” $9 billion, or an average of $360 million. One year after a financial collapse caused by the financial innovations peddled by Wall Street, the top 25 hedge fund managers paid themselves $25 billion, or an average of $1 billion a piece. For some perspective, there were 7 million unemployed Americans in 2006. Today there are 14.6 million unemployed Americans. While the country plunges deeper into Depression, the barbarians pick up the pace of their plundering and looting of the remaining wealth of the nation. Bill Bonner and Lila Rajiva pointed out a basic truth in 2007, before the financial collapse.

“On the Forbes list of rich people, you will find hedge fund managers in droves, but no one who made his money as a hedge fund client.” – Mobs, Messiahs and Markets

Ask the clients of Bernie Madoff how they are doing.

1920’s Redux

The parallels between the period leading up to the Great Depression and our current situation leading to a Greater Depression are revealing. When you examine the facts without looking through the prism of party politics it becomes clear that when the wealth and power of the country are overly concentrated in the clutches of the top 1% wealthiest Americans, financial collapse and depression follow. This concentration of income and wealth did not cause the Stock Market Crash of 1929 or the financial system implosion in 2008, but they were a symptom of a sick system of warped incentives. The top 1% of income earners were raking in 24% of all the income in America in 1928. After World War II until 1980, the top 1% of income earners consistently took home between 9% and 11% of all income in the country. During the 1950’s and 1960’s when average Americans made tremendous strides in their standard of living, the top 1% were earning 10% of all income. A hard working high school graduate could rise into the middle class, owning a home and a car.

From 1980 onward, the top 1% wealthiest Americans have progressively taken home a greater and greater percentage of all income. It peaked at 22% in 1999 at the height of the internet scam. Wall Street peddled IPOs of worthless companies to delusional investors and siphoned off billions in fees and profits. The rich cut back on their embezzling of our national wealth for a year and then resumed despoiling our economic system by taking advantage of the Federal Reserve created housing boom. By 2007, the top 1% again was taking home 24% of the national income, just as they did in 1928. When the wealth of the country is captured by a small group of ruling elite through fraudulent means, collapse and crisis becomes imminent. We have experienced the collapse, while the crisis deepens.