I became a math teacher by a circuitous route. My degree is in engineering. I spent five and a half years refurbishing nuclear submarines, and then I quit work to bear, rear, and eventually homeschool our three children.

As a homeschool mom, I participated in co-ops, taking turns teaching groups of homeschooled children subjects such as nature study and geography. As our children entered their teen years, I began teach to teach algebra, trig, and calculus to small classes of homeschoolers at my kitchen table. And as our children left home for their four-year universities, two to major in engineering and one in art, I began teaching in small private schools known as classical academies.

This last year, I have also been tutoring public-school students in Common Core math, and this summer I taught a full year of Common Core Algebra 2 compressed into six weeks at an expensive, ambitious private school.

I’ve taught and tutored the gamut of textbooks and curricula: Miquon and Saxon to my own kids and whenever the choice of curriculum was mine to make; Foerster, Saxon, Jacobs, or Holt when hired to teach at a school. I’ve tutored out of the California state adopted texts: CPM, Everyday Math, Mathland, Houghton Mifflin Harcourt, McGraw Hill, Addison Wesley, and Holt. I’ve had students come to me from all of the above plus Teaching Textbooks, Singapore, and Math U See.

This last year was my first experience first tutoring, then teaching Common Core, and I was curious. I had read the reports of elementary-school children crying over their homework and staying up past midnight to complete it, so I expected Common Core to be like Everyday Math, Mathland, and CPM: poorly explained, abstruse, confusing. I was correct on those counts.

What surprised me was that Common Core was also hard.

Now, I like rigor. I have high standards. My goal for my students is that they will become competent and confident mathematicians. But I was stunned to see that my tutoring student’s pre-algebra work incorporated about a third of a year of algebra 1. The algebra 2 text incorporated about a third of the topics I would expect to find in a precalculus course. And so forth.

This did not mesh with the reports from Pennsylvania, Wisconsin, Utah, or New York, where Common Core is alleged to lower standards – in one case, specifically, to move multiplication tables from third grade to fifth grade. It appears that Common Core is not being implemented in a consistent (or common) way across the United States. But I can only address pre-algebra through calculus in texts claiming to be Common Core in California. These texts are shoveling about a third of the subsequent year’s topics into the current year.

This problem is exacerbated by the recent fad for accelerating students through their math classes. Fifty years ago, algebra 1 was a ninth-grade course for fourteen-year-olds. Now it is routinely taught in eighth grade, sometimes in seventh. Algebra 1 in seventh grade means that pre-algebra is taught in sixth grade to eleven-year-olds, and few eleven-year-olds have achieved the cognitive development necessary to master the abstract logic of one third of a year of algebra.

Cognitive development proceeds not in a smooth curve, but in jumps and plateaus. Just as most babies learn to walk at twelve months, so most adolescents become capable of logical operations such as algebra at twelve years. And just as whether a baby walks at nine months or fifteen months has no bearing on whether he plays football in college, so whether a student learns algebra in 7th or 9th grade has no bearing on whether she becomes a National Merit Scholar…save that a child who is pushed and flounders and fails is unlikely to love an activity.

That is what I am seeing with my tutoring students: the math-bright ones are being encouraged to take honors pre-algebra at age eleven. In prior years, this would have meant that they first had a thorough, final review of arithmetic: adding, subtracting, multiplying, and dividing whole numbers, decimals, and fractions; long division; changing fractions to decimals to percents and back. Then for a treat, they would be introduced to the glories of algebra, the fun stuff: Rene Descartes’ brilliant invention, with plenty of lists of points that, if properly executed, form an outline of a fish or a dinosaur. They would be taught signed numbers, order of operations, distributive property, and how to solve for x, and that would be about it. They would finish the year happily aware that math is fun and that they are good at it. If they were fortunate enough to be taught from Jacobs’s Mathematics: a Human Endeavor, they would learn about sequences and mosaics and logarithms and even networks, but all with a very concrete development, suited to the emergent logical thinker.

The reform mathematicians who put together Common Core are ignoring cognitive development. My Common Core pre-algebra students are hurried through the arithmetic review and taught the coordinate system. They graph lines and parabolas. They do transformations, exponents (including zero and negative exponents), and a truly horrendous percentage of percentage problems. The homework can be finished in an hour if the student’s parents can afford to hire a BS mechanical engineer to sit at his elbow and remind him when he takes a wrong turn. Otherwise, he is up ’til midnight. Students work hard at tasks beyond their strength; they flounder; they fail; they learn that math is no fun.

This isn’t education. This is child abuse.

Another aspect of Common Core that surprised me was the emphasis given to parent functions and transformations. People over forty years of age, even techies such as physicists, chemists, engineers, and mathematicians, won’t know what parent functions are. People under thirty-five who have been educated in reform mathematics textbooks will be surprised that is possible to learn mathematics without learning about transformations.

Fifty years ago, transformations were not taught, although math-bright students would figure them out for themselves in analytic geometry (second-semester pre-calculus). Today, they are taught systematically beginning in elementary school.

The treatment of transformations reminds me of the New Math debacle of the 1960s. The reform mathematicians of the day decided that they were going to improve mathematical education by teaching all students what the math-bright children figured out for themselves.

In exactly the same way, the current crop of reform math educators has decided that transformations are an essential underlying principle, and are teaching them: laboriously, painfully, and unnecessarily. They are tormenting and confusing the average student, and depriving the math-bright student of the delight of discovering underlying principles for herself.

One aspect of Common Core that did not surprise me was a heavy reliance on calculators.

The main problem I see with my algebra students is that they have poor number sense. They can’t tell whether the answer their calculator shows is reasonable or not. They cling to the notion that 1.41 is somehow more precise than square root of two. They also can’t add fractions or do long division, which puts them at a severe disadvantage when they must add rational expressions or divide polynomials.

Common Core exacerbates this problem. At every level, the problems are designed to be too hard to solve by hand. A calculator is necessary even in elementary school – unless a child is to spend 5 hours a night on homework. A graphing calculator is necessary for algebra – calculating correlation coefficients by hand is not a viable option. My students are whizzes with their calculators. But they reach for them to square 1/3…then write it as 0.11.

Common Core advocates claim that they are avoiding that boring, rote drill in favor of higher-order thinking skills. Nowhere is this more demonstrably false than in their treatment of formulas. An old-style text would have the student memorize a few formulas and be able to derive the rest. Common Core loads the student down with more formulas than can possibly be memorized. There is no instruction on derivation; the formulas are handed down as though an archangel brought them down from heaven. Since it is impossible to memorize all the various formulas, students are permitted – nay, encouraged – to develop cheat sheets to use on the tests.

The second-biggest problem with Common Core is the problem of Big Mistakes. Pretend for a moment that a homeschool family did something as asinine as giving their eight-year-old a calculator instead of teaching him his times tables. That child would be a calculator cripple.

But that would be a small mistake, affecting one child. Now consider what happens when a state made such a mistake. We don’t even have to pretend. In 1986, California adopted Whole Language Arts, which proved to be a disaster. Within a decade, California plunged to 49th out of 50 in reading performance. Millions of children were affected. Big mistake.

If different states have different curricula, we can observe what works and what does not, and improve thereby. But Common Core is being pushed nationwide. This could be the Biggest of all possible Mistakes.

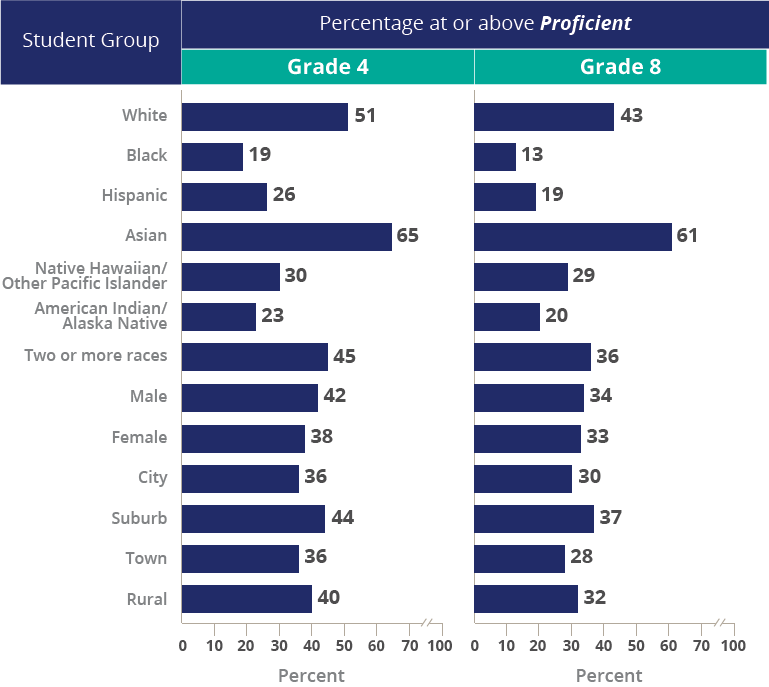

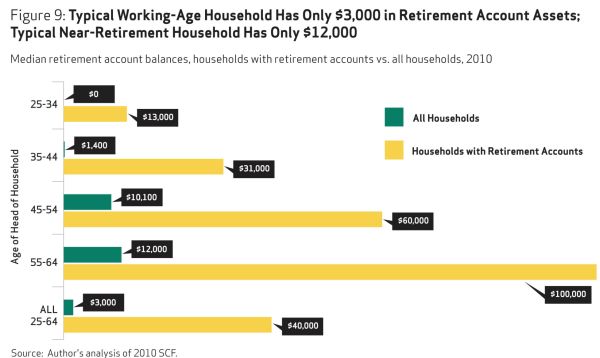

But the worst problem with Common Core is its likely effect on the educational gap between rich and poor in this country. The students I tutor have parents who would describe themselves as “comfortable.” No one likes to admit to being rich. But the middle class and poor cannot afford to pay a tutoring company $50 to $100 per hour so that someone will sit with their children and explain trig identities.

The oft-repeated goal of Common Core is that every child will be “college or career ready.” Couple that slogan with the oft-expressed admiration for the European system of education – in European countries, students are slotted for university or a dead-end job at age fourteen, based ostensibly on their performance on high-stakes tests, but that performance almost inevitably matches the student’s socioeconomic class. Do we really want to destroy upward mobility and implement a rigid class structure in the United States of America?

To recapitulate: Common Core teaches about a third of algebra 1 in pre-algebra, a third of pre-calculus in algebra 2, et cetera. Common Core teaches unnecessary abstractions as essential principles. Common Core creates calculator cripples. Common Core fails to derive mathematical expressions, instead presenting them as Holy Writ.

I predict that if we continue implementing Common Core, average students will drop out of math as early as they are allowed. Even math-bright students will hate math. Tutoring companies will proliferate to serve wealthy families. The educational gap between rich and poor will widen. If we want to destroy math and science education in this country, keep Common Core.