Guest Post by Mark Nestmann

Imagine arriving at your local airport one morning for a domestic flight to a neighboring city. You approach the security checkpoint and the TSA lackey asks for your identification. After handing him your driver’s license, you prepare to be groped as you pass through the checkpoint.

But instead, the TSA man tells you your driver’s license is no longer accepted as identification for domestic flights. He asks you for your passport.

Unfortunately, you don’t have a passport. A few months ago, you received a letter from the State Department stating that since you owed the IRS money, your passport was hereby revoked, effective immediately. It further ordered you to turn your passport in.

You’re officially grounded – courtesy of the IRS.

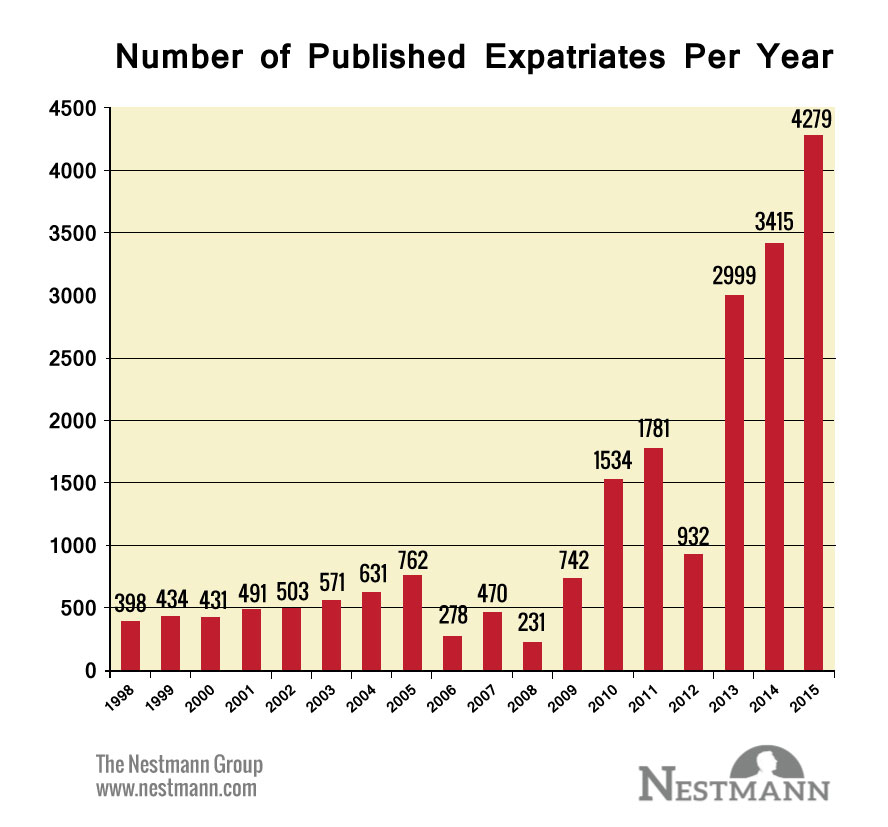

How could this happen? Thank Congress for enacting a pair of obscure laws, one in 2005 and another in 2015.

#1 The Real ID Act of 2005 established federally mandated “national uniform standards” for driver’s licenses… 43 separate requirements in all. State driver’s licenses that fail to conform to these standards are no longer valid for any federal “official purpose.” Examples of “official purposes” include boarding an airplane, buying a firearm, or even entering a federal courthouse.

Originally, the deadline for states to comply with the law was December 31, 2009. But the Department of Homeland Security repeatedly extended it. However, after October 1, 2020, you won’t be able to use a noncompliant driver’s license to identify yourself for any federal “official purpose,” including boarding an airplane. And 26 states have yet to comply with the new requirements.

#2 H.R. 22, the FAST Act (Fixing America’s Surface Transportation Act) passed Congress last December. It added a little-noticed section to the Internal Revenue Code entitled, “Revocation or Denial of Passport in Case of Certain Tax Delinquencies.” This section empowers the State Department to “deny, revoke, or limit the passport of individuals” with a “seriously delinquent tax debt.” This is defined as a tax debt that exceeds $50,000 for which the IRS has filed a notice of lien or levy. The act doesn’t solely apply to just criminal tax cases either; any tax debt over this threshold could trigger passport revocation.

Continue reading “The IRS could stop you from flying. Here’s how…”