Tag: insider trading

Doug Casey on Insider Trading… Why Politicians Can Do it and You Can’t

International Man: What exactly is insider trading? Is it inherently unethical?

Doug Casey: The term insider trading is nebulous and as open to arbitrary interpretation as the Internal Revenue Code. A brief definition is to “to trade on material, non-public information.” That sounds simple enough, but in its broadest sense, it means you are a potential criminal for attempting to profit from researching a company beyond its public statements.

Is the use of insider information ethical? The government says, “No!” I say, “Absolutely, whenever the data is honestly gained, and no confidence is betrayed by disclosing or using it.” The whole concept of inside information is a floating abstraction, a witch hunter’s dream, and a bonanza for government lawyers looking to take scalps.

When the SEC prosecutes someone, it can cost millions of dollars in legal fees to defend against them. And as with most regulatory law, concepts of ethics, justice, and property rights never even enter the equation. Instead, it’s a question of arbitrary legalities.

Continue reading “Doug Casey on Insider Trading… Why Politicians Can Do it and You Can’t”

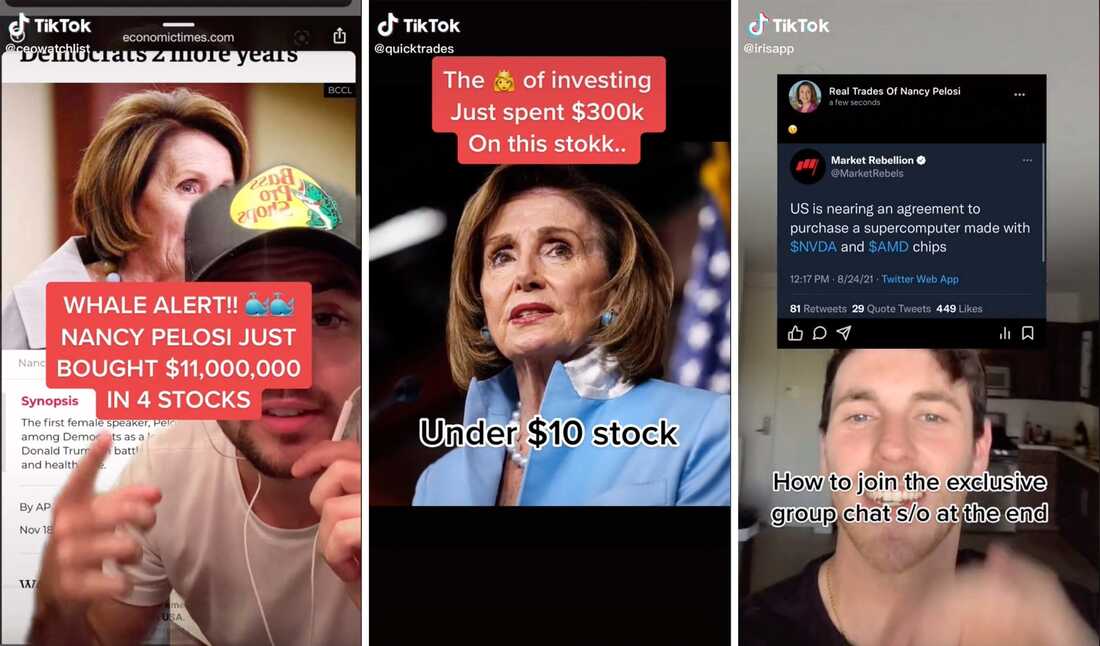

TikTokers Are Trading Stocks By Copying What Members Of Congress Do

Young investors have a new strategy: watching financial disclosures of sitting members of Congress for stock tips.

Among a certain community of individual investors on TikTok, House Speaker Nancy Pelosi’s stock trading disclosures are a treasure trove. “Shouts out to Nancy Pelosi, the stock market’s biggest whale,” said user ‘ceowatchlist.’ Another said, “I’ve come to the conclusion that Nancy Pelosi is a psychic,” while adding that she is the “queen of investing.”

“She knew,” declared Chris Josephs, analyzing a particular trade in Pelosi’s financial disclosures. “And you would have known if you had followed her portfolio.”

Last year, Josephs noticed that the trades, actually made by Pelosi’s investor husband and merely disclosed by the speaker, were performing well.

Continue reading “TikTokers Are Trading Stocks By Copying What Members Of Congress Do”

Corrupt Politicians: Is Nancy Pelosi guilty of insider trading?

Emails Expose Hillary & Insider Trading on Greek Bailouts?

Guest Post by Martin Armstrong

The Clinton Scandals will provide endless TV entertainment, which may be more like a reality TV show with the Kardashians. Most people think it will be Donald Trump. He may give us some frank insults that are badly needed now and then to keep people focused, but the Clintons will provide never ending intrigue and scandals. Now we have the new one involving Hillary’s hedge fund manager son-in-law who is the husband of Chelsea Clinton, who set up in 2012 a Greek bond fund with a special arrangement with none other than Goldman Sachs expecting a bailout to boost Greek debt values. Yep! Now hedge fund manager Marc Mezvinsky placed a huge bet big on a Greek economic recovery based upon political expectations of a bailout for Greece would go through. His Secretary of State mother-in-law seems to have been sharing classified information to help her son-in-law.

Continue reading “Emails Expose Hillary & Insider Trading on Greek Bailouts?”

The Sweet Google/Lenovo Deal

Check this out. I read an article last week, I think, that described a deal in the works with the Chinese Co. Lenovo and Google. The deal would have Google selling off its Motorola handset division for a cool $2.91 billion(here) only 2 years after Google purchased Motorola Mobility for $13 billion (here). Now, Reuters is reporting that Google purchased an almost 6% stake in Lenovo a month ago for $750 million (here). WTF is up with that? Some suggest insider trading? I say we ask Jim, since he is an accountant! This smells like some kind of gimmick like Enron might run! Picaboo Accounting tricks as Max Keiser calls it! Shell games! I call Bullshit!