Market tops don’t happen on a particular day. They won’t be ringing a bell. Market tops occur because valuations become extreme and overconfidence, delusional thinking, and unrealistic expectations combine to produce a crash. The 3rd crash in the last 14 years is imminent. All of the gains since 2010 will be purged. The general public will again be shocked and flabbergasted. Hussman lays it all out. I’ve included the chart of doom and a few pertinent passages from his weekly letter. Maybe this time will be different. 🙂

“It’s instructive that the 2000-2002 decline wiped out the entire total return of the S&P 500 – in excess of Treasury bills – all the way back to May 1996, while the 2007-2009 decline wiped out the entire excess return of the S&P 500 all the way back to June 1995. Overconfidence and overvaluation always extract a terrible payback.

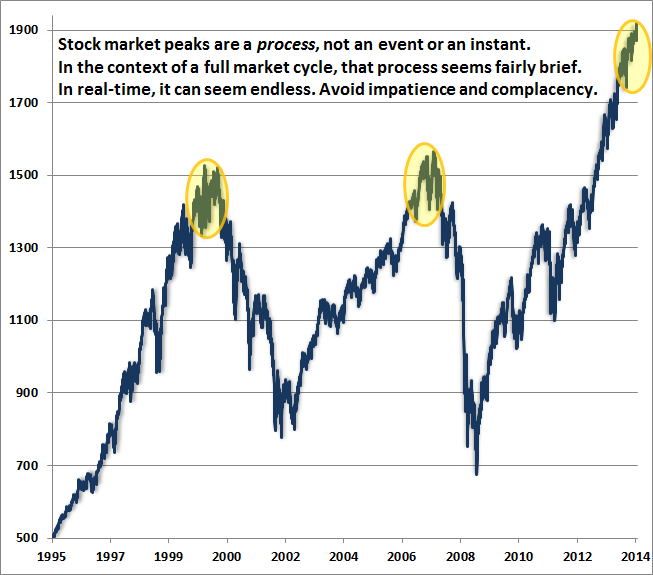

It may also be helpful to remember that market peaks are a process, not an event. In the presence of a broad range of reliable valuation metrics uniformly at more than twice their historical norms, coupled with the most severe overvalued, overbought, overbullish, rising-yield syndrome we define, it is instructive how shorter-term action has evolved near those points. Outside of today and 1929, the other two instances are, not surprisingly, 2000 and 2007. The chart below provides a more granular reminder that market peaks are often a broad process and can involve hard initial downturns and swift recoveries. The ultimate follow-through provides some insight regarding the full scale of our concerns.”

It is Informed Optimism To Wait for the Rain – Hussman Weekly Market Comment 3/10/14

“From a valuation standpoint, we estimate that the S&P 500 Index would have to fall to the 1000 level to bring prospective 10-year nominal total returns toward their historical norm of about 10% annually. With the exception of the 2000-2002 bear market, valuations have typically been lower, and prospective returns higher, at cyclical troughs throughout recorded history (even in data prior to the 1960’s when interest rates were similarly depressed).

Other considerations that have historically been important would persist independent of our various concerns about profit margins, Fed-induced yield-seeking, covenant-lite leveraged loan issuance, equity margin debt, economic deceleration, and so forth.

In my view, investors should be thinking very seriously about the extent of potential market losses over the completion of the present market cycle. It is the wrong question to ask “where else am I going to put my money with short-term interest rates near zero?” The problem with that question is that it carries the implicit assumption that the expected return on stocks is even positive or adequate given the prospective risks. At present, the better question is “do I prefer a zero loss to the prospect of a 40-60% interim loss in a market that is strenuously overbought and overbullish, and has returned to valuations that are more than double reliable historical valuation norms?”

On Friday, our estimate of prospective 10-year S&P nominal total returns set a new low for this cycle, falling below 2.2% annually. This is worse than the level observed at the 2007 market peak, or at any point in history outside of the late-1990’s market bubble.”