Tag: Iowa

MEANWHILE….IN IOWA

Lucky? Hillary Clinton Wins All 6 Coin Tosses In Iowa, Taking Narrow Delegate Lead

She won all six of the coin tosses. The odds against winning six out of six coin flips are 64-to-1 against, or 1.56 percent.

The Des Moines Register explains that one of the coin tosses came from precinct 2-4 in Ames, where “60 caucus participants apparently disappeared from the proceedings.”

The Register quotes caucus participant and Iowa State University professor David Schewingruber, a Sanders supporter, on how it went down:

A total of 484 eligible caucus attendees were initially recorded at the site. But when each candidate’s preference group was counted, Clinton had 240 supporters, Sanders had 179 and Martin O’Malley had five (causing him to be declared non-viable).

Those figures add up to just 424 participants, leaving 60 apparently missing. When those numbers were plugged into the formula that determines delegate allocations, Clinton received four delegates and Sanders received three — leaving one delegate unassigned.

Unable to account for that numerical discrepancy and the orphan delegate it produced, the Sanders campaign challenged the results and precinct leaders called a Democratic Party hot line set up to advise on such situations.

Party officials recommended they settle the dispute with a coin toss.

A Clinton supporter correctly called “heads” on a quarter flipped in the air, and Clinton received a fifth delegate.

The same thing happened at precincts in Des Moines, Newton, West Branch, and Davenport.

The coin tosses gave Clinton a technical delegate victory in Iowa, although it’s hard to call it a win.

We’re Gonna Need a Bigger Vote

Guest Post by Stilton Jarlsberg

Tonight the various contenders wishing (or in many cases obsessing) to become President of the United States will get their first real test in the Iowa caucuses. The caucus (meaning “a gathering of Caucasians”) process involves Iowans grouping together to publicly debate which candidates have spent the most money in the state.

Following these impassioned discussions (frequently peppered with expletives like “gosh durn it!” and “hold on thar!”) the Republicans cast traditional secret ballots for their candidates, while the Democrats wave their hands in the air, shout, steal supporters from other groups, and eventually come to agreement via arm wrestling.

Still, the results in Iowa are very, very important because…uh…they’re first. Not because the state is a good predicter of national results (it isn’t), and not because the state has demographics which “look like America” (it doesn’t). But still, Iowa is first for a very good reason: because they called “dibs.”

According to the latest polls, things are wattled-neck and neck between Hillary Clinton and Bernie Sanders amongst the Democrats, while on the GOP side Donald Trump is predicted to edge out Ted Cruz. Which is why later this week we’ll get to see…

In order to attack the alleged Islamaphobia of the eventual GOP winners in Iowa, Barack Hussein Obama will be visiting an American mosque in Baltimore which is apparently in a part of town that mayor Stephanie Rawlings-Blake did not give to protesters to destroy.

This will be Mr. Obama’s first visit to an American mosque as president, a trip long-delayed because, according to White House spokesman Josh Earnest, “the president’s golf spikes really tear the hell out of prayer rugs.”

Obama is going to the mosque “to celebrate the contributions Muslim Americans make to our life,” and indeed there are many. Just off the top of our heads, for instance, we can thank them for greatly increased national security measures, a decrease in sun-related skin cancers amongst women wearing burqas, a more diverse view of what constitutes “a clock,” and heightened awareness that, despite the similarity in names, San Bernadino and San Bernardino are two different soft targets.

CLINTON CAUCUS

Rewriting The Rules – Trump’s Rise Is Unprecedented

Submitted by Tyler Durden on 08/31/2015 14:30 -0400

In May, when the Register last polled, 27 percent of likely Iowa GOP caucus-goers viewed Trump favorably while 63 percent regarded him unfavorably.

In the new poll, which was released Saturday night, Trump’s favorable number is at 61 percent and his unfavorable at 35 percent.

As The Washington Post’s Chris Cillizza exclaims,

Continue reading “Rewriting The Rules – Trump’s Rise Is Unprecedented”

“WE’RE BUILDING A DOMESTIC ARMY”

It’s free!!!!!

DHS is giving away military vehicles to copfuks across the land. I wonder why? But at least they’re FREE. Everyone loves free shit, especially from the government.

How many iGadget distracted brain dead zombies in this country wonder how a $500,000 armored military vehicle could be given to a local police force for FREE? The answer is ZERO. That is why we are doomed.

KNOW YOUR ENEMY BECAUSE THEY KNOW YOU.

An Iowa City With A Population Of 7,000 Will Receive Armored Military Vehicle

Submitted by Mike Krieger of Liberty Blitzkrieg blog,

I’ve covered the militarization of the domestic police force on several occasions on this website. For those of you who need a refresher, I suggest reading the following:

There are Over 50,000 SWAT Team Raids Annually in America

Retired Marine Colonel to New Hampshire City Council: “We’re Building a Domestic Army”

Video of the Day – Thuggish Militarized Police Terrorize and SWAT Team Iowa Family.

Moving along to the subject of today’s absurdity, the tiny city of Washington, Iowa with a population of 7,000 and 11 police officers, will be receiving a Mine Resistant Ambush Protected (MRAP) vehicle. Yes, they will be employing one of these in the field:

These things normally cost $500,000, but will be given to Washington, Iowa for free under a Defense Department program that gives surplus military equipment to domestic law enforcement.

Matthew Byrd writes in the Daily Iowan that:

Sometimes the news is just so drearily awful that you have to sit back and almost appreciate the pure comedy induced by it.

Take this item from Washington, Iowa, where the local police have recently acquired an MRAP vehicle (short for Mine Resistance Ambush Protected) through a Defense Department program that donates excess vehicles originally produced for the wars in Iraq and Afghanistan to local police departments across the United States, including other Iowa towns such as Mason City and Storm Lake.

The MRAP weighs an impressive 49,000 pounds, stands 10-feet tall, and possesses a whopping six-wheel drive. Originally designed to resist landmines and IEDs, it sure seems like the MRAP will come in handy for the notorious war zone otherwise known as Washington County, Iowa.

If you’re having a bad day, I highly recommend watching a video produced by the Des Moines Register in which Washington police officials try to justify the possession of a vehicle it clearly has no use for. The excuses range from school shootings (which are an actual concern but an MRAP seems like overkill) to a terrorist attack happening in central Iowa (because if there’s any place that seems ripe for a high-profile terrorist attack it’s Washington, Iowa, population 7,000).

As Radley Balko, the author of the book The Rise of the Warrior Cop, an expose of the police militarization of the last decade, found, in 2006 alone the Pentagon, “distributed vehicles worth $15.4 million, aircraft worth $8.9 million, boats worth $6.7 million, weapons worth $1 million and “other” items worth $110.6 million to local police agencies.”

The effects of cops moving from handguns to assault rifles and being equipped with tanks, bazookas, and Kevlar has been twofold. First, civil liberties have absolutely been eroded, with police-brutality rates skyrocketing in last decade according to the Justice Department. Not only that, but, with the influx of military gear into local police forces, cops begin to view themselves as soldiers whose main job is combat rather than keeping the peace. How else can you explain the rise in police shootings since 9/11?

USA! USA! USA!

Keep chanting like idiots until one of these rolls up to your doorstep.

Full article here.

FARMER FSA WADDLES UP TO THE TROUGH

Corporate Green Acres is the place to be. It seems the free shit army isn’t just occupying West Philly. They are crawling all over the Midwest farmbelt. It’s not your small family farm. It’s the giant corporate farms that have big time lobbyists and congressmen in their pockets. These bloated bills are nothing but handouts to corporations. Why should corporate farms be guaranteed a profit even if they don’t produce a crop? Why should I pay so that corporate fat cat farmers have no risk if their crops fail? Why should milk prices be controlled? Why should government be spending almost $100 billion per year of our tax dollars to promote and subsidize farmers in any way? Since the SNAP food stamp program falls under this bloated bill, maybe the West Philly FSA can join forces with the Iowa FSA to lobby for this bill.

Farm Bill Redux

Tuesday, June 12,2012

THE U.S. SENATE is poised this week to take up the crucial 2012 Farm Bill. This inordinately complex legislation is projected to cost $969 billion over the next 10 years, about $24 billion less than the cost of extending the soon-to-expire existing farm bill.

Big agriculture and its deep-pocketed lobbyists support the new bill, having accepted deep cuts in direct crop subsidies in exchange for legislators “protecting and strengthening” crop insurance programs. Industry considers the latter its safety net against adverse weather and unpredictable fluctuations of global commodities prices.

It’s less of a safety net than a security blanket that shifts risks to taxpayers and guarantees farmers substantial profits. That must change; otherwise, the cost of the new insurance programs could greatly exceed Congressional Budget Office estimates, leaving the federal government on the hook for billions of added dollars each year.

In a particularly cruel twist, the bill pays for these new programs in part by taking food out of the mouths of poor children.

Farm bills are the long-time home of the Supplemental Nutrition Assistance Program — food stamps. The proposal strips $4.5 billion from the SNAP program over 10 years, even as the struggling economy has record numbers of Americans seeking food stamps to help feed their families. The reductions would eliminate about $90 worth of groceries a month from the kitchens of low-income families. According to Sen. Kirsten Gillibrand, D-N.Y., who is introducing an amendment to restore the SNAP funds, half of those who benefit from the program are children.

The Obama White House is supporting the bill, S. 3240, sponsored by Sen. Debbie Stabenow, D-Mich., who chairs the Senate Agriculture Committee. The administration opposes the SNAP reductions, however, and wants the cost of crop insurance reduced.

MEANWHILE, AN odd amalgamation has emerged to oppose the bill. The liberal Environmental Working Group used U.S. Department of Agriculture data to reaffirm that corporate and very large individual agriculture operations — not small and mid-sized family farms — enjoy the vast majority of the insurance benefits. Last year in Missouri, for example, 74 percent of the $267 million in benefits went to 20 percent of recipients. In Illinois, the top 20 percent received 72 percent of $518.5 million.

From the right comes the American Enterprise Institute with its “Field of Schemes” report. It’s part of a broader AEI project called “American Boondoggle: Fixing the 2012 Farm Bill.” In “Schemes,” AEI experts focused on the bill’s proposed ‘shallow losses” insurance. Such insurance would cost far more than the direct crop subsidy programs being dropped and “create incentives for the wasteful use of economic resources,” the report says.

EXISTING CROP insurance programs already are out of whack. If crop yields fall short of projections, farmers collect from the government. If harvest prices fall short of projections, farmers collect. To make sure that farmers can afford the insurance premiums, the government pays an average of 60 percent of the cost. To make sure private companies offer the insurance, the government pays their commissions and administrative costs.

Expanded shallow-loss coverage would distort the system even further. As one Minnesota farmer told “The New York Times” last week, “I can farm on low-quality land that I know is not going to produce and still turn a profit.”

The farm bill needs a lot of work before it merits the support of the American people.

— The St. Louis Post-Dispatch

HOW MANY SENATORS DOES IT TAKE TO SCREW A TAXPAYER? (Featured Article)

“Today, the government decides and they misdirect the investment to their friends in the corn industry or the food industry. Think how many taxpayer dollars have been spent on corn [for ethanol], and there’s nobody now really defending that as an efficient way to create diesel fuel or ethanol. The money is spent for political reasons and not for economic reasons. It’s the worst way in the world to try to develop an alternative fuel.” – Ron Paul

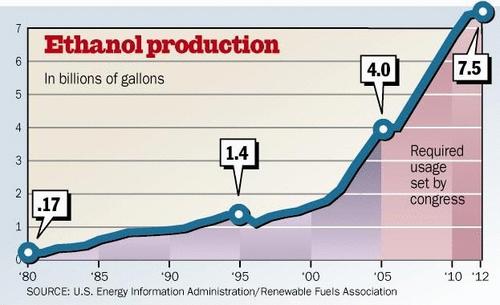

When bipartisanship breaks out in Washington DC, check to make sure your wallet is still in your pocket. Every time you fill up your car this winter you are participating in the biggest taxpayer swindle in history. Forcing consumers to use domestically produced ethanol is one of the single biggest boondoggles ever committed by the corrupt brainless twits in Washington DC. Ethanol prices have soared 30% in the last year as the supplies of corn have plunged. Only a policy created in Washington DC could drive up the prices of gasoline and food, with the added benefits of costing the American taxpayer billions in tax subsidies and killing people in 3rd world countries.

The grand lame duck Congress tax compromise extended a 45-cent incentive to ethanol refiners for each gallon of the fuel blended with gasoline and renewed a 54-cent tariff on Brazilian imports. The extension of these subsidies, besides costing American taxpayers $6 billion per year, has the added benefit of driving up food costs across the globe, causing food riots in Tunisia, and resulting in the starving of poor peasants throughout the world. This taxpayer boondoggle is a real feather in the cap of that fiscally conservative curmudgeon Senator Charley Grassley. He was joined in this noble effort by another fiscal conservative, presidential hopeful John Thune. It seems these guys hate wasteful spending, except when it benefits their states. The bipartisanship in this effort was truly touching, as Democrats Kent Conrad and Tom Harkin also brought home the pork for their states.

- Promoting ethanol reduces our dependence on foreign oil

- Ethanol is green renewable energy

- Ethanol is cheaper than gasoline

As we all know when dealing with a politician, “half the truth, is often a great lie.”

Amaizing

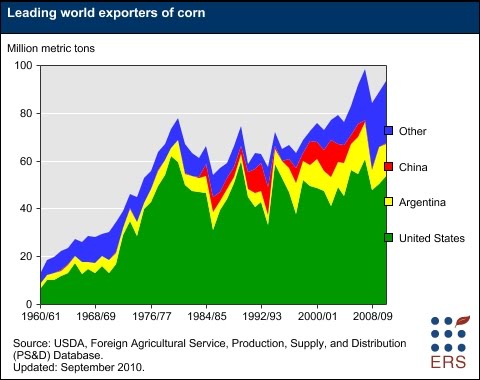

Corn is the most widely produced feed grain in the United States, accounting for more than 90% of total U.S. feed grain production. 81.4 million acres of land are utilized to grow corn, with the majority of the crop grown in the Midwest. Although most of the crop is used to feed livestock, corn is also processed into food and industrial products including starch, sweeteners, corn oil, beverage and industrial alcohol, yogurt, latex paint, cosmetics, and last but not least, fuel Ethanol. Of the 10,000 items in your average grocery store, at least 2,500 items use corn in some form during the production or processing. The United States is the major player in the world corn market providing more than 50% of the world’s corn supply. In excess of 20% of our corn crop had been exported to other countries, but the government ethanol mandates have reduced the amount that is available to export.

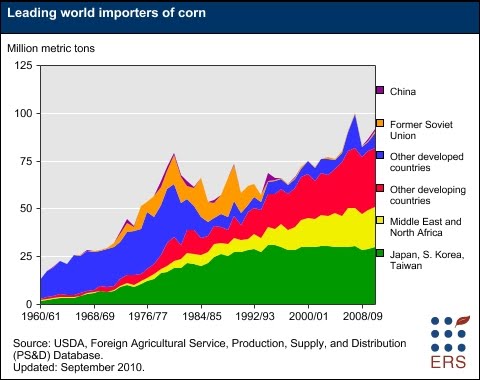

This year, the US will harvest approximately 12.5 billion bushels of corn. More than 42% will be used to feed livestock in the US, another 40% will be used to produce government mandated ethanol fuel, 2% will be used for food products, and 16% is exported to other countries. Ending stocks are down 963 million bushels from last year. The stocks-to-use ratio is projected at 5.5%, the lowest since 1995/96 when it dropped to 5.0%. As you can see in the chart below, poor developing countries are most dependent on imports of corn from the US. Food as a percentage of income for peasants in developing countries in Africa and Southeast Asia exceeds 50%. When the price of corn rises 75% in one year, poor people starve.

The combination of an asinine ethanol policy and the loosest monetary policy in the history of mankind are combining to kill poor people across the globe. I wonder if Blankfein, Bernanke, and Grassley chuckle about this at their weekly cocktail parties while drinking Macallan scotch whiskey and snacking on mini beef wellington hors d’oeuvres. The Tunisians aren’t chuckling as food riots have brought down the government. This month, the U.N. Food and Agricultural Organization (FAO) reported that its food price index jumped 32% in the second half of 2010 — surpassing the previous record, set in the early summer of 2008, when deadly clashes over food broke out around the world, from Haiti to Somalia.

Let’s Starve a Tunisian

“What is my view on subsidizing ethanol and farmers? Under the constitution, there is no authority to take money from one group of people and give it to another group of people for so called economic benefits. So, no, I don’t think we should do that. Besides, bureaucrats and the politicians don’t know how to invest money.” – Ron Paul

The United States is the big daddy of the world food economy. It is far and away the world’s leading grain exporter, exporting more than Argentina, Australia, Canada, and Russia combined. In a globalized food economy, increased demand for corn, to fuel American vehicles, puts tremendous pressure on world food supplies. Continuing to divert more food to fuel, as is now mandated by the U.S. federal government in its Renewable Fuel Standard, will lead to higher food prices, rising hunger among the world’s poor and to social chaos across the globe. By subsidizing the production of ethanol, now to the tune of $6 billion each year, U.S. taxpayers are subsidizing skyrocketing food bills at home and around the world.

The energy bill signed by that free market capitalist George Bush in 2008 mandates that increasing amounts of corn based ethanol must be used in gasoline sold in the U.S. This energy legislation requires a five-fold increase in ethanol use by 2022. Some 15 billion gallons must come from traditional corn-blended ethanol. Nothing like combining PhD models and political corruption to cause worldwide chaos. Ben Bernanke and Charley Grassley have joined forces to bring down the President of 23 years in Tunisia. People tend to get angry when they are starving. Bringing home the bacon for your constituents has consequences. In the U.S. only about 10% of disposable income is spent on food. By contrast, in India, about 40% of personal disposable income is spent on food. In the Philippines, it’s about 47.5%. In some sub-Saharan Africa, consumers spend about 50% of the household budget on food. And according to the U.S.D.A., “In some of the poorest countries in the region such as Madagascar, Tanzania, Sierra Leone, and Zambia, this ratio is more than 60%.”

The 107 million tons of grain that went to U.S. ethanol distilleries in 2009 was enough to feed 330 million people for one year at average world consumption levels. More than a quarter of the total U.S. grain crop was turned into ethanol to fuel cars last year. With 200 ethanol distilleries in the country set up to transform food into fuel, the amount of grain processed has tripled since 2004. The government subsidies led to a boom in the building of ethanol plants across the heartland. As usual, when government interferes in the free market, the bust in 2009, when fuel prices collapsed, led to the bankruptcy of almost 20% of the ethanol plants in the U.S.

The amount of grain needed to fill the tank of an SUV with ethanol just once can feed one person for an entire year. The average income of the owners of the world’s 940 million automobiles is at least ten times larger than that of the world’s 2 billion hungriest people. In the competition between cars and hungry people for the world’s harvest, the car is destined to win. In March 2008, a report commissioned by the Coalition for Balanced Food and Fuel Policy estimated that the bio-fuels mandates passed by Congress cost the U.S. economy more than $100 billion from 2006 to 2009. The report declared that “The policy favoring ethanol and other bio-fuels over food uses of grains and other crops acts as a regressive tax on the poor.” A 2008 Organization for Economic Cooperation and Development (O.E.C.D.) issued its report on bio-fuels that concluded: “Further development and expansion of the bio-fuels sector will contribute to higher food prices over the medium term and to food insecurity for the most vulnerable population groups in developing countries.” These forecasts are coming to fruition today.

It Costs What?

The average American has no clue about the true cost of ethanol. They probably don’t even know there is ethanol mixed in their gasoline. The propaganda spread by the ethanol industry and their mouthpieces in Congress obscures the truth and proclaims the clean energy mistruths and the thousands of jobs created in America. The truth is that producing ethanol uses more energy than is created while driving costs higher. The jobs created in Iowa are offset by the jobs lost because users of energy incur higher costs and hire fewer workers as a result. It takes a lot of Saudi oil to make the fertilizers to grow the corn, to run the tractors, to build the silos, to get the corn to a processing plant, and to run the processing plant. Also, ethanol cannot be moved in pipelines, because it degrades. This means using thousands of big diesel sucking polluting trucks to move the ethanol – first as corn from the fields to the processing plants, and then from the processing plants to the coasts.

The current ethanol subsidy is a flat 45 cents per gallon of ethanol usually paid to the an oil company, that blends ethanol with gasoline. Some States add other incentives, all paid by the taxpayer. On top of this waste of taxpayer funds, the free trade capitalists in Congress slap a 54 cent tariff on all imported ethanol. Ronald R. Cooke, author of Oil, Jihad & Destiny, created the chart below to estimate the true cost for a gallon of corn ethanol. Cooke describes a true taxpayer boondoggle:

It costs money to store, transport and blend ethanol with gasoline. Since ethanol absorbs water, and water is corrosive to pipeline components, it must be transported by tanker to the distribution point where it is blended with gasoline for delivery to your gas station. That’s expensive transportation. It costs more to make a gasoline that can be blended with ethanol. Ethanol is lost through vaporization and contamination during this process. Gasoline/ethanol fuel blends that have been contaminated with water degrade the efficiency of combustion. E-85 ethanol is corrosive to the seals and fuel systems of most of our existing engines (including boats, generators, lawn mowers, hand power tools, etc.), and can not be dispensed through existing gas station pumps. And finally, ethanol has about 30 percent less energy per gallon than gasoline. That means the fuel economy of a vehicle running on E-85 will be about 25% less than a comparable vehicle running on gasoline.

Real Cost For A Gallon Of Corn Ethanol |

|

| Corn Ethanol Futures Market quote for January 2011 Delivery | $2.46 |

| Add cost of transporting, storing and blending corn ethanol | $0.28 |

| Added cost of making gasoline that can be blended with corn ethanol | $0.09 |

| Add cost of subsidies paid to blender | $0.45 |

| Total Direct Costs per Gallon | $3.28 |

| Added cost from waste | $0.40 |

| Added cost from damage to infrastructure and user’s engine | $0.06 |

| Total Indirect Costs per Gallon | $0.46 |

| Added cost of lost energy | $1.27 |

| Added cost of food (American family of four) | $1.79 |

| Total Social Costs | $3.06 |

| Total Cost of Corn Ethanol @ 85% Blend | $6.80 |

Multiple studies by independent non-partisan organizations have concluded that mandating and subsidizing ethanol fuel production is a terrible policy for Americans:

- In May 2007, the Center for Agricultural and Rural Development at Iowa State University released a report saying the ethanol mandates have increased the food bill for every American by about $47 per year due to grain price increases for corn, soybeans, wheat, and others. The Iowa State researchers concluded that American consumers face a “total cost of ethanol of about $14 billion.” And that figure does not include the cost of federal subsidies to corn growers or the $0.51 per gallon tax credit to ethanol producers.

- In May 2008, the Congressional Research Service blamed recent increases in global food prices on two factors: increased grain demand for meat production, and the bio-fuels mandates. The agency said that the recent “rapid, ‘permanent’ increase in corn demand has directly sparked substantially higher corn prices to bid available supplies away from other uses – primarily livestock feed. Higher corn prices, in turn, have forced soybean, wheat, and other grain prices higher in a bidding war for available crop land.”

- Mark W. Rosegrant of the International Food Policy Research Institute, testified before the U.S. Senate on bio-fuels and grain prices. Rosegrant said that the ethanol scam has caused the price of corn to increase by 29 percent, rice to increase by 21 percent and wheat by 22 percent. Rosegrant estimated that if the global bio-fuels mandates were eliminated altogether, corn prices would drop by 20 percent, while sugar and wheat prices would drop by 11 percent and 8 percent, respectively, by 2010. Rosegrant said that “If the current bio-fuel expansion continues, calorie availability in developing countries is expected to grow more slowly; and the number of malnourished children is projected to increase.” He continued, saying “It is therefore important to find ways to keep bio-fuels from worsening the food-price crisis. In the short run, removal of ethanol blending mandates and subsidies and ethanol import tariffs, in the United States—together with removal of policies in Europe promoting bio-fuels—would contribute to lower food prices.”

The true cost of the ethanol boondoggle is hidden from the public. The mandates, subsidies and tariffs take place out of plain view. The reason blenders (and gas stations) will pay the same for ethanol is because they can sell it at the same price as gasoline to consumers. A consumer will pay the same for ten gallons of E10 as for ten gallons of gasoline even though the E10 contains a gallon of ethanol. Consumers pay the same for the gallon of ethanol for three reasons. (1) They don’t know there’s ethanol in their gasoline. (2) There is often ethanol in all the gasoline because of state requirements, so they have no choice. (3) They never know the ethanol has only 67% the energy of gasoline and gets them only 67% as far. The result is that drivers always pay much more for ethanol energy than for gasoline energy, simply because they pay the same amount per gallon. When gasoline prices are $3.00 per gallon, Joe Six-pack pays $4.50 for the same amount of ethanol energy.

You know a politician, government bureaucrat or central banker is lying when they open their mouths. Whenever evaluating a policy or plan put forth by those in control, always seek out who will benefit and who will suffer. Who benefits from corn based ethanol mandates and subsidies? The beneficiaries are huge corporations like Archer Daniels Midland and Monsanto, along with corporate farming operations (80% of all US farm production), and Big Oil. The mandated ethanol levels are set in law. By providing tax subsidies we are bribing oil companies with taxpayer dollars to do something they are legally required to do, resulting in a $6 billion windfall profit to oil companies. The other beneficiaries are the Senators and Representatives from the farming states who are bankrolled by the corporate ethanol beneficiaries and their constituents who will re-elect them. The environment does not benefit, as many studies have concluded that it requires more fossil fuel energy (oil & coal) to produce a gallon of ethanol than the energy created. The jobs created in the farm belt at artificially profitable ethanol plants are more than offset by job losses due to the added costs in the rest of the economy. When subsidies are removed or oil prices drop, the ethanol plant jobs disappear, resulting in a massive capital mal-investment.

Our supposedly wise PhD and MBA leaders have created a perfect storm. The unintended consequences of government intervention in the markets are causing havoc, food riots, starvation and intense suffering for the poor and middle class. Brazil produces sugar cane ethanol in vast quantities and can export it to the U.S. much cheaper than we can produce corn ethanol. Fuel prices would be lower without tariffs on Brazilian ethanol imports. The average cost of food as a percentage of disposable income for an American is 10%. Averages obscure the truth that the cost is probably .0001% for Lloyd Blankfein, Ben Bernanke and Chuck Grassley, while it is 30% for a poor family in Harlem. America’s horribly misguided ethanol policy combined with Ben Bernanke’s Wall Street banker subsidy program are resulting in soaring fuel and food prices across the globe. Poor people around the world suffer greatly from these policies. Below are two assessments of ethanol.

“Everything about ethanol is good, good, good.” – Senator Chuck Grassley, Iowa

“This is not just hype — it’s dangerous, delusional bullshit. Ethanol doesn’t burn cleaner than gasoline, nor is it cheaper. Our current ethanol production represents only 3.5 percent of our gasoline consumption — yet it consumes twenty percent of the entire U.S. corn crop, causing the price of corn to double in the last two years and raising the threat of hunger in the Third World.” – Jeff Goodell

Who do you believe?