Guest post by David Stockman from his great new website.

Flask in hand, Boris Yelstin famously mounted a tank outside the Soviet Parliament in August 1991. Presently, the fearsome Red Army stood down—an outcome which 45 years of Cold War military mobilization by the West had failed to accomplish.

At the time, the U.S. Warfare State’s budget— counting the pentagon, spy agencies, DOE weapons, foreign aid, homeland security and veterans—-was about $500 billion in today’s dollars. Now, a quarter century on from the Cold War’s end, that same metric stands at $900 billion.

This near doubling of the Warfare State’s fiscal girth is a tad incongruous. After all, America’s war machine was designed to thwart a giant, nuclear-armed industrial state, but, alas, we now have no industrial state enemies left on the planet.

The much-shrunken Russian successor to the Soviet Union, for example, has become a kleptocracy run by a clever thief who prefers stealing from his own citizens rather than his neighbors.

Likewise, the Red Chinese threat consists of a re-conditioned aircraft carrier bought second-hand from a former naval power—-otherwise known as the former Ukraine. China’s bubble-ridden domestic economy would collapse within six weeks were it to actually bomb the 4,000 Wal-Mart outlets in America on which its mercantilist export machine utterly depends.

On top of that, we’ve been fired as the world’s policeman, al Qaeda has essentially vanished and during last September’s Syria war scare the American people even took away the President’s keys to the Tomahawk missile batteries. In short, the persistence of America’s trillion dollar Warfare State budget needs some serious “splainin”.

The Great War and Its Aftermath

My purpose tonight is to sketch the long story of how it all happened, starting precisely 100 years ago in 1914.

In that year the Fed opened-up for business just as the carnage in northern France closed-down the prior magnificent half-century era of liberal internationalism and honest gold-backed money.

The Great War was self-evidently an epochal calamity, especially for the 20 million combatants and civilians who perished for no reason that is discernible in any fair reading of history, or even unfair one.

Yet the far greater calamity is that Europe’s senseless fratricide of 1914-1918 gave birth to all the great evils of the 20th century— the Great Depression, totalitarian genocides, Keynesian economics, permanent warfare states, rampaging central banks and the exceptionalist-rooted follies of America’s global imperialism.

Indeed, in Old Testament fashion, one begat the next and the next and still the next.

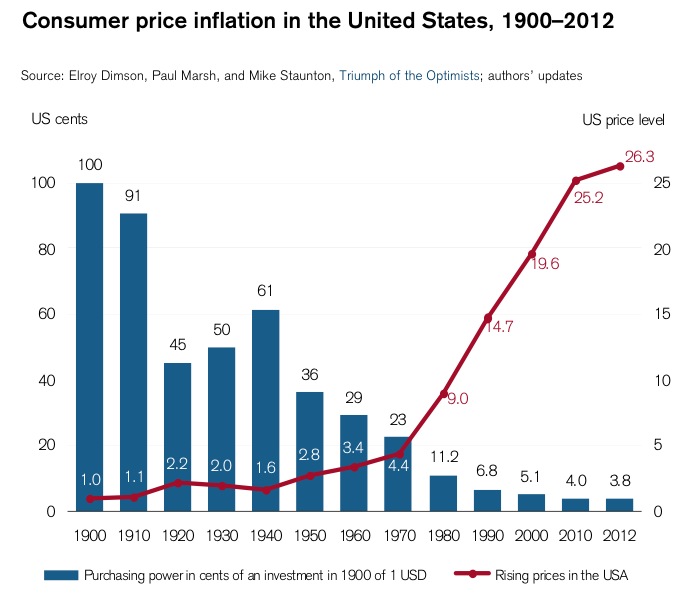

This chain of calamity originated in the Great War’s destruction of sound money, that is, in the post-war demise of the pound sterling which previously had not experienced a peacetime change in its gold content for nearly two hundred years.

Not unreasonably, the world’s financial system had become anchored on the London money markets where the other currencies traded at fixed exchange rates to the rock steady pound sterling—which, in turn, meant that prices and wages throughout Europe were expressed in common money and tended toward transparency and equilibrium.

This liberal international economic order—that is, honest money, relatively free trade, rising international capital flows and rapidly growing global economic integration—-resulted in a 40-year span between 1870 and 1914 of rising living standards, stable prices, massive capital investment and prolific technological progress that was never equaled—either before or since.

During intervals of war, of course, 19th century governments had usually suspended gold convertibility and open trade in the heat of combat. But when the cannons fell silent, they had also endured the trauma of post-war depression until wartime debts had been liquidated and inflationary currency expedients had been wrung out of the circulation.

This was called “resumption” and restoring convertibility at the peacetime parities was the great challenge of post-war normalizations.

The Great War, however, involved a scale of total industrial mobilization and financial mayhem that was unlike any that had gone before. In the case of Great Britain, for example, its national debt increased 14-fold, its price level doubled, its capital stock was depleted, most off-shore investments were liquidated and universal wartime conscription left it with a massive overhang of human and financial liabilities.

Yet England was the least devastated. In France, the price level inflated by 300 percent, its extensive Russian investments were confiscated by the Bolsheviks and its debts in New York and London catapulted to more than 100 percent of GDP.

Among the defeated powers, currencies emerged nearly worthless with the German mark at five cents on the pre-war dollar, while wartime debts—especially after the Carthaginian peace of Versailles—–soared to crushing, unrepayable heights.

In short, the bow-wave of debt, currency inflation and financial disorder from the Great War was so immense and unprecedented that the classical project of post-war liquidation and “resumption” of convertibility was destined to fail. In fact, the 1920s were a grinding, sometimes inspired but eventually failed struggle to resume the international gold standard, fixed parities, open world trade and unrestricted international capital flows.

Only in the final demise of these efforts after 1929 did the Great Depression, which had been lurking all along in the post-war shadows, come bounding onto the stage of history.

I.

The Great Depression’s tardy, thoroughly misunderstood and deeply traumatic arrival happened compliments of the United States.

In the first place, America’s wholly unwarranted intervention in April 1917 prolonged the slaughter, doubled the financial due bill and generated a cockamamie peace, giving rise to totalitarianism among the defeated powers and Keynesianism among the victors. Choose your poison.

Even conventional historians like Niall Ferguson admit as much. Had Woodrow Wilson not misled America on a messianic crusade, the Great War would have ended in mutual exhaustion in 1917 and both sides would have gone home battered and bankrupt but no danger to the rest of mankind.

Indeed, absent Wilson’s crusade there would have been no allied victory, no punitive peace, and no war reparations; nor would there have been a Leninist coup in Petrograd or Stalin’s barbaric regime.

Likewise, there would have been no Hitler, no Nazi dystopia, no Munich, no Sudetenland and Danzig corridor crises, no British war to save Poland, no final solution and holocaust, no global war against Germany and Japan and no incineration of 200,000 civilians at Hiroshima and Nagasaki.

Nor would there have followed a Cold War with the Soviets or CIA sponsored coups and assassinations in Iran, Guatemala, Indonesia, Brazil, Chile and the Congo, to name a few.

Surely there would have been no CIA plot to assassinate Castro, or Russian missiles in Cuba or a crisis that took the world to the brink of annihilation. There would have been no Dulles brothers, no domino theory and no Vietnam slaughter, either.

Nor would we have launched Charlie Wilson’s War to arouse the mujahedeen and train the future al Qaeda. Likewise, there would have been no shah and his Savak terror, no Khomeini-led Islamic counter-revolution, no US aid to enable Saddam’s gas attacks on Iranian boy soldiers in the 1980s.

Nor would there have been an American invasion of Arabia in 1991 to stop our erstwhile ally Hussein from looting the equally contemptible Emir of Kuwait’s ill-gotten oil plunder—or, alas, the horrific 9/11 blowback a decade later.

Most surely, the axis-of-evil—-that is, the Washington-based Cheney-Rumsfeld-neocon axis—- would not have arisen, nor would it have foisted a $1 trillion Warfare State budget on 21st century America.

II.

But….I digress!

The real point is that the Great War enabled the already rising American economy to boom and bloat in an entirely artificial and unsustainable manner for the better part of 15 years. The exigencies of war finance also transformed the nascent Federal Reserve into an incipient central banking monster in a manner wholly opposite to the intentions of its great legislative architect—the incomparable Carter Glass of Virginia.

The 1914-1929 Boom Was An Artifact of War and Money Printing

In the first stage, America became the granary and arsenal to the European Allies—-triggering an eruption of domestic investment and production that transformed the nation into a massive global creditor and powerhouse exporter virtually overnight.

American farm exports quadrupled, farm income surged from $3 billion to $9 billion, land prices soared, country banks proliferated like locusts and the same was true of industry—where steel production, for example, rose from 30 million tons annually to nearly 50 million tons.

Altogether, in six short years $40 billion of money GDP became $92 billion in 1920—a sizzling 15 percent annual rate of gain.

Needless to say, these fantastic figures reflected an inflationary, war-swollen economy—-a phenomena that prudent finance men of the age knew was wholly artificial and destined for a thumping post-war depression. This was especially so because America had loaned the Allies massive amounts of money to purchase grain, pork, wool, steel, munitions and ships. This transfer amounted to nearly 15 percent of GDP or $2 trillion equivalent in today’s economy, but it also amounted to a form of vendor finance that was destined to vanish at war’s end.

As it happened, the nation did experience a brief but deep recession in 1920, but this did not represent a thorough-going end-of-war “de-tox” of the historical variety. The reason is that America’s newly erected Warfare State had hijacked Carter Glass “banker’s bank” to finance Wilson’s crusade.

Indeed, when Congress acted just six months before Archduke Ferdinand’s assassination, it had provided no legal authority whatsoever for the Fed to buy government bonds or undertake so-called “open market operations” to finance the public debt. In part this was due to the fact that there were precious few Federal bonds to buy. The public debt then stood at just $1.5 billion, which is the same figure that had pertained 51 years earlier at the battle of Gettysburg, and amounted to just 4 percent of GDP or $11 per capita.

Thus, in an age of balanced budgets and bipartisan fiscal rectitude, the Fed’s legislative architects had not even considered the possibility of central bank monetization of the public debt, and, in any event, had a totally different mission in mind.

The new Fed system was to operate decentralized “reserve banks” in 12 regions—most of them far from Wall Street in places like San Francisco, Dallas, Kansas City and Cleveland. Their job was to provide a passive “rediscount window” where national banks within each region could bring sound, self-liquidating commercial notes and receivables to post as collateral in return for cash to meet depositor withdrawals or to maintain an approximate 15 percent cash reserve.

Accordingly, the assets of the 12 reserve banks were to consist entirely of short-term commercial paper arising out of the ebb and flow of commerce and trade on the free market, not the debt emissions of Washington. In this context, the humble task of the reserve banks was to don green eyeshades and examine the commercial collateral brought by member banks, not to grandly manage the macro economy through targets for interest rates, money growth or credit expansion—to say nothing of targeting jobs, GDP, housing starts or the Russell 2000, as per today’s fashion.

Even the rediscount rate charged to member banks for cash loans was to float at a penalty spread above money market rates set by supply and demand for funds on the free market.

The big point here is that Carter Glass’ “banker’s bank” was an instrument of the market, not an agency of state policy. The so-called economic aggregates of the later Keynesian models—-GDP, employment, consumption and investment—were to remain an unmanaged outcome on the free market, reflecting the interaction of millions of producers, consumers, savers, investors, entrepreneurs and even speculators.

In short, the Fed as “banker’s bank” had no dog in the GDP hunt. Its narrow banking system liquidity mission would not vary whether the aggregates were growing at 3 percent or contracting at 3 percent.

What would vary dramatically, however, was the free market interest rate in response to shifts in the demand for loans or supply of savings. In general this meant that investment booms and speculative bubbles were self-limiting: When the demand for credit sharply out-ran the community’s savings pool, interest rates would soar—thereby rationing demand and inducing higher cash savings out of current income.

This market clearing function of money market interest rates was especially crucial with respect to leveraged financial speculation—such as margin trading in the stock market. Indeed, the panic of 1907 had powerfully demonstrated that when speculative bubbles built up a powerful head of steam the free market had a ready cure.

In that pre-Fed episode, money market rates soared to 20, 30 and even 90 percent at the peak of the bubble. In short order, of course, speculators in copper, real estate, railroads, trust banks and all manner of over-hyped stock were carried out on their shields—-even as JPMorgan’s men, who were gathered as a de facto central bank in his library on Madison Avenue, selectively rescued only the solvent banks with their own money at-risk.

Needless to say, these very same free market interest rates were a mortal enemy of deficit finance because they rationed the supply of savings to the highest bidder. Thus, the ancient republican moral verity of balanced budgets was powerfully reinforced by the visible hand of rising interest rates: deficit spending by the public sector automatically and quickly crowded out borrowing by private households and business.

And this brings us to the Rubicon of modern Warfare State finance. During World War I the US public debt rose from $1.5 billion to $27 billion—an eruption that would have been virtually impossible without wartime amendments which allowed the Fed to own or finance U.S. Treasury debt. These “emergency” amendments—it’s always an emergency in wartime—enabled a fiscal scheme that was ingenious, but turned the Fed’s modus operandi upside down and paved the way for today’s monetary central planning.

As is well known, the Wilson war crusaders conducted massive nationwide campaigns to sell Liberty Bonds to the patriotic masses. What is far less understood is that Uncle Sam’s bond drives were the original case of no savings? No credit? No problem!

What happened was that every national bank in America conducted a land office business advancing loans for virtually 100 percent of the war bond purchase price—with such loans collateralized by Uncle Sam’s guarantee. Accordingly, any patriotic American with enough pulse to sign the loan papers could buy some Liberty Bonds.

And where did the commercial banks obtain the billions they loaned out to patriotic citizens to buy Liberty Bonds? Why the Federal Reserve banks opened their discount loan windows to the now eligible collateral of war bonds.

Additionally, Washington pegged the rates on these loans below the rates on its treasury bonds, thereby providing a no-brainer arbitrage profit to bankers.

Through this backdoor maneuver, the war debt was thus massively monetized. Washington learned that it could unplug the free market interest rate in favor of state administered prices for money, and that credit could be massively expanded without the inconvenience of higher savings out of deferred consumption. Effectively, Washington financed Woodrow Wilson’s crusade with its newly discovered printing press—-turning the innocent “banker’s bank” legislated in 1913 into a dangerously potent new arm of the state.

III

It was this wartime transformation of the Fed into an activist central bank that postponed the normal post-war liquidation—-moving the world’s scheduled depression down the road to the 1930s. The Fed’s role in this startling feat is in plain sight in the history books, but its significance has been obfuscated by Keynesian and monetarist doctrinal blinders—that is, the presumption that the state must continuously manage the business cycle and macro-economy.

Having learned during the war that it could arbitrarily peg the price of money, the Fed next discovered it could manage the growth of bank reserves and thereby the expansion of credit and the activity rate of the wider macro-economy. This was accomplished through the conduct of “open market operations” under its new authority to buy and sell government bonds and bills—something which sounds innocuous by today’s lights but was actually the fatal inflection point. It transferred the process of credit creation from the free market to an agency of the state.

As it happened, the patriotic war bond buyers across the land did steadily pay-down their Liberty loans, and, in turn, the banking system liquidated its discount window borrowings—-with a $2.7 billion balance in 1920 plunging 80 percent by 1927. In classic fashion, this should have caused the banking system to shrink drastically as war debts were liquidated and war-time inflation and malinvestments were wrung out of the economy.

But big-time mission creep had already set in. The legendary Benjamin Strong had now taken control of the system and on repeated occasions orchestrated giant open market bond buying campaigns to offset the natural liquidation of war time credit.

Accordingly, treasury bonds and bills owned by the Fed approximately doubled during the same 7-year period. Strong justified his Bernanke-like bond buying campaigns of 1924 and 1927 as helpful actions to off-set “deflation” in the domestic economy and to facilitate the return of England and Europe to convertibility under the gold standard.

But in truth the actions of Bubbles Ben 1.0 were every bit as destructive as those of Bubbles Ben 2.0.

In the first place, deflation was a good thing that was supposed to happen after a great war. Invariably, the rampant expansion of war time debt and paper money caused massive speculations and malinvestments that needed to be liquidated.

Likewise, the barrier to normalization globally was that England was unwilling to fully liquidate its vast wartime inflation of wage, prices and debts. Instead, it had come-up with a painless way to achieve “resumption” at the age-old parity of $4.86 per pound; namely, the so-called gold exchange standard that it peddled assiduously through the League of Nations.

The short of it was that the British convinced France, Holland, Sweden and most of Europe to keep their excess holdings of sterling exchange on deposit in the London money markets, rather than convert it to gold as under the classic, pre-war gold standard.

This amounted to a large-scale loan to the faltering British economy, but when Chancellor of the Exchequer Winston Churchill did resume convertibility in April 1925 a huge problem soon emerged. Churchill’s splendid war had so debilitated the British economy that markets did not believe its government had the resolve and financial discipline to maintain the old $4.86 parity. This, in turn, resulted in a considerable outflow of gold from the London exchange markets, putting powerful contractionary pressures on the British banking system and economy.

Real Cause of the Great Depression: Collapse of the Artificial Boom

In this setting, Bubbles Ben 1.0 stormed in with a rescue plan that will sound familiar to contemporary ears. By means of his bond buying campaigns he sought to drive-down interest rates in New York relative to London, thereby encouraging British creditors to keep their money in higher yielding sterling rather than converting their claims to gold or dollars.

The British economy was thus given an option to keep rolling-over its debts and to continue living beyond its means. For a few years these proto-Keynesian “Lords of Finance” —- principally Ben Strong of the Fed and Montague Norman of the BOE—-managed to kick the can down the road.

But after the Credit Anstalt crisis in spring 1931, when creditors of shaky banks in central Europe demanded gold, England’s precarious mountain of sterling debts came into the cross-hairs. In short order, the money printing scheme of Bubbles Ben 1.0 designed to keep the Brits in cheap interest rates and big debts came violently unwound.

In late September a weak British government defaulted on its gold exchange standard duty to convert sterling to gold, causing the French, Dutch and other central banks to absorb massive overnight losses. The global depression then to took another lurch downward.

But central bankers tamper with free market interest rates only at their peril—-so the domestic malinvestments and deformations which flowed from the monetary machinations of Bubbles Ben 1.0 were also monumental.

Owing to the splendid tax-cuts and budgetary surpluses of Secretary Andrew Mellon, the American economy was flush with cash, and due to the gold inflows from Europe the US banking system was extraordinarily liquid. The last thing that was needed in Roaring Twenties America was the cheap interest rates—-at 3 percent and under—that resulted from Strong’s meddling in the money markets.

At length, Strong’s ultra-low interest rates did cause credit growth to explode, but it did not end-up funding new steel mills or auto assembly plants. Instead, the Fed’s cheap debt flooded into the Wall Street call money market where it fueled that greatest margin debt driven stock market bubble the world had ever seen. By 1929, margin debt on Wall Street had soared to 12 percent of GDP or the equivalent of $2 trillion in today’s economy.

As is well known, much economic carnage resulted from the Great Crash of 1929. But what is less well understood is that the great stock market bubble also spawned a parallel boom in foreign bonds—-specie of Wall Street paper that soon proved to be the sub-prime of its day.

Indeed, Bubbles Ben 1.0 triggered a veritable cascade of speculative borrowing that soon spread to the far corners of the globe, including places like municipality of Rio de Janeiro, the Kingdom of Denmark and the free city of Danzig, among countless others.

It seems that the margin debt fueled stock market drove equity prices so high that big American corporations with no needs for cash were impelled to sell bundles of new stock anyway in order to feed the insatiable appetites of retail speculators. They then used the proceeds to buy Wall Street’s high yielding “foreign bonds”, thereby goosing their own reported earnings, levitating their stock prices even higher and causing the cycle to be repeated again and again.

As the Nikkei roared to 50,000 in the late 1980s, the Japanese were pleased to call this madness “zaitech”, and it didn’t work any better the second time around. But the 1920s version of zaitech did generate prodigious sums of cash that cycled right back to exports from America’s farms, mines and factories. Over the eight years ending in 1929, the equivalent of $1.5 trillion was raised on Wall Street’s red hot foreign bond market, meaning that the US economy simply doubled-down on the vendor finance driven export boom that had been originally sparked by the massive war loans to the Allies.

In fact, over the period 1914-1929 the U. S. loaned overseas customers—-from the coffee plantations of Brazil to the factories of the Ruhr—-the modern day equivalent of $3.5 trillion to prop-up demand for American exports. The impact was remarkable. In the 15 years before the war American exports had crept up slowly from $1.6 billion to $2.4 billion per year, and totaled $35 billion over the entire period. By contrast, shipments from American farms and factors soared to nearly $11 billion annually by 1919 and totaled $100 billion—three times more—over the 15 years through 1929.

So this was vendor finance on a vast scale——reflecting the exact mercantilist playbook that Mr. Deng chanced upon 60 years later when he opened the export factories of East China, and then ordered the People’s Bank to finance China’s exports of T-shirts, sneakers, plastic extrusions, zinc castings and mini-backhoes via the continuous massive purchases of Uncle Sam’s bonds, bills and guaranteed housing paper.

Our present day Keynesian witch doctors antiseptically label the $3.8 trillion that China has accumulated through this massive currency manipulation and repression as “foreign exchange reserves”, but they are nothing of the kind. If China had honest exchange rates, it reserves would be a tiny sliver of today’s level.

In truth, China’s $3.8 trillion of reserves are a gigantic vendor loan to its customers. This is a financial clone of the $3.5 trillion equivalent that the great American creditor and export powerhouse loaned to the rest of the world between 1914 and 1929.

Needless to say, after the October 1929 crash, the Wall Street foreign bond market went stone cold, with issuance volume dropping by 95 percent within a year or two. Thereupon foreign bond default rates suddenly soared because sub-prime borrowers all over the world had been engaged in a Ponzi—-tapping new money on Wall Street to pay interest on the old loans.

By 1931 foreign bonds were trading at 8 cents on the dollar—-not coincidentally in the same busted zip code where sub-prime mortgage bonds ended up in 2008-2009.

Still, busted bonds always mean a busted economic cycle until the malinvestments they initially fund can be liquidated or repurposed. Thus, the 1929 Wall Street bust generated a devastating crash in US exports as the massive vendor financed foreign demand for American farm and factory goods literally vanished. By 1933 exports had slipped all the way back to the $2.4 billion level of 1914.

That’s not all. As US export shipments crashed by 70 percent between 1929 and 1933, there were ricochet effect throughout the domestic economy.

This artificial 15-year export boom had caused the production capacity of American farms and factories to become dramatically oversized, meaning that during this interval there had occurred a domestic capital spending boom of monumental proportions. While estimated GDP grew by a factor of 2.5X during 1914-1929, capital spending by manufacturers rose by 7X. Auto production capacity, for example, increased from 2 million vehicles annually in 1920 to more than 6 million by 1929.

Needless to say, when world export markets collapsed, the US economy was suddenly drowning in excess capacity. In short order, the decade-long capital spending boom came to a screeching halt, with annual outlays for plant and equipment tumbling by 80 percent in the four years after 1929, and shipments of items like machine tools plummeting by 95 percent.

Not surprisingly, in the wake of this drastic downshift in output, American business also found itself drowning in excess inventories. Accordingly, nearly half of all production inventories extant in 1929 were liquidated by 1933, resulting in a shocking 20 percent hit to GDP—a blow that would amount to a $3 trillion drop in today’s economy.

Finally, Bubbles Ben 1.0 had induced vast but temporary “wealth effects” just like his present day successor. Stock prices surged by 150 percent in the final three years of the mania. There was also an explosion of consumer installment loans for durable goods and mortgages for homes. Indeed, mortgage debt soared by nearly 4X during the decade before the crash, while boom-time sales of autos, appliances and radios nearly tripled durable goods sales in the eight years ending in 1929.

All of this debt and wealth effects induced spending came to an abrupt halt when stock prices came tumbling back to earth. Durable goods and housing plummeted by 80 percent during the next four years. In the case of automobiles, where stock market lottery winners had been buying new cars hand over fist, the impact was especially far reaching. After sales peaked at 5.3 million units in 1929, they dropped like a stone to 1.4 million vehicles in 1932, meaning that this 75 percent shrinkage of auto sales cascaded through the entire auto supply chain including metal working equipment, steel, glass, rubber, electricals and foundry products.

Thus, the Great Depression was born in the extraordinary but unsustainable boom of 1914-1929 that was, in turn, an artificial and bloated project of the warfare and central banking branches of the state, not the free market.

Nominal GDP, which had been deformed and bloated to $103 billion by 1929, contracted massively, dropping to only $56 billion by 1933. Crucially, the overwhelming portion of this unprecedented contraction was in exports, inventories, fixed plant and durable goods—the very sectors that had been artificially hyped. These components declined by $33 billion during the four year contraction and accounted for fully 70 percent of the entire drop in nominal GDP.

So there was no mysterious loss of that Keynesian economic ether called “aggregate demand”, but only the inevitable shrinkage of a state induced boom. It was not the depression bottom of 1933 that was too low, but the wartime debt and speculation bloated peak in 1929 that had been unsustainably too high.

The Mythical Banking Crisis and the Failure of the New Deal

IV

The Great Depression thus did not represent the failure of capitalism or some inherent suicidal tendency of the free market to plunge into cyclical depression—absent the constant ministrations of the state through monetary, fiscal, tax and regulatory interventions. Instead, the Great Depression was a unique historical occurrence—the delayed consequence of the monumental folly of the Great War, abetted by the financial deformations spawned by modern central banking.

But ironically, the “failure of capitalism” explanation of the Great Depression is exactly what enabled the Warfare State to thrive and dominate the rest of the 20th century because it gave birth to what have become its twin handmaidens—-Keynesian economics and monetary central planning. Together, the latter two doctrines eroded and eventually destroyed the great policy barrier—-that is, the old-time religion of balanced budgets— that had kept America a relatively peaceful Republic until 1914.

To be sure, under Mellon’s tutelage, Harding, Coolidge and Hoover strove mightily, and on paper successfully, to restore the pre-1914 status quo ante on the fiscal front. But it was a pyrrhic victory—since Mellon’s surpluses rested on an artificially booming, bubbling economy that was destined to hit the wall.

Worse still, Hoover’s bitter-end fidelity to fiscal orthodoxy, as embodied in his infamous balanced budget of June 1932, got blamed for prolonging the depression. Yet, as I have demonstrated in the chapter of my book called “New Deal Myths of Recovery”, the Great Depression was already over by early summer 1932.

At that point, powerful natural forces of capitalist regeneration had come to the fore. Thus, during the six month leading up to the November 1932 election, freight loadings rose by 20 percent, industrial production by 21 percent, construction contract awards gained 30 percent, unemployment dropped by nearly one million, wholesale prices rebounded by 20 percent and the battered stock market was up by 40 percent.

So Hoover’s fiscal policies were blackened not by the facts of the day, but by the subsequent ukase of the Keynesian professoriat. Indeed, the “Hoover recovery” would be celebrated in the history books even today if it had not been interrupted in the winter of 1932-1933 by a faux “banking crisis” which was entirely the doing of President-elect Roosevelt and the loose-talking economic statist at the core of his transition team, especially Columbia professors Moley and Tugwell.

The truth of the so-called banking crisis is that the artificial economic boom of 1914-1929 had generated a drastic proliferation of banks in the farm country and in the booming new industrial centers like Chicago, Detroit, Youngtown and Toledo, along with vast amounts of poorly underwritten debt on real estate and businesses.

When the bubble burst in 1929, the financial system experienced the time-honored capitalist cure—-a sweeping liquidation of bad debts and under-capitalized banks. Not only was this an unavoidable and healthy purge of economic rot, but also reflected the fact that the legions of banks which failed were flat-out insolvent and should have been closed.

Indeed, 10,000 of the 12,000 banks shuttered during the years before 1933 were tiny rural banks located in communities of less than 2,500. Most had been chartered with trivial amounts of capital under lax state banking laws, and amounted to get-rich-quick schemes which proliferated during the export boom.

Indeed, a single startling statistic puts paid to the whole New Deal mythology that FDR rescued the banking system after a veritable heart attack: to wit, losses at failed US banks during the entire 12-year period ending in 1932 amounted to only 2-3 percent of deposits. There never was a sweeping contagion of failure in the banking system.

Nor did the Fed’s alleged failure to undertake a massive bond-buying program in 1930-1932 to pump cash into the banking system constitute the monumental monetary policy error that Milton Friedman so dogmatically claimed, and which has become the raison d’etre of contemporary central banking.

In fact, fifty years after the fact, Bubbles Ben 2.0 essentially zeroxed the errors in Friedman’s treatise and got awarded a PhD for this tommyrot by Professor Stanley Fischer of MIT, who Obama has now seen fit to make Vice-Chairman of the Fed. Bernanke then passed himself off as a scholar of the Great Depression and a Friedman disciple, thereby bamboozling the ever gullible Bush White House into appointing a rank money-printer and Keynesian to head the Fed.

Bernanke then proceeded to follow Friedman’s bad advice about 1932 and flooded the banking system with money during the so-called financial crisis, and thereby bailed out the rot on Wall Street instead of purging it as the Board of Governors had the good sense to do in the early 1930s.

But…I digress—slightly!

In fact, it is important to refute the scary bedtime stories that have been handed down about the pre-New Deal banking crisis because they are the predicate for the Fed’s current lunacy of QE, ZIRP and massive monetization of the public debt, which, in turn, enables the perpetual deficit finance on which the Warfare State vitally depends.

In truth, the banking liquidation was over by Election Day, failures and losses had virtually disappeared, and as late as the first week of February 1933, according the Fed’s daily currency reports, there were no unusual demands for cash.

The legendary “bank runs” occurred almost entirely during the last two weeks before FDR’s inauguration. The trigger was Henry Ford’s vicious spat with his former partner and then Michigan Senator, James Couzens, over responsibility for the failure of a go-go banking group in Detroit that had been started by his son Edsel and Goldman Sachs. Always Goldman!

The hapless Herbert Hoover secretly wrote FDR begging him to cooperate in resolving the Michigan banking crisis. Instead, Roosevelt failed to answer the President’s letter for two weeks; lost Carter Glass as his Treasury Secretary because the President-elect refused to affirm his commitment to the sound money platform on which he had campaigned; and allowed Tugwell to leak to the press a radical plan to reflate the economy by reneging on the dollar’s 100-year old linkage to one-twentieth ounce of gold.

Within days there was a massive run on gold at the New York Fed and a scramble for cash at teller windows across the land. Unlike historians today, citizens back then knew that the Fed could not legally issue more currency unless it had 40 percent gold-backing—hence the sudden outbreak of currency hoarding.

In this context, the daily figures for currency outstanding give ringing evidence of FDR’s culpability for the midnight-hour run on the banks. After rising by a trivial $8 million per day in early in the month, cash outstanding rose by $200 million per day by late February and by a staggering half billion dollars on the day before the FDR’s inauguration. All told, 80 percent of the increase in currency outstanding—from $5.6 billion to $7.5 billion—occurred in the last ten days before FDR took office.

Then, even more fantastically, nearly all of the hoarded cash flowed back into the banking system on its own when 95 percent of the banks were re-opened in an “as is, where is” condition during the three weeks after FDR’s inauguration. Moreover, the mass re-opening scheme was actually drafted and executed by Hoover hold-overs at the Treasury, and had been completely accomplished before the heralded banking reforms of the New Deal and deposit insurance had even had Congressional hearings.

In short, the banking system never did really collapse and the true problem was bad debt and insolvency—not Fed errors or an existential crisis of capitalism.

Beyond that, the New Deal was a political gong show that amounted to a grab-bag of statist gimcrack. The mild fascism of the NRA and AAA caused the economy to further contract, not recover. The legendary WPA cycled violently between 1 million make-work jobs in the off-years and 3 million make-vote jobs in the election years—-before even a Democratic Congress was compelled to shut it down in a torrent of corruption in 1939.

Likewise, the TVA was a senseless boondoggle and environmental curse; the Wagner Act paved the way for the kind of coercive, monopolistic industrial unionism that resulted in “Rust Bucket America” five decades later; and the legacy of New Deal housing stimulants like Fannie Mae speaks for itself.

Finally, universal social insurance enacted in 1935 was actually a fiscal doomsday machine. When in the context of modern political democracy the state offers universal transfer payments to its citizenry without proof of need it thereby offers to bankrupt itself—eventually.

To be sure, during the middle 1930s, the natural rebound of the nation’s capitalist economy continued where the Hoover Recovery left off— notwithstanding the New Deal headwinds. Yet the evidence that FDR’s policies retarded recovery screams out of the last year of pre-war data for 1939: GDP at $90 billion was still 12 percent below 1929, while manufacturing value added was off by 20 percent and business investment by 40 percent.

Most telling of all was private non-farm man-hours worked: the 1939 level was still 15 percent lower than what the BLS recorded in 1929.

So the New Deal did nothing to help the domestic economy. But FDR did personally torpedo world recovery and paved the way toward WWII with his so-called “bombshell” message to the London Economic Conference in July 1933. The latter had been the world’s last best hope for rescue of the failed task of post-war resumption. Specifically, the conferees had shaped a plan for restoring convertibility by means of pegging the pound sterling at a lower exchange rate to the dollar and gold, thereby alleviating the beggar-thy-neighbor pressure on the remaining gold standard countries like France, the Netherlands and Sweden.

In turn, monetary stabilization would pave the way for reduction of Smoot-Hawley instigated tariff barriers and the restoration of global trade and capital flows.

The American delegation led by the magnificent statesman, Cordell Hall, had molded a tentative agreement among the British and French, and thereby had attained a crucial inflection point in the post-war struggle for resumption of the old international order. Yet FDR defied his advisors to the very last man, including the nationalistic and protectionist-minded Raymond Moley, who the President had sent to London as his personal emissary.

Roosevelt’s message, penned by moonlight on the luxurious yacht of his chum, Vincent Astor, was undoubtedly the most intemperate, incoherent and bombastic communique ever publicly issued by a US President. It not only stunned the assembled world leaders gathered in London and killed the monetary stabilization agreement on the spot, but it also locked in a destructive worldwide regime of economic nationalism and autarky.

Accordingly, high tariffs and trade subsidies, state-dominated recovery and rearmament programs and manipulated currencies became universal after the London Conference failed, leaving international financial markets demoralized and chaotic.

The irony was that the Great Depression was the step-child of the Great War. American entry had unnecessarily extended it; had greatly amplified its destructive impact on the liberal international order; and had contributed a witch’s brew of Wilsonian nostrums to a Carthaginian peace that laid the planking for a new world war. FDR then delivered the coup de grace, extinguishing the last hope for resumption and insuring that autarky, revanchism and rearmament would hurtle the world to an even greater eruption of carnage, and an even more debilitating rendition of the Warfare State.

Krugman’s Lie: WWII Was Not A Splendid Exercise in Keynesian Debt Finance

World War II soon delivered another blow to the old-time fiscal religion. Not only did that vast expansion of war production fuel the illusion that New Deal statism had alleviated an endemic crisis of capitalism, but it also became heralded as a splendid exercise in Keynesian deficit finance when, in fact, it was nothing of the kind.

The national debt did soar from less than 50 percent of GDP, notwithstanding the chronic New Deal deficits, to nearly 120 percent at the 1945 peak. But this was not your Krugman’s debt ratio— or proof that the recent surge to $17 trillion of national debt has been done before and had been proven harmless.

Instead, the 1945 ratio was an artifact of a command and control war economy which had banished civilian goods including new cars, houses and most consumer durables, and tightly rationed everything else including sugar, butter, meat, tires, shoes, shirts, bicycles, peanut brittle and candied yams.

With retail shelves empty the household savings rate soared from 4 percent in 1938-1939 to an astounding 35 percent of disposable income by the end of the war.

Consequently, the Keynesians have never acknowledged the single most salient statistic about the war debt: namely, that the debt burden actually fell during the war, with the ratio of total credit market debt to GDP declining from 210 percent in 1938 to 190 percent at the 1945 peak!

This obviously happened because household and business debt was virtually eliminated by the wartime savings spree, dropping from 150 percent of GDP to barely 60 percent and thereby making headroom for the temporary surge of public debt.

In short, the nation did not borrow its way to victory via a Keynesian miracle. Measured GDP did rise smartly because half of it was non-recurring war expenditure. But even then, the truth is that the American economy “regimented” and “saved” its way through the war.

Supplementing the aforementioned “voluntary” savings spree were “mandatory savings” in the form of a staggering increase in taxation. Confiscatory levies on the wealthy and merely onerous taxation on everyone else caused the tax take to rise from 8 percent to a never again equaled 25 percent of GDP.

In January 2013, Obama signed a permanent extension of the unaffordable Bush tax cuts for 98 percent of households at a cost of $4 trillion in added national debt over the next decade. And this was at a time when household, business and financial sector debt was 260 percent of GDP, not 60 percent as in 1945.

Yet professor Krugman said don’t sweat it—FDR proved the national debt doesn’t matter.

That wasn’t remotely true—but the persistence of this canard amounts to one more nail in the coffin of fiscal rectitude, and still another illusion that perpetuates the nation’s trillion dollar Warfare State.

VI.

The Victory of The Permanent Warfare State

After America’s earlier wars there occurred a swift and near total demobilization: the Union Army of 2 million had been reduced to 24,000 within months of month of Appomattox, and the 3 million World War I military was down to 50,000 within a few years.

By contrast, the American Warfare State became permanent and self-fueling after World War II. So doing, it both catalyzed new extensions of Keynesian statism and monetary central planning and simultaneously flourished from their rise.

President Eisenhower famously warned about the dangers of the military-industrial complex in his 1961 farewell, but it was Harry Truman who first felt the sting of its political power. Truman was an old-fashioned budget balancer and made remarkable strides in the immediate post-war years toward traditional demobilization, cutting military spending from $70 billion to $15 billion by 1948 and balancing the Federal budget two years in a row.

Unfortunately, his government was still crawling with warriors—like Admiral Leahey and General Curtis LeMay and civilian hardliners like Secretaries Forrestal and Acheson—-who had thrived during WWII and were looking for new enemies to vanquish. Moreover, the unschooled haberdasher and machine politician from Missouri had made it far easier for them with his deplorable decision to drop atom bombs on an already beaten Japan.

There is now plenty of evidence from the archives of both sides that Truman’s brusque treatment of Stalin at Potsdam based on his atomic secret was the catalyst that began the Cold War. Thereafter, his unwillingness to over-ride the brass and the hardliners and negotiate international control of atomic weapons—eloquently urged by the legendary statesman, Henry Stimson, in his last cabinet meeting after serving presidents for half a century—assured a nuclear arms race and perpetual cold war.

Indeed, upon Truman’s rejection of Stimson’s plea, another Cabinet participant presciently queried, “…. (so) the arms race is on, is that right?”

Truman famously agreed and insisted “but we should stay ahead”. Except that he could not both continue the demobilization and stay ahead in the arms race and nascent cold war.

Indeed, by spring 1950 Truman had already lost the battle. His government had become increasingly populated with hardliners as Stalin, fearful of encirclement yet again and Truman’s atomic diplomacy, brutally enforced his eastern European territorial winnings from Yalta—even as the Republican Right went on a jihad about the “loss” of China.

In that context, the cold warriors led by Paul Nitze at State and the Keynesian professoriat represented by CEA Chairman Leon Keyserling effected a fatal alliance. In that truly insidious policy document known as NSC-68, they proclaimed a Soviet agenda to conquer the world, which was balderdash, and averred that a massive increase in cold war defense spending would levitate the American economy, which was lunacy.

Soon an inconsequential civil war on the barren Korean peninsula between two brutal tyrants became a flash point in the Cold War, causing military re-mobilization and sending the defense budget soaring five-fold to more than $60 billion. Harry Truman, the resolute budget balancer, avoided a torrent of red ink only by seizing on the moment of domestic fear, when the “chicoms” came flooding across the Yalu River, to re-impose FDR’s onerous wartime taxes.

In my book, I gave Truman the hero award for insisting that an elective war be financed with current taxes.

But tonight I give him a villains badge for succumbing to the war-mongers, and for invading Asian rice paddies that posed no threat to American security, and which might just as well have become a province of China’s “red capitalism”, which both the Keynesians and Wall Street now tell us is an economic cat’s meow.

Thereafter the “begats” went full retard, old testament-style.

The great General Dwight Eisenhower had no trouble seeing the folly of a land-war in Asia and quickly ended the hideously named “police action” in Korea after 58,000 American soldiers and upwards of a million civilians had been killed. He also had the strategic vision to see the folly of NSC-68, which called for massive conventional military capacity to fight multiple land and air wars all over the planet.

Instead, Ike drastically downsized the army, shelved naval plans for a massive armada of supercarriers, and cut Truman’s bloated war budget from $500 billion in today’s money to $370 billion based on the gutsy doctrine of massive nuclear retaliation and the correct perception that the Soviets were not suicidal.

By decisively throttling the Warfare State, President Eisenhower gave brief reprieve to the old time fiscal religion. He balanced his budgets repeatedly, refused to reduce Truman’s war taxes until reductions were earned with spending cuts, shrunk the total Federal budget in constant dollars for the last time ever, and over his eight year term held average new public borrowing to a miniscule 0.4 percent of GDP.

Yet in his endless quest to economize Eisenhower carried a good thing too far by delegating cold war fighting to the seemingly low-cost cloak-and-dagger operations of the detestable Dulles brothers. Yet to this day, the Warfare State flourishes from the bitter harvest planted by the Allen’s CIA and Foster’s bully-boy diplomacy throughout the developing world.

The untoward legacy of the 1953 coup against Mossadeq in Iran is obvious. But it was no less stupid than the Dulles brothers’ senseless assault on Nasserism, which brought the Soviets into the Middle East and turned it into a permanent armed camp.

But the most abominable Dulles legacy was the insanity of Vietnam. Not only did it saddle America with culpability for an outright genocide, but it set-off a string of economic calamities that spelled the final doom of the old time fiscal religion and extinguished what remained of sound money doctrine at the Fed.

In quick sequence, Kennedy gifted Washington’s politicians with the Keynesian gospel of full-employment deficits; Johnson’s guns and butter then engendered a flood of red ink; and thereafter the White House broke the will and integrity of the great Fed Chairman, William McChesney Martin, thereby busting the financial discipline of the Bretton Woods gold standard with a battering ram of unwanted off-shore dollars.

It was Nixon who committed the final abomination of Camp David in August 1971 by defaulting on the nation’s obligation to live within its means and redeem dollars for gold at $35 per ounce. Adhering to the canons of sound money, of course, would have caused a deep recession after a decade of fiscal excess —and that, in turn, might have spared the nation of Nixon’s horrific second term.

It also would have put the Democrats’ peacenik wing in power, thereby exposing the Warfare State to an existential challenge at just the right moment— to wit, when it was on its heels from the Vietnam fiasco. But instead of serendipity, we got Milton Friedman’s Folly—-that it, floating fiat money and a central bank unshackled from the anchor of gold.

Ironically, the great libertarian’s monetary recipe amounted to statist management of our massive capitalist economy through the wisdom of 12 monetary eunuchs ensconced in the Eccles Building where they were to occupy themselves playing scrabble and reading book reviews, while occasionally adjusting the money supply dials exactly in accordance with the Friedmanite formula.

It didn’t work out that way. The cowardly Dr. Arthur Burns quickly became a mad money printer and we were presently off to the 1970 races of double-digit inflation. And soon enough there arose the hoary legend that this calamity of central banking was actually caused by high oil prices and the machinations of the former camel-drivers who had recently conquered the oil-rich lands of eastern Arabia.

Thus, thanks to the abominations of Camp David, the Warfare State got two massive boosts which have carried it far toward its current trillion dollar girth.

First, instead of a house cleaning by the likes of Frank Church, Nixon’s re-election eventually brought the Yale skull and bones back to the CIA. There, during his brief but destructive tenure, Poppy Bush rummaged up the neo-con “B team” and paved the way for the massive Reagan defense build-up a few years later.

The B team’s report falsely painted lurid imagery of an Evil Empire bent on a nuclear war-winning strategy, when, in truth, the Soviet Union was already a beached whale of decaying state socialism.

Secondly, Washington went into the misbegotten business of fighting so-called high oil prices by massive policing of the Persian Gulf and through incessant meddling in the region, including military alliances with an endless stable of corrupt sheikhs, princes, emirs, dictators and despots—-with the despicable royal family of Saudi Arabia in the lead.

By the late 1970s, moreover, Washington had become so mesmerized by the Keynesian predicate—that is, the notion that the state must constantly maneuver to levitate the GDP—that it didn’t even know that American prosperity did not depend on carrier battle groups cruising the straits of Hormuz or alliances with despots.

The simple and pacific solution was free market pricing—the sure fire route to new supplies, alternative energy and more efficient consumption. The truth is, there never was an OPEC cartel—just the Saudi royal family, whose greed and intoxication with decadent opulence apparently knows no bounds.

If they threatened to hold-back production, we should have let the global market price work its magic, meaning probably less GDP in 1974 and more by 1994. The intra-temporal distribution of GDP is a matter for the market to decide, not the state. Accordingly, it should never have been an excuse to arm and ally with the sordid despots of Riyadh, nor to keep them on the throne to avert a Shia uprising in the eastern oil provinces.

Twenty million everyday Saudis would have been every bit as eager for the oil revenues as 2,000 gluttonous princes.

Regrettably the Reagan Presidency brought on the final apotheosis of the American Warfare State. The massive $1.5 trillion defense build-up launched without shred of analysis in February 1981 was not only an unnecessary and utter waste, but it also left four legacies that enabled today’s trillion dollar Warfare State, and which now propel the nation on its appointed path toward fiscal bankruptcy.

First, the only politician of modern times who honestly campaigned against Big Government and the national debt was reduced to enunciating pure fiscal babble once in office. Ronald Reagan was so mesmerized by the brass and so bamboozled by the neo-cons’ scary bedtime stories about the Soviets that he not only gave the Pentagon a blank check, but he then proclaimed that there was no deficit problem because the flood of red ink on his watch amounted to necessary and excusable “war debt”.

Secondly, when the national debt skyrocketed from $1 trillion to $3.5 trillion during the Reagan-Bush era, the GOP interred the old time fiscal religion once and for all and proclaimed the modest debt fueled boom of those years as a victory for tax-cutting and the gospel of painless growth. So with two fiscal free lunch parties now in incumbent in the machinery of governance, the Warfare State was unleashed like never before.

Indeed, in due course the fatuous Dick Cheney proclaimed that Reagan proved deficits don’t matter, and then charted the most reckless fiscal course in modern history: massive tax cuts and a doubling of the defense budget during the midst of a Fed induced credit boom that was destined to collapse.

When it did, the Federal deficit surged to nearly 10 percent of GDP—even before Obama’s Keynesian witch doctors got their hands in the public till.

Thirdly, the massive Reagan defense buildup did not go to countering the alleged strategic nuclear threat posed by the Evil Empire because there wasn’t one in the first place, and there was not much to spend it on anyway—-except the rank fantasy of Star Wars which even the Congressional porkers couldn’t abide.

Instead, the Pentagon poured hundreds of billions into a vast conventional war machine, including the 600-ship Navy and its 13 lethal carrier-battle groups; 12,000 new tanks and armored fighting vehicles; 16,000 fighters, bombers, attack helicopters, close air support and transport planes; and a blizzard of cruise missiles and electronic warfare suites.

All of this soon proved well suited to wars of invasion and occupation in the lands of the unwilling and among the desert and mountain redoubts of the mostly unarmed.

In short, the wherewithal for the pointless invasions of 1991, 2001 and 2003 and all the lesser American aggressions in-between and after was requisitioned during the Reagan defense spending binge to thwart an enemy of liberty that had already failed by eating its own cooking.

Finally, if the truth be told the Reagan White House could not get rid of Paul Volcker soon enough. Doing so in 1987, it removed from what was already a rogue central bank the last vestige of sound money discipline and fearless independence from Wall Street.

Treasury Secretary Jim Baker, a policy descendent of John Connally, wanted low interest rates, a weak dollar and a politically pliant disposition at the Fed. Alan Greenspan 2.0 accomplished all of the above and much more, turning the Fed into a pliant tool of GOP triumphalism and Wall Street speculation—even as he spent 19 years in the Eccles Building institutionalization the destruction of the very doctrines of sound finance and gold-backed money about which Greenspan 1.0 had written so eloquently before he came to Washington.

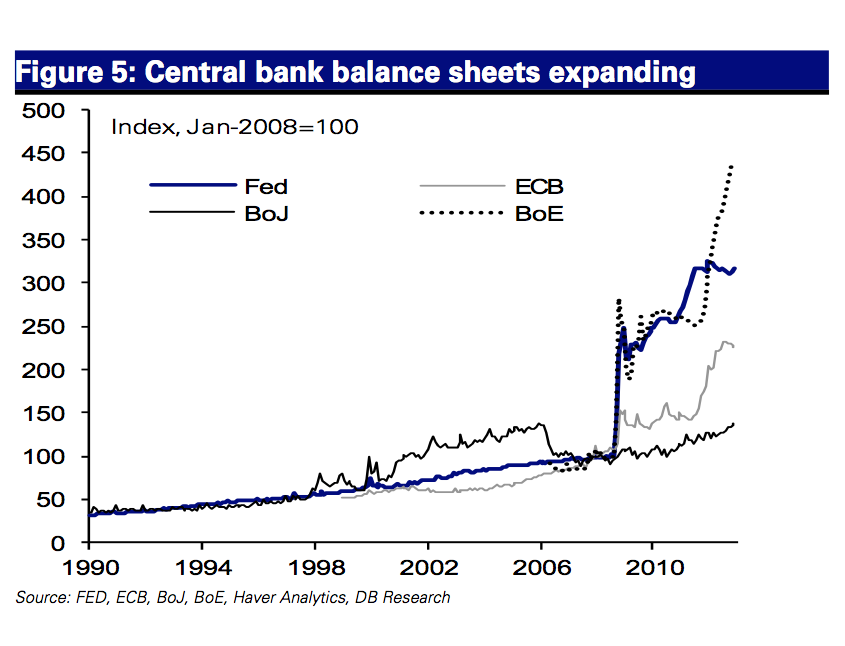

Now caught up fueling a repetitive and destructive cycle of financial bubbles and busts, the Greenspan-Bernanke-Yellen Fed has taken monetary central planning into the deep waters of wanton monetization of the public debt.

Under these circumstances there is no fiscal governance—-just an inexorable drift toward monetary catastrophe. In the interim, our senseless and dangerous trillion dollar Warfare State rolls on.

Keynesian statism and monetary central planning have triumphed, meaning that the American Republic has no remaining fiscal defenses, nor immunities from its extractions.

The good Ben (Franklin that is) said,” Sir you have a Republic if you can keep it”.

We apparently haven’t.