Republicans and Democrats spent last summer battling how best to save $2.1 trillion over the next decade. They are spending this summer battling how best to not save $2.1 trillion over the next decade.

In the course of that year, the U.S. government’s fiscal gap — the true measure of the nation’s indebtedness — rose by $11 trillion.

The fiscal gap is the present value difference between projected future spending and revenue. It captures all government liabilities, whether they are official obligations to service Treasury bonds or unofficial commitments, such as paying for food stamps or buying drones.

Some question whether “official” and “unofficial” spending commitments can be added together. But calling particular obligations “official” doesn’t make them economically more important. Indeed, the government would sooner renege on Chinese holding U.S. Treasuries than on Americans collecting Social Security, especially because the U.S. can print money and service its bonds with watered-down dollars.

For its part, economic theory sees through labels and views a country’s official debt for what it is — a linguistic construct devoid of real economic content. In contrast, the fiscal gap is theoretically well-defined and invariant to the choice of labels. Each labeling choice changes the mix of obligations between official and unofficial, but leaves the total unchanged.

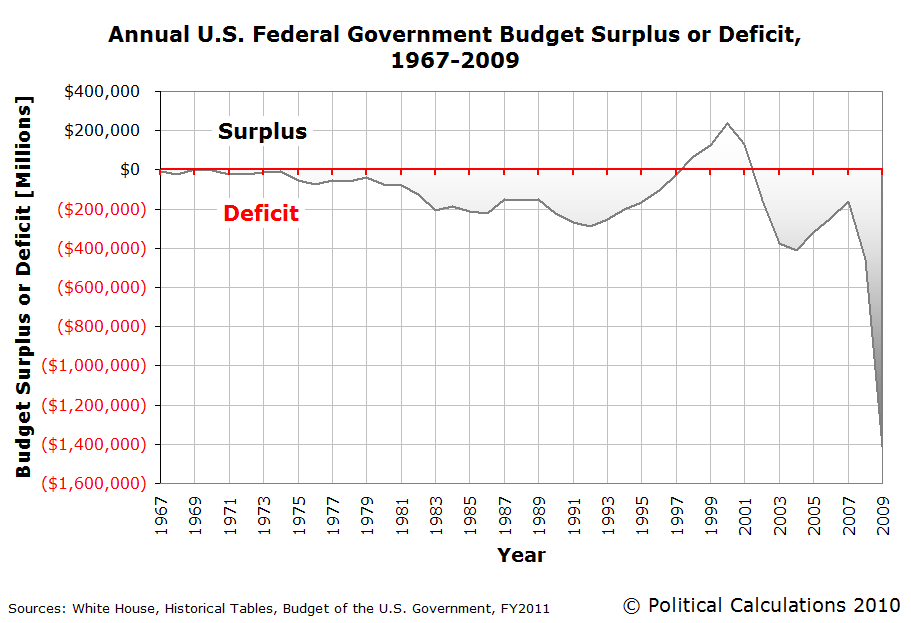

Dangerous Growth

The U.S. fiscal gap, calculated (by us) using theCongressional Budget Office’s realistic long-term budget forecast — the Alternative Fiscal Scenario — is now $222 trillion. Last year, it was $211 trillion. The $11 trillion difference — this year’s true federal deficit — is 10 times larger than the official deficit and roughly as large as the entire stock of official debt in public hands.

This fantastic and dangerous growth in the fiscal gap is not new. In 2003 and 2004, the economists Alan Auerbach and William Gale extended the CBO’s short-term forecast and measured fiscal gaps of $60 trillion and $86 trillion, respectively. In 2007, the first year the CBO produced the Alternative Fiscal Scenario, the gap, by our reckoning, stood at $175 trillion. By 2009, when the CBO began reporting the AFS annually, the gap was $184 trillion. In 2010, it was $202 trillion, followed by $211 trillion in 2011 and $222 trillion in 2012.

Part of the fiscal gap’s growth reflects changes in policy, such as the Bush and Obama tax cuts, the introduction of Medicare Part D, and the expansion of defense spending. Part reflects “natural” growth of existing programs, including growth in Medicare and Medicaid reimbursement rates. And part reflects the demographic time bomb U.S. politicians are blithely ignoring.

When fully retired, 78 million baby boomers will collect, on average, more than 85 percent of per-capita gross domestic product ($40,000 in today’s dollars) in Social Security, Medicare and Medicaid benefits. Each passing year brings these outlays one year closer, which raises their present value.

Governments, like households, can’t indefinitely spend beyond their means. They have to satisfy what economists call their “intertemporal budget constraint.” The fiscal gap simply measures the extent to which this constraint is violated and tells us what is needed to balance the government’s intertemporal budget.

The answer for the U.S. isn’t pretty. Closing the gap using taxes requires an immediate and permanent 64 percent increase in all federal taxes. Alternatively, the U.S. needs to cut, immediately and permanently, all federal purchases and transfer payments, including Social Security and Medicare benefits, by 40 percent. Or it can mix these terrible fiscal medicines with honey, namely radical fiscal reforms that make the economy much fairer and far stronger. What the government can’t do is pay its bills by spending more and taxing less. America’s children, whose futures are being rapidly destroyed, are smart enough to tell us this.

(Laurence Kotlikoff, an economist at Boston University, andScott Burns, a syndicated columnist, are co-authors of “The Clash of Generations.” The opinions expressed are their own.)