I’m sure absolutely nothing terrible is going to happen when inflation for September was 8.2% but the 10-YR Treasury is 4.13% currently. Nothing to worry about at all. I’m sure everybody will be lining up around the block to buy treasuries that’ll pay out half the current inflation rate 10 years from now. Sounds totally logical.

Tag: Janet Yellen

U.S. Officials Have a Bizarre, Confusing Strategy to Fight Inflation

Like the flaming oil wells during the first Iraq War, Biden’s inflation fires blaze on. As of March 2022, inflation had risen by 8.5% compared to the same time last year.

Making matters worse, U.S. economic growth slowed 1.4% according to the most recent official report. Even the bulliest-of-bulls in the mainstream media, CNBC, couldn’t put a positive spin on this…

U.S. GDP fell at a 1.4% pace to start the year as pandemic recovery takes a hit

Continue reading “U.S. Officials Have a Bizarre, Confusing Strategy to Fight Inflation”

David Stockman on Janet Yellen’s Return and the Financial Storm Ahead…

Guest Post by David Stockman via International Man

Janet Yellen is back.

Naturally, the follies of Keynesian central banking come to mind.

In many ways, Yellen’s tenure as Fed chairman was far worse than Ben Bernanke’s. At least Bernanke’s money-printing madness was undergirded by his credentials as a misguided scholar of the Great Depression and the mistaken conclusion that the Wall Street meltdown of September 2008 was the prelude to another such occurrence.

The Great Depression of the 1930s was caused by way too much Fed-fostered foreign borrowing on Wall Street during the roaring twenties. It stimulated an unsustainable boom in US exports—soaring domestic CapEx in order to expand production capacity and a stock bubble–fueled consumer-spending boom in cars, radios and appliances. Therefore, when the Wall Street bubble burst in October 1929, foreign borrowing dried up, US exports and CapEx crashed and spending on consumer durables plummeted.

Continue reading “David Stockman on Janet Yellen’s Return and the Financial Storm Ahead…”

A MAN’S GOTTA KNOW HIS LIMITATIONS

As I’ve been observing the actions and justifications of men like Jerome Powell, Anthony Fauci, Andrew Cuomo, Joe Biden and Donald Trump during this self-inflicted global depression, I can’t help but channel the iconic American actor Clint Eastwood and his most famous role – Dirty Harry, when assessing whether they have an understanding of their limitations. If a man doesn’t know his limitations, he can ruin his own life.

When men in positions of immense power don’t know their limitations, they can ruin the world, destroying the lives of millions and propelling the world towards a catastrophic financial collapse and likely global conflict. Our benevolent leaders act as if they know what is best for mankind, when they are actually flailing about blindly, corrupted by their own power and wealth, leading us on a path to destruction, because their immense egos won’t allow them to humbly admit their dreadful mistakes and take corrective actions.

UNDERESTIMATING THEM & OVERESTIMATING US

“Do not underestimate the ‘power of underestimation’. They can’t stop you, if they don’t see you coming.” ― Izey Victoria Odiase

During the summer of 2008 I was writing articles a few times per week predicting an economic catastrophe and a banking crisis. When the biggest financial crisis since the Great Depression swept across the world, resulting in double digit unemployment, a 50% stock market crash in a matter of months, millions of home foreclosures, and the virtual insolvency of the criminal Wall Street banks, my predictions were vindicated. I was pretty smug and sure the start of this Fourth Turning would follow the path of the last Crisis, with a Greater Depression, economic disaster and war.

In the summer of 2008, the national debt stood at $9.4 trillion, which amounted to 65% of GDP. Total credit market debt peaked at $54 trillion. Consumer debt peaked at $2.7 trillion. Mortgage debt crested at $14.8 trillion. The Federal Reserve balance sheet had been static at or below $900 billion for years.

FOURTH TURNING ECONOMICS

“In retrospect, the spark might seem as ominous as a financial crash, as ordinary as a national election, or as trivial as a Tea Party. The catalyst will unfold according to a basic Crisis dynamic that underlies all of these scenarios: An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction. At home and abroad, these events will reflect the tearing of the civic fabric at points of extreme vulnerability – problem areas where America will have neglected, denied, or delayed needed action.” – The Fourth Turning – Strauss & Howe

The quote above captures the current Fourth Turning perfectly, even though it was written more than a decade before the 2008 financial tsunami struck. With global debt now exceeding $250 trillion, up 60% since the Crisis began, and $13 trillion of sovereign debt with negative yields, it is clear to all rational thinking individuals the next financial crisis will make 2008 look like a walk in the park. We are approaching the eleventh anniversary of this crisis period, with possibly a decade to go before a resolution.

10 YEARS LATER – NO LESSONS LEARNED

“A variety of investors provided capital to financial companies, with which they made irresponsible loans and took excessive risks. These activities resulted in real losses, which have largely wiped out the shareholder equity of the companies. But behind that shareholder equity is bondholder money, and so much of it that neither depositors of the institution nor the public ever need to take a penny of losses. Citigroup, for example, has $2 trillion in assets, but also has $600 billion owed to its own bondholders. From an ethical perspective, the lenders who took the risk to finance the activities of these companies are the ones that should directly bear the cost of the losses.” – John Hussman – May 2009

This month marks the 10th anniversary of the Wall Street/Fed/Treasury created financial disaster of 2008/2009. What should have happened was an orderly liquidation of the criminal Wall Street banks who committed the greatest control fraud in world history and the disposition of their good assets to non-criminal banks who did not recklessly leverage their assets by 30 to 1, while fraudulently issuing worthless loans to deadbeats and criminals. But we know that did not happen.

You, the taxpayer, bailed the criminal bankers out and have been screwed for the last decade with negative real interest rates and stagnant real wages, while the Wall Street scum have raked in risk free billions in profits provided by their captured puppets at the Federal Reserve. The criminal CEOs and their executive teams of henchmen have rewarded themselves with billions in bonuses while risk averse grandmas “earn” .10% on their money market accounts while acquiring a taste for Fancy Feast savory salmon cat food.

GOLDILOCKS IS DEAD

“Once you strip out the effects of the debt binge, the artificial stimulus via currency depreciation, and the fabled ‘wealth effect’ from the equity market runup, real GDP growth stripped-down to its core was the grand total of 0.7% last year. Potemkin would be proud.” – David Rosenberg

It appears every president finds the religion of false economic narrative once they ascend to power. Trump never stops babbling and tweeting about the fantastic economy and raging jobs market since his election. He has embraced the stock market bubble as proof of his brilliant leadership, rather than the tens of trillions in debt propping up the most overvalued market in world history. Every president takes credit for any good news, spins bad news as good news, or blames the previous president for bad news that can’t be denied. The president has absolutely zero impact on the economy or stock market over the short term. It’s like taking credit for the sun rising in the east each morning.

The Big Lie method works wonders when you have a willfully ignorant, mathematically challenged, easily manipulated populace. I spent the entire Obama presidency obliterating the fake economic data perpetuated by his BLS, BEA and every other government agency trying to paint a rosy economic picture. I voted for Trump because the thought of Crooked Hillary as the president made me ill. Despite disagreeing with many of his economic, budgetary, and military policies during his first year in office, I’d vote for him again over Hillary in an instant. The thought of having that evil shrew running the country gives me chills.

Powell ain’t Yellen

When police try to solve a crime one of the key tasks is to determine who benefits from the crime. The beneficiary of a crime is not necessarily the perpetrator, but motive goes a long way to narrow the circle of potential suspects.

When police try to solve a crime one of the key tasks is to determine who benefits from the crime. The beneficiary of a crime is not necessarily the perpetrator, but motive goes a long way to narrow the circle of potential suspects.

Who benefitted from this sudden aggressive sell-off aside from anyone who was positioned short?

Certainly not hedge funds that capitulated long in January with their highest long exposure in 3 years literally right before the sell-off.

And certainly not retail that went full balls long on the aura of optimism:

This trend continued right into February 1 following the FOMO train. Remember Ray Dalio?

QUOTES OF THE DAY

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency.” – Ben Bernanke – March 2007

“The fact that those valuations are high doesn’t mean that they are necessarily overvalued. We are enjoying solid economic growth with low inflation. And the risks to the global economy look more balanced than they have in many years. I think when we look at other indicators of financial stability risks, there is nothing flashing red there or possibly even orange. The banking system is more resilient than in the past, and there is not a worrisome buildup in leverage or credit growth at excessive levels.” – Janet Yellen – December 2017

Good Riddance, Janet, You Were A Colossal Failure, Part 1

This is one for the record books. During Janet Yellen’s last week in office, the Dow dropped by 1,095 points or 4.1%. But by her lights, apparently, that wasn’t even a warning bell— just the market clearing its collective throat.

So on the way out the door our Keynesian school marm could not resist delivering what will soon be seen as a grand self-indictment. There’s nothing to worry about, she averred, because Wall Street’s OK and main street is positively awesome:

I don’t want to label what we’re seeing as a bubble….(even if) asset valuations are generally elevated….(but) when I see the unemployment rate fall to 4.1%…I feel very good about the progress we’ve seen there.

No, there is a monumental bubble out there that was born, bred and nurtured at the hands of the Fed. At the same time, Yellen and her merry band of money printers had virtually nothing to do with the 4.1% unemployment rate—even if that were a valid measure of return to full employment prosperity, which it is not.

Continue reading “Good Riddance, Janet, You Were A Colossal Failure, Part 1”

Liesman Asks Yellen: “Is The Fed Worried By The Market Going Up Triple Digits Every Day?”

CNBC’s Steve Liesman: “Every day it seems the stock market goes up triple digits… is it now, or will it soon become a worry for the central bank that valuations are this high?”

Yellen’s response appeared very similar to Bernanke’s “contained” moment:

‘”The stock market has gone up a great deal this year,” and asset valuations are “elevated.”

“We see ratios in the high end of historical ranges,” but “Economists are not great at knowing what the right valuations are…we don’t have a terrific track record.”

“Low interest rates support higher valuations.”

”The risks in the global economy look more balanced than they have in recent years.”

”There is nothing flashing red there or possibly even orange,” on asset valuations…

So this is not even flashing orange?

An Angry Rudy Havenstein Lashes Out: “No, The Fed Is Not Populist”

Submitted by Rudy Havenstein

After years of seeing terrible market news and commentary, I’m pretty jaded, but when I saw the recent Marketwatch op-ed, “Janet Yellen’s true legacy is her focus on middle-class wages” (by Tim Mullaney), I thought such nonsense needed a reponse that went beyond 280 characters. (Half of Mullaney’s article is an anti-Trump rant, which is fine, and which I will ignore).

“If something is nonsense, you say it and say it loud.”

– Nassim Taleb

The article’s tagline, “Outgoing Federal Reserve chairwoman is a true populist, representing the interests of ordinary people”, reflects an Orwellian perversion of language that is so common today, a bizarro land where “inflation” is “growth”, “debt” is “wealth,” “QE” is “economic stimulus,” and “plutocracy” is “populism”.

Continue reading “An Angry Rudy Havenstein Lashes Out: “No, The Fed Is Not Populist””

QUOTES OF THE DAY

“Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will.”

Janet Yellen – 6/27/17

“The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.”

Ben Bernanke – 6/10/08

David Stockman Offers “More Proof Of Janet Yellen’s Idiocy”

Authored by David Stockman via The Daily Reckoning,

During the last 129 months, the Fed has held 86 meetings. On 83 of those occasions it either cut rates or left them unchanged.

So you can perhaps understand why Wednesday’s completely expected (for the last three weeks!) 25 bips left the day traders nonplussed. The Dow rallied over 100 points that day.

Traders understandably believe that this monetary farce can continue indefinitely, and that our Keynesian school marm’s post-meeting presser was evidence that the Fed is still their friend.

No it isn’t!

Continue reading “David Stockman Offers “More Proof Of Janet Yellen’s Idiocy””

A NEW JACKSONIAN ERA? (PART TWO)

In Part One of this article I documented the populist administration of Andrew Jackson and similarities to Donald Trump’s populist victory in the recent election. I’ll now try to assess the chances of a Trump presidency accomplishing its populist agenda.

The Trumpian Era

“But you must remember, my fellow-citizens, that eternal vigilance by the people is the price of liberty, and that you must pay the price if you wish to secure the blessing. It is to be regretted that the rich and powerful too often bend the acts of government to their own selfish purposes.” – Andrew Jackson

“For too long, a small group in our nation’s capital has reaped the rewards of government while the people have borne the cost. Washington flourished, but the people did not share in its wealth. Politicians prospered, but the jobs left and the factories closed. The establishment protected itself, but not the citizens of our country. Their victories have not been your victories. Their triumphs have not been your triumphs. And while they celebrated in our nation’s capital, there was little to celebrate for struggling families all across our land. What truly matters is not which party controls our government, but whether our government is controlled by the people. January 20th, 2017 will be remembered as the day the people became the rulers of this nation again. The forgotten men and women of our country will be forgotten no longer.” – Donald J. Trump – Inaugural Speech

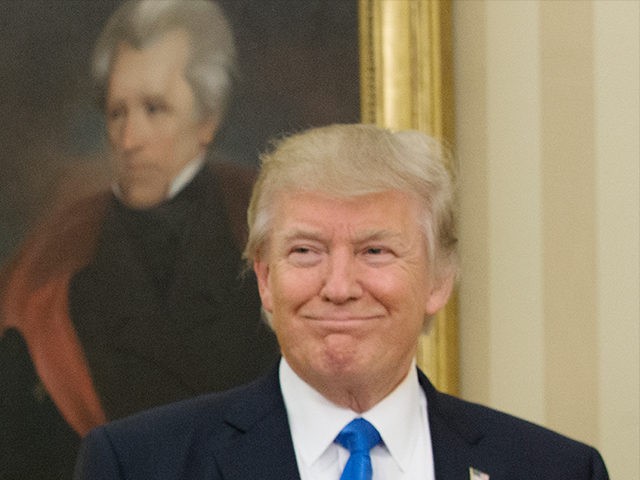

It is not a coincidence the painting in the oval office behind President Trump’s desk is of Andrew Jackson. He has promoted his presidency as a Jacksonian quest to return government to the people. His chief strategist Steve Bannon, a student of history, helped mold Trump’s speech with echoes of Jacksonian populism:

“It was an unvarnished declaration of the basic principles of his populist and kind of nationalist movement. It was given, I think, in a very powerful way. I don’t think we’ve had a speech like that since Andrew Jackson came to the White House. But you could see it was very Jacksonian. It’s got a deep, deep root of patriotism there.”